Sales Tax Rules 2006 Sales Tax Rules 2006 3 20 Cancellation or return of supply 29

The Sales Tax Rules 2006 List of Chapters Chapter I REGISTRATION COMPULSORY REGISTRATION AND DE REGISTRATION Chapter II FILING OF RETURNS Chapter III CREDIT AND DEBIT NOTE AND DESTRUCTION OF GOODS Chapter IV APPORTIONMENT OF INPUT TAX Chapter V REFUND Chapter VI SPECIAL AUDIT 1 The SALES TAX RULES 2006 Updated By FATE WING FEDERAL BOARD OF REVENUE ISLAMABAD Updated up to 30 10 2018 Last amendments made through S R O No 259 I 2018 S R O No 277 I 2018 S R O No 493 I 2016 S R O No 757 I 2016 S R O No 1031 I 2016 S R O No 227 I 2016 have been shown in RED

Sales Tax Rules 2006

Sales Tax Rules 2006

https://static.helpjuice.com/helpjuice_production/uploads/upload/image/3606/direct/1518172604809-1518172604809.jpg

California 1031 Exchange Sales Tax Rules Atlas 1031

https://atlas1031.com/wp-content/uploads/2013/09/image-3.png

Sales Tax Rules 2006 Amendment Supply Of Used Vehicles All Pak

https://i1.wp.com/allpaknotifications.com/wp-content/uploads/2020/10/Sales-Tax-Rules-for-Vehicles.jpeg?fit=734%2C884&ssl=1

Sales Tax Rules 2006 6 1Notification No S R O 555 1 2006 dated 5th June 2006 In exercise of the powers conferred by sub section I of section 4 and section 40 of the Federal Excise Act 2005 section 219 of the Customs Act 1969 IV of 1969 section 50 of the Sales Tax Act 1990 read with sub section 2 Sales Tax Rules 2006 Sales Tax Rules 2006 FBR Federal Board of Revenue is the Revenue Division of Government of Pakistan tasked with collecting taxes duties and administrating relevant legislation

The new rule reads as under 10 Cancellation of multiple registrations 1 In case a person holds multiple sales tax registrations he shall retain only one registration and surrender all other registrations under intimation to CRO 4 The Sales Tax Rules 2006 updated upto 30 06 2020 View 5 The Sales Tax Rules 2006 updated upto 30 10 2018 View 6 Sales Tax Rules 2006 amended up to 30th June 2015 View

Download Sales Tax Rules 2006

More picture related to Sales Tax Rules 2006

Texas Tax Sale Investing Tax Sale Lists Struck Off Property YouTube

https://i.ytimg.com/vi/ak6HXlL0BCs/maxresdefault.jpg

Have Sales Tax Rules Changed For Businesses Logan Graham Conner

https://www.lgcaccounting.com/wp-content/uploads/2018/09/091616-sales-tax-illustration-e1474058592450-1184x631.jpg

Income Tax Rules 5th e Buy Income Tax Rules 5th e Online At Low Price

https://n3.sdlcdn.com/imgs/d/n/3/Income-Tax-Rules-5th-e-SDL076879114-1-da7d7.jpg

1 These Rules may be called the Sales Tax Rules 2006 2 They shall be applicable to such persons or class of persons as are specified in the respective chapters 3 They shall come into force on the first day of July 2006 Shall be made in the Sales Tax Rules 2006 namely In the aforesaid Rules for Chapter XIV B the following shall be substituted namely CHAPTER XIV B ELECTRONIC MONITORING TRACKING AND TRACING OF SPECIFIED GOODS AND LICENSING THEREFOR SUB CHAPTER 1 PRELIMINARY 150ZF Application The provisions of

[desc-10] [desc-11]

Rule 46A Of Income tax Rules Does Not Restrict Power Of CIT A To Admit

https://ttplimages.imgix.net/tax-practice-images/IT-APP-R-15.jpg?w=1200

Top 3 Which States Do Not Collect Sales Tax In 2022 G u y

https://www.taxjar.com/wp-content/uploads/TAX_States-Without-Sales-Tax_Blog_L1R1-copy.jpg

https://download1.fbr.gov.pk/Docs/...

Sales Tax Rules 2006 3 20 Cancellation or return of supply 29

https://download1.fbr.gov.pk/sros/salestaxsros/...

The Sales Tax Rules 2006 List of Chapters Chapter I REGISTRATION COMPULSORY REGISTRATION AND DE REGISTRATION Chapter II FILING OF RETURNS Chapter III CREDIT AND DEBIT NOTE AND DESTRUCTION OF GOODS Chapter IV APPORTIONMENT OF INPUT TAX Chapter V REFUND Chapter VI SPECIAL AUDIT

Tax Accounting Services Lee s Tax Service

Rule 46A Of Income tax Rules Does Not Restrict Power Of CIT A To Admit

Sales Tax Finevolution

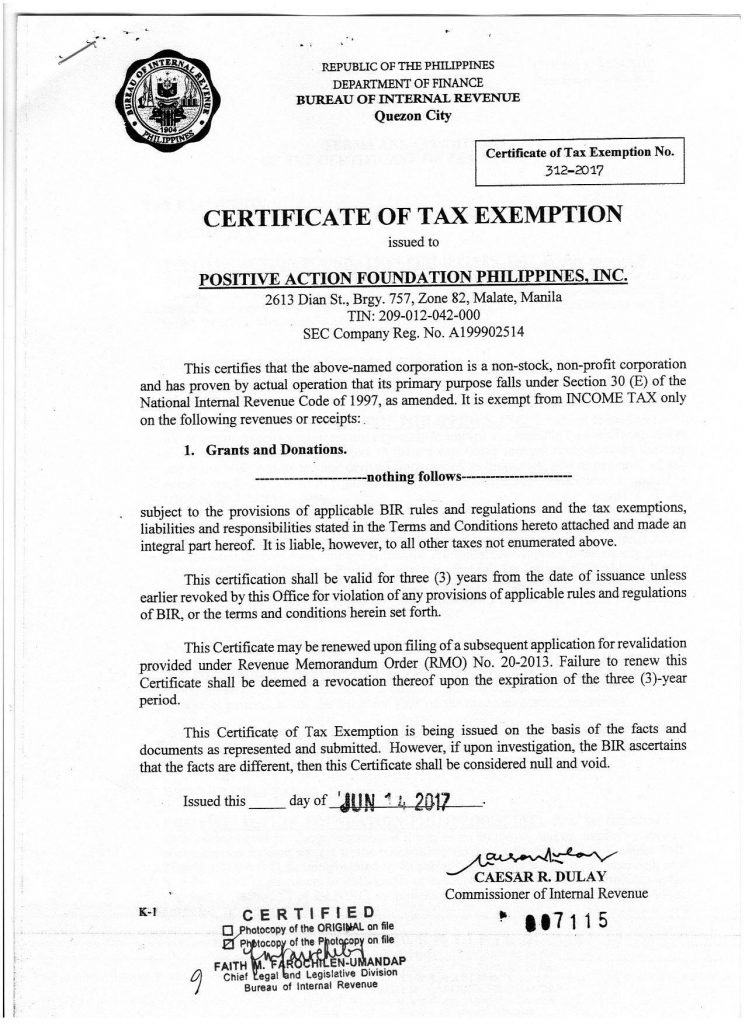

Certificate Of TAX Exemption PAFPI

New Tax Rules For Divorce And Alimony Payments

-480a.jpg)

Visualizing Taxes By State

-480a.jpg)

Visualizing Taxes By State

Nevada Sales Tax Forms 2020 Semashow

Switching To New Age 72 RMD Rules Under SECURE Act Tax Rules Tax

Tax Rules And Due Diligence For Gambling Think Outside The Tax Box

Sales Tax Rules 2006 - [desc-14]