Sales Tax In Texas 2024 Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties special

We ll tell you everything you need to know about sales tax in Texas TX in our 2024 Texas Sales Tax Guide We ll cover everything from the threshold for achieving Texas The base state sales tax rate in Texas is 6 25 but since the local rates range from 0 125 2 the total sales tax range is 6 375 8 25 Use our online sales tax calculator to determine the

Sales Tax In Texas 2024

Sales Tax In Texas 2024

https://www.worldatlas.com/r/w1200-q80/upload/41/72/bb/shutterstock-402316468.jpg

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

HOW TO APPLY FOR THE TEXAS SALES TAX PERMIT 2020 Step By Step YouTube

https://i.ytimg.com/vi/dWl8n-4y4qI/maxresdefault.jpg

To administer the two sales tax rates the two parts of the district are described below with the appropriate local code and tax rate The Wise County Emergency Services Texas imposes a 6 25 sales tax on most retail sales leases and rentals of most goods and taxable services Local jurisdictions can also add a 2 sales and use tax for a maximum

The city sales and use tax will be increased to 2 percent as permitted under Chapter 321 of the Texas Tax Code effective October 1 2024 in the city listed below What is the sales tax rate in Texas The state sales tax rate in Texas is currently 6 25 However these rates increase to 8 25 in almost every Texas jurisdiction as cities counties

Download Sales Tax In Texas 2024

More picture related to Sales Tax In Texas 2024

Taxes Scolaires Granby

https://1.bp.blogspot.com/-FBZaqEQDH_o/UTeOM4UQVWI/AAAAAAAAAXI/-pdogFJD8xw/s1600/tax+map.png

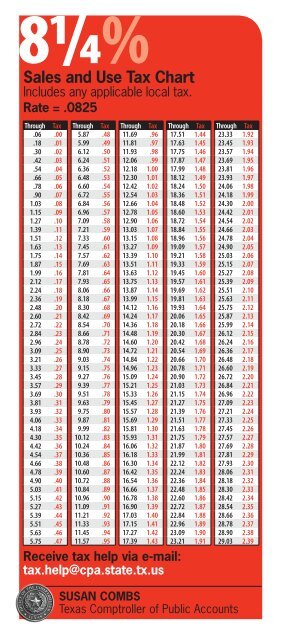

Sales And Use Tax Chart Texas Comptroller Of Public Accounts

https://img.yumpu.com/22949643/1/500x640/sales-and-use-tax-chart-texas-comptroller-of-public-accounts.jpg

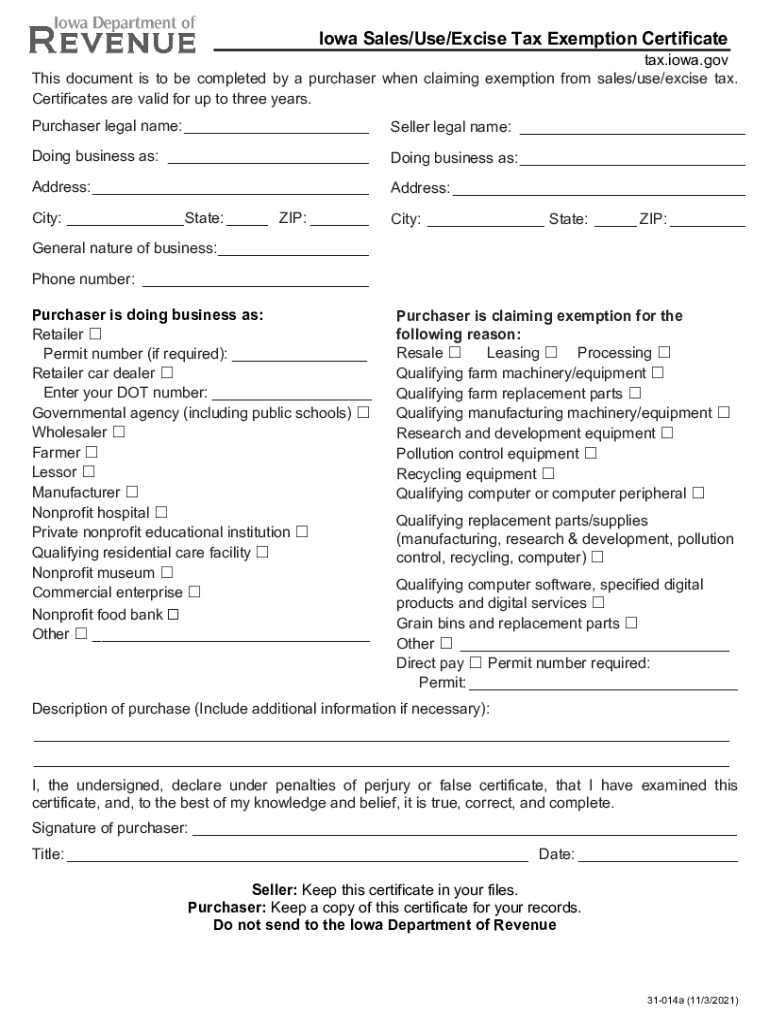

Iowa Sales Tax Exemption Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/579/84/579084590/large.png

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code The calculator will show you the total sales tax amount as well as the county city and Look up 2024 Texas sales tax rates in an easy to navigate table listed by county and city Free sales tax calculator tool to estimate total amounts

[desc-10] [desc-11]

States Without Sales Tax Sales Tax Data Link

https://www.salestaxdatalink.com/wp-content/uploads/2023/03/AdobeStock_223751615.jpeg

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

https://files.taxfoundation.org/20230306143844/Compare-2023-state-gross-receipts-taxes-by-state-Delaware-gross-receipts-tax-Nevada-gross-receipts-tax-Ohio-gross-receipts-tax-Oregon-gross-receipts-tax-Texas-gross-receipts-tax.png

https://comptroller.texas.gov › taxes › sales

Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties special

https://taxcloud.com › state-guides › texas

We ll tell you everything you need to know about sales tax in Texas TX in our 2024 Texas Sales Tax Guide We ll cover everything from the threshold for achieving Texas

Sales Tax By State Here s How Much You re Really Paying Sales Tax

States Without Sales Tax Sales Tax Data Link

TaxConnex Releases New Research That Reveals Top Concerns Among

State And Local Sales Tax Rates 2019 State Sales Tax 2019 Sales Tax

New York Sales Tax Exemptions Agile Consulting Group

The United States Of Sales Tax In One Map The Washington Post

The United States Of Sales Tax In One Map The Washington Post

Sales Tax In Nevada Nevada Sales Tax Registration

How Much Does Your State Collect In Sales Taxes Per Capita Forty five

Texas Sales Tax Revenue Declined 6 5 Versus Last June As State

Sales Tax In Texas 2024 - [desc-12]