Sars Tax Rebates Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of taxable income R226 001

Web Trusts other than special trusts rate of tax 45 Rebates Primary R16 425 Secondary Persons 65 and older R9 000 Tertiary Persons 75 and older R2 997 Age Tax Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2022 Taxable income Rate of tax R0 R216 200 18 of taxable income R216 201

Sars Tax Rebates

Sars Tax Rebates

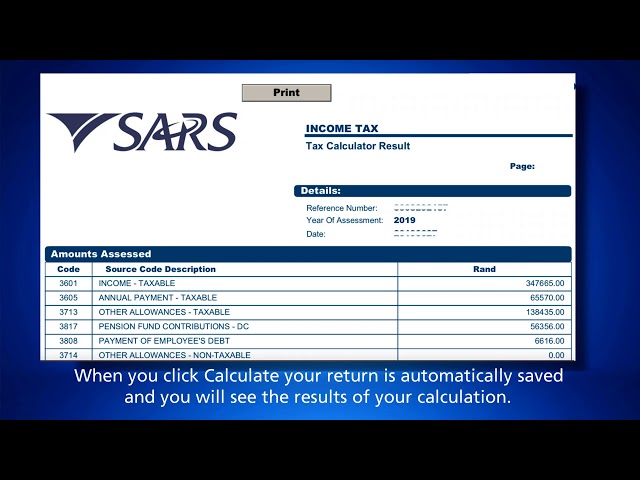

https://i.ytimg.com/vi/ZZjVYJlYUSY/sddefault.jpg

Sars Personal Income Tax Tables 2022 Whichpermit

https://i2.wp.com/www.sanlam.com/productcatalog/PublishingImages/annexure1.PNG

How The SARS Income Tax Brackets Work

https://image-prod.iol.co.za/resize/610x61000/?source=https://xlibris.public.prod.oc.inl.infomaker.io:8443/opencontent/objects/a43613f6-a44b-557e-b6b3-9afdf3e0c85f&operation=CROP&offset=0x0&resize=1075x472

Web 27 juin 2023 nbsp 0183 32 The rebates have the effect of establishing tax thresholds below which no tax is payable For the 2024 tax year i e the tax year commencing on 1 March 2023 and Web R 23 per month for 6 months Buy now and save SARS Tax Brackets amp Tax Tables for 2023 2024 Personal Income Tax In South Africa you are liable to pay income tax if you

Web 20 mars 2018 nbsp 0183 32 1 Primary rebate under 65 years 2 Secondary rebate between 65 and 75 years 3 Tertiary rebate over 75 years Depending on your age group you ll qualify Web 1 mars 2021 nbsp 0183 32 The primary and additional age rebate is available to all South African individual taxpayers The rebate is not reduced where a person has taxable income for

Download Sars Tax Rebates

More picture related to Sars Tax Rebates

SARS Tax Rates For Individuals South African Tax Consultants

https://www.tax-consultant.co.za/wp-content/uploads/2020/03/Tax-Rebates-and-Thresholds.png

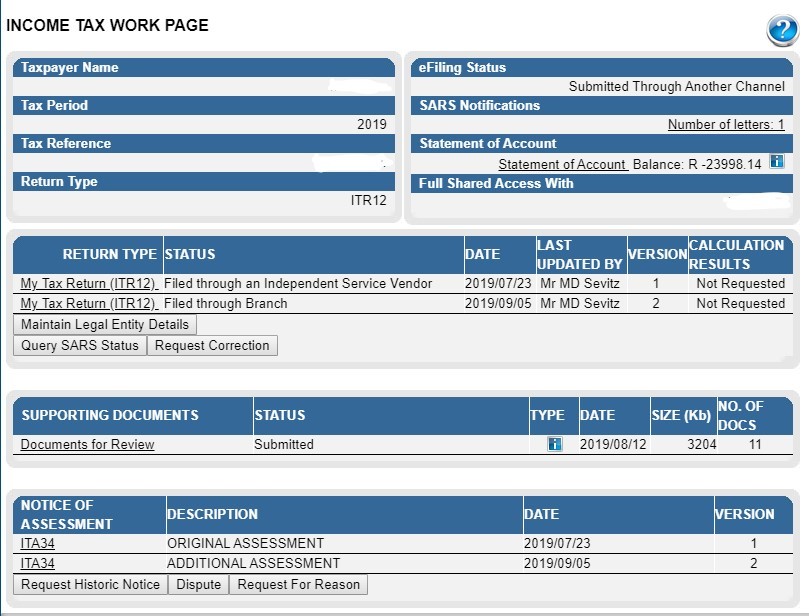

Return Status Filed Through Branch What Does This Mean Taxtim Blog Sa

https://www.taxtim.com/za/images/media-za/Filed-through-branch.jpg

Sars 2022 Medical Tax Tables Brokeasshome

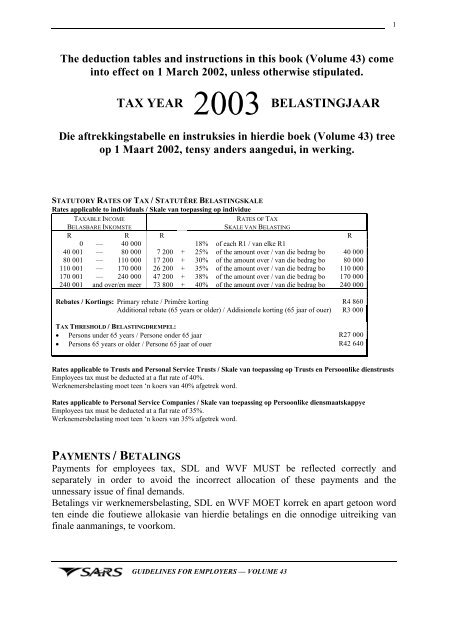

https://img.yumpu.com/42571125/1/500x640/sars-employee-tax-deductions-guidelines-workinfocom.jpg

Web Have no outstanding debt for any taxes you are registered for excluding Instalment payment arrangements Compromise of tax debt Payment of tax suspended pending Web 20 juil 2023 nbsp 0183 32 For the 2021 year of assessment 1 March 2020 28 February 2021 R83 100 if you are younger than 65 years If you are 65 years of age to below 75 years the

Web Congruent with this tradition and common practice the current Minister of Finance Mr Tito Mboweni delivered the budget speech on Wednesday 24 February 2023 laying out Web 1 mars 2020 nbsp 0183 32 VAT R360 6 bn Corporate Income Tax R230 2 bn Customs amp Excise Duties R112 7 bn Other R91 8 bn Fuel Levies R83 4 bn INDIVIDUAL TAX TAX

National Budget Speech 2023 SimplePay Blog

https://www.simplepay.co.za/blog/assets/images/blog-image.png

SARS Budget 2020 Tax Guide SSK

https://www.ssk.co.za/wp-content/uploads/SARS-Budget-2020-Tax-Guide.jpg

https://www2.deloitte.com/content/dam/Deloitte/za/Documen…

Web Tax Rates and Rebates Individuals Estates amp Special Trusts 1 Year ending 28 February 2023 Taxable income Rate of tax R0 R226 000 18 of taxable income R226 001

https://www.sars.gov.za/wp-content/uploads/Docs/Budget/2…

Web Trusts other than special trusts rate of tax 45 Rebates Primary R16 425 Secondary Persons 65 and older R9 000 Tertiary Persons 75 and older R2 997 Age Tax

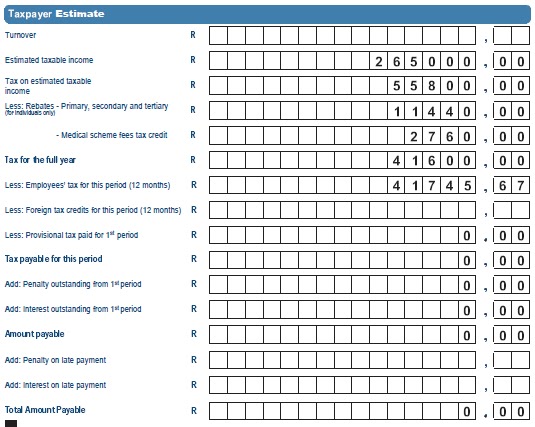

Accounting And Financial Updates SARS Provisional Tax Claim Your

National Budget Speech 2023 SimplePay Blog

Sars 2022 Tax Tables Brokeasshome

Sars Paye Annual Tax Tables 2017 Review Home Decor

SARS Tax Rates For Individuals South African Tax Consultants

Sars Paye Annual Tax Tables 2017 Review Home Decor

Sars Paye Annual Tax Tables 2017 Review Home Decor

SARS Budget Pocket Guide News

SARS Archives Pay Solutions

Income Tax Rates 2022 South Africa

Sars Tax Rebates - Web From a corporate tax perspective and following a commitment made in 2020 and reaffirmed in the 2021 Budget Speech National Treasury has reduced the corporate tax rate by 1