S Corp Tax Savings Example Thinking of starting an S corp Use this payroll tax savings calculator to figure out if an S corp really is the best business entity for you

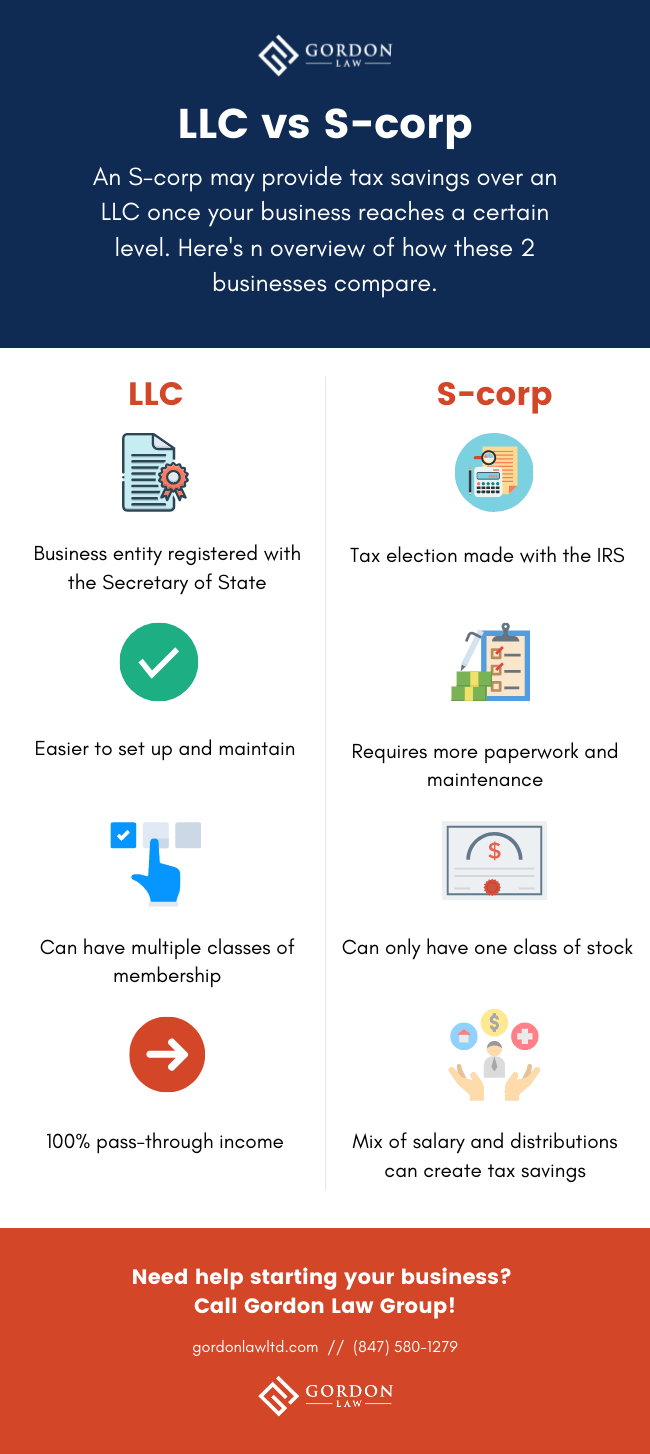

Example of S corp tax savings calculation When you operate an S Corp the more money you pay yourself as a distribution the more Social Security and Medicare tax you will save In a similar vein you will save more money the more money your business makes Total Taxes Paid as S Corp 41 737 50 In this example by opting for an S Corp the consultant could potentially save 17k in taxes Try our S Corp tax savings calculator to see how this could impact your business

S Corp Tax Savings Example

S Corp Tax Savings Example

https://static.showit.co/800/t0_lGhRVTGGy-jSFlCZ5QQ/156755/screen_shot_2022-01-31_at_1_58_00_pm.png

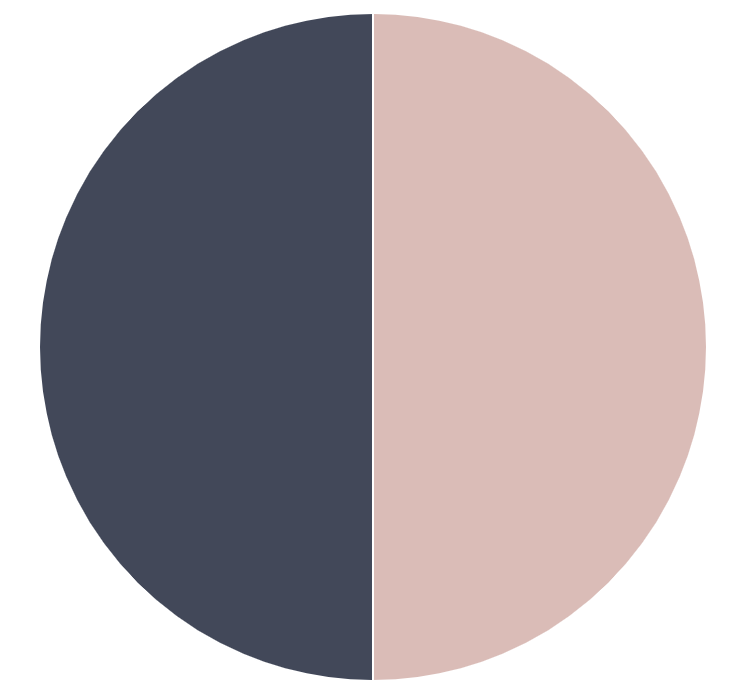

Should You Switch To An S Corp LLC Vs S Corp Tax Savings Tweak Your Biz

https://tweakyourbiz.com/wp-content/uploads/2022/10/LLC-vs-S-Corp-Tax-Savings-3-scaled-1.jpeg

S Corp Tax Savings Calculator Ask Spaulding

https://secureservercdn.net/198.12.144.78/askspaulding.com/wp-content/uploads/2020/08/Benefits-01 JPEG.jpg?time=1603910327

Setting up your business as an S corporation S corp provides several tax advantages that are not available to owners of C corporations C corp or Limited Liability Companies LLCs You may wonder how the S corporation taxation generally works S Corp Tax Savings Calculator Reduce your federal self employment tax by electing to be treated as an S Corporation Regardless if you re self employed or an employee you have to pay Social Security and Medicare taxes to the government

S corporations enjoy pass through taxation in which the owner pays taxes based on their individual tax rate Learn how to file S corp taxes in five steps Use our S Corp Tax Calculator to calculate your tax savings and decide if an S corp makes financial sense for your company

Download S Corp Tax Savings Example

More picture related to S Corp Tax Savings Example

What Is An S Corp

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/2147486381/images/eo83Z5NdTBmo3m2lobQi_Screen_Shot_2022-02-04_at_4.03.50_PM.png

S Corp Tax Benefits How Business And Its Shareholders Are Taxed

https://bbcincorp.com/wp-content/uploads/2022/11/S-corp-tax-benefits.jpg

Should You Switch To An S Corp LLC Vs S Corp Tax Savings Tweak Your Biz

https://tweakyourbiz.com/wp-content/uploads/2022/10/LLC-vs-S-Corp-Tax-Savings-4-scaled.jpg

Let s look at an example and truly paint a picture of how switching to an S Corp and changing how you receive income can lead to tax savings Say you are a Customer Support Rep for your company and you Try our free tax savings calculator to estimate the financial benefit of electing S Corp as a solopreneur Instantly calculate the time and money you can potentially save

An S corporation or S corp is a special designation carved out of the U S tax code for small businesses Benefits include pass through tax status but it offers limited growth potential The main benefit of incorporating as an S corporation over being self employed is the tax savings on self employment taxes Social Security and Medicare For each dollar of profit it could mean as much as 14 13 in savings when it s

S Corp S Corporation Profitable Business Tax Preparation

https://i.pinimg.com/originals/7d/f6/fb/7df6fb59fb345ad7b4ddfe9af0c8ec7c.jpg

S corp Savings Singletrack Accounting

https://singletrackaccounting.com/wp-content/uploads/2020/10/Screen-Shot-2020-10-05-at-9.10.13-AM.png

https://gusto.com/.../s-corp-tax-savings-calculator

Thinking of starting an S corp Use this payroll tax savings calculator to figure out if an S corp really is the best business entity for you

https://www.deskera.com/blog/s-corp-tax-savings-calculator

Example of S corp tax savings calculation When you operate an S Corp the more money you pay yourself as a distribution the more Social Security and Medicare tax you will save In a similar vein you will save more money the more money your business makes

Here s How Much You ll Save In Taxes With An S Corp Hint It s A LOT

S Corp S Corporation Profitable Business Tax Preparation

Tax Difference Between LLC And S Corp LLC Vs S Corporation

33 S Corp Reasonable Salary Calculator KarraKartney

Corporation Tax Ambiance Accountants Sheffield Accountants

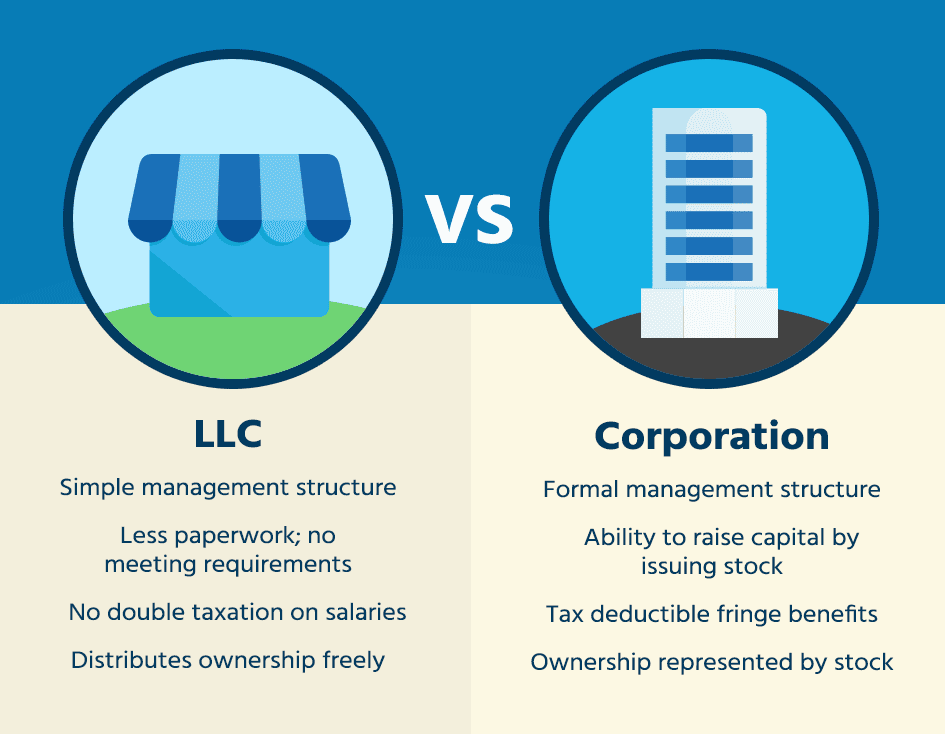

LLC Vs S Corp Business Law Limited Liability Company Business Offer

LLC Vs S Corp Business Law Limited Liability Company Business Offer

How To Set Up An S Corp

Crissy Quick

What Business Structure Is Right For Your Company Embark

S Corp Tax Savings Example - S Corp Tax Savings Calculator Reduce your federal self employment tax by electing to be treated as an S Corporation Regardless if you re self employed or an employee you have to pay Social Security and Medicare taxes to the government