Fuel Tax Credit Rates Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

Learn how to claim fuel tax credits for the fuel tax included in the price of fuel used in your business activities Check the fuel tax credit rates and how to register for fuel What Is Form 4136 and Who Can Benefit from It Form 4136 officially titled Credit for Federal Tax Paid on Fuels serves a crucial role in the US tax system It s

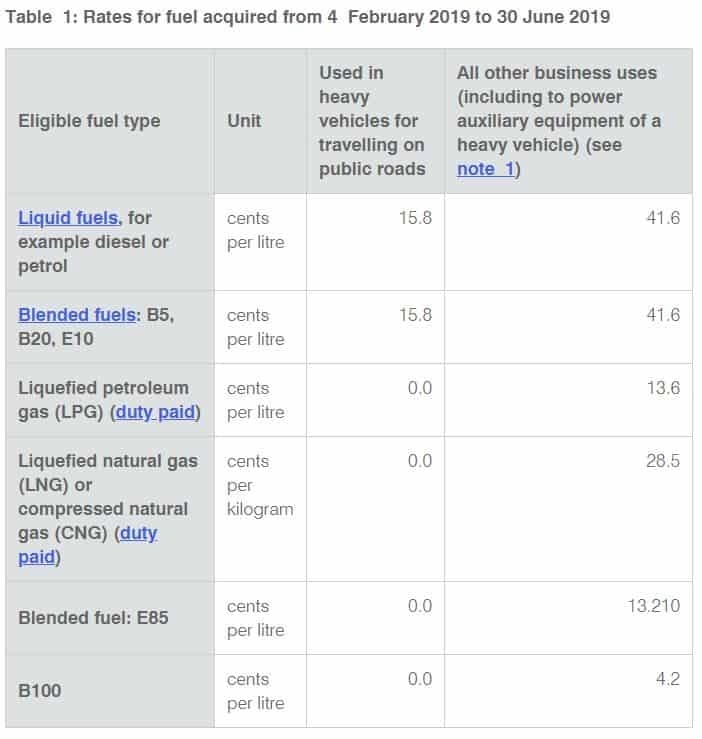

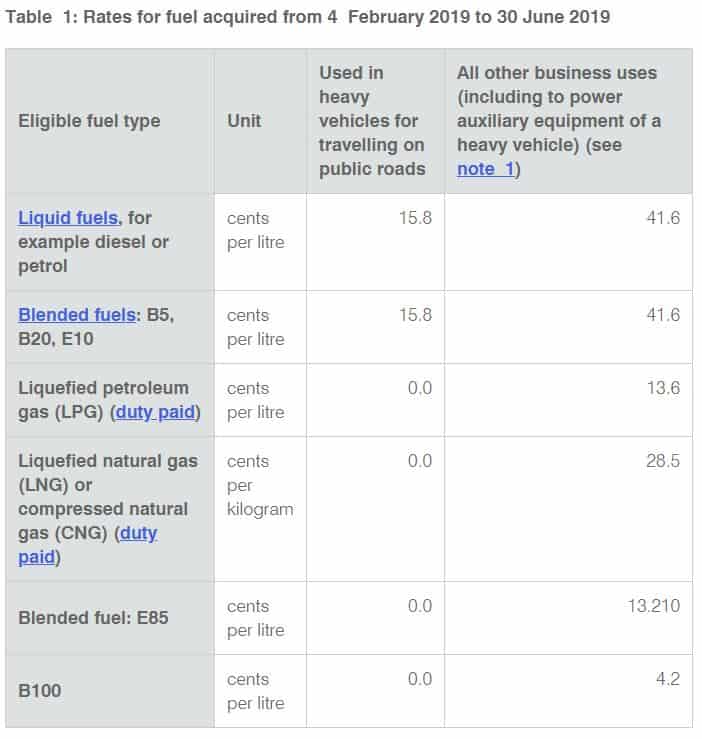

Fuel Tax Credit Rates

Fuel Tax Credit Rates

https://atotaxrates.info/wp-content/uploads/2019/01/rates-4feb2019.jpg

Fuel Tax Credit Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2013/06/FTC-1Feb2017.jpg

Changes To fuel Tax Credit Rates Cotchy

https://cotchy.com.au/wp/wp-content/uploads/2023/09/Fuel-tax-credits.png

The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses Instructions for Form 4136 2023 Credit for Federal Tax Paid on Fuels Section references are to the Internal Revenue Code unless otherwise noted 2023 Instructions for Form

A credit for exporting dyed fuels or gasoline blendstocks Substainable aviation fuel SAF credit Attach Form 4136 to your tax return Instead of waiting to claim an annual Jan 17 2020 IRS provides window of Feb 14 Aug 11 for filing Forms 8849 The IRS recently released Notice 2020 8 providing the procedures for taxpayers to claim the fuel

Download Fuel Tax Credit Rates

More picture related to Fuel Tax Credit Rates

.png)

Fuel Tax Credit Rates Have Changed DG Business Services

https://images.squarespace-cdn.com/content/v1/613802bb301c037597cbdee3/429fe0ab-f77b-4a93-80c6-f425b6b96405/Fuel+tax+credit+rates+have+changed.+(1).png

Fuel Tax Credit Rates Have Increased Custom Accounting Pty Ltd

https://customaccounting.com.au/wp-content/uploads/2019/02/Fuel-Tax-Credits-have-increased.png

Fuel Tax Credit Rates Have Increased Business Wise

https://www.businesswise.com.au/wp-content/uploads/2019/02/fuel_tax_credit-1.png

Reviewed by Vedant Khamesra Published date November 17 2022 Fuel Tax Credit What Is It Regular gasoline and diesel fuel both reached above 5 per gallon in 2022 a record high that has put a Pro Tax Tip Fuel tax credits change on a regular basis Check in regularly for the latest rates each time your lodge your BAS Your business must be registered for

Learn how to claim fuel tax credits for your business activities using eligible vehicles and fuels Find out the current and updated rates the factors that Find out the current and prior fuel tax credit rates for different types of fuel and vehicles in Australia Learn how to register claim and simplify your fuel tax credits

Changes To fuel Tax Credit Rates Paris Financial Accounting And

https://www.parisfinancial.com.au/wp-content/uploads/2023/08/Fuel-Tax-Credits.png

Fuel Tax Credit Rates Have Changed Small Business Minder

https://www.ato.gov.au/uploadedImages/Content/SBIT/Newsroom/Articles/GST_and_excise/6g-Fuel-tax-credits_a.png

https://www. irs.gov /.../fuel-tax-credits

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

https:// business.gov.au /finance/taxation/claim-fuel-tax-credits

Learn how to claim fuel tax credits for the fuel tax included in the price of fuel used in your business activities Check the fuel tax credit rates and how to register for fuel

TAS AUS VIC Melbourne Eastern Suburbs Olinda Yarra Ranges

Changes To fuel Tax Credit Rates Paris Financial Accounting And

Increase To fuel Tax Credit Rates Articles

Fuel Tax Credit Rates Fuel Tax Assist

Rates Increase For Fuel Tax Credits Smart Steps Accounting

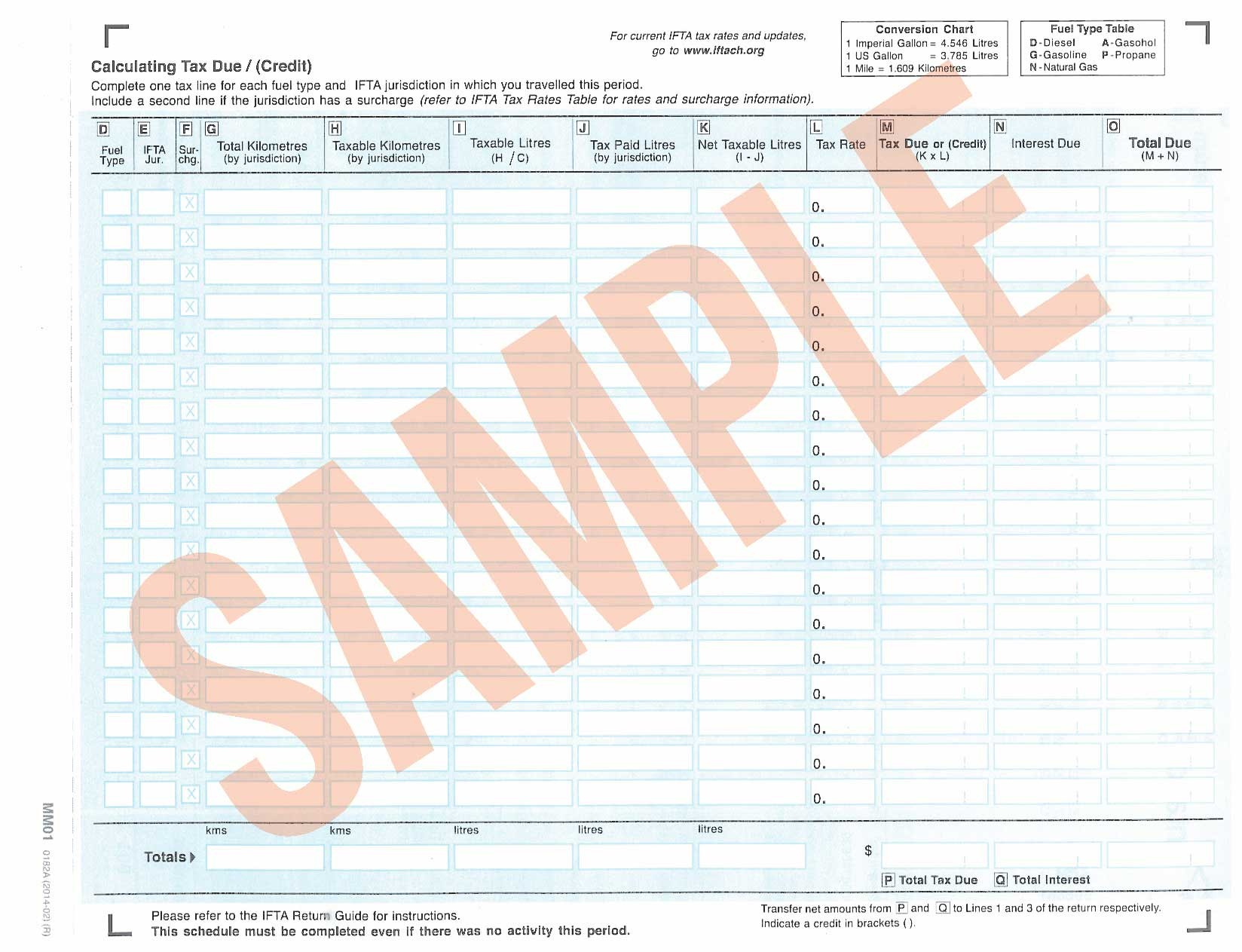

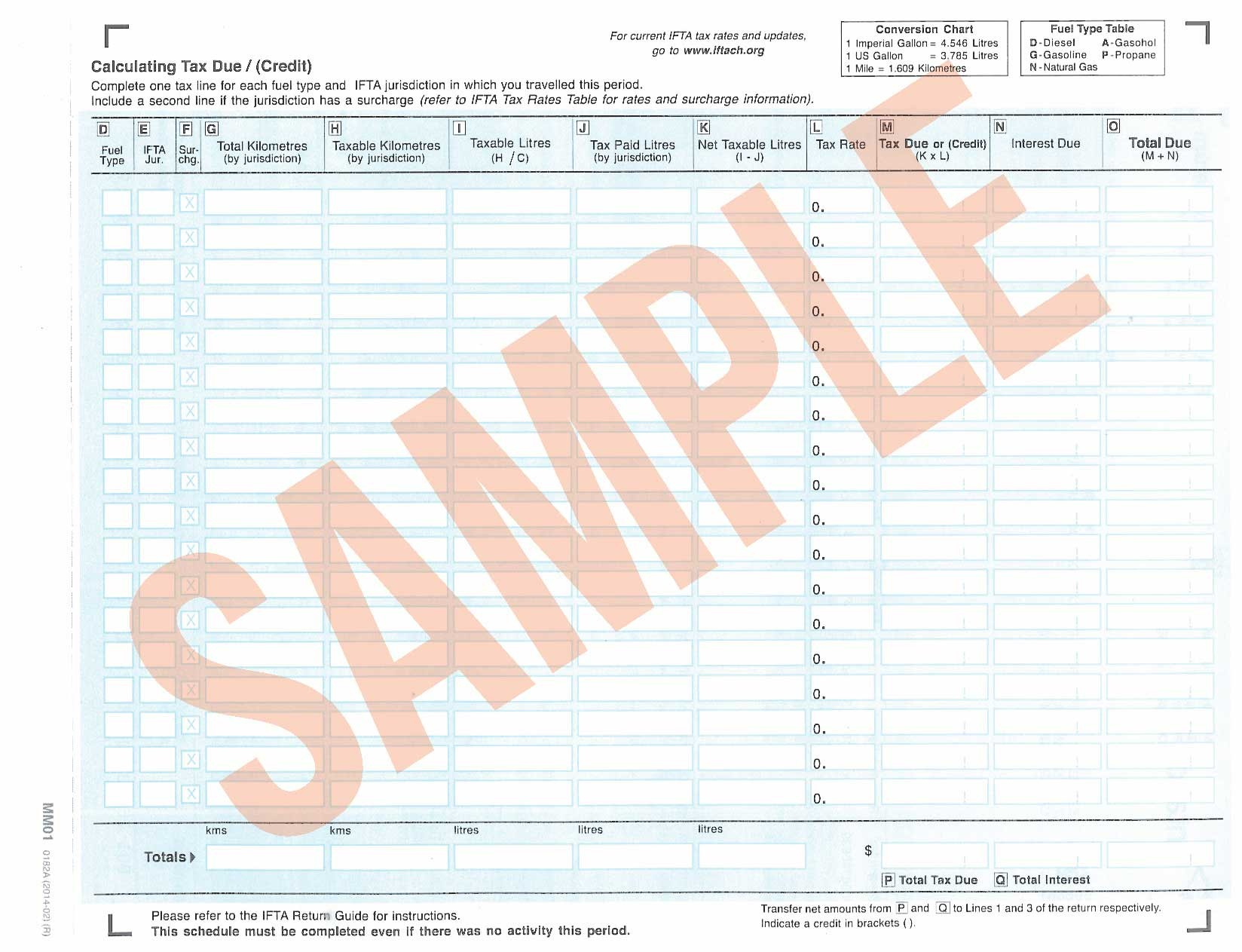

Ifta Fuel Tax Spreadsheet With Example Of Ifta Spreadsheet

Ifta Fuel Tax Spreadsheet With Example Of Ifta Spreadsheet

FUEL TAX CREDIT RATE INCREASE FROM 5 FEBRUARY 2018 Stubbs Wallace

Calculating Fuel Tax Credits Aspire Consulting

Fuel Tax Credit Rates Have Increased Paris Financial Accounting And

Fuel Tax Credit Rates - Last Updated 27 November 2023 Fuel Tax Credits provide businesses who have purchased fuel for their business with a credit for the tax that is included in the price of