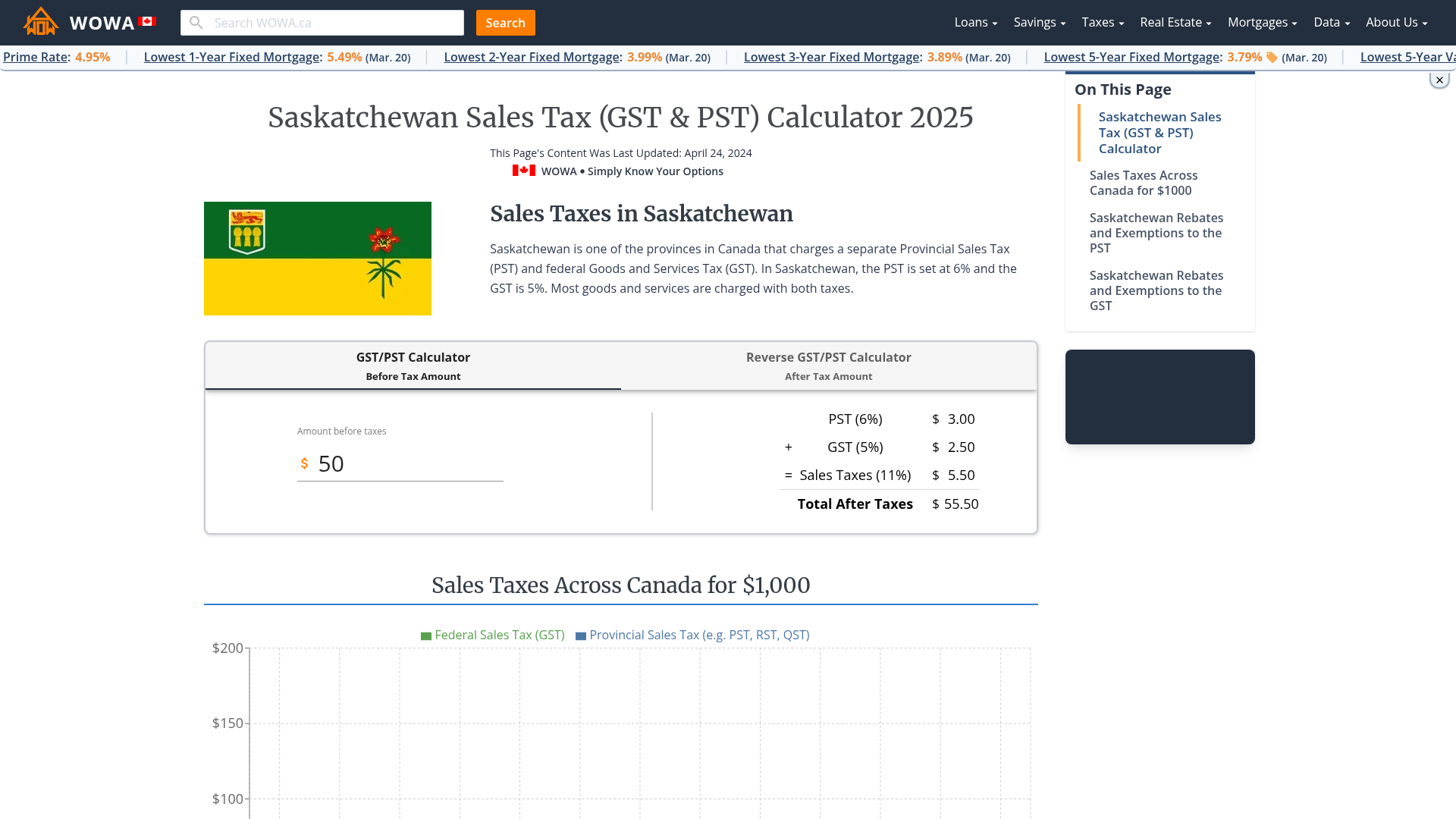

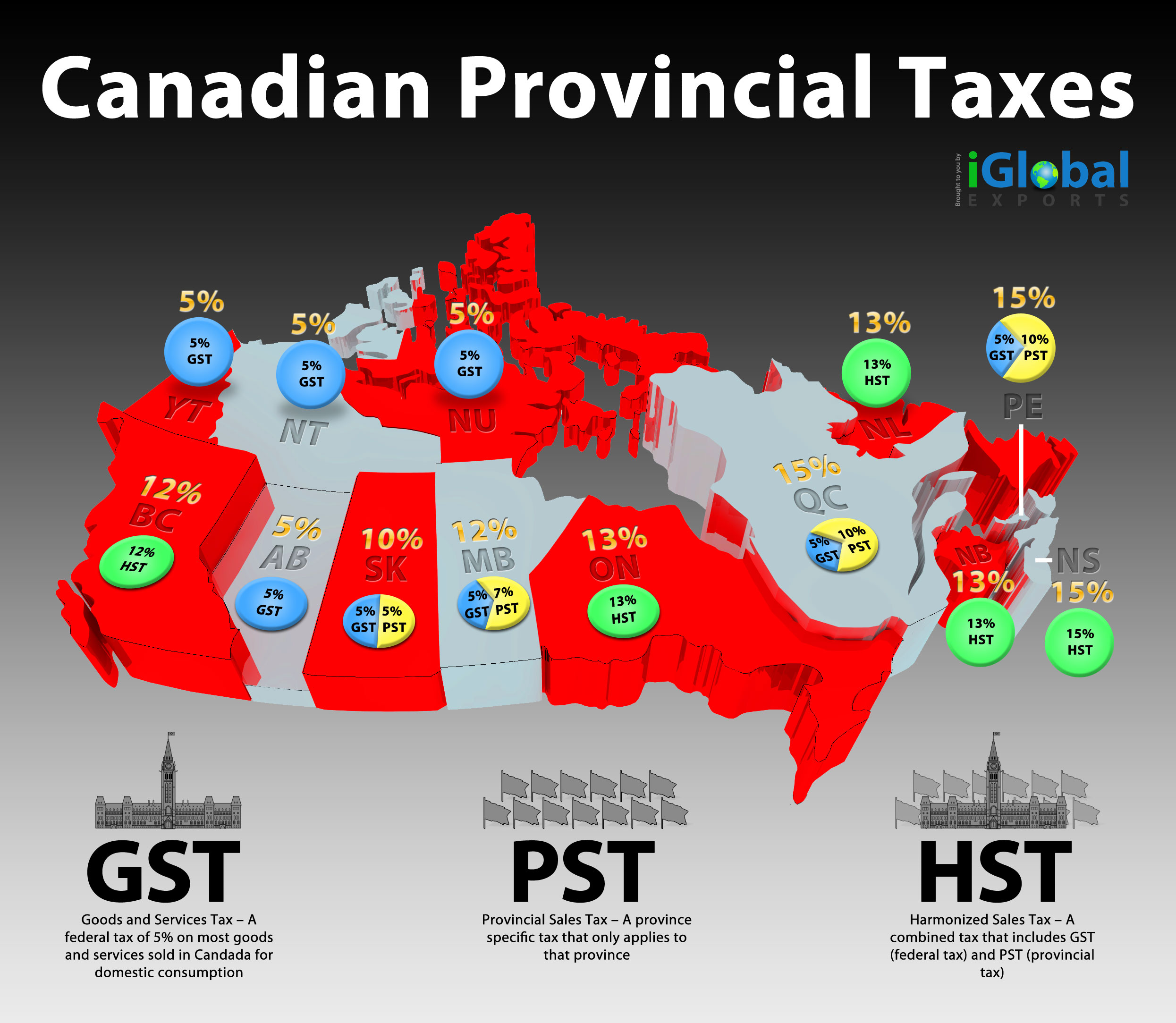

Saskatchewan Pst Return Total Sales Verkko Provincial Sales Tax PST is a six per cent sales tax that applies to taxable goods and services consumed or used in Saskatchewan It applies to goods and services purchased in the province as well as goods and services imported for consumption or use in Saskatchewan

Verkko Total Sales Enter the total amount as listed in your sales records not including GST or other taxes of all taxable and non taxable sales made during the reporting period Net Tax Collected This amount equals the total tax collected as Verkko 10 toukok 2023 nbsp 0183 32 Tax Guides Worldwide Tax Guides Business Guide to PST in Saskatchewan Posted by Quaderno Team May 10 2023 Updated on Sep 19 2023 PST 6 Local Taxes No Tax threshold CAD 0 for remote sellers Website Ministry of Finance XXX Sales Tax Calculator Zip Postal code XX Create a free account

Saskatchewan Pst Return Total Sales

Saskatchewan Pst Return Total Sales

https://www.vatcalc.com/wp-content/uploads/Saskatchewan.jpg

The Ultimate Guide To PST In Saskatchewan Jeremy Scott Tax Law

https://jeremyscott.ca/wp-content/uploads/2023/05/Guide-to-Saskachewan-PST.jpg

Saskatchewan Sales Tax GST PST Calculator 2024 WOWA ca

https://wowa.ca/static/img/opengraph/calculators/saskatchewan-sales-tax-calculator.png

Verkko Provincial Sales Tax PST is a sales tax that applies to all taxable goods and services in Saskatchewan PST applies to both sales that occur within Saskatchewan and goods and services imported and consumed or used in Saskatchewan This sales tax applies to both new and used goods it even applies to rental transactions Verkko this case when completing your Remittance Form enter your total sales in Box A enter zero if no sales and enter zero in Boxes B amp C If no tax is payable for this period enter zero in Box D

Verkko 11 toukok 2023 nbsp 0183 32 Before you get started you should collect all the information about your taxable sales in Saskatchewan during the previous quarter The tax website suggests having these pieces ready total sales and income total purchases and expenses You can file online in your SETS account Just log in here and click File and Pay in the Verkko 1 helmik 2022 nbsp 0183 32 Generally all businesses operating in Saskatchewan are required to register for Saskatchewan PST unless they are considered a small traders business A small traders business does not have to register for PST if they Have sales less than 10 000 per year Only make and sell goods from their home or provide services from

Download Saskatchewan Pst Return Total Sales

More picture related to Saskatchewan Pst Return Total Sales

Saskatchewan PST Refund ClearBenefits ca

https://clearbenefits.ca/wp-content/uploads/2018/11/learningcenter-saskatchewan-1080x720-1.jpg

Provincial Taxation In The Ur III State Cuneiform Monographs

https://i.visual.ly/images/canadian-provincial-taxes_502914bc01c88.jpg

Brief Expansion Of Saskatchewan PST An Unsustainable Budget Strategy

https://i1.wp.com/smartcdn.gprod.postmedia.digital/thestarphoenix/wp-content/uploads/2022/04/235722283-0729_wknd_unclaimed_3-w.jpg

Verkko Calculate tax paid on purchases based on the sales amount mark down 30 Sales 247 1 30 Purchases Purchases x 6 Tax Paid on Purchases Tax Collected on Sales Tax Paid on Purchases Tax Payable Businesses with a Vendor s Licence Businesses are required to pay PST directly to their suppliers on goods purchased for use in Verkko You may claim a refund by requesting a refund from your supplier or by applying to the Ministry of Finance Note that refund applications may be subject to future audit verification Eligibility You must claim a PST refund within

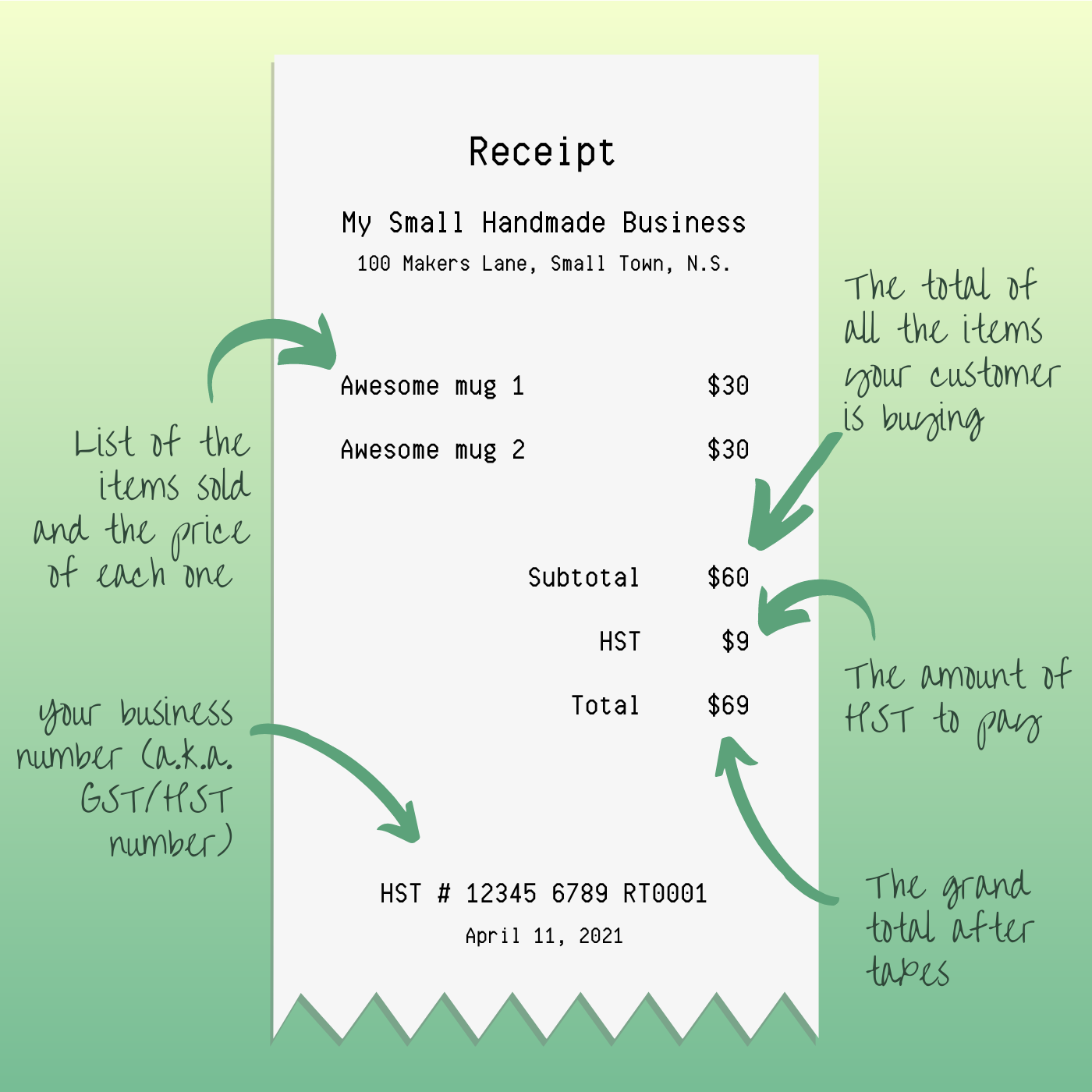

Verkko Revenues from sales taxes such as the PST are expected to total 2 555 billion or 33 7 of all of Saskatchewan s taxation revenue during the 2019 fiscal year This is greater than revenue from Saskatchewan s corporate income Verkko Small Business Bookkeeping for Saskatchewan Provincial Sales Tax PST All your sales invoices should list the item or service being sold plus the total retail amount The percentage of tax GST 5 PST 6 should be separate line items PST and inventory Any purchases that are intended for resale such as inventory are PST

The Cost Of The Saskatchewan PST YouTube

https://i.ytimg.com/vi/RmzglvXv2LY/maxresdefault.jpg

Saskatchewan Sales Tax Bulletin PST 5 General Information YouTube

https://i.ytimg.com/vi/Z8ME-RtaXvk/maxresdefault.jpg

https://www.saskatchewan.ca/.../provincial-sales-tax

Verkko Provincial Sales Tax PST is a six per cent sales tax that applies to taxable goods and services consumed or used in Saskatchewan It applies to goods and services purchased in the province as well as goods and services imported for consumption or use in Saskatchewan

https://pubsaskdev.blob.core.windows.net/pubsask-prod/3…

Verkko Total Sales Enter the total amount as listed in your sales records not including GST or other taxes of all taxable and non taxable sales made during the reporting period Net Tax Collected This amount equals the total tax collected as

PST To Be Charged On Insurance PremiumsDehoney Financial Group

The Cost Of The Saskatchewan PST YouTube

PST In Saskatchewan Explained Empire CPA

PST Expansion Goes Into Effect R saskatchewan

Saskatchewan PST Eliminated again For Oil Gas Industry MNP

Government Of Saskatchewan PST Charges On Sports Fees Ringette

Government Of Saskatchewan PST Charges On Sports Fees Ringette

Saskatchewan Wikitravel

How To Complete A Canadian PST Return 7 Steps with Pictures

A Beginner s Guide To Charging Sales Tax In Canada Everything Makers

Saskatchewan Pst Return Total Sales - Verkko 1 Total Sales Total sales on which SK PST is collectable or purchases on which SK PST is payable 2 Tax Collected Total SK PST collected on sales 3 Tax Payable on Goods Purchased Total SK PST collected on sales 4 Tax Payable Sum of Tax Collected 2 plus Tax Payable on Goods Purchased 3 5 Deduct Tax Paid on