Energy Efficiency Rebates And Tax Credits 2024 You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying improvements Homeowners who improve their primary residence will find the most opportunities to claim a credit for qualifying expenses

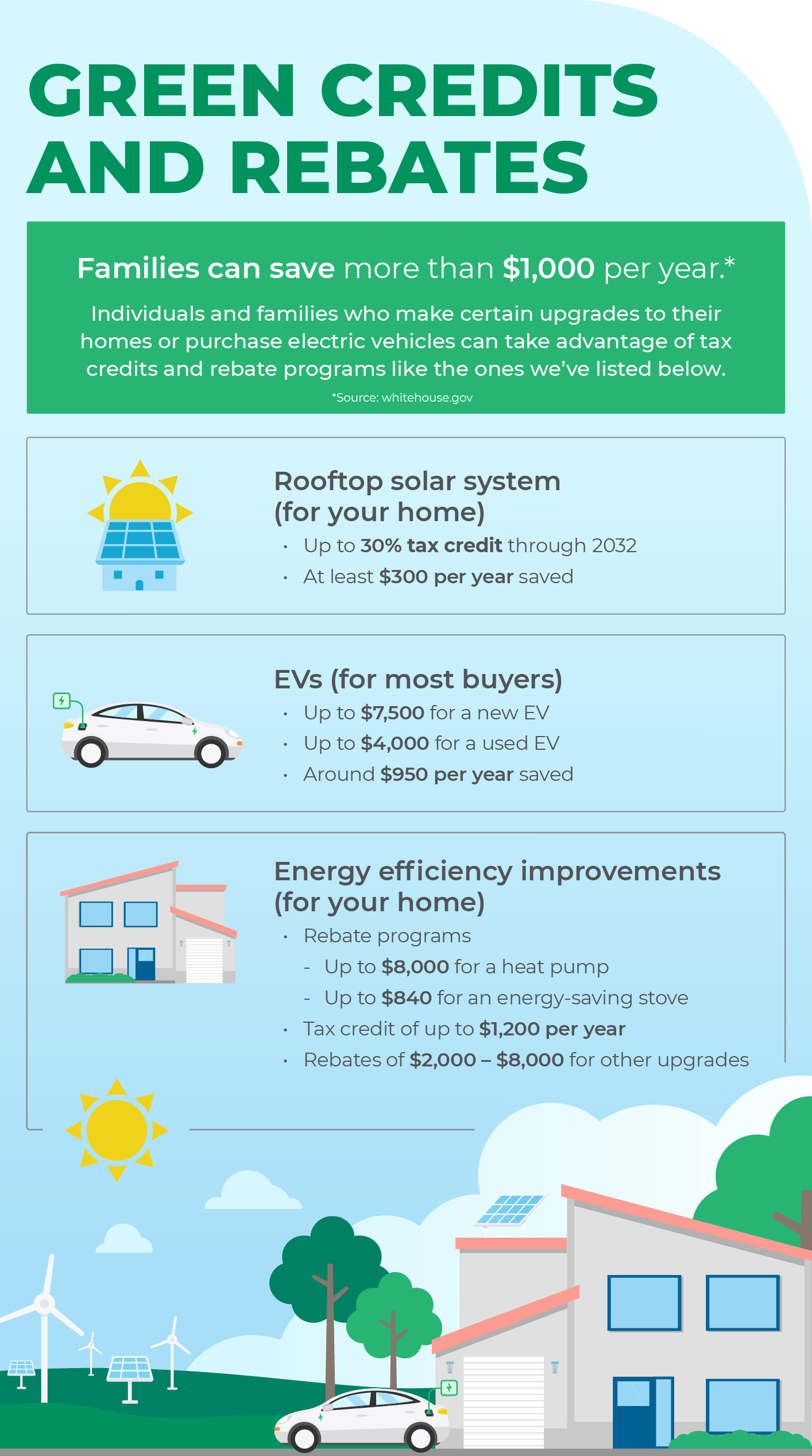

Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Energy Efficiency Rebates And Tax Credits 2024

Energy Efficiency Rebates And Tax Credits 2024

https://earthwisewindows.com/wp-content/uploads/2023/01/Energy-Efficiency-Tax-Credits-for-2023-1.jpg

Take Advantage Of 2023 VA Energy Efficiency Rebates

https://smithandkeene.com/wp-content/uploads/2023/01/72.png

Energy Efficiency Rebates And Tax Credits For Home Improvements In 2023 Wilson Exteriors

https://wilsonexteriors.com/wp-content/uploads/2023/05/Featured-image-223.png

Passed in August 2022 the IRA is the largest governmental investment in greenhouse gas reduction ever It includes tax credits for heat pumps heat pump water heaters weatherization electric The High Efficiency Electric Homes and Rebates Act HEEHRA allocates 4 5 billion dollars to the states to create point of sale rebates for home electrification projects for low and moderate income households Program specifics are still being determined and will vary from state to state

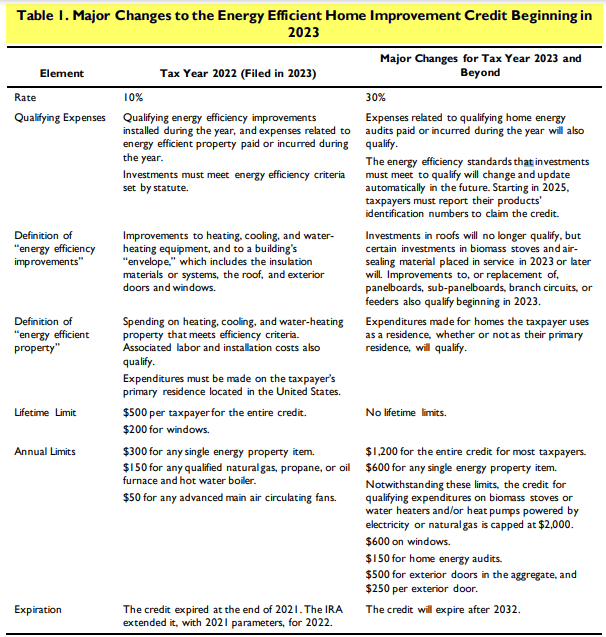

Some energy efficiency standards are updated as well In addition the 500 lifetime limit is replaced by a 1 200 annual limit on the credit amount the lifetime limit on windows will go The following are questions and answers regarding the Home Energy Rebates administered by the U S Department of Energy DOE and funded by the Inflation Reduction Act IRA For more information please visit the Home Energy Rebates page Question Categories

Download Energy Efficiency Rebates And Tax Credits 2024

More picture related to Energy Efficiency Rebates And Tax Credits 2024

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

How To Save Money On Home Improvements With Energy Efficiency Tax Credits Rebates

https://mlsjoxwh2dv5.i.optimole.com/cb:fJ2b~7176/w:auto/h:auto/q:90/f:avif/https://finmasters.com/wp-content/uploads/2022/12/How-to-Save-Money-on-Home-Improvements-with-Energy-Efficiency-Tax-Credits-Rebates.jpg

2022 Tax Credits For Residential Energy Efficiency Improvements Ciel Power LLC Insulation

http://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/6348575eae4b7b40b45e895e/1665685342187/2022_Energy_Efficiency_Tax_Credits.jpg?format=1500w

The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential Clean Energy Credit provides tax credits for the purchase of qualifying equipment including solar wind geothermal and fuel cell technology Homeowners and multifamily building owners can get rebates by making energy efficiency upgrades the amount of money you can claim depends on how much energy you save The max is 4 000 for most

Windows Skylights Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 The installation of the system must be complete during the tax year Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible

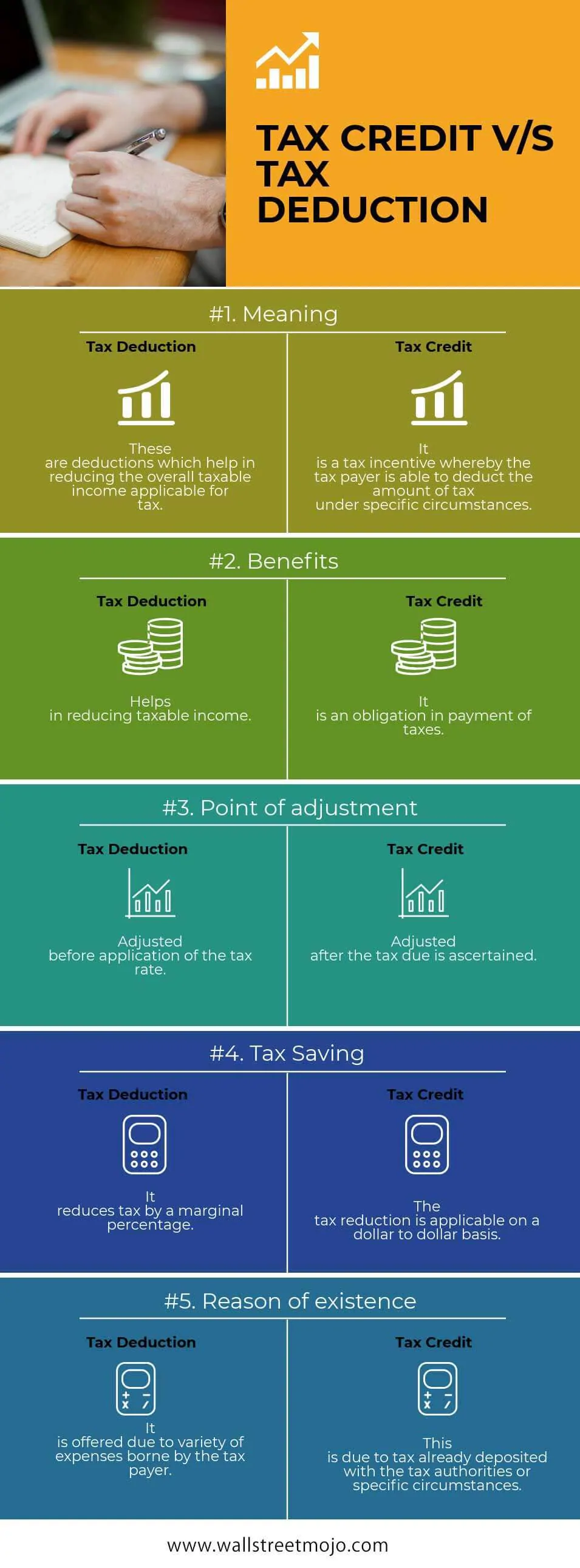

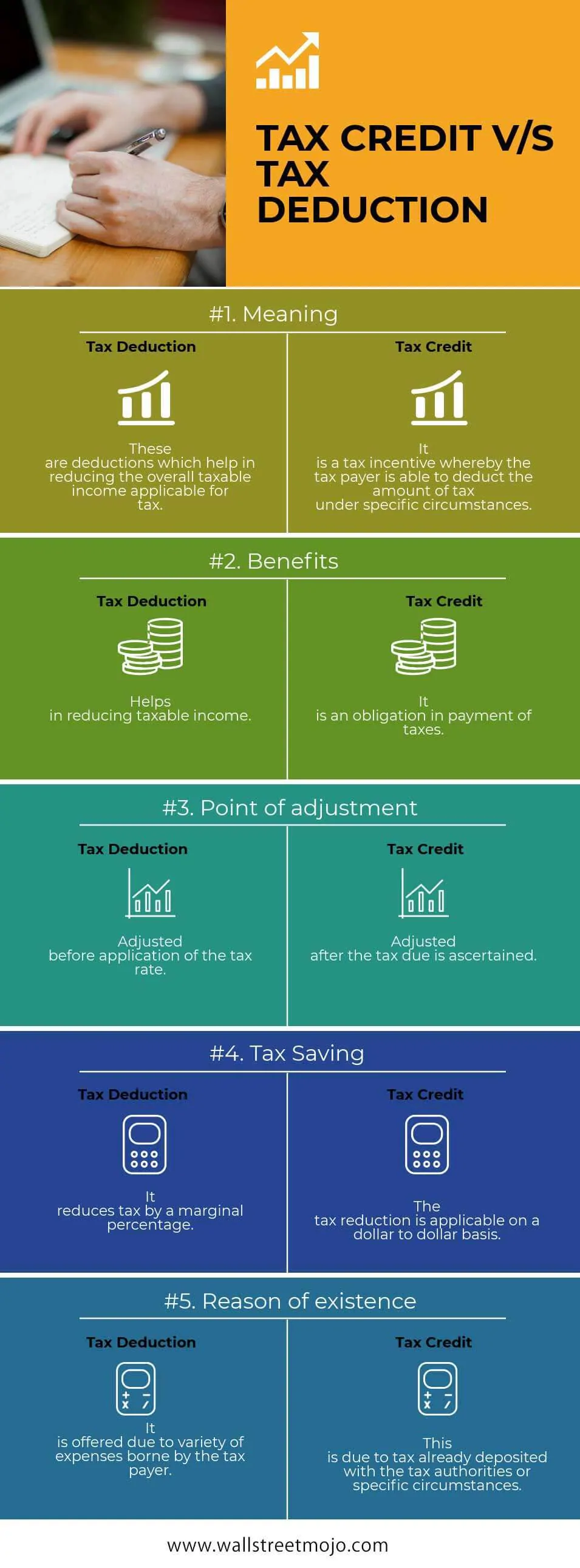

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

https://www.wallstreetmojo.com/wp-content/uploads/2018/05/TAX-CREDIT-VS-TAX-DEDUCTION.jpg.webp

Energy Efficiency Rebates And Tax Credits 2023 New Incentives For Home Electrification Solar

https://assets.solar.com/wp-content/uploads/2022/09/energy-efficient-tax-credits-and-rebates-e1662140600355.jpeg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

You can claim either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit for the year when you make qualifying improvements Homeowners who improve their primary residence will find the most opportunities to claim a credit for qualifying expenses

https://www.energystar.gov/about/federal_tax_credits

Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Expired Energy Efficiency Tax Credits Renewed Under Inflation Reduction Act Of 2022 National

Tax Credits Vs Tax Deductions Top 5 Differences You Must Know

2022 Tax Credits For Residential Energy Efficiency Improvements Ciel Power LLC Insulation

Energy Efficiency Rebates Tax Credits Corning Natural Gas Corporation

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500 Electrek

The New Federal Tax Credits And Rebates For Home Energy Efficiency

The New Federal Tax Credits And Rebates For Home Energy Efficiency

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits Affect My Refund Fabalabse

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

The 2023 Energy Efficiency Rebates And Tax Credits BSH Accounting

Energy Efficiency Rebates And Tax Credits 2024 - The following are questions and answers regarding the Home Energy Rebates administered by the U S Department of Energy DOE and funded by the Inflation Reduction Act IRA For more information please visit the Home Energy Rebates page Question Categories