Second Recovery Rebate Credit Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

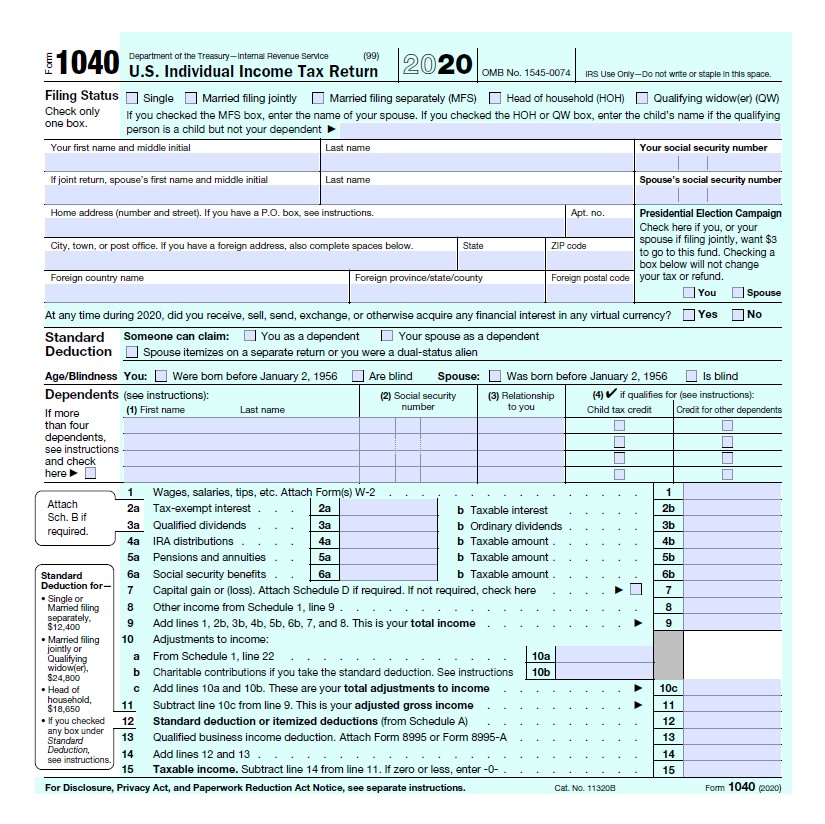

Web 2020 Recovery Rebate Credit The first two rounds of Economic Impact Payments were advance payments of 2020 Recovery Rebate Credits claimed on a 2020 tax return The Web 17 ao 251 t 2022 nbsp 0183 32 You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized

Second Recovery Rebate Credit

Second Recovery Rebate Credit

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

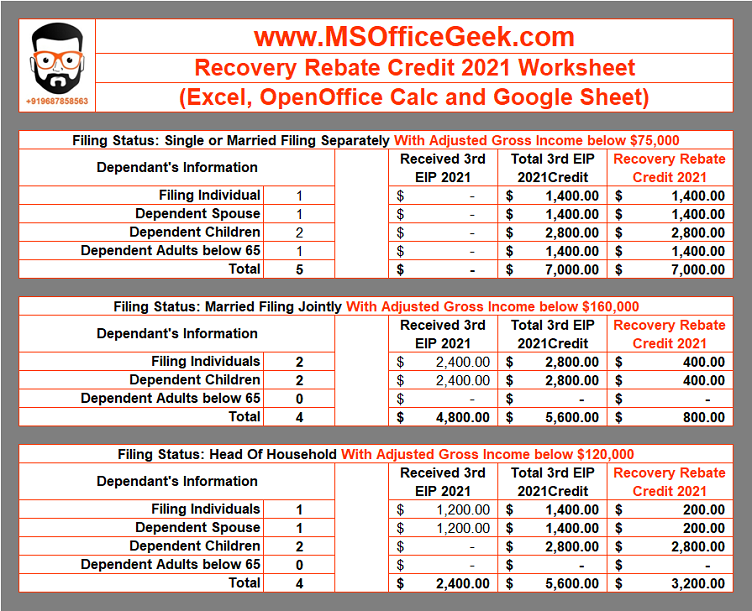

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

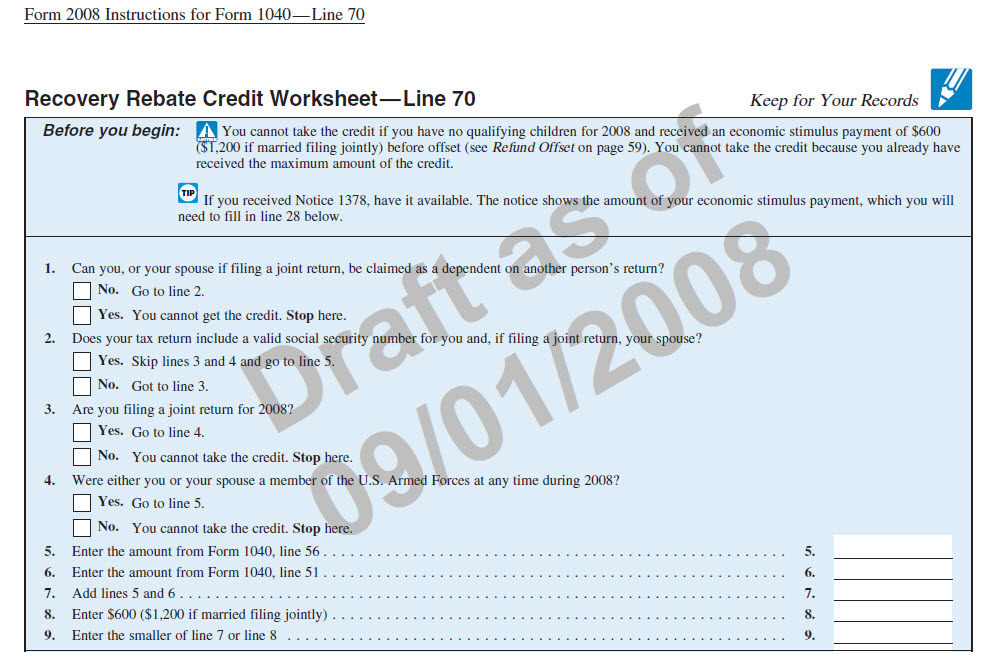

Recovery Rebate Credit 2020 Calculator KwameDawson

https://support.taxslayer.com/hc/article_attachments/4415864484109/mceclip1.png

Web 15 mars 2023 nbsp 0183 32 Sign in to your Online Account Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on

Web 1 d 233 c 2022 nbsp 0183 32 This second stimulus payment distributed up to 600 per qualified recipient The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of Web 27 avr 2023 nbsp 0183 32 You can claim missing or partial first and second round stimulus payments only on your 2020 federal tax return Any missing or partial third round stimulus payments can be claimed on your 2021

Download Second Recovery Rebate Credit

More picture related to Second Recovery Rebate Credit

The Recovery Rebate Credit Calculator MollieAilie

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/af2544cc-cc99-4803-9277-be1c0c86ef28.default.PNG

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

Web 29 d 233 c 2020 nbsp 0183 32 Generally if you have adjusted gross income for 2019 up to 75 000 for individuals and up to 150 000 for married couples filing joint returns and surviving Web demander le cr 233 dit de d 233 gr 232 vement de r 233 cup 233 ration Recovery Rebate Credit si vous n avez pas b 233 n 233 fici 233 de la premi 232 re ou de la seconde s 233 rie de paiements pour limiter

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 6 avr 2021 nbsp 0183 32 The IRS notes that the first and second Economic Impact Payments were technically advance payments of the 2020 Recovery Rebate Credit Why should we be

The Recovery Rebate Credit Calculator MollieAilie

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

The Recovery Rebate Credit Calculator ShauntelRaya

https://www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

https://www.irs.gov/pub/taxpros/fs-2022-27.pdf

Web 2020 Recovery Rebate Credit The first two rounds of Economic Impact Payments were advance payments of 2020 Recovery Rebate Credits claimed on a 2020 tax return The

Federal Recovery Rebate Credit Recovery Rebate

The Recovery Rebate Credit Calculator MollieAilie

Recovery Rebate Credit Worksheet Pdf Recovery Rebate

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

Second Recovery Rebate Credit - Web 30 d 233 c 2020 nbsp 0183 32 If you did not receive a first or second stimulus check or received less than the full amount you may be eligible for the 2020 Recovery Rebate Credit RRC