Sars Medical Rebate 2024 21 February 2024 No changes from last year See more tax rates here How does it work The MTC will effectively impact both the employer and the employee This credit must be taken into account by the employer when calculating the amount of employees tax to be deducted or withheld from the employees remuneration

What is it An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a person pays For the 2024 tax year i e the tax year starting on 1 March 2022 and ending on 28 February 2024 the following rebates apply Primary rebate ZAR 16 425 for all natural persons Secondary rebate ZAR 9 000 if the taxpayer is 65 years of age or over Tertiary rebate ZAR 2 997 if the taxpayer is 75 years of age or over

Sars Medical Rebate 2024

Sars Medical Rebate 2024

https://www.tirerebate.net/wp-content/uploads/2022/06/continental-tires-rebate-best-tire-deal-at-lamb-s-tire-automotive-5.jpg

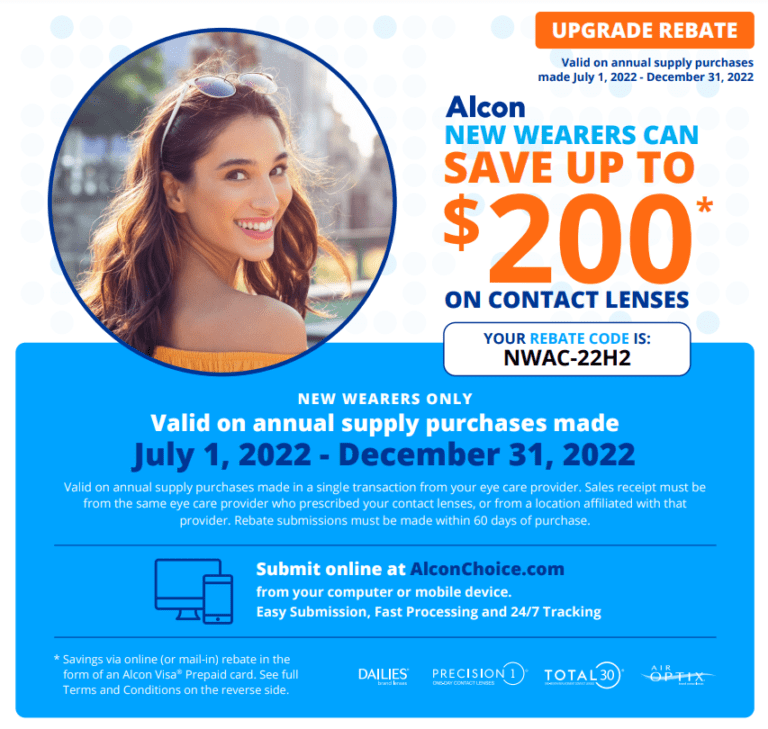

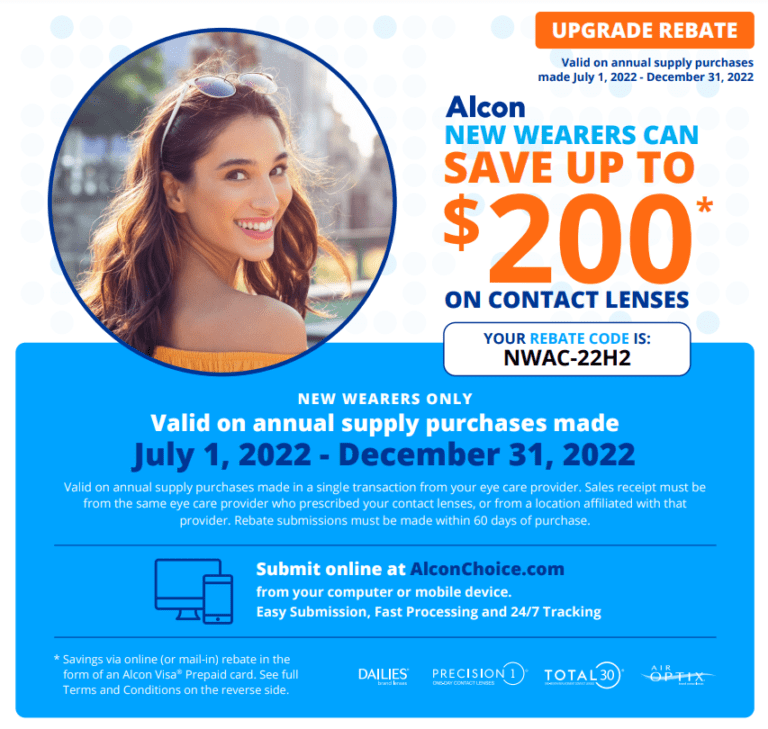

Contact Lens Rebate Forms

https://www.royacdn.com/unsafe/Site-88a5128c-aaae-4122-b1ad-472be343579c/rebate/2022_1H_Existing_Wearer_Rebate_page_001.jpg

How Does The SARS Tax Rebate Work YouTube

https://i.ytimg.com/vi/lL7HbFj2i_A/maxresdefault.jpg

SARS calls this rebate the Medical Schemes Fees Tax Credit and it applies to the fees paid by a taxpayer to a registered medical scheme for you as the taxpayer and your dependent s The credit for 2025 is a fixed monthly amount of R 364 2024 R 364 for you as the primary member a further R 364 for your first dependent and R 246 2024 What are the SARS medical tax credits How does SARS eFiling work How do you calculate your medical aid tax credit When should you submit your medical aid tax So if you re ready to go all in with the medical aid tax credit in South Africa this guide is for you Let s dive right in Important Notice

A medical tax credit is available in respect of medical scheme contributions for taxpayers under the age of 65 This rebate replaced the deduction that was previously available For the tax year commencing on 1 March 2024 the monthly rebates for medical scheme contributions are as follows Taxpayer ZAR 364 The medical tax credit brought in from the 2013 tax year provides for a monthly credit against your tax owing to SARS If you and or your dependents belong to a medical aid then you will receive in 2025 a R364 R364 in 2024 medical tax credit per month for the first two members and a further R246 in 2025 R246 in 2024 per month for every

Download Sars Medical Rebate 2024

More picture related to Sars Medical Rebate 2024

National Budget Speech 2022 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/tax-rate-tables.png

How You Can Get A Rebate From SARS YouTube

https://i.ytimg.com/vi/6ViEHjG6rHM/maxresdefault.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

Effective September 2024 medical aids are expected to provide the requested data in line with the conditions outlined in the external Medical Scheme Contributions Business Requirement Specification BRS How much did you spend on Medical Aid How much did you spend on qualifying Medical Expenses that was not paid back to you by Medical Aid Use our medical aid credits calculator to work out how much of your medical spending you can claim back from tax

[desc-10] [desc-11]

Alcon Printable Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/Alcon-Rebate-Form-2022-Printable-768x729.png

Rebate Forms CooperVision

https://coopervision.com/sites/coopervision.com/files/styles/full_content/public/2023-06/14657A-2HF23-National-Patient-Rebate-Image-800x450.jpg?itok=Dl7Ot0sa

https://www.sars.gov.za/types-of-tax/personal-income-tax/medical...

21 February 2024 No changes from last year See more tax rates here How does it work The MTC will effectively impact both the employer and the employee This credit must be taken into account by the employer when calculating the amount of employees tax to be deducted or withheld from the employees remuneration

https://www.sars.gov.za/.../additional-medical-expenses-tax-credit

What is it An Additional Medical Expenses Tax Credit also known as an AMTC is a rebate which in itself is non refundable but which is used to reduce the normal tax a person pays

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Alcon Printable Rebate Form Printable Rebate Form

Get Up To A 300 Rebate On Bausch Lomb Contact Lenses Sunshine

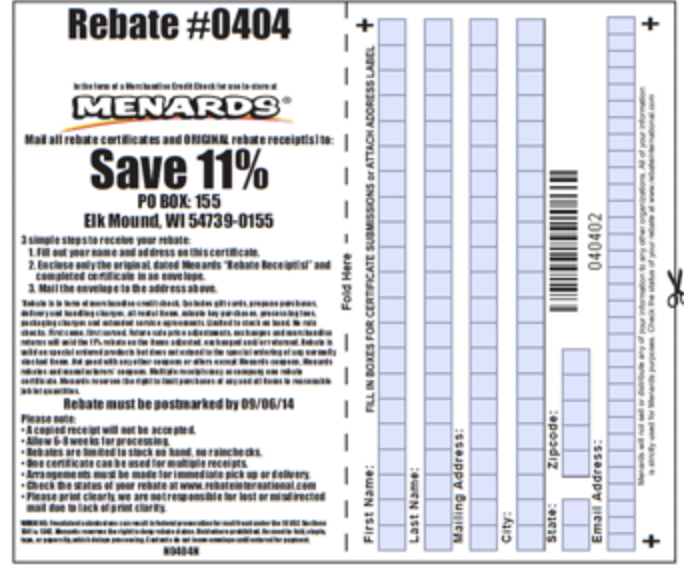

Printable Menards Rebate Form 2024 January Rebates

Missouri Renters Rebate 2024 PrintableRebateForm

File Tripler Army Medical Center Aerial View jpg Wikimedia Commons

File Tripler Army Medical Center Aerial View jpg Wikimedia Commons

SARS Logbook Requirements And The Trip Logbook App

Sars Tax Tables 2017 Pdf Cabinets Matttroy

Bud Light Beer Rebate Form 2023 How To Claim Validity And All You

Sars Medical Rebate 2024 - [desc-12]