Self Employed Construction Tax Rebate Web 12 avr 2021 nbsp 0183 32 12 04 2021 Chaque ann 233 e la loi de finance pr 233 cise quels sont les travaux d 233 ductibles des imp 244 ts sur le revenu Ils permettent aux propri 233 taires d obtenir un

Web If you do you can claim back tax relief on some or all of those expenses for the last four tax years It s common for construction workers to have employed work under PAYE and Web 4 avr 2014 nbsp 0183 32 If you re a self employed subcontractor use the online form to make a claim for repayment of pay deductions in the current tax year Use your tax return instead of

Self Employed Construction Tax Rebate

Self Employed Construction Tax Rebate

https://i.pinimg.com/originals/4b/77/09/4b770950e17d5318c7eca4e453b04c2e.jpg

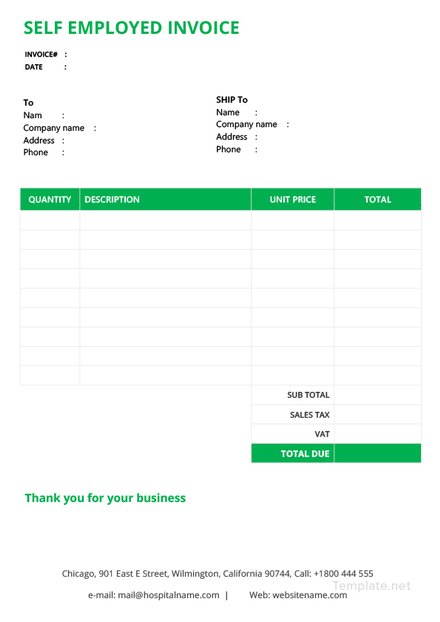

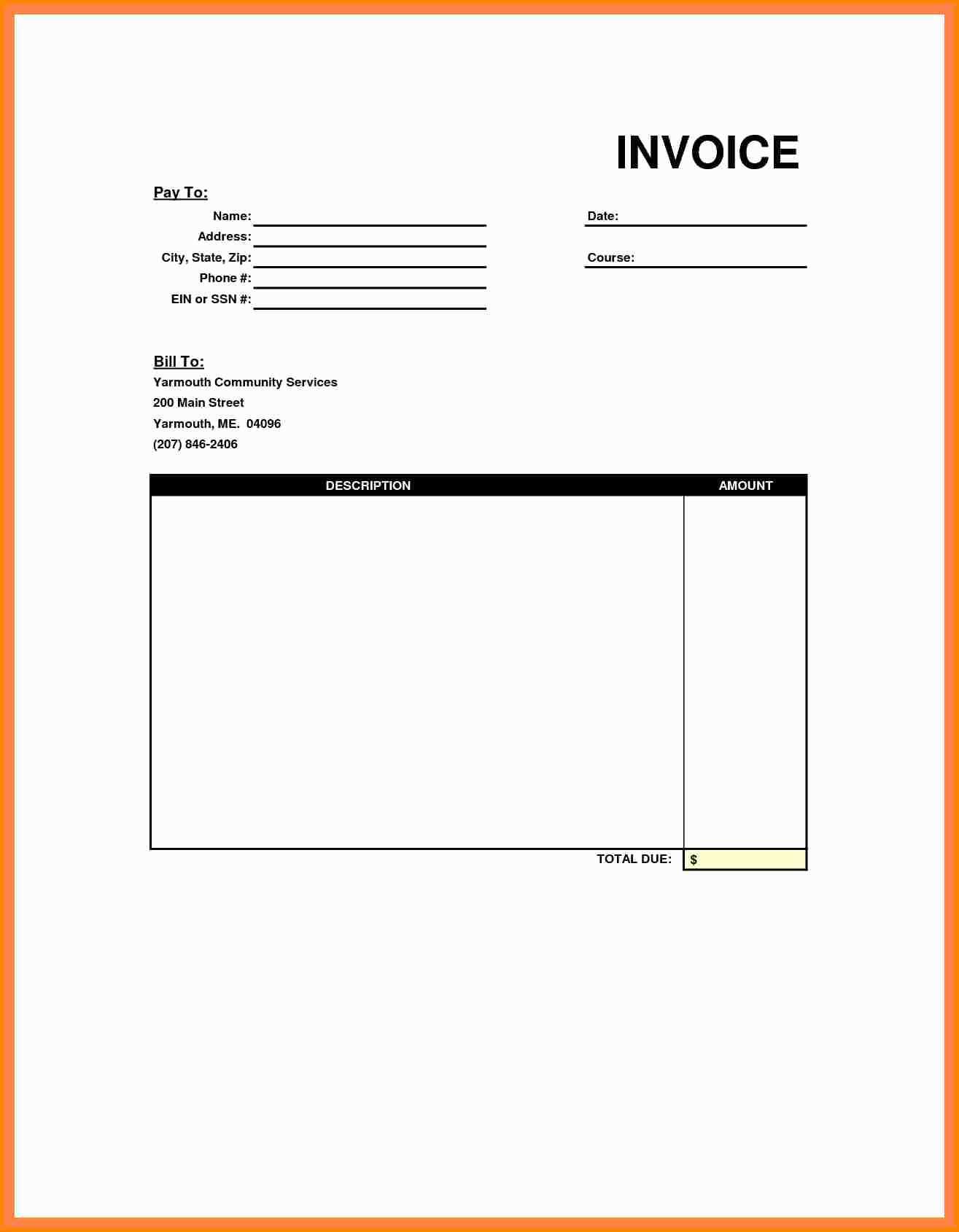

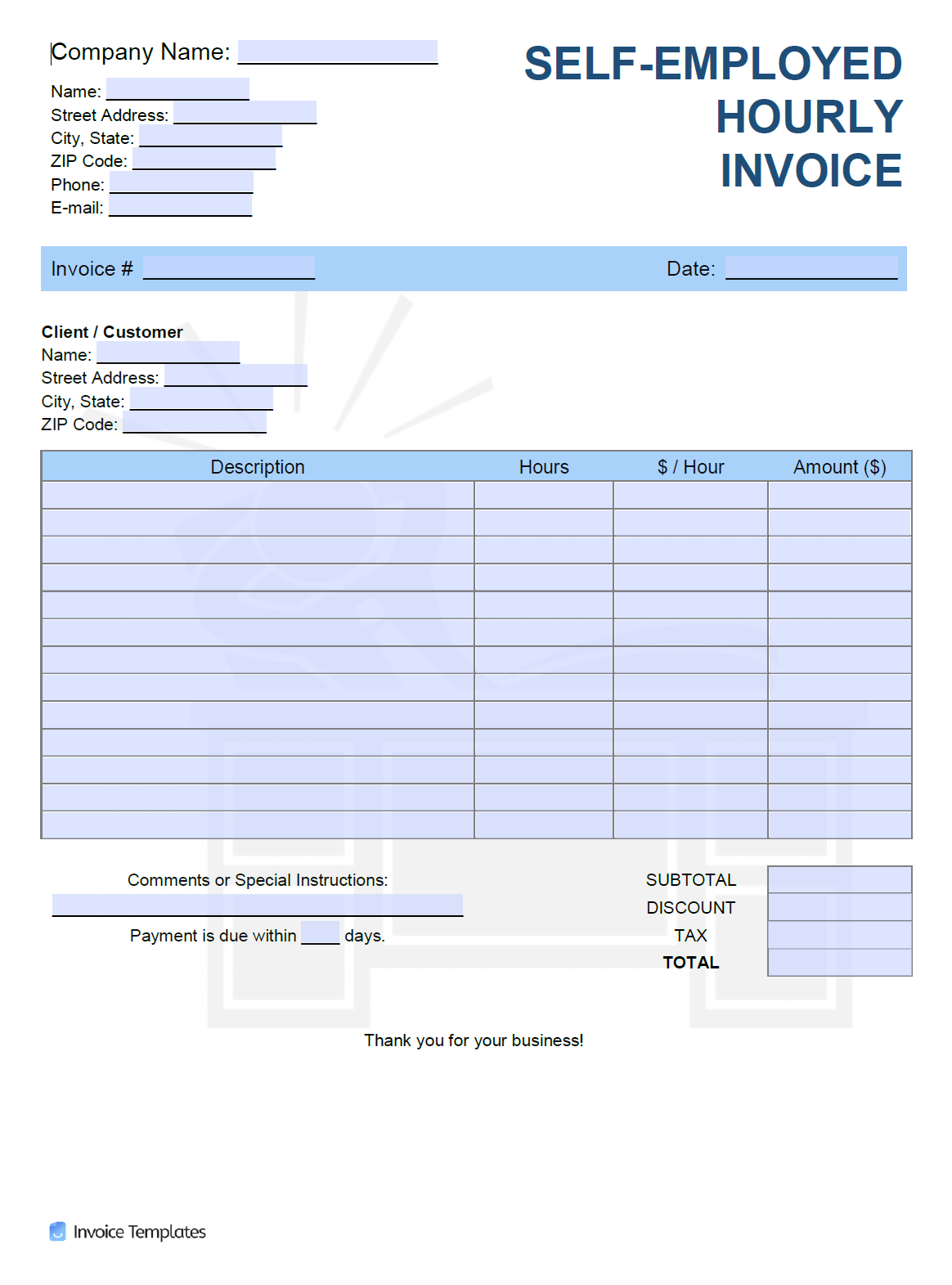

Free Blank Invoice Templates 30 Pdf Eforms Free Self Employed Invoice

https://i1.wp.com/prodblobcdn.azureedge.net/wp/webp/self-employed-construction-invoice-template.webp

Self Employed Construction Invoice Template Cards Design Templates

https://images.template.net/3434/Self-Employed-Invoice-440x622.jpg

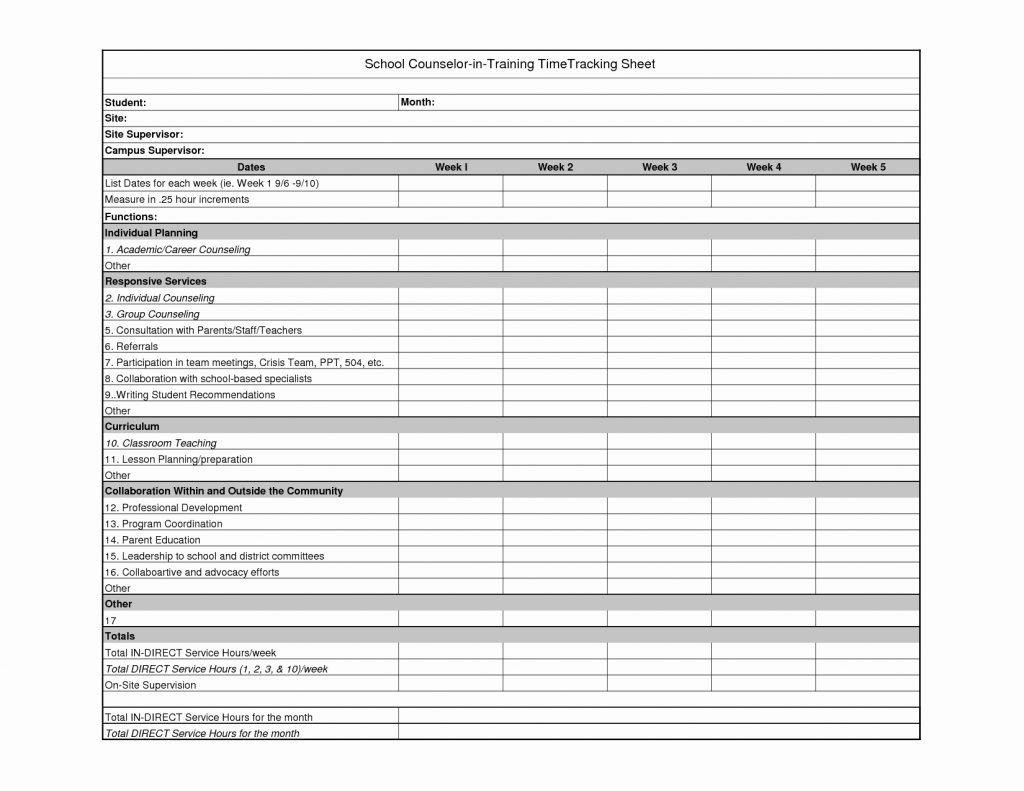

Web 9 f 233 vr 2023 nbsp 0183 32 Last updated 9 Feb 2023 If you re a self employed individual under the CIS Construction Industry Scheme luckily for you there are a few CIS deductions you Web 6 avr 2023 nbsp 0183 32 Updated on 6 April 2023 Tax basics If you are taxed under the CIS your contractor is obliged to withhold tax on its payments to you Many people under the CIS

Web 17 d 233 c 2020 nbsp 0183 32 Voici la liste des travaux vous donnant droit 224 un cr 233 dit d imp 244 ts de 30 Cette liste n est pas exhaustive le site du Gouvernement Faire permet de consulter les Web The Construction Industry Scheme CIS is a scheme used by HMRC to collect Income Tax from subcontractors in the construction industry You re eligible to register for the

Download Self Employed Construction Tax Rebate

More picture related to Self Employed Construction Tax Rebate

Self Employed Construction Invoice Template Cards Design Templates

https://cdn.formtemplate.org/images/482/blank-self-employed-invoice-template.png

Self Employed Construction Invoice Template Cards Design Templates

https://legaldbol.com/wp-content/uploads/2019/03/95-Customize-Our-Free-Blank-Self-Employed-Invoice-Template-Maker-by-Blank-Self-Employed-Invoice-Template.jpg

Self Employed Construction Invoice Template Cards Design Templates

https://cdn.poptemplate.com/Image/728/self-employed-chef-invoice-template.jpg

Web 25 mars 2022 nbsp 0183 32 25th Mar 2022 If any of your clients are self employed workers in the construction industry it s well worth brushing up your knowledge around the Web 4 janv 2022 nbsp 0183 32 Published on 4 January 2022 Most CIS workers receive a tax refund rebate after they submit their Self Assessment tax return because they usually overpay

Web In most cases you can register as self employed by calling the Newly Self employed Helpline on 0300 200 3504 If you are already registered as self employed but need to Web 27 nov 2020 nbsp 0183 32 November 27 2020 CIS Construction Industry Scheme What is CIS If you work for a contractor in the construction industry as a self employed individual

Self Employed Printable Invoice Template Printable Templates

https://images.sampletemplates.com/wp-content/uploads/2018/02/SelfEmployed-Invoice-Template-in-PDF.jpg

Printable Self Employed Tax Deductions Worksheet Ideas Gealena

https://i.pinimg.com/originals/4b/17/c4/4b17c442fc6fbe2ddac4f4163b2bad62.jpg

https://www.coulon-sa.fr/actualites/quels-sont-les-travaux-d...

Web 12 avr 2021 nbsp 0183 32 12 04 2021 Chaque ann 233 e la loi de finance pr 233 cise quels sont les travaux d 233 ductibles des imp 244 ts sur le revenu Ils permettent aux propri 233 taires d obtenir un

https://www.taxrebateservices.co.uk/tax-guides/construction-workers...

Web If you do you can claim back tax relief on some or all of those expenses for the last four tax years It s common for construction workers to have employed work under PAYE and

Invoice Template For Independent Contractor

Self Employed Printable Invoice Template Printable Templates

Self Employed Tax Deductions Worksheet 2020 Form Jay Sheets

The Ultimate Self Employed Deduction Cheat Sheet Artofit

Self Employed Tax Deductions Worksheet 2019 Form Jay Sheets

Self Employed Tax Deductions Worksheet 2020 Instructions Fleur Sheets

Self Employed Tax Deductions Worksheet 2020 Instructions Fleur Sheets

Small Business Tax Spreadsheet Business Worksheet Business Tax

39 Self Employed Expenses Worksheet Worksheet Resource

39 Self Employed Expenses Worksheet Worksheet Resource

Self Employed Construction Tax Rebate - Web 6 avr 2023 nbsp 0183 32 Updated on 6 April 2023 Tax basics If you are taxed under the CIS your contractor is obliged to withhold tax on its payments to you Many people under the CIS