School Property Tax Credit Wisconsin Apartment Below are credits that are available on your Wisconsin return Renter s and Homeowner s School Property Tax Credit Available if you paid rent during 2023 for living quarters that was used as your primary residence OR you paid property taxes on your home

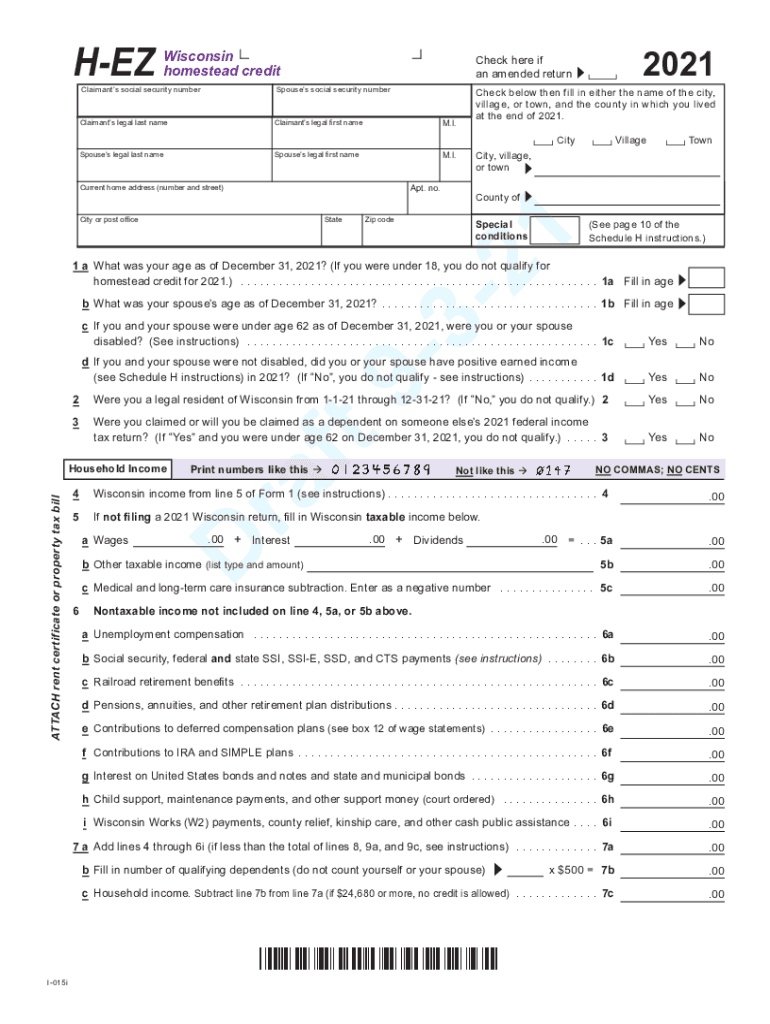

The Homestead tax credit and the school property tax credit are two different things Anyone who rents or pays property taxes on their primary residence can take the school property tax credit Only those whose incomes are 24 680 or below can qualify for the Homestead tax credit How does a property owner qualify for the school levy tax credit The school levy tax credit is applied to every taxable property The credit amount is based on the property s assessed value as a percent of the municipality s total assessed value

School Property Tax Credit Wisconsin Apartment

School Property Tax Credit Wisconsin Apartment

https://i.ytimg.com/vi/MnKruWkqVqI/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYACzAWKAgwIABABGBUgWShyMA8=&rs=AOn4CLDJvdSDYNrBwg-McRVD1yBWIpL7Fg

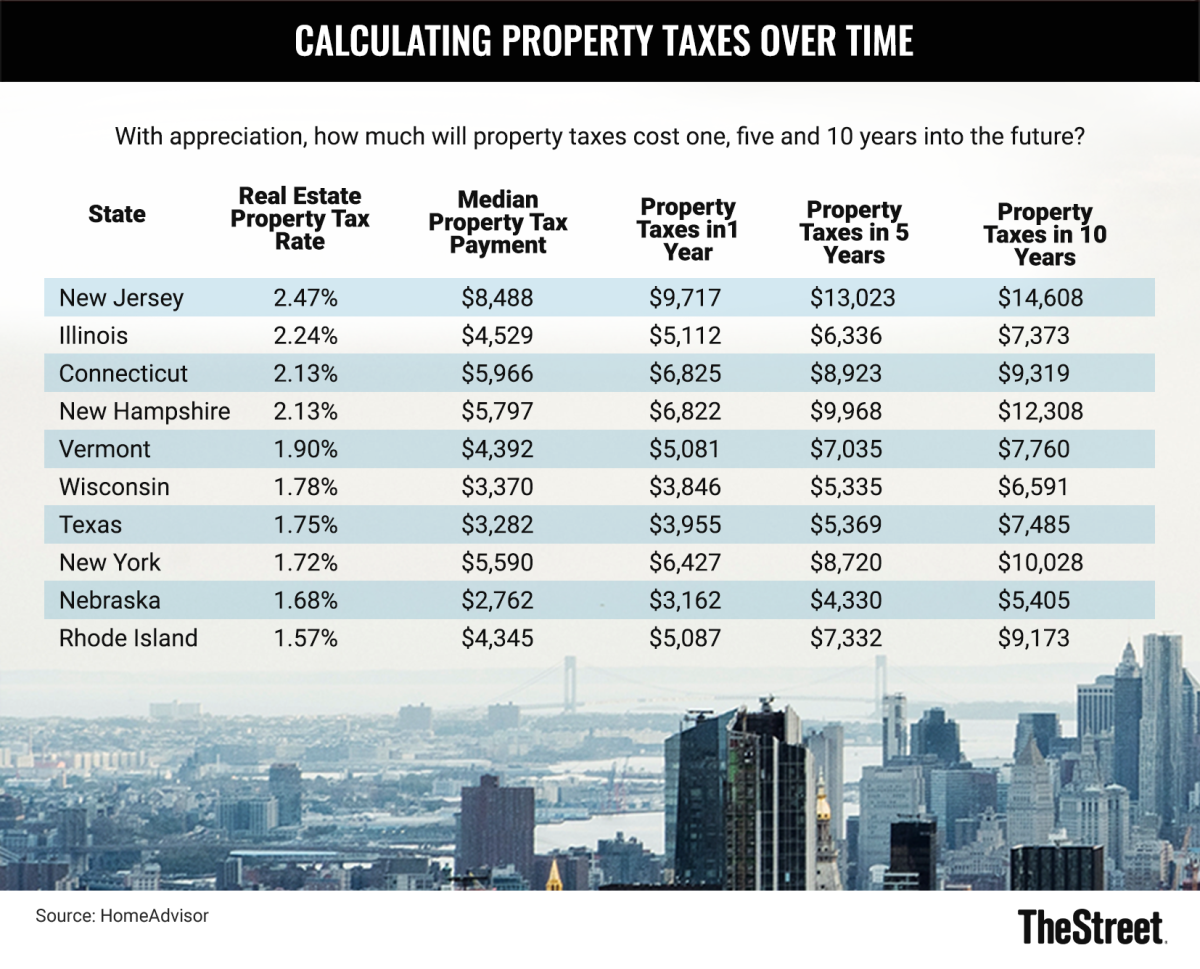

These States Have The Highest Property Tax Rates TheStreet

https://www.thestreet.com/.image/t_share/MTkzMTM5Mzg2MDIyNDM4MjQ0/table-property-taxes-101922.png

10 States With The Lowest Property Taxes In 2022

https://www.fortunebuilders.com/wp-content/uploads/2021/07/states-with-no-property-tax-1.jpeg

Yes a renter can qualify for this credit The only condition is that You may NOT claim the school property tax credit if you or your spouse are claiming the veterans and surviving spouses property tax credit WI web site In the state program the screen for this credit comes right after the Homestead credit screen How can this program help me This is a tax credit that can be claimed on your Wisconsin income tax return You can get a credit for part of the rent or property taxes you paid in that tax year It is a credit against the tax you paid and it is not refundable

Renter s and Homeowner s School Property Tax Credit This is a tax credit can be claimed on your Wisconsin income tax return You can receive a credit for part of the rent or property taxes you paid in that tax year It is a credit against the tax you paid and it Homeowners are entitled to an income tax credit for school property taxes of up to 300 based on the amount of property taxes paid for a primary residence Veterans and surviving spouses may be entitled to an income tax credit based on property taxes paid for the claimant s principal residence

Download School Property Tax Credit Wisconsin Apartment

More picture related to School Property Tax Credit Wisconsin Apartment

Tax Data

http://www.nystax.gov/images/icons/od-property-yellow.svg

Wisconsin Homestead Credit 2021 2024 Form Fill Out And Sign Printable

https://www.signnow.com/preview/573/344/573344198/large.png

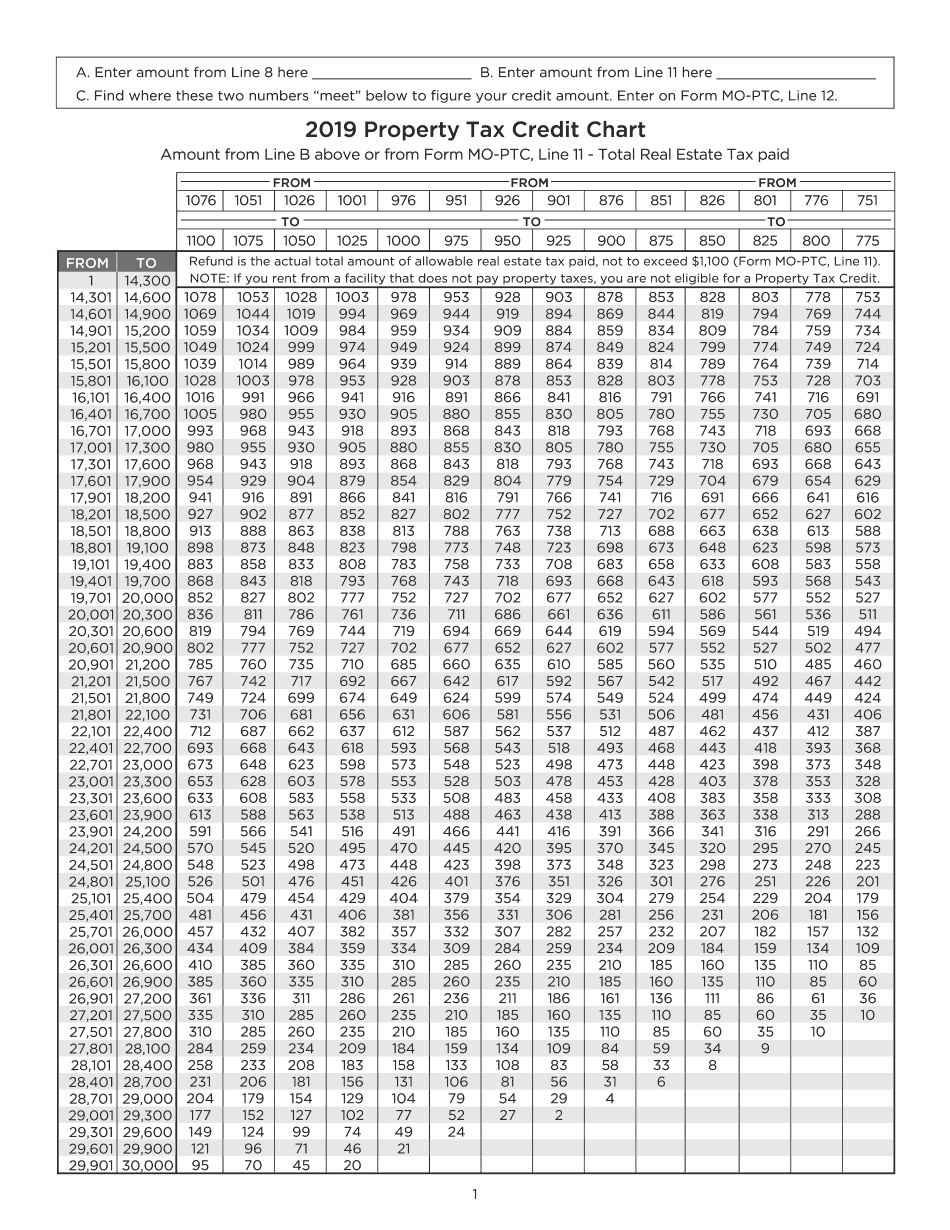

Edit Document Property Tax Credit Chart Form With Us Fastly Easyly

https://www.pdffiller.com/preview/491/866/491866144/big.png

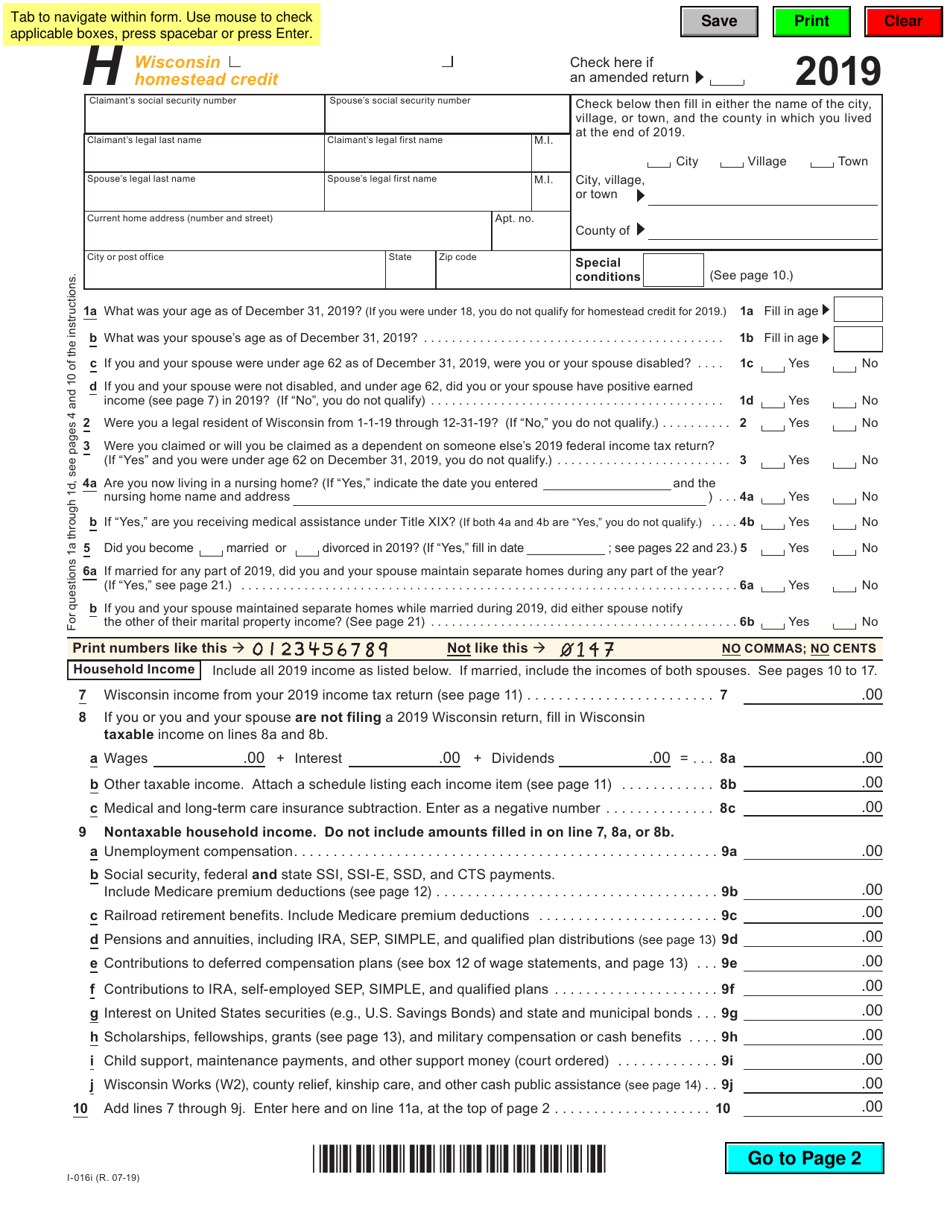

Qualifications You may be able to claim homestead credit if You occupied and owned or rented a home apartment or other dwelling that is subject to Wisconsin property taxes during 2023 You are a legal resident of Wisconsin for all of 2023 You are 18 years of age or older on December 31 2023 Wisconsin currently has three tax credit programs where credits are paid to municipalities and shown on property tax bills the school levy credit the first dollar credit and the lottery and gaming credit Annual funding for the school levy tax credit program was set at 469 305 000 from the 1996 97 to the 2005 06 property tax years

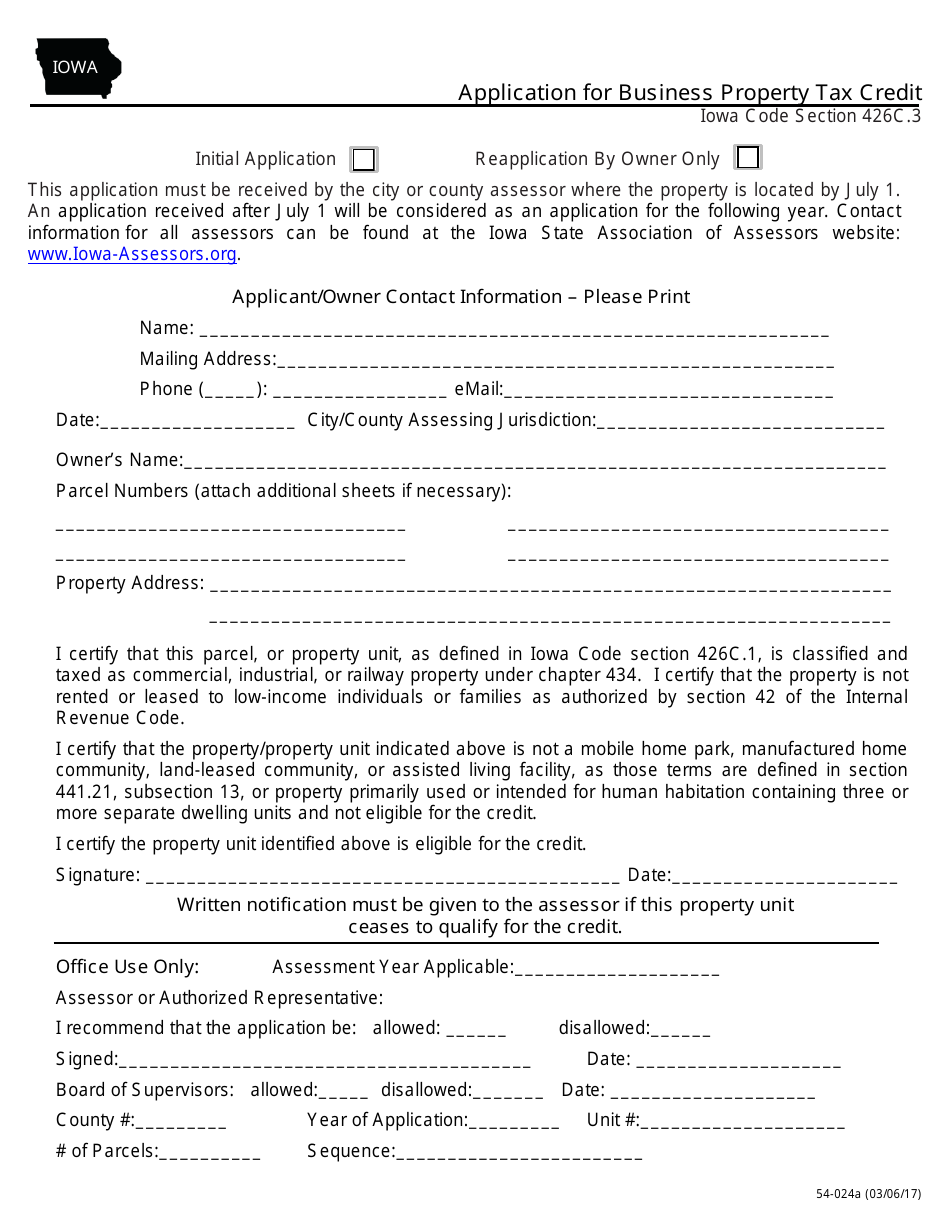

Determining whether property tax credits are provided equally across taxpayers including renters whose rents are determined in part by the property taxes landlords pay This paper provides a description of the three state property tax credits shown on property tax bills For each credit the description includes the distribution formula administration and funding level In addition historic information on previ ous property tax credit programs is provided

Hecht Group Who Pays Pro Rated Property Taxes When Buying A Home

https://img.hechtgroup.com/1662947805514.jpeg

School Property Tax Fight Brewing In Pennsylvania The Morning Call

http://www.trbimg.com/img-5651e934/turbine/mc-pa-school-property-tax-fight-brewing-20151122

https://support.taxslayer.com/hc/en-us/articles/360015708692

Below are credits that are available on your Wisconsin return Renter s and Homeowner s School Property Tax Credit Available if you paid rent during 2023 for living quarters that was used as your primary residence OR you paid property taxes on your home

https://www.reddit.com/.../school_property_tax_credit

The Homestead tax credit and the school property tax credit are two different things Anyone who rents or pays property taxes on their primary residence can take the school property tax credit Only those whose incomes are 24 680 or below can qualify for the Homestead tax credit

Sell My Apartment Building In Wisconsin We Buy WI Multifamily

Hecht Group Who Pays Pro Rated Property Taxes When Buying A Home

Form 54 024A Fill Out Sign Online And Download Fillable PDF Iowa

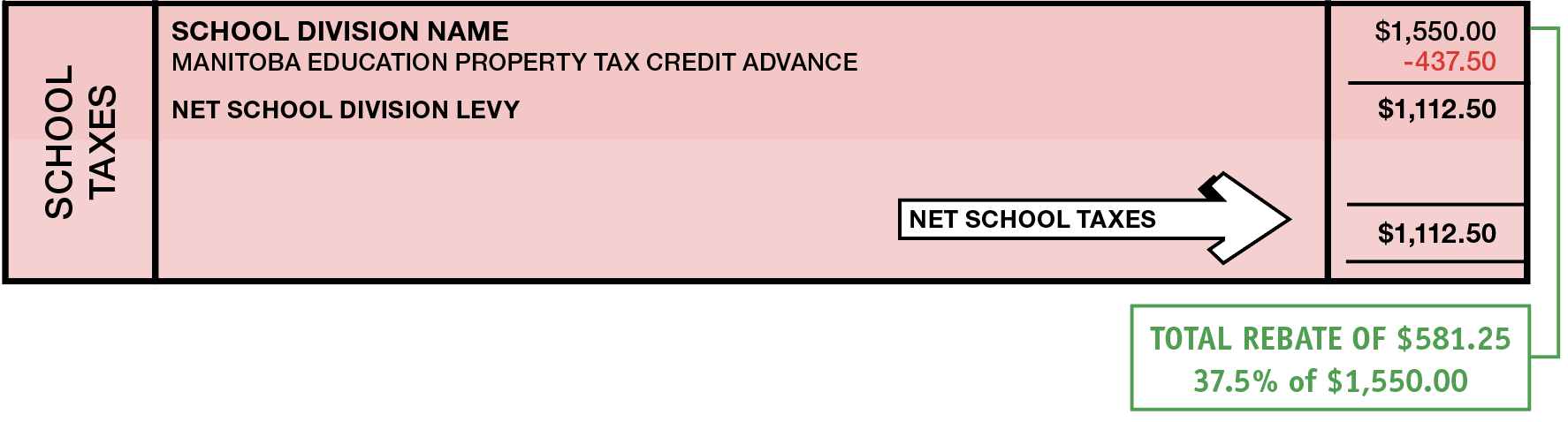

Tax And Fee Measures Budget 2022 Province Of Manitoba

Wisconsin Schedule H Fillable Form Printable Forms Free Online

Hecht Group Who Pays Pro Rated Property Taxes When Buying A Home

Hecht Group Who Pays Pro Rated Property Taxes When Buying A Home

Hecht Group The American Frontier A Land Of Opportunity High

Uses Of Iowa s General Fund Surplus And Reserve Funds

Hecht Group Do I Have To Pay Property Tax On My Business s Furniture

School Property Tax Credit Wisconsin Apartment - Homeowners are entitled to an income tax credit for school property taxes of up to 300 based on the amount of property taxes paid for a primary residence Veterans and surviving spouses may be entitled to an income tax credit based on property taxes paid for the claimant s principal residence