Sales Tax Exemption On New Vehicle Purchase You can report your purchase of a vehicle and pay the use tax by using the CDTFA s online services and selecting the option to File a Return or Claim an Exemption for a Vehicle Vessel

Virginia is required to collect a 4 15 Sales and Use Tax SUT at the time of titling whenever a vehicle is sold and or the ownership of the vehicle changes The amount due is based on the To qualify for the motor vehicle sales tax exemption a veteran typically needs to have a service connected disability This means that the disability was a result of an injury or illness that occurred while on active duty

Sales Tax Exemption On New Vehicle Purchase

Sales Tax Exemption On New Vehicle Purchase

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/fillable-form-st-5-sales-and-use-tax-certificate-of-exemption-georgia-10.png

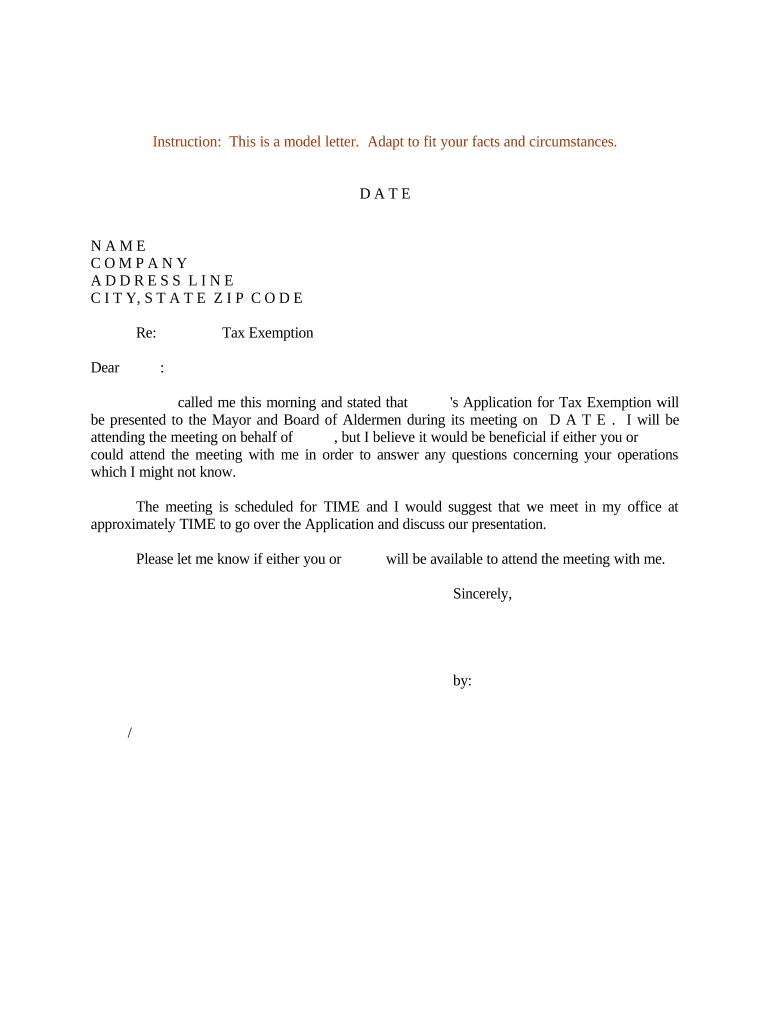

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Illinois Tax Exempt Certificate Five Mile House

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg

You can deduct sales tax on a vehicle purchase but only the state and local sales tax You ll only want to deduct sales tax if you paid more in state and local sales tax than you paid in state and local income tax There are several exemptions for car sales tax including Historic vehicles made before 1973 Vehicles used for agriculture or forestry Disabled car owners do not have to pay sales tax If you meet any of the exemptions listed you must

Any portion of the sales price paid by the purchaser is subject to tax The purchaser provides the selling dealer a completed notarized Partial Exemption for Motor Vehicle Sold to Resident of If you trade in your old car to buy a new car the sales tax you pay will depend on local and state sales tax rates and whether the taxable sale price is calculated before or after the trade in allowance was subtracted

Download Sales Tax Exemption On New Vehicle Purchase

More picture related to Sales Tax Exemption On New Vehicle Purchase

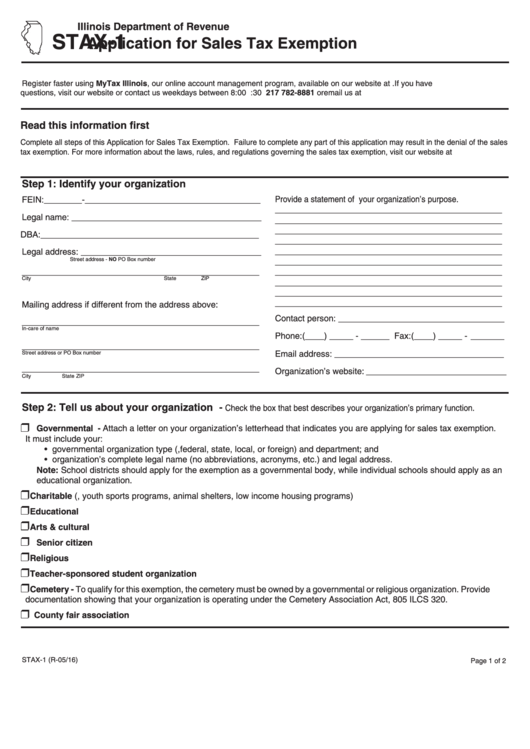

Stax1 Application For Sales Tax Exemption Illinois Printable Pdf

https://www.exemptform.com/wp-content/uploads/2022/08/stax1-application-for-sales-tax-exemption-illinois-printable-pdf-download.png

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/virginia-sales-tax-exemption-form-st-11-fill-out-and-sign-printable-6.png

![]()

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

https://www.rebelliouspixels.com/wp-content/uploads/2020/03/tax_free_residency-1536x1066.jpg

Use the best online free tool Car Sales Tax Calculator calculates the car sales tax in any state of the USA Find out how much tax you will pay when buying a new or used car Try it now In general sales tax or a fee collected when you register the car can significantly impact the total cost of your new vehicle Keep this in mind when building your budget and starting the shopping process

Many states allow people with disabilities to qualify for a sales tax exemption when purchasing a vehicle Individuals with mobility issues paraplegics and disabled veterans who satisfy the requirements can take advantage of this There are several scenarios in which you might be exempt from paying sales tax when buying a car in Florida If you re trading in your old vehicle for a new one you re only required to pay

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/how-to-get-a-sales-tax-certificate-of-exemption-in-north-carolina-3.png

Save Time And Money On Sales Tax Exemption Certificate And Workbooks

https://rossum.ai/use-cases/img/illust/documents/sales_tax_exemption_certificate.png

https://www.cdtfa.ca.gov › industry › vehicles-vessels...

You can report your purchase of a vehicle and pay the use tax by using the CDTFA s online services and selecting the option to File a Return or Claim an Exemption for a Vehicle Vessel

https://www.dmv.virginia.gov › vehicles › taxes-fees › sut

Virginia is required to collect a 4 15 Sales and Use Tax SUT at the time of titling whenever a vehicle is sold and or the ownership of the vehicle changes The amount due is based on the

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

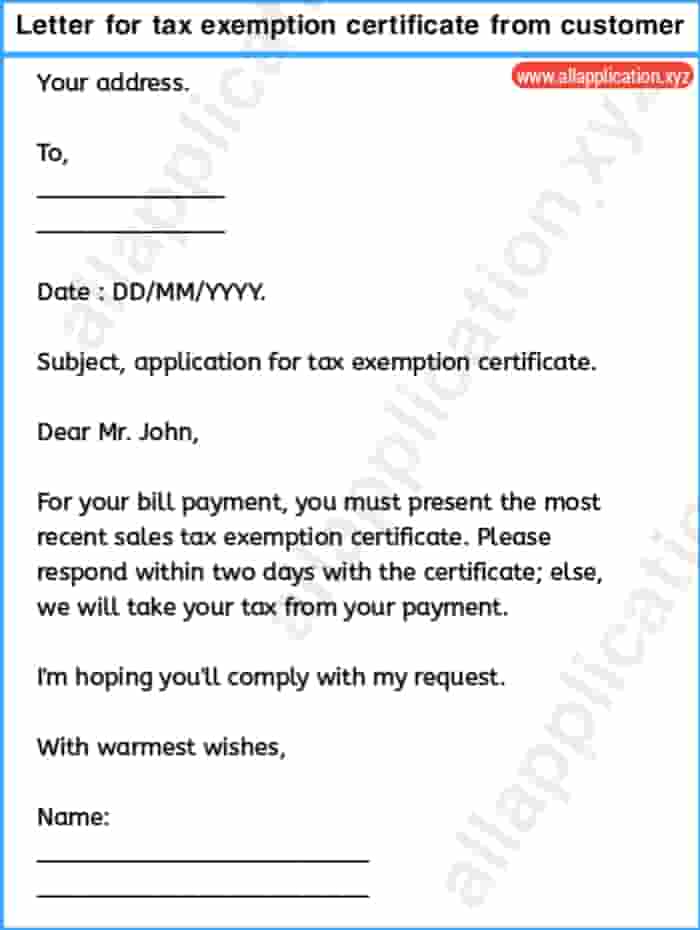

Letter Requesting Tax Exemption Certificate From Customer

WEBINAR ON SALES TAX EXEMPTION AUDIT APPROACH Perkasa Putrajaya

State Sales Tax State Sales Tax Exemption Certificate New York

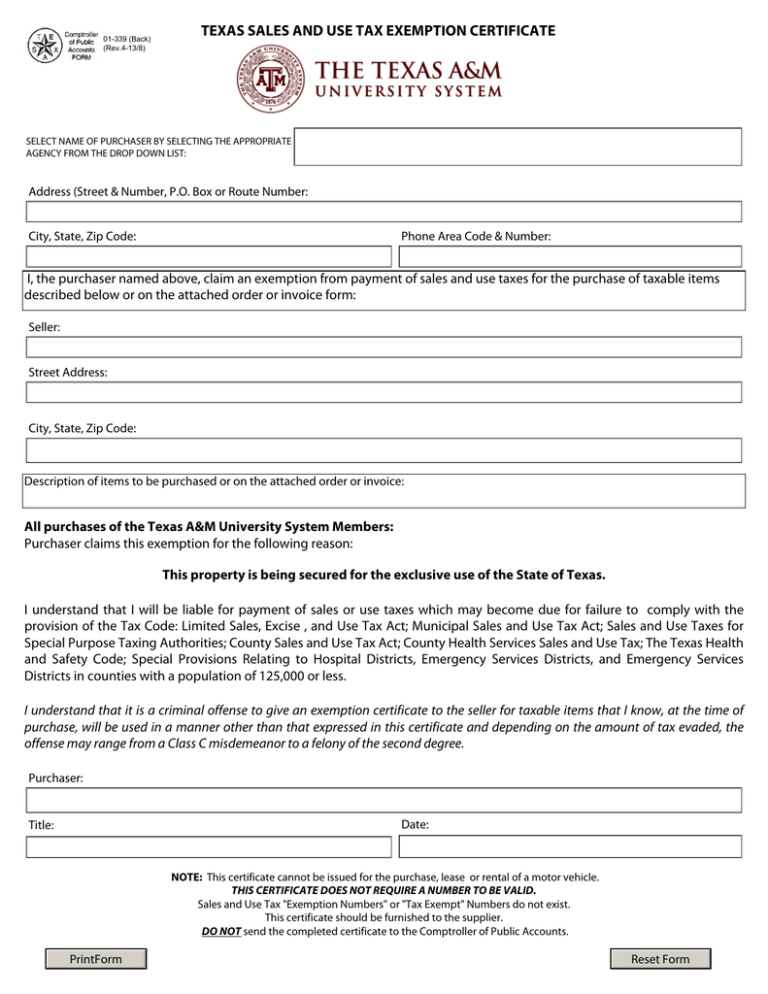

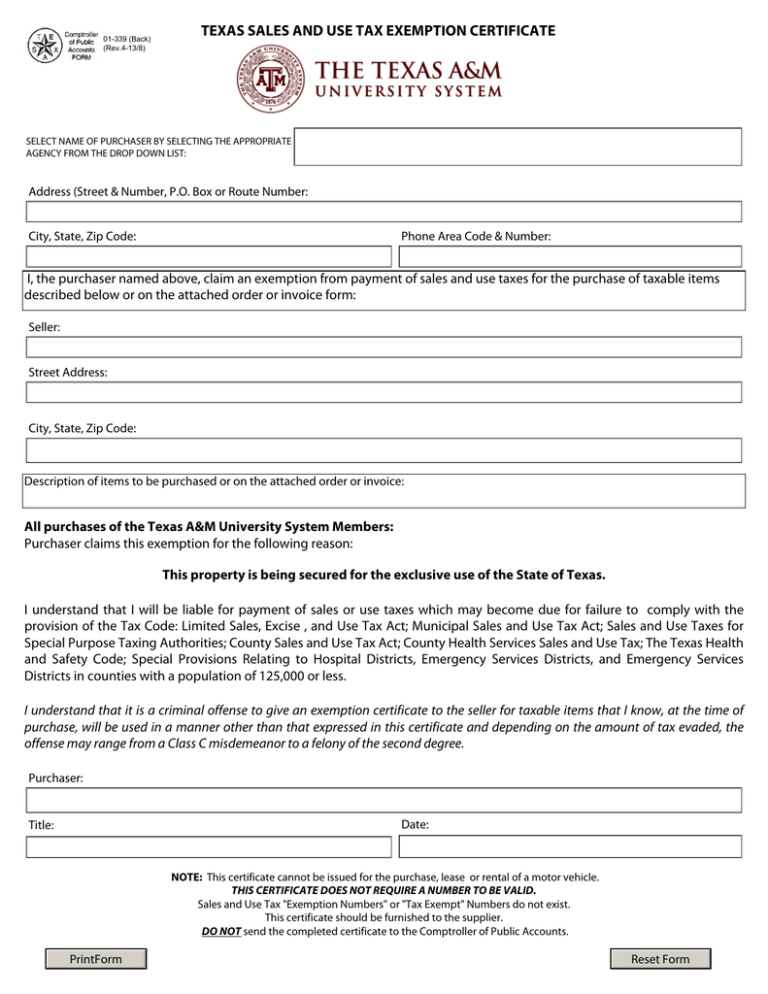

2023 Sales Tax Exemption Form Texas ExemptForm

2023 Sales Tax Exemption Form Texas ExemptForm

Texas Sales And Use Tax Exemption Blank Form

A Guide To Sales Tax Exemption Certificates TaxConnex

Request Letter For Tax Exemption And Certificate SemiOffice Com

Sales Tax Exemption On New Vehicle Purchase - Any portion of the sales price paid by the purchaser is subject to tax The purchaser provides the selling dealer a completed notarized Partial Exemption for Motor Vehicle Sold to Resident of