Sars Personal Tax Return Deadline 2022 On or before 24 October 2022 if the return is submitted manually or with the assistance of a SARS official at one of SARS s offices or for a non provisional taxpayer

The South African Revenue Services SARS has announced that taxpayers will be able to file their tax returns from 1 July 2022 SARS said that the other important On 3 June 2022 SARS will publish a notice in the Government Gazette specifying the taxpayers that do not need to file income tax returns for the 2022 year of assessment

Sars Personal Tax Return Deadline 2022

Sars Personal Tax Return Deadline 2022

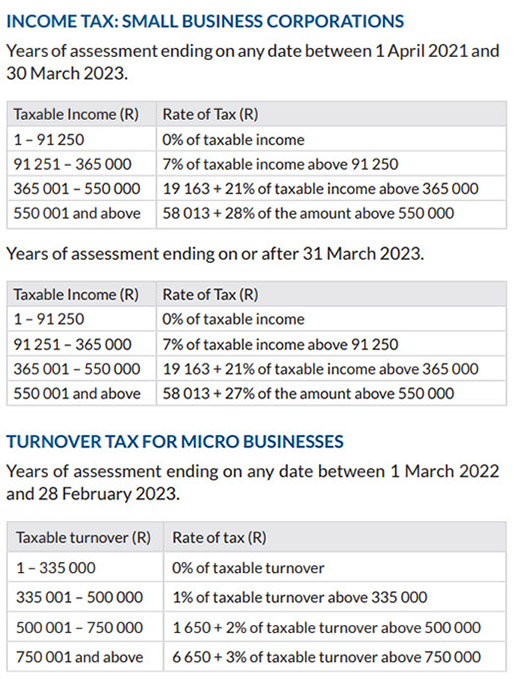

https://www.dotnews.co.za/Code/Uploads/Article/2022/2_IncomeTax_Companies.jpg

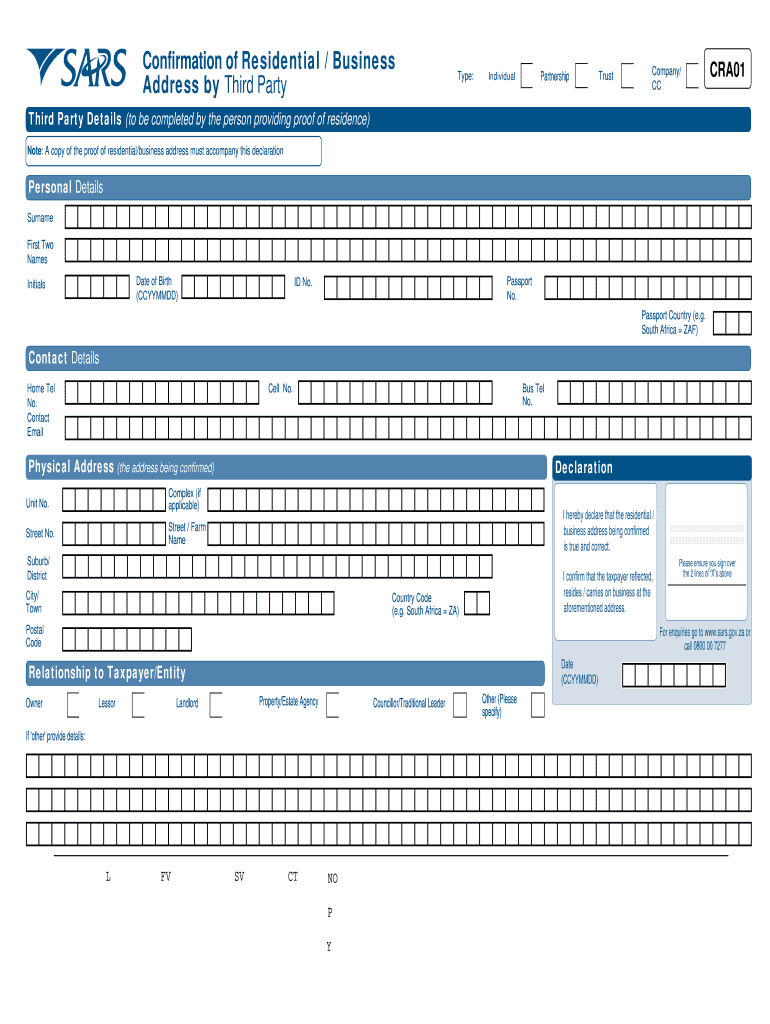

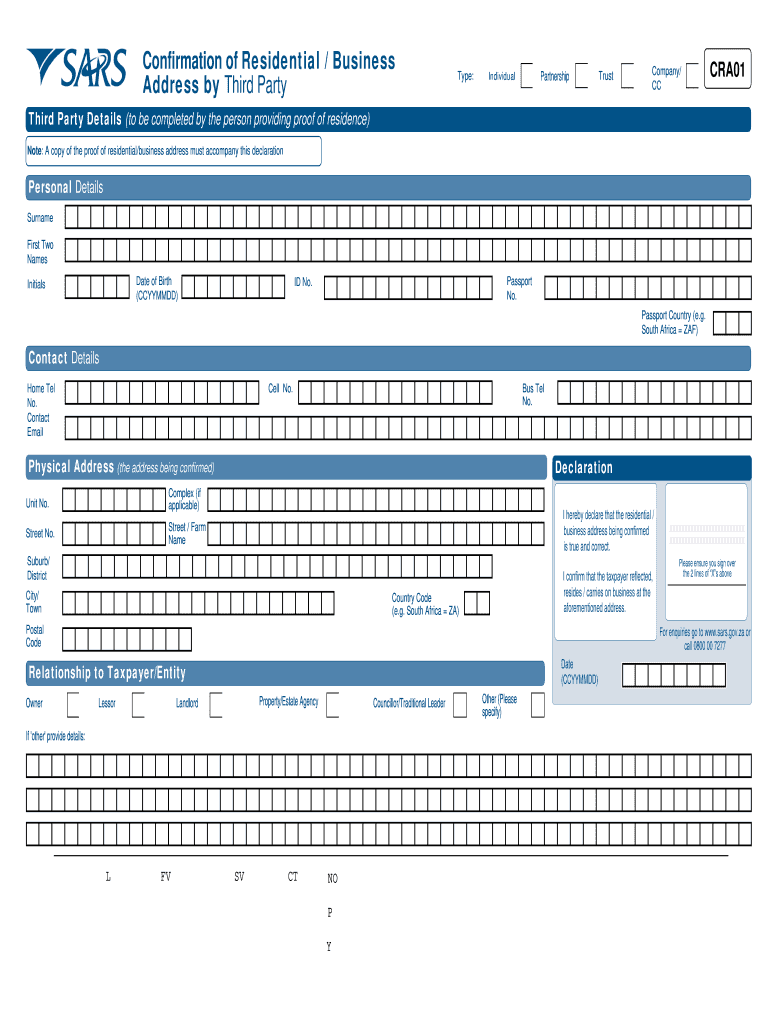

Cra01 Form Sars Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/100/822/100822082/large.png

SARS Sets The Record Straight About EFiling ITWeb

https://www.itweb.co.za/static/pictures/2018/07/resized/-fs-TAX-return-2018.xl.jpg

SARS has announced the deadline dates for filing income tax returns for the 2022 year of assessment as well as the details of those exempt from filing returns On 3 On 3 June 2022 SARS will publish a notice in the Government Gazette specifying the taxpayers that do not need to file income tax returns for the 2022 year of assessment

30 Jun 2022 The tax season for the 2022 tax year is here and it will be one of the shortest to date The period to submit tax returns will be open from July 1 2022 and close on Welcome to the SARS eFiling Landing Page SARS eFiling is a free online process for the submission of returns and declarations and other related services This free service

Download Sars Personal Tax Return Deadline 2022

More picture related to Sars Personal Tax Return Deadline 2022

HOW TO SUBMIT YOUR SARS TAX RETURN ONLINE USING EFILING Personal

https://i.ytimg.com/vi/qXttaUbEx_A/maxresdefault.jpg

2022 TAX DEADLINE 2022 Tax Return YouTube

https://i.ytimg.com/vi/7HXNAa-39JI/maxresdefault.jpg

SARS Makes Changes To The 2020 Tax Filing Season Zululand Observer

https://zululandobserver.co.za/wp-content/uploads/sites/56/2020/07/Filing-tax-return.jpeg

Andre Bothma 15 5K subscribers 212K views 1 year ago How to use SARS eFiling more Learn how to submit your 2022 tax return on SARS eFiling in this detailed The filing deadline of 24 October 2022 is just around the corner Provisional Taxpayers your tax return filing deadline is 23 January 2023 Breathe easy If you think

On 3 June 2022 SARS will publish a notice in the Government Gazette specifying the taxpayers that do not need to file income tax returns for the 2022 year of assessment According to the Guide on Income Tax and the Individual 2021 22 if SARS receives the request for extension together with reasonable grounds for requesting the

Sars Personal Income Tax Tables 2022 Whichpermit Free Download Nude

https://i2.wp.com/www.sanlam.com/productcatalog/PublishingImages/annexure1.PNG

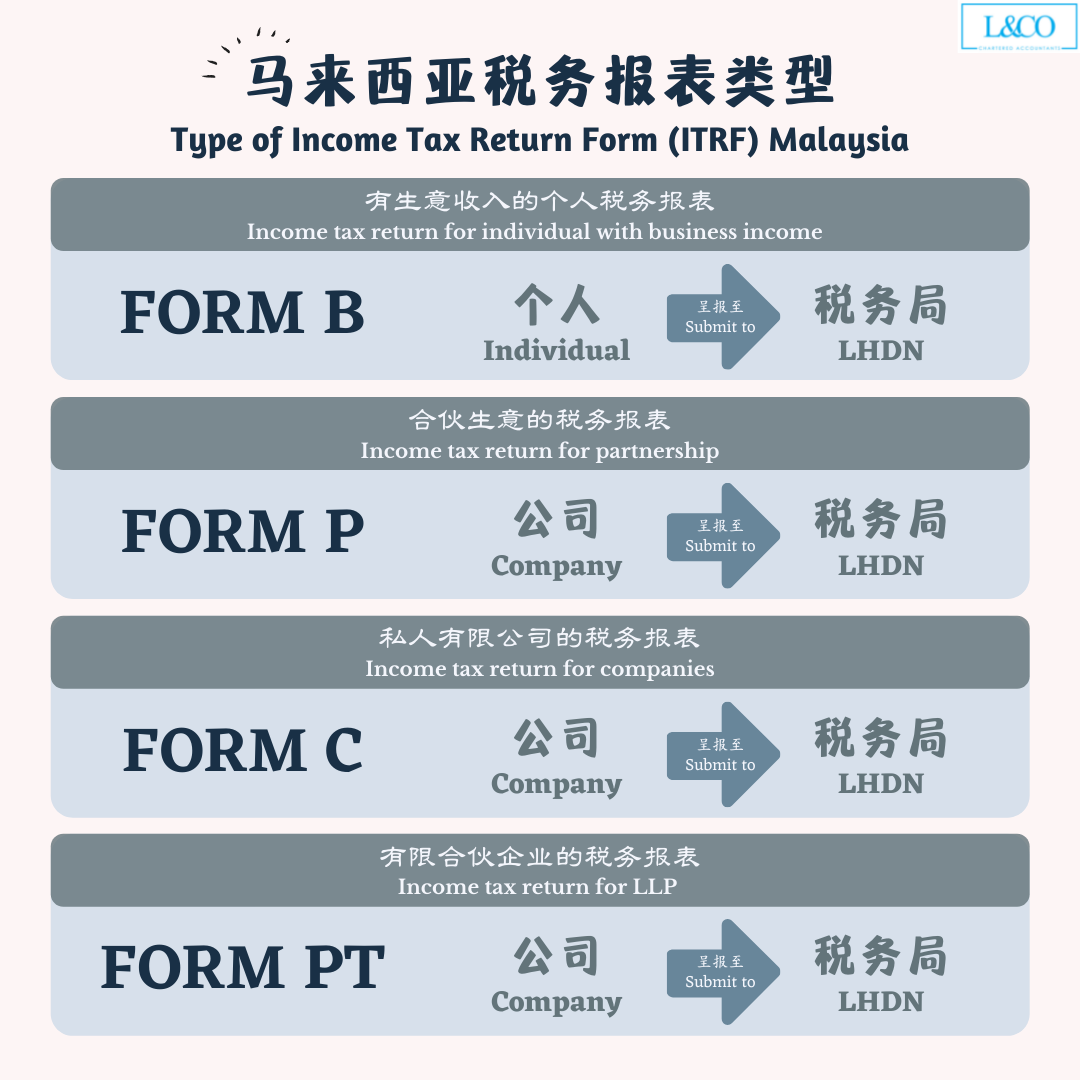

Deadline For Malaysia Income Tax Submission In 2023 for 2022 Calendar

https://landco.my/wp-content/uploads/2021/02/3-9.png

https://www.mondaq.com/southafrica/income-tax/1205814

On or before 24 October 2022 if the return is submitted manually or with the assistance of a SARS official at one of SARS s offices or for a non provisional taxpayer

https://businesstech.co.za/news/wealth/591942/sars...

The South African Revenue Services SARS has announced that taxpayers will be able to file their tax returns from 1 July 2022 SARS said that the other important

SARS Auto Assessment What Are The Risks

Sars Personal Income Tax Tables 2022 Whichpermit Free Download Nude

Tick Tock What Happens If You MISS The 2023 Tax Return Deadline

Reminder SARS Income Tax Return Deadline Is TODAY

SARS Tax Clearance Certificates CFO360 CFO360

SARS Tax Tables 2021 2022 Http exchangesoftware info

SARS Tax Tables 2021 2022 Http exchangesoftware info

URGENT SARS DEADLINE 2022 Individual Filing Season Deadline Is Set For

SARS Tax Season 2018 Deadline Reminder YouTube

SARS Announced The 2018 Tax Season Deadline Dates CTF

Sars Personal Tax Return Deadline 2022 - 30 Jun 2022 The tax season for the 2022 tax year is here and it will be one of the shortest to date The period to submit tax returns will be open from July 1 2022 and close on