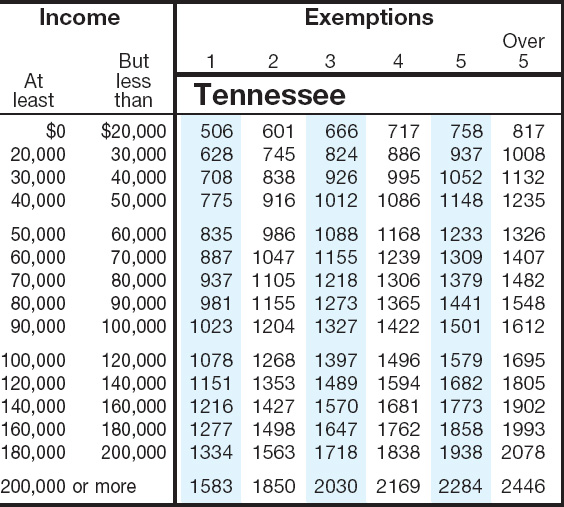

Sales Tax On Rebates Tn Web 28 f 233 vr 2023 nbsp 0183 32 SUT 13 Sales and Use Tax Rates Overview The state sales tax rate for most taxable items and services is 7 However there are exceptions For example

Web sales tax paid at time of purchase Vehicle price 35 000 Documentation fee 300 Add Rebate 3500 do not add or subtract just a third party payment Trade in Web 7 10 Base state sales tax rate 7 Local rate range 0 3 Total rate range 7 10 Due to varying local sales tax rates we strongly recommend using our calculator below

Sales Tax On Rebates Tn

Sales Tax On Rebates Tn

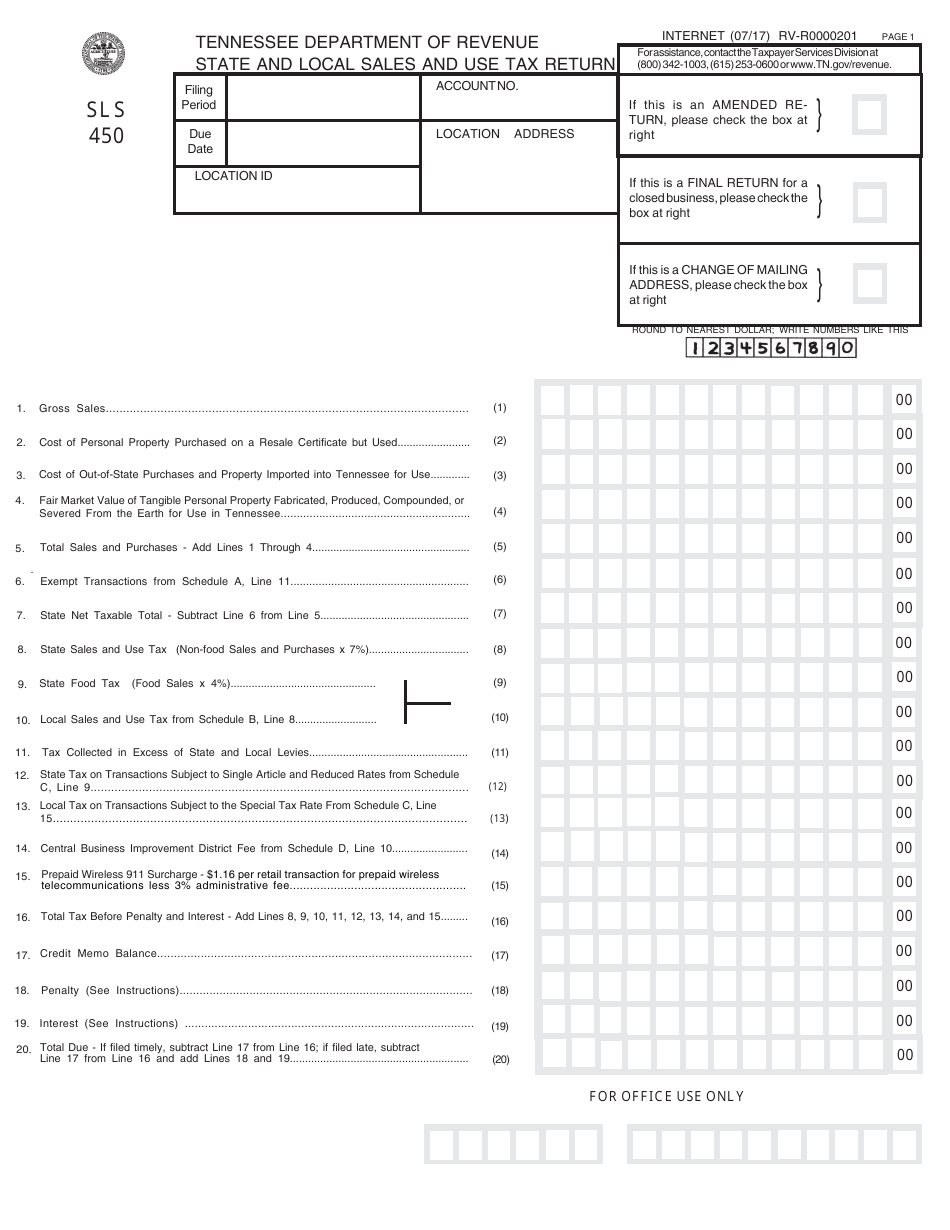

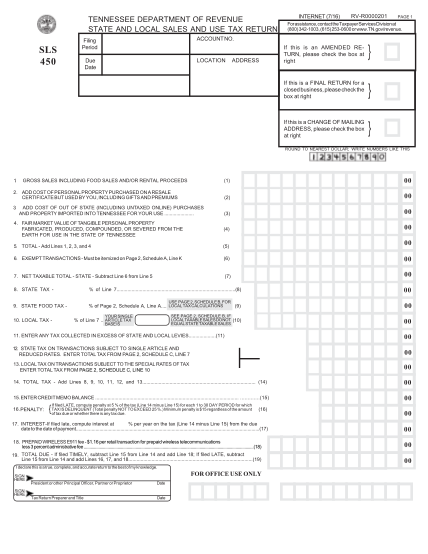

https://data.templateroller.com/pdf_docs_html/1728/17287/1728783/form-sls-450-state-and-local-sales-and-use-tax-return-tennessee_print_big.png

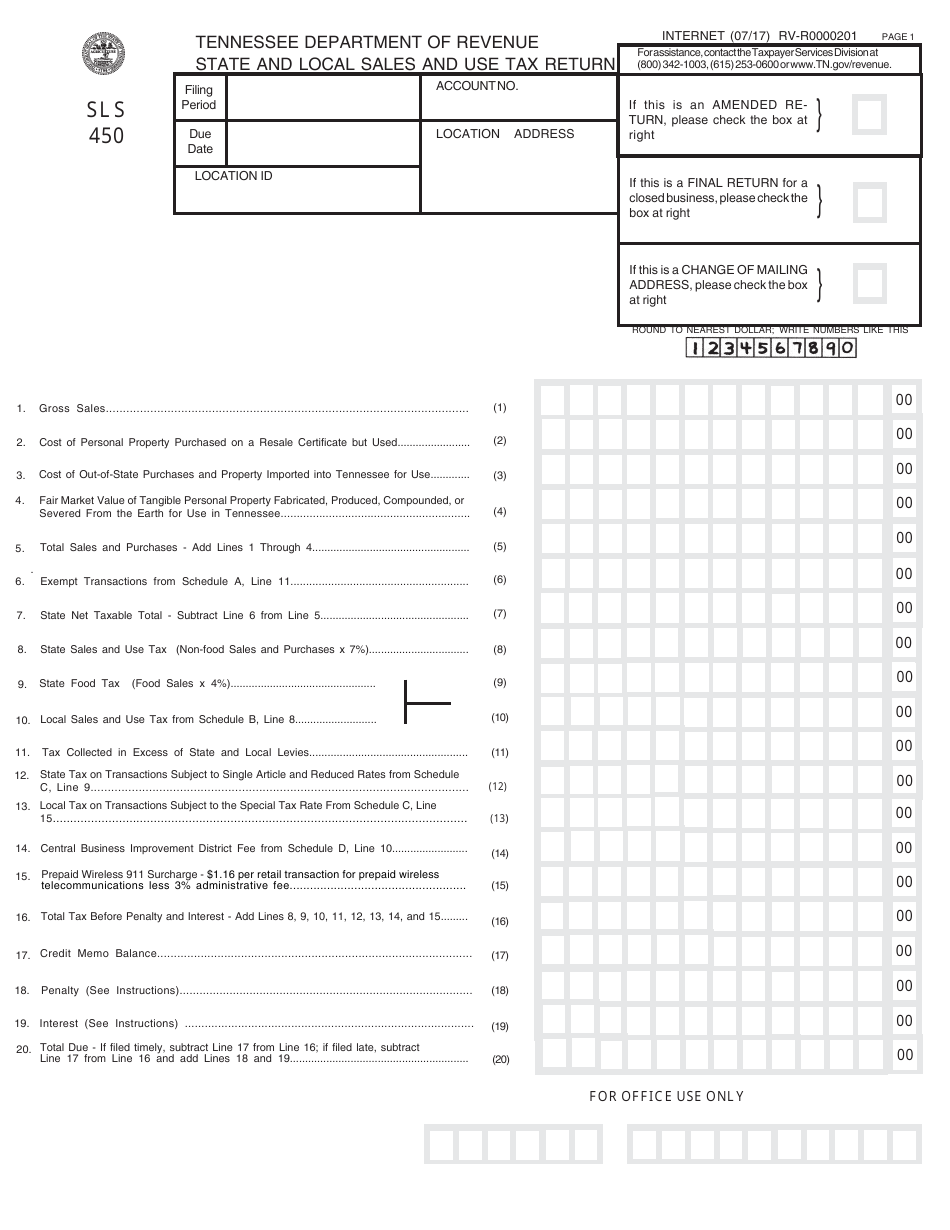

Sales Tax Tennessee Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/5/403/5403799/large.png

The Latest Changes In The Tax Law That Will Effect You New Tax

http://www.savingadvice.com/state_sales_tax/states/tennessee.jpg

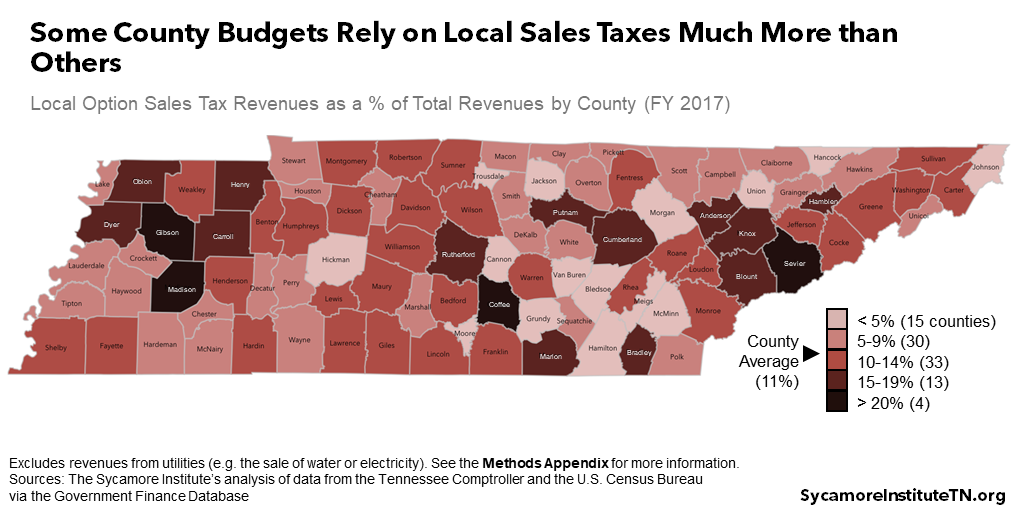

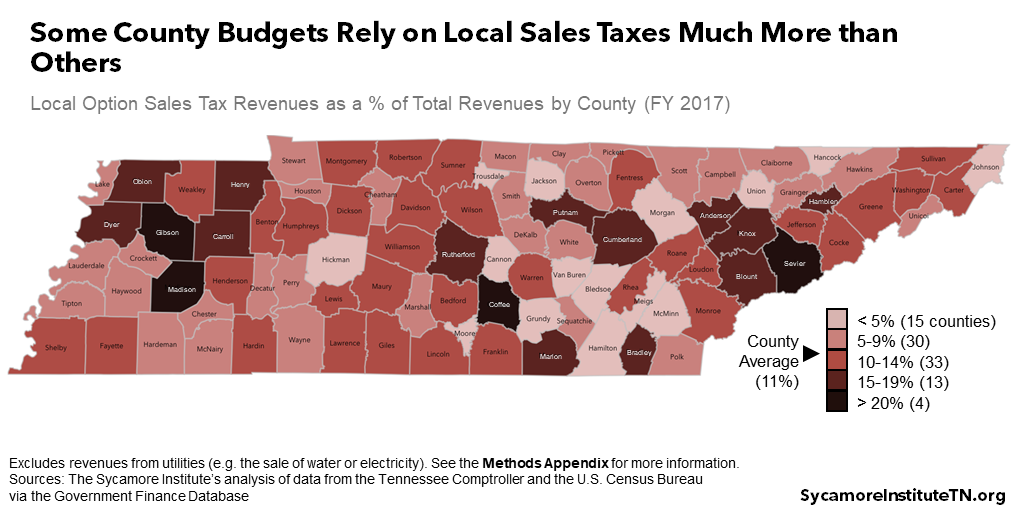

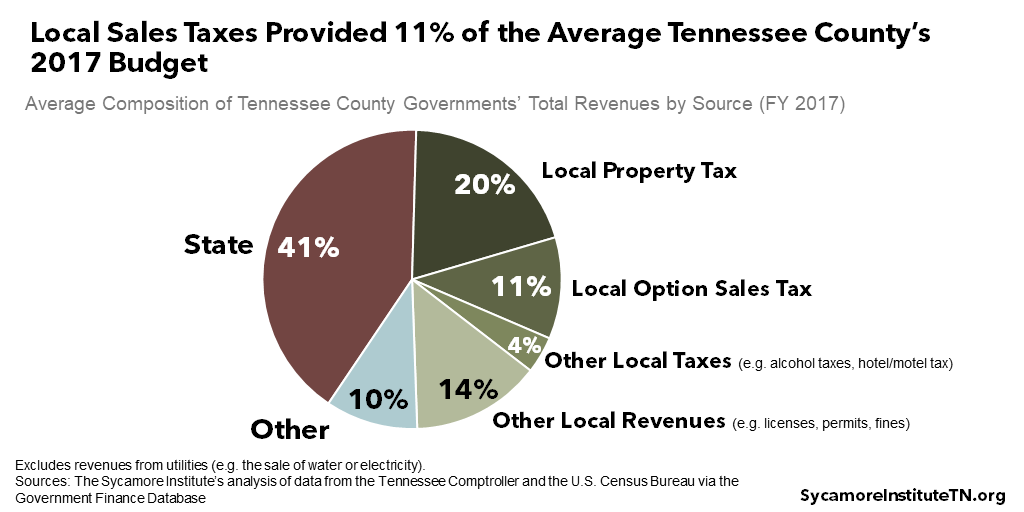

Web Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10 Find your Tennessee combined state and local tax rate Web Column C The temporary exemption list includes the following Sales Tax Holiday Last Friday of July to the following Sunday Gun Safe Safety Device Sales Tax Holiday

Web 28 f 233 vr 2023 nbsp 0183 32 Services that are not specifically enumerated in the law may be subject to sales tax where the charges for the services even if separately itemized are Web 7 janv 2022 nbsp 0183 32 The state sales tax rate in Tennessee TN is 7 0 percent The total sales tax rate might be as high as 10 depending on local tax authorities Other local level tax

Download Sales Tax On Rebates Tn

More picture related to Sales Tax On Rebates Tn

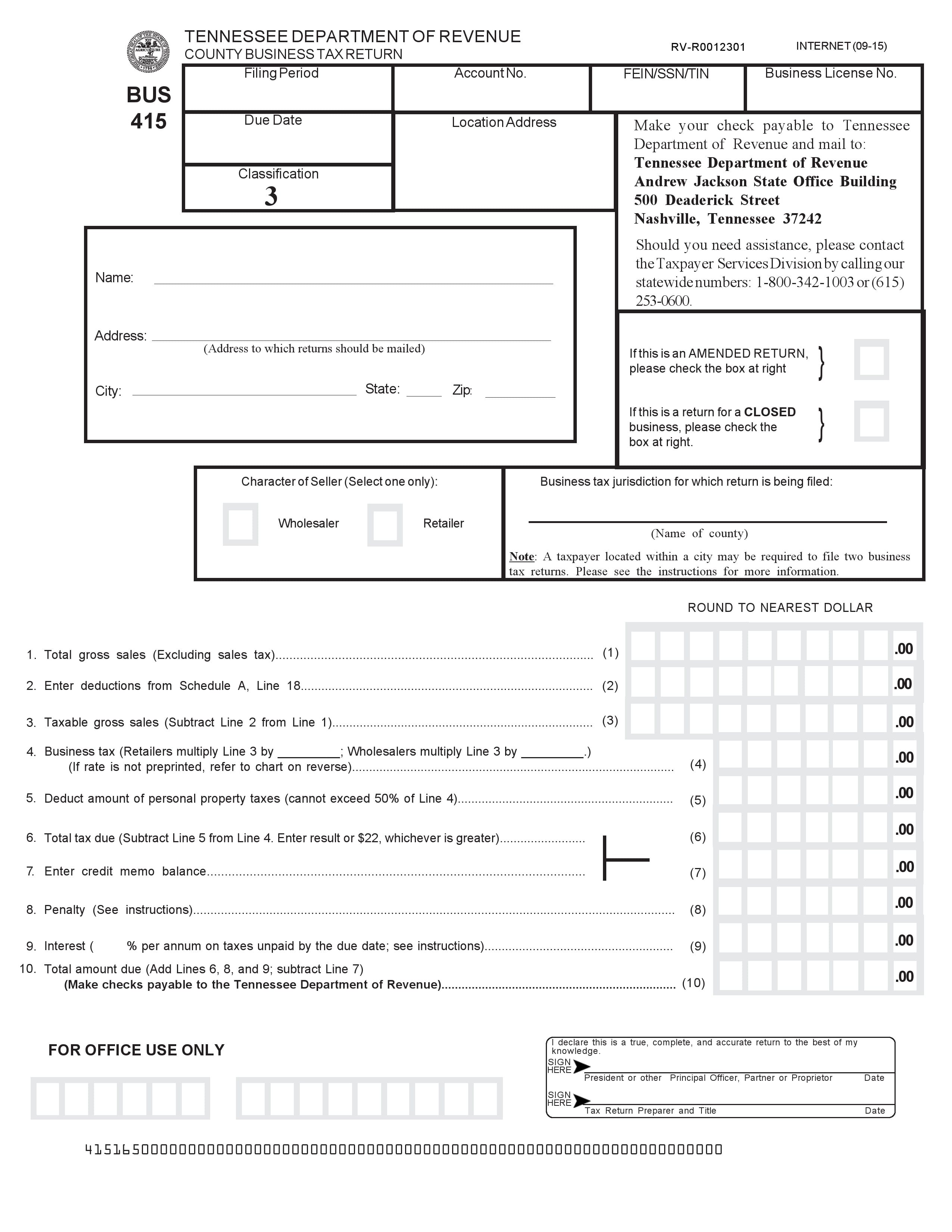

Free Tennessee Department Of Revenue County Business Tax Return RV

https://formdownload.org/wp-content/uploads/2016/04/Tennessee-Department-of-Revenue-County-Business-Tax-Return-RV-R0012301.jpg

Tennessee Sales Tax For Online Sellers

https://1lz3sq2g71xv1ij3mj13d04u-wpengine.netdna-ssl.com/wp-content/uploads/2013/05/tn-sales-tax-rates.png

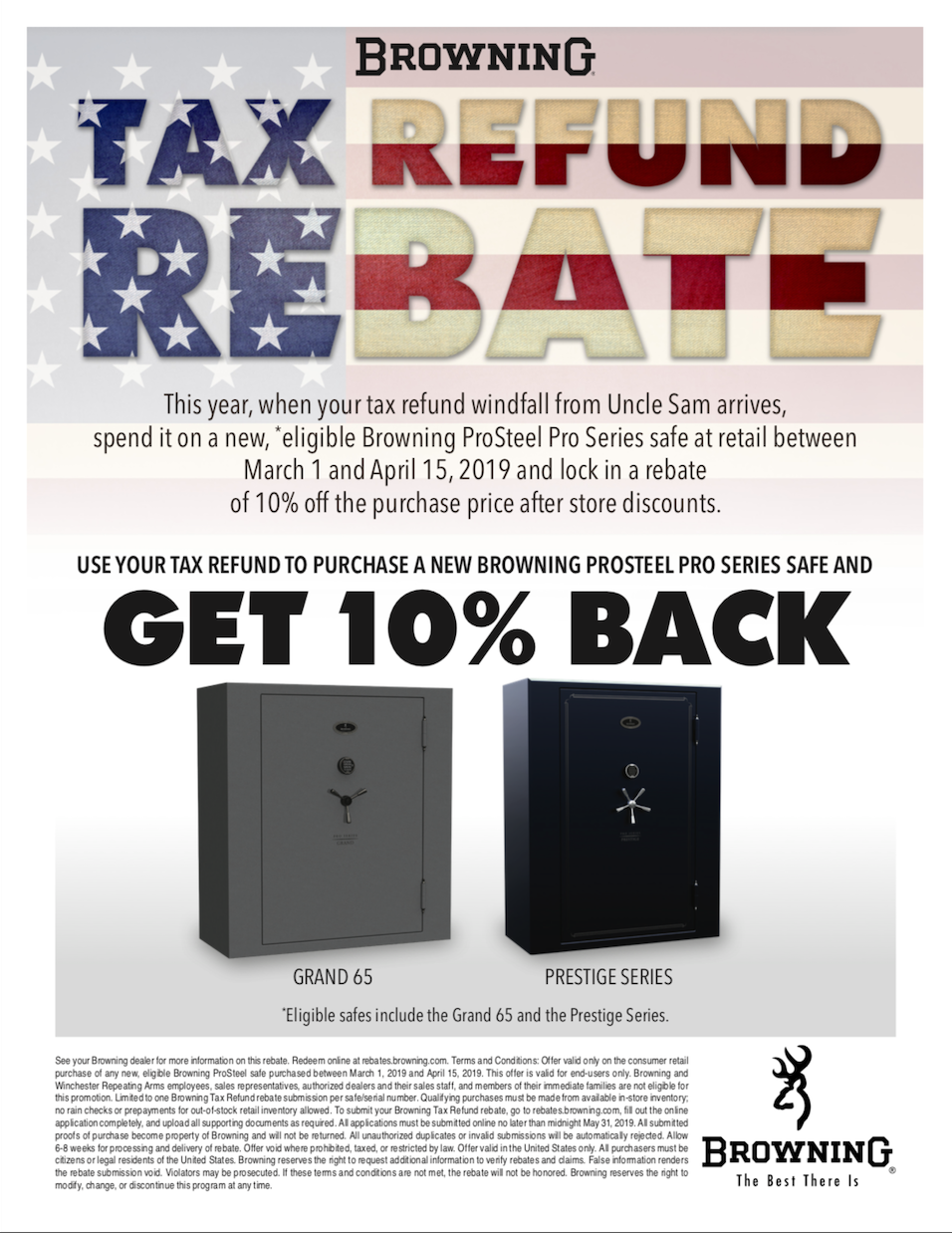

Browning Safe Tax Refund Rebate The Safe House Nashville TN

https://thesafehousestore.com/nashvillesafehouse/wp-content/uploads/sites/6/2018/03/Screen-Shot-2019-02-26-at-2.16.07-PM.png

Web Are sales taxes calculated before or after a rebate or incentive is applied The short answer is it depends on the state Please see What Fees Should You Pay for detailed Web Tennessee Sales Tax Calculator You can use our Tennessee Sales Tax Calculator to look up sales tax rates in Tennessee by address zip code The calculator will show you the

Web Tennessee first adopted a general state sales tax in 1947 and since that time the rate has risen to 7 percent On top of the state sales tax there may be one or more local sales Web Under Tennessee sales and use tax law sales of motor vehicles trailers and off highway vehicles are sales of tangible personal property and subject to sales and use tax

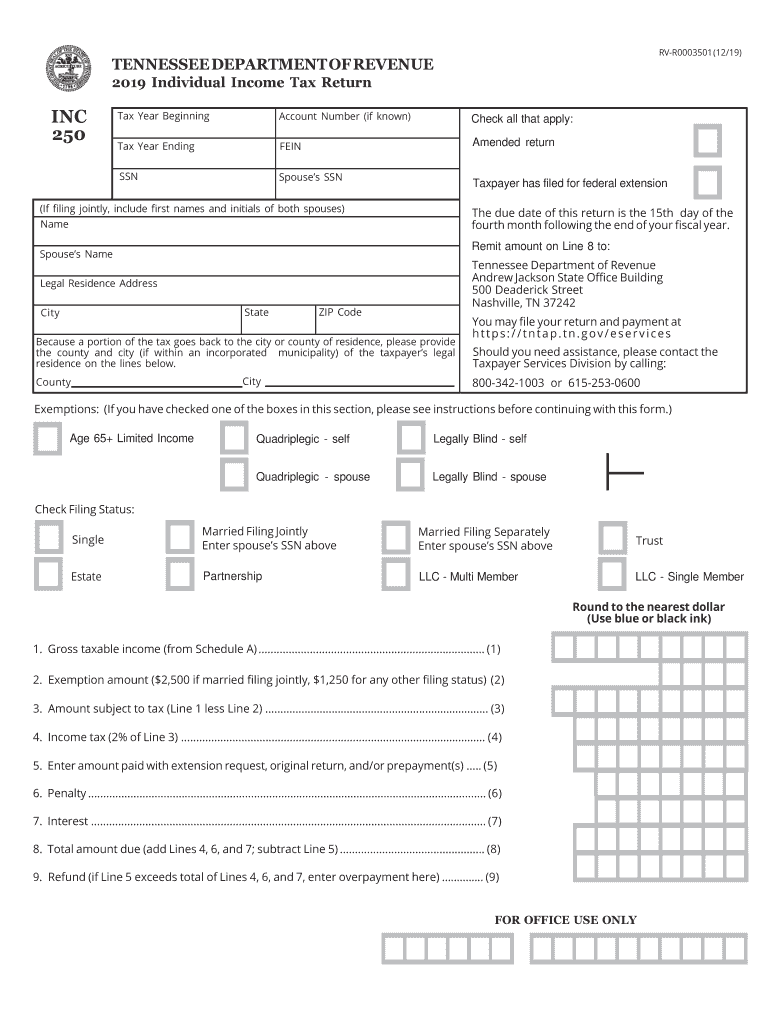

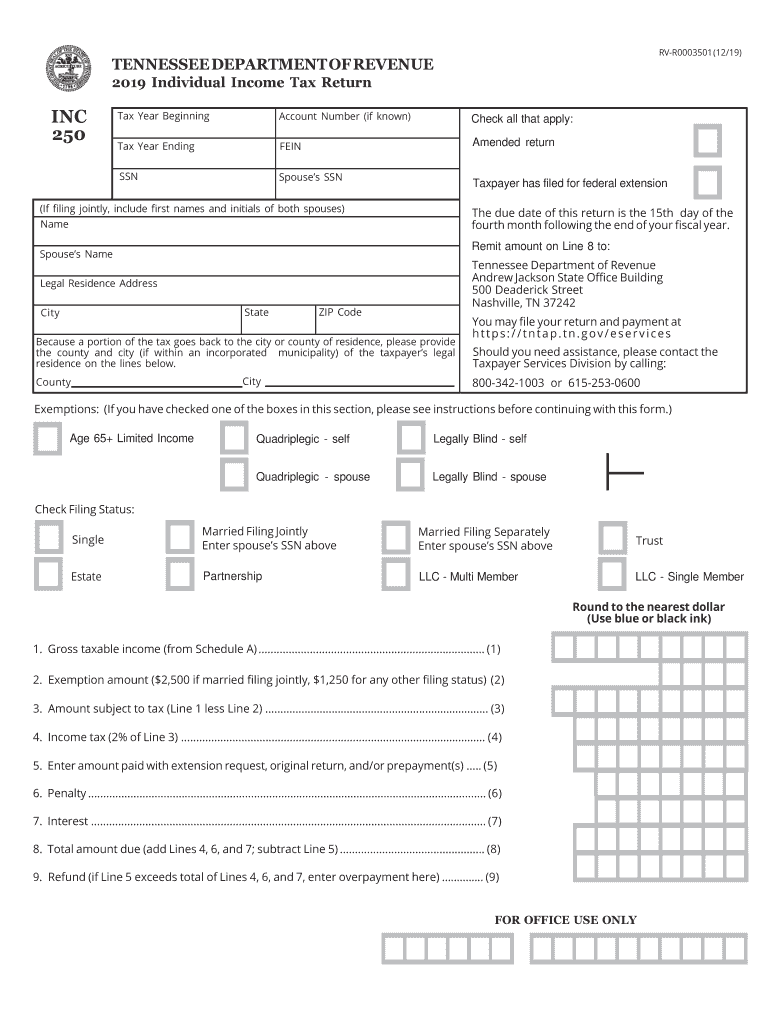

Tennessee State Tax Form 2019 Fill Out And Sign Printable PDF

https://www.signnow.com/preview/489/139/489139362/large.png

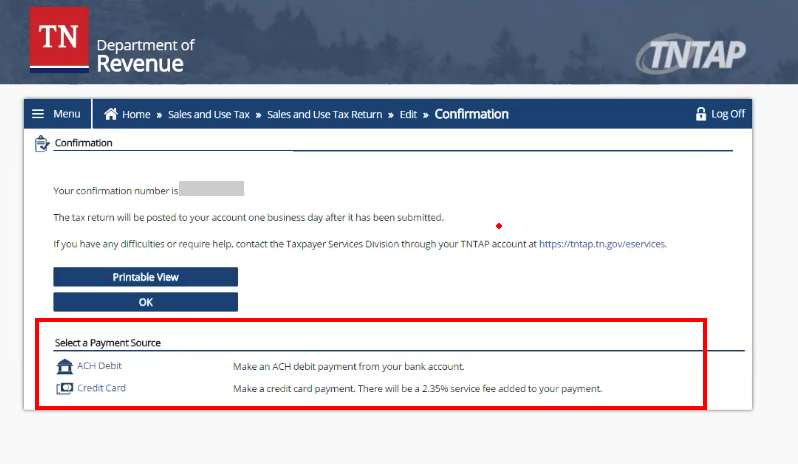

How To File A Tennessee Sales Tax Return

http://blog.taxjar.com/wp-content/uploads/2016/01/Tennessee-sales-tax-return-payment.png

https://revenue.support.tn.gov/hc/en-us/articles/360058139672-SUT-13...

Web 28 f 233 vr 2023 nbsp 0183 32 SUT 13 Sales and Use Tax Rates Overview The state sales tax rate for most taxable items and services is 7 However there are exceptions For example

https://www.tn.gov/.../documents/countyclerks/SalesUseTax…

Web sales tax paid at time of purchase Vehicle price 35 000 Documentation fee 300 Add Rebate 3500 do not add or subtract just a third party payment Trade in

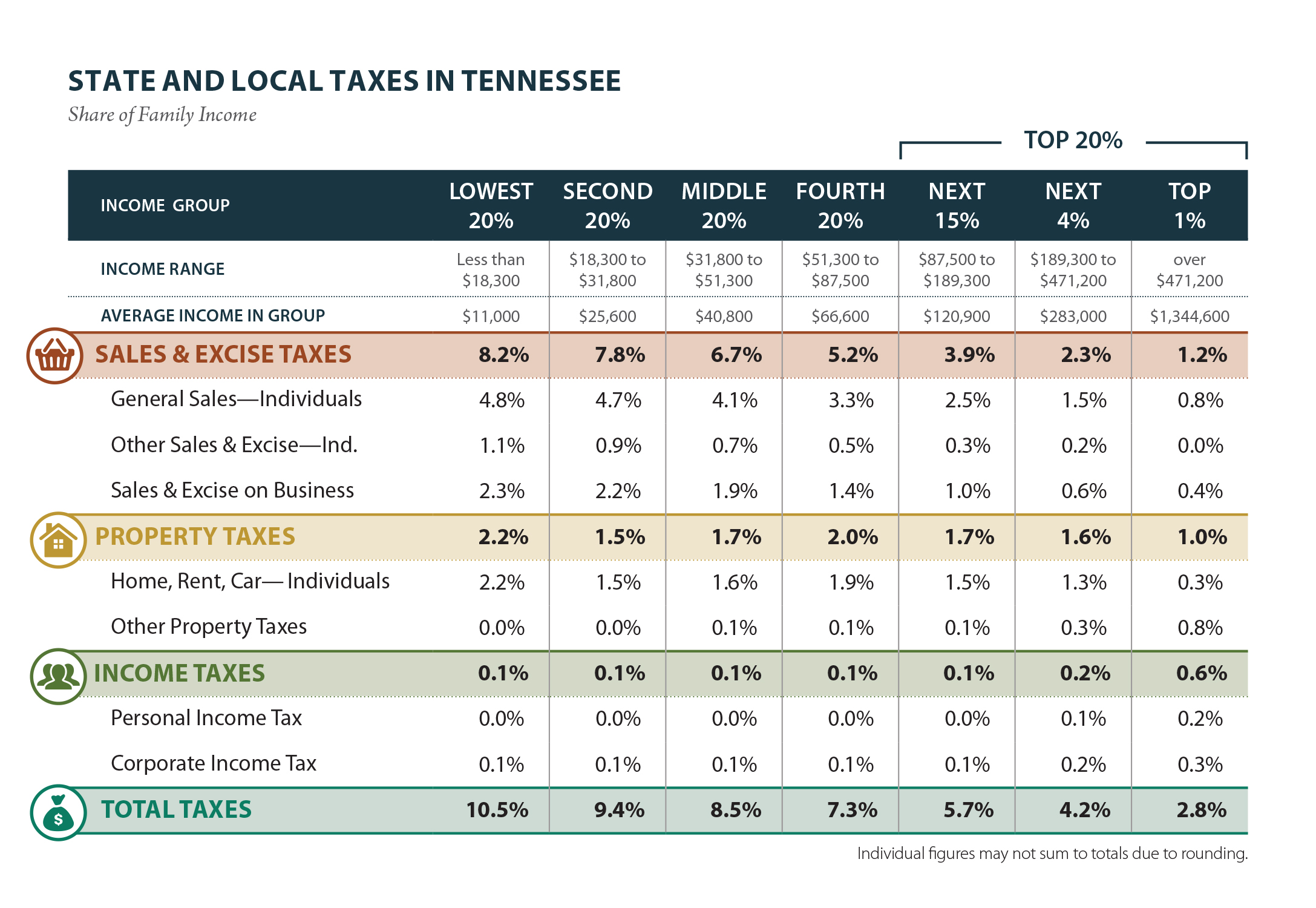

Tennessee Who Pays 6th Edition ITEP

Tennessee State Tax Form 2019 Fill Out And Sign Printable PDF

Tennessee Exemption State Fill Out And Sign Printable PDF Template

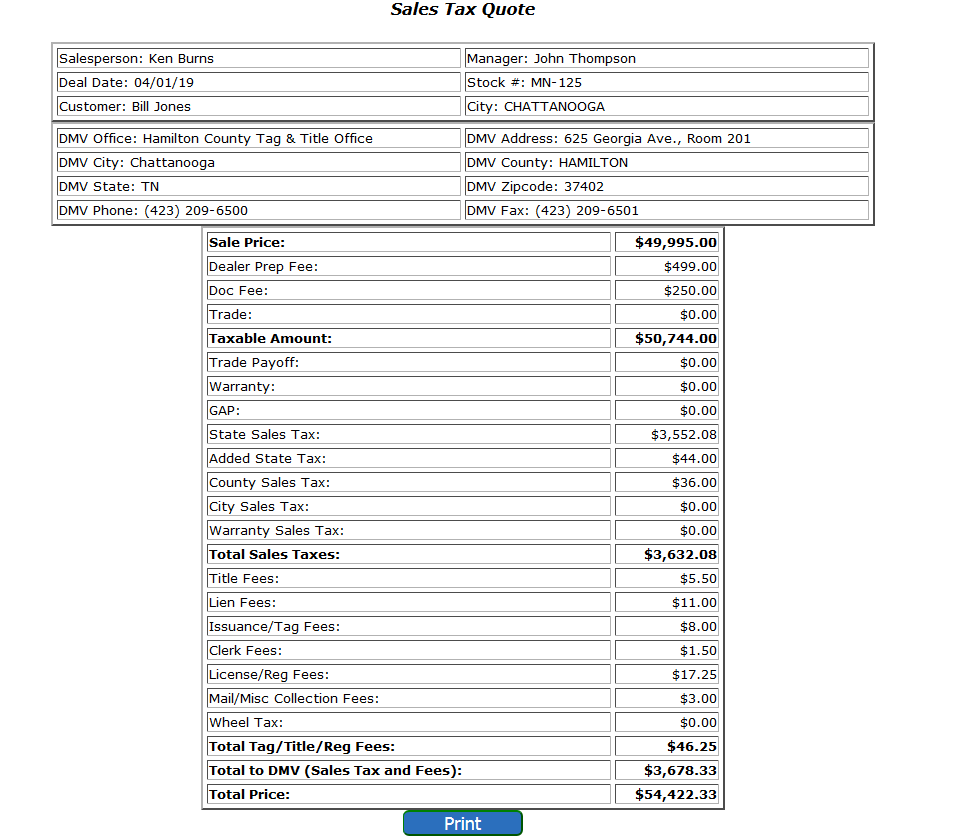

Tn Vehicle Sales Tax Calculator Hamilton County Tax

71 Character Reference For A Friend In Court Page 2 Free To Edit

Knoxville Tn Sales Tax Rate 2019 Be A Real Personal Website

Knoxville Tn Sales Tax Rate 2019 Be A Real Personal Website

Jenniffer Comstock

Tn Vehicle Sales Tax Calculator Hamilton County Tax

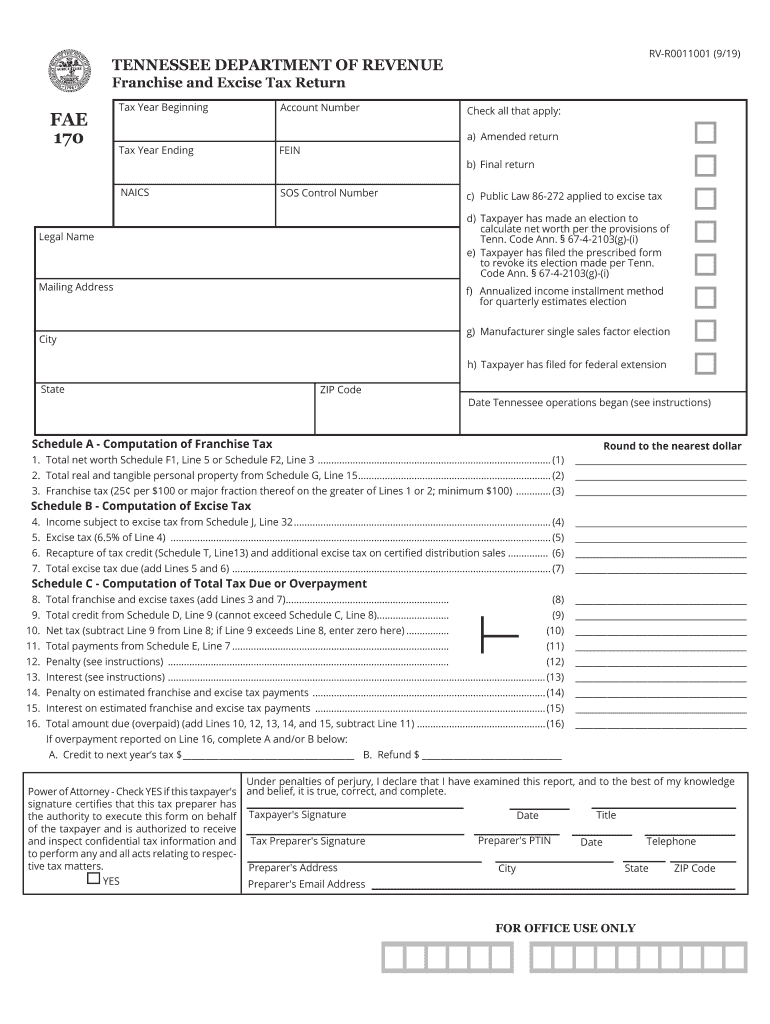

Tn Fae 170 Fill Out And Sign Printable PDF Template SignNow

Sales Tax On Rebates Tn - Web The taxes are as follows Beer barrelage tax Paid by the wholesaler or manufacturer The tax is 4 29 per one gallon barrel and is due on the 20th of every month Wholesale beer