Savings For Tax Rebate Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many Web 3 f 233 vr 2023 nbsp 0183 32 Get a 150 tax credit on a home energy assessment and relax while trained professionals get to work finding opportunities for energy savings in your house Find

Savings For Tax Rebate

Savings For Tax Rebate

https://www.theastuteparent.com/wp-content/uploads/2022/03/tax-savings.png

Tax Rebate Services Hi res Stock Photography And Images Alamy

https://c8.alamy.com/comp/2H4NF61/rebate-refund-savings-plan-tax-and-government-support-concept-notebooks-pen-and-colored-pencils-on-a-wooden-table-2H4NF61.jpg

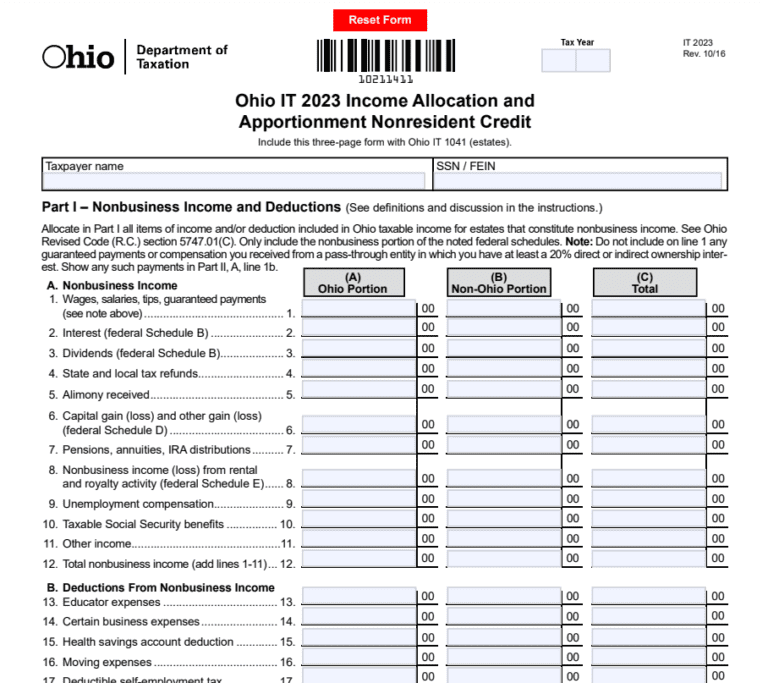

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Ohio-Tax-Rebate-2023-768x683.png

Web 8 sept 2023 nbsp 0183 32 The calculator says the Smiths will qualify for rebates in 2024 and they qualify for 15 600 in available tax credits right away which means the Smiths can claim Web 9 sept 2022 nbsp 0183 32 President Biden s Inflation Reduction Act takes on climate change by helping Americans reduce their carbon footprint A key element in that push is offering up to

Web 13 ao 251 t 2022 nbsp 0183 32 The rebates are double up to 4 000 and 8 000 respectively for lower income households Their income must be 80 or less of an area s median Web 29 d 233 c 2022 nbsp 0183 32 3 ways to tap billions in new money to go green starting this month In 2023 you can electrify your home and your car with the help of the U S government Here s how A contractor

Download Savings For Tax Rebate

More picture related to Savings For Tax Rebate

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

Best Investment Options Best Tax Saving Schemes In India For 2012

http://myinvestmentideas.com/wp-content/uploads/2012/09/best-tax-saver-bank-FDs.png

Best Tax Saving Investments Under Section 80c For FY 2019 20

https://www.paisabazaar.com/wp-content/uploads/2019/01/Tax-saving-schemes-under-section-80c-768x511.jpg

Web Breaker box 4 000 limit Electric wiring 2 500 limit Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you Web 21 sept 2022 nbsp 0183 32 As a taxpayer you can save up to 15 600 under this section You can also claim tax benefits for premiums paid towards health insurance for self spouse children and parents and term insurance

Web 30 d 233 c 2022 nbsp 0183 32 Savings for Home Builders The Inflation Reduction Act of 2022 updates and extends the Section 45L Tax Credit for Energy Efficient New Homes Web 12 sept 2023 nbsp 0183 32 According to EnergySage the average solar panel cost in Colorado is 3 13 per watt So if you install a solar panel system that s five kilowatts which is an average

Virginia Tax Credits Rebates Savings Richmond Spray Foam

http://richmondsprayfoam.com/images/slider15.jpg

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

https://www.irs.gov/credits-and-deductions-under-the-inflation...

Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many

Saving Money The Strategic Way REBATES

Virginia Tax Credits Rebates Savings Richmond Spray Foam

Council Tax Rebate Single Person

Are Investment Expenses Tax Deductible In 2019 Antique Wooden World

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

Maine Tax Relief 2023 Printable Rebate Form

Maine Tax Relief 2023 Printable Rebate Form

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Oregon Solar Power For Your House Rebates Tax Credits Savings Tax

Savings For Tax Rebate - Web 8 sept 2023 nbsp 0183 32 The calculator says the Smiths will qualify for rebates in 2024 and they qualify for 15 600 in available tax credits right away which means the Smiths can claim