Second House Loan Tax Rebate Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

Web 9 janv 2021 nbsp 0183 32 From FY 19 20 onwards in the Finance Act 2019 government has allowed a major relief u s 23 and 24 of the Income Tax Act 1961 by allowing the taxpayers to Web 30 mars 2023 nbsp 0183 32 Taxation rules for a second home loan depend on the purpose of your purchase So here s how you can claim tax benefits as per the usage of your second

Second House Loan Tax Rebate

Second House Loan Tax Rebate

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

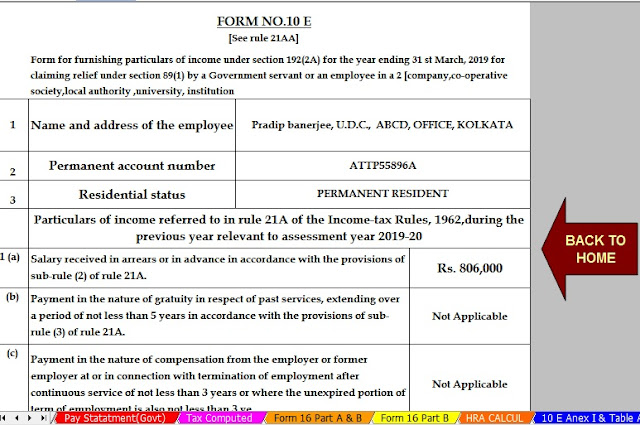

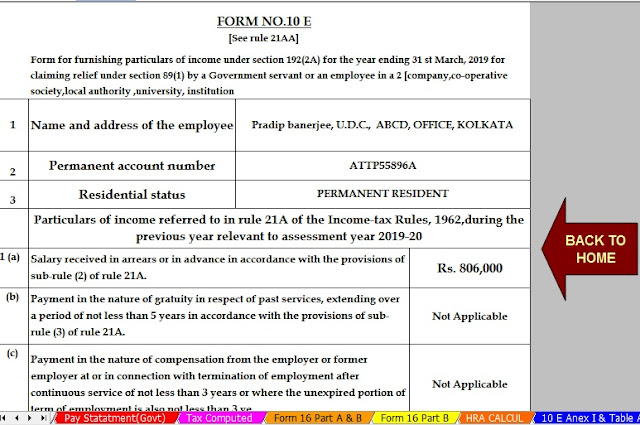

Second Home Loan Tax Implication And Benefit With Automated Arrears

https://4.bp.blogspot.com/-YlnBFRDgiEM/W8ikWwIioZI/AAAAAAAAHxs/5COMxdScJIYnwczTaNAkK4MRLVBZeqycgCLcBGAs/s640/Arr%2BRelf%2BPage%2B3.jpg

Know How To Claim Tax Benefits On Second Home Loan PNB Housing

https://www.pnbhousing.com/wp-content/uploads/2022/12/cropped-Know-How-to-Claim-Tax-Benefits-on-Second-Home-Loan.png

Web You can claim deduction for interest payable on a loan taken for purchase construction repair or renovation of any property whether commercial or residential under Section 24 b This deduction on interest payment is Web Watch on Tax Benefits for Second Home Loan Those who own two homes are eligible for a bevy of tax breaks However if you have previously paid off your house loan in full

Web 21 mars 2021 nbsp 0183 32 Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible items Web 20 mai 2016 nbsp 0183 32 1 If you have taken a home loan for the second house you are eligible to claim a deduction for the interest you have paid Under the section 24 you can claim all

Download Second House Loan Tax Rebate

More picture related to Second House Loan Tax Rebate

Complete Guide On Second Home Loan Tax Benefit In India

https://favesblog.com/wp-content/uploads/2023/02/Featured-Image.jpg

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

https://tax2win.in/assets-new/img/form-12bb/form-12bb.jpg

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Web 13 janv 2021 nbsp 0183 32 Under Section 24B of the Income Tax I T Act you can claim deduction for interest payable on a loan repair renovation or construction But if you own only one house which is self occupied the Web Income Tax benefit on Second Home Loan As discussed above the second house is considered as let out whether it is actually rented out or not You have to add rental

Web Tax benefits on a Home Loan for a second home If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C Web 1 Self Occupying the Second Home If you own more than one residential property for your use one of the properties will be considered to be self occupied and its annual value will

Second Home Loan Vs Investment Property InvestmentProGuide

https://www.investmentproguide.com/wp-content/uploads/loan-rates-on-second-home-tesatew.png

Designyourownperfume Second Home Loan Tax Benefit Example

https://static.money.product.which.co.uk/money/media/images/826x429_ct/1059_house_stamp_duty_final_files4_a361f7e43315d14da3e389a0e37ccaff.png

https://www.icicibank.com/blogs/home-loan/ta…

Web Tax Benefits on Second Home Loan The Government made a significant amendment to the financial budget for FY 2019 20 in which taxpayers have been allowed to declare two houses as self occupied As a result

https://taxguru.in/income-tax/income-tax-benefits-deductions-second...

Web 9 janv 2021 nbsp 0183 32 From FY 19 20 onwards in the Finance Act 2019 government has allowed a major relief u s 23 and 24 of the Income Tax Act 1961 by allowing the taxpayers to

Home Loan Tax Exemption Home Loan Tax Rebate Rules YouTube

Second Home Loan Vs Investment Property InvestmentProGuide

Home Loan Tax Benefit Calculator FrankiSoumya

Microfinance Loan Application Form

India Second Home Loan Tax Benefit

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

Can I Fully Pay My Loan In Advance Is There A Benefit To Paying My

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

Advantages Of Second Home Loan Tax Benefit In India Tata Capital

Second House Loan Tax Rebate - Web 24 d 233 c 2019 nbsp 0183 32 Yes it is possible to get tax benefit on the second home loan in the same financial year The tax benefit on two home loans taken for the purchase of two self