Section 16 Deduction Income Tax Under Section 16 ia of the Income Tax Act 1961 the standard deduction allows a flat deduction of Rs 50 000 or the amount of the salary whichever is lower

Explore Standard Deduction under Section 16 ia and in the new tax regime Know standard deduction in new old tax regimes its applicability benefits for senior citizens Learn how it would impact Standard deduction under Section 16 ia is a flat deduction that is allowed from the salary income The concept of standard deduction was introduced in the

Section 16 Deduction Income Tax

Section 16 Deduction Income Tax

https://margcompusoft.com/m/wp-content/uploads/2023/03/12-17-1024x576.jpg

Ezylia Explains Section 16 Income Tax Charged By Deduction

https://blog.taxworld.ie/hubfs/income tax charged by deduction - section 16.jpg#keepProtocol

Deductions From Gross Salary Under Income Tax Sec 16 YouTube

https://i.ytimg.com/vi/ZWqK77YuH2E/maxresdefault.jpg

Section 16 of the Income Tax Act ITA 1961 deals with deductions allowed from income under the head Salaries These deductions help reduce salaried individuals taxable income thereby Section 16 of Income Tax Act 1961 provides deduction from income chargeable to tax under the head salaries It provides deductions for the standard deduction entertainment allowance and

Under Section 16 of the IT Act pensioners are entitled to claim a deduction of Rs 50 000 per annum or the amount of pension whichever is less Therefore the reintroduction of Explore the benefits and eligibility criteria for the Section 16 deduction under the Income Tax Act Understand how salaried employees can claim relief and

Download Section 16 Deduction Income Tax

More picture related to Section 16 Deduction Income Tax

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Donate Under Section 80G Of Income Tax Receive Deduction

https://www.lyceetrust.org/storage/uploads/2023/01/blog-lyecc.jpg

L Section 16 Deduction From Gross Salary L YouTube

https://i.ytimg.com/vi/SW79YfEGQL4/maxresdefault.jpg

Learn about the three deductions under Section 16 of the Income Tax Act that can reduce your taxable salary standard deduction entertainment allowance Understand deductions under Section 16 of Income Tax Act for salaried individuals Know about standard deduction entertainment allowance professional tax

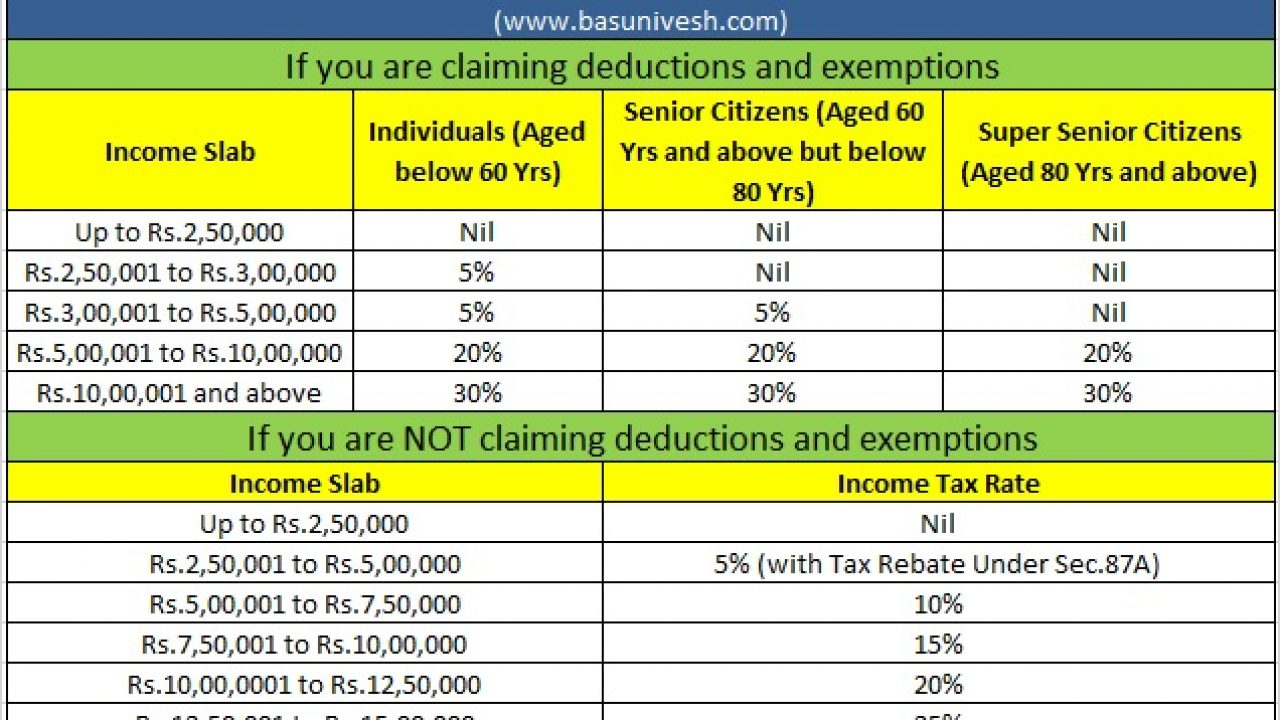

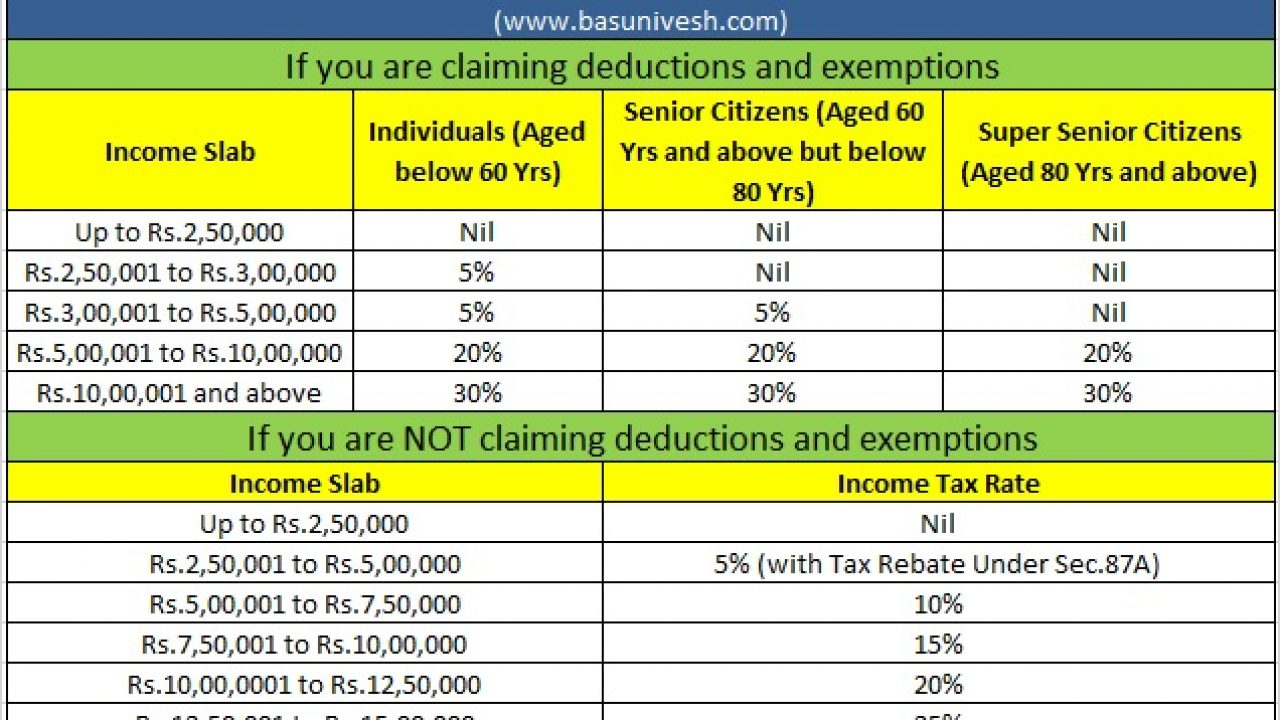

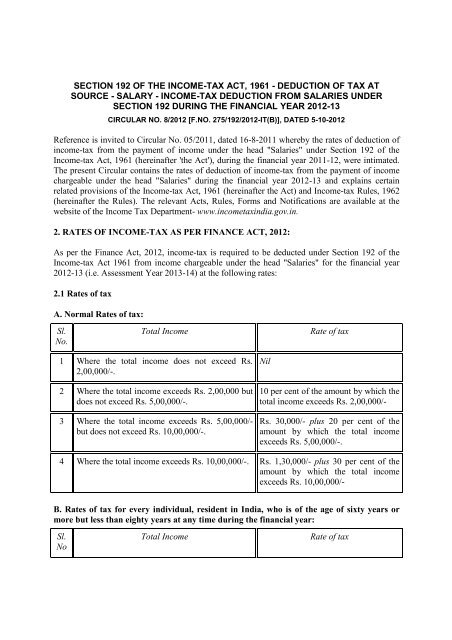

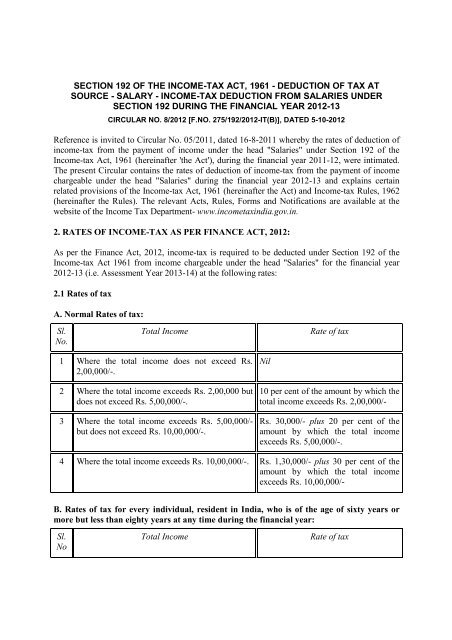

This section sets out specific components that can be deducted from taxable income and the limits on those deductions When filing your income tax it is Most of them get their salary after tax deduction under section 192 of the Income Tax Act 1962 Deductions under section 16 is a way to reduce excess burden

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction-913x1024.jpg

https://www.taxbuddy.com/blog/standard-deduction...

Under Section 16 ia of the Income Tax Act 1961 the standard deduction allows a flat deduction of Rs 50 000 or the amount of the salary whichever is lower

https://cleartax.in/s/standard-deduction …

Explore Standard Deduction under Section 16 ia and in the new tax regime Know standard deduction in new old tax regimes its applicability benefits for senior citizens Learn how it would impact

NPS Deduction In Income Tax 2023 Guide InstaFiling

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

Section 16 Deductions From Salaries Direct And Indirect Taxes With

What Is Section 24 Of Income Tax Act Save More Worry Less

Module 8 Deduction From Business Income 3 PDF Tax Deduction

Income tax Deduction From Salaries Under Section

Income tax Deduction From Salaries Under Section

Section 194 Of Income Tax Act 1961 Sorting Tax

Income Tax Deduction For Senior Citizens Turning 60 Claim Rs 50 000

Information On Section 80G Of Income Tax Act Ebizfiling

Section 16 Deduction Income Tax - Section 16 of the Income Tax Act 1961 mentions allowances and deductions on your taxable salary According to Section 16 salaried taxpayers and