Section 80d Tax Exemption Limit What is Section 80D of Income tax Act Section 80D of the Income tax Act offers deduction on the health insurance premium paid during the financial year The premium must be paid for self spouse dependent children Additional tax deduction can be claimed for health insurance premium paid for parents

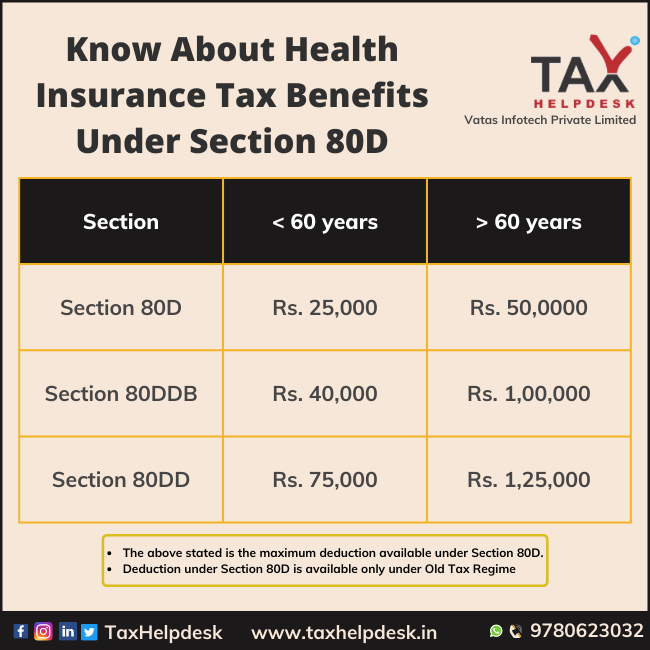

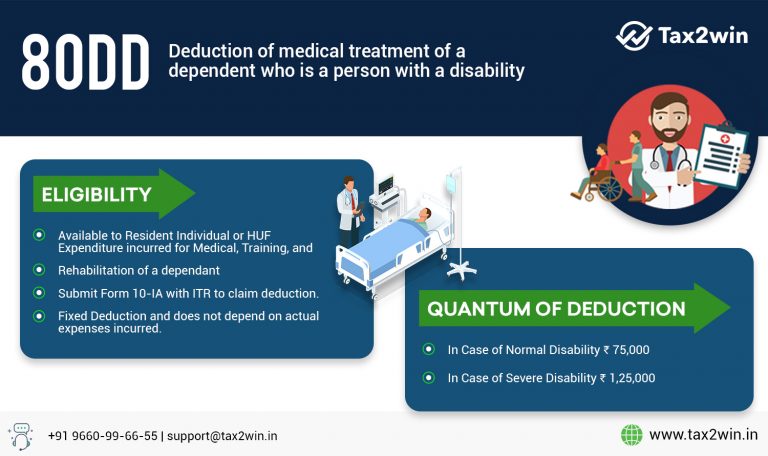

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family Yes under Section 80D taxpayers can avail of tax deduction up to INR 25 000 per year for medical premium paid for self family and dependent who are under 60 years of age

Section 80d Tax Exemption Limit

Section 80d Tax Exemption Limit

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

Section 80d Of Income Tax Section 80d Medical Expenditure Trutax

https://www.trutax.in/blog/wp-content/uploads/2021/05/section-80d-of-income-tax-act-1-1024x576.png

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

What is the limit of deduction under section 80D of Income Tax You can claim a deduction of up to Rs 25 000 for medical insurance premiums for yourself your spouse and your children If you are paying your parents health insurance premium you can claim an additional deduction of Rs 25 000 Have a look at the limits of deduction under section 80D for different scenarios For self and family 25 000 tax deduction 5 000 health check up which sums up to 30 000 For self family and parents 50 000 tax deduction 5 000 health check up exemption which sums up to 55 000

Deduction under section 80D of the Income Tax Act is available in addition to the deduction of INR 1 50 Lakhs available collectively under section 80C section 80CCC and section 80CCD 1 Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health According to Section 80D of the Income Tax Act Senior Citizens may avail a higher deduction of up to 50 000 for payment of premium towards medical insurance policy The limit is 25 000 in case of Non Senior Citizens

Download Section 80d Tax Exemption Limit

More picture related to Section 80d Tax Exemption Limit

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/Section-80D.jpg

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Section 80D offers tax deductions on health insurance premiums of up to a maximum limit of 25 000 in a financial year You can claim deductions for a policy bought for yourself your spouse and your dependent children The maximum permissible deduction is INR 25 000 every financial year on the premium for health insurance for self family For senior citizens the maximum permissible deduction is INR 50 000 per financial year

Individuals can claim maximum Rs 25000 every financial year as deduction under Section 80D of Income Tax Act For Senior citizens the 80D exemption limit is Rs 50 000 For parents below than 60 years of age the maximum limit is Section 80D Deduction Limit As per Section 80D a taxpayer can claim deductions on health insurance premiums paid for self family and parents apart from deductions on expenses related to health check ups The overall deduction limits are

Section 80D Deduction In Respect Of Health Or Medical Insurance

http://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

https://economictimes.indiatimes.com/wealth/tax/...

What is Section 80D of Income tax Act Section 80D of the Income tax Act offers deduction on the health insurance premium paid during the financial year The premium must be paid for self spouse dependent children Additional tax deduction can be claimed for health insurance premium paid for parents

https://tax2win.in/guide/section-80d-deduction...

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

Section 80D Deduction For Medical Insurance Health Checkups

Section 80D Deduction In Respect Of Health Or Medical Insurance

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80d Of Income Tax Act Health Insurance Tax Benefits

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

Tax Saving On Health Insurance Section 80D Detailed Guide For FY

Section 80D Deductions For Medical Health Insurance

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80d Tax Exemption Limit - Have a look at the limits of deduction under section 80D for different scenarios For self and family 25 000 tax deduction 5 000 health check up which sums up to 30 000 For self family and parents 50 000 tax deduction 5 000 health check up exemption which sums up to 55 000