Sale Leaseback Accounting Treatment This new guide to sale and leaseback accounting addresses practical questions we have encountered in applying IFRS 16 It also covers the new amendments with detailed worked

With the removal of the distinction between operating and finance leases Adam Deller explains the new accounting treatment for sale and leaseback arrangements IFRS 16 makes significant changes to sale and leaseback accounting A sale and leaseback transaction is one where an entity the seller lessee transfers an asset to

Sale Leaseback Accounting Treatment

Sale Leaseback Accounting Treatment

https://www.journalofaccountancy.com/content/dam/jofa/issues/2020/jul/failed-leaseback.jpg

A Lease Is An Arrangement Under Which A Lessor Agrees To Allow A Lessee

https://i.pinimg.com/originals/70/40/10/704010bbc824bad4a695b6199fc69780.jpg

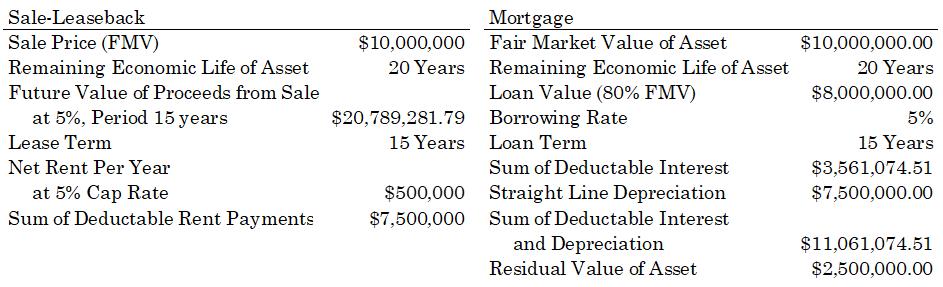

SALE LEASEBACK TRANSACTIONS Solutions To Liquidity And Returns

https://appalachian.scholasticahq.com/article/67904-sale-leaseback-transactions-solutions-to-liquidity-and-returns/attachment/144409.png

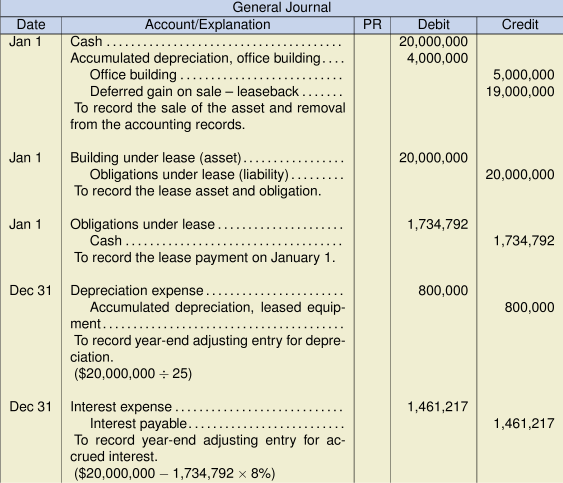

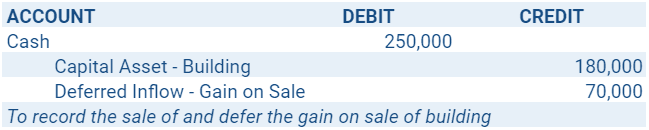

If a leaseback is classified as a finance lease seller lessee or a sales type lease buyer lessor then no sale has occurred and the transaction should be accounted for as a failed sale and Assessing whether a transaction qualifies for sale and leaseback accounting under IFRS 16 is a key judgement Calculating the profit or loss on the sale is also not always

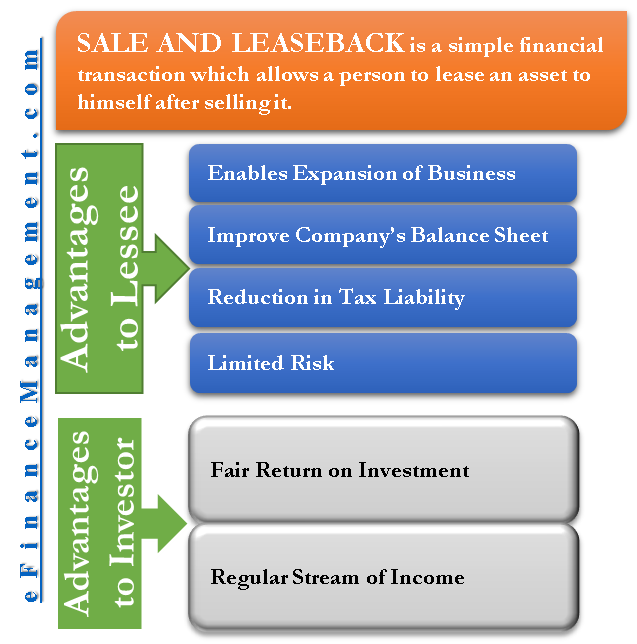

Sale and leaseback transactions are a popular financing mechanism wherein a seller lessee sells an asset to a buyer lessor and simultaneously agrees to lease the same At its core a sale leaseback transaction involves two primary steps the sale of an asset and the subsequent lease of that same asset from the buyer This dual arrangement

Download Sale Leaseback Accounting Treatment

More picture related to Sale Leaseback Accounting Treatment

17 4 Sales And Leaseback Transactions Intermediate Financial Accounting 2

https://ecampusontario.pressbooks.pub/app/uploads/sites/2343/2022/02/17.4-General-Journal-Example.png

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

https://www.journalofaccountancy.com/content/dam/jofa/issues/2020/jul/amortization-imputed-rate.jpg

Sale Leaseback Tax Treatment Implications EasyKnock

https://blog.easyknock.com/wp-content/uploads/2023/03/Sale-Leaseback-Tax-Treatment-Implications.jpg

This chapter discusses the specific accounting considerations applicable to sale and leaseback transactions Different accounting outcomes can exist depending on the structure of the Following the IFRS 15 assessment if a sale is concluded to have occurred then this is treated as a sale and leaseback transaction for which the accounting treatment is covered in the rest of this article

IFRS 16 makes significant changes to sale and leaseback accounting A sale and leaseback transaction is one where an entity the seller lessee transfers an asset to another entity the Sale leaseback transactions provide a way to negotiate existing lease contracts to cater to specific business needs A sale leaseback is appealing to companies looking for a liquidity

Criteria Of Sale Leaseback Accounting Under ASC 842 Visual Lease

https://visuallease.com/wp-content/uploads/2017/12/VL_11.17_BlogPost.png

Accounting For Sale Leaseback Financing Lease Made Easy YouTube

https://i.ytimg.com/vi/VwQX1aw1Ssg/maxresdefault.jpg

https://assets.kpmg.com › content › dam › kpmgsites › xx › ...

This new guide to sale and leaseback accounting addresses practical questions we have encountered in applying IFRS 16 It also covers the new amendments with detailed worked

https://www.accaglobal.com › ... › sale-leaseback.html

With the removal of the distinction between operating and finance leases Adam Deller explains the new accounting treatment for sale and leaseback arrangements

GASB 87 Sale Leaseback And Lease Leaseback Accounting Transactions

Criteria Of Sale Leaseback Accounting Under ASC 842 Visual Lease

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

Lecture 08 Sale And Leaseback Accounting Seller Lessee

Sale And Leaseback Example Advantages To Lessee And Investor EFM

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

Accounting For Sale And Leaseback Transactions Journal Of Accountancy

Leases Sale And Leaseback ACCA Financial Reporting FR YouTube

What Is A Sale Leaseback

Sale Leaseback Accounting Treatment - At its core a sale leaseback transaction involves two primary steps the sale of an asset and the subsequent lease of that same asset from the buyer This dual arrangement