Senior Citizen Concession In Income Tax A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The exemption limit

Section 80TTB is a provision under the Indian Income Tax Act that offers tax benefits to senior citizens on their interest income Income tax slab for senior citizen women over 60 years of age Income tax slab for super senior citizen women over 80 years of age Alternatively women

Senior Citizen Concession In Income Tax

Senior Citizen Concession In Income Tax

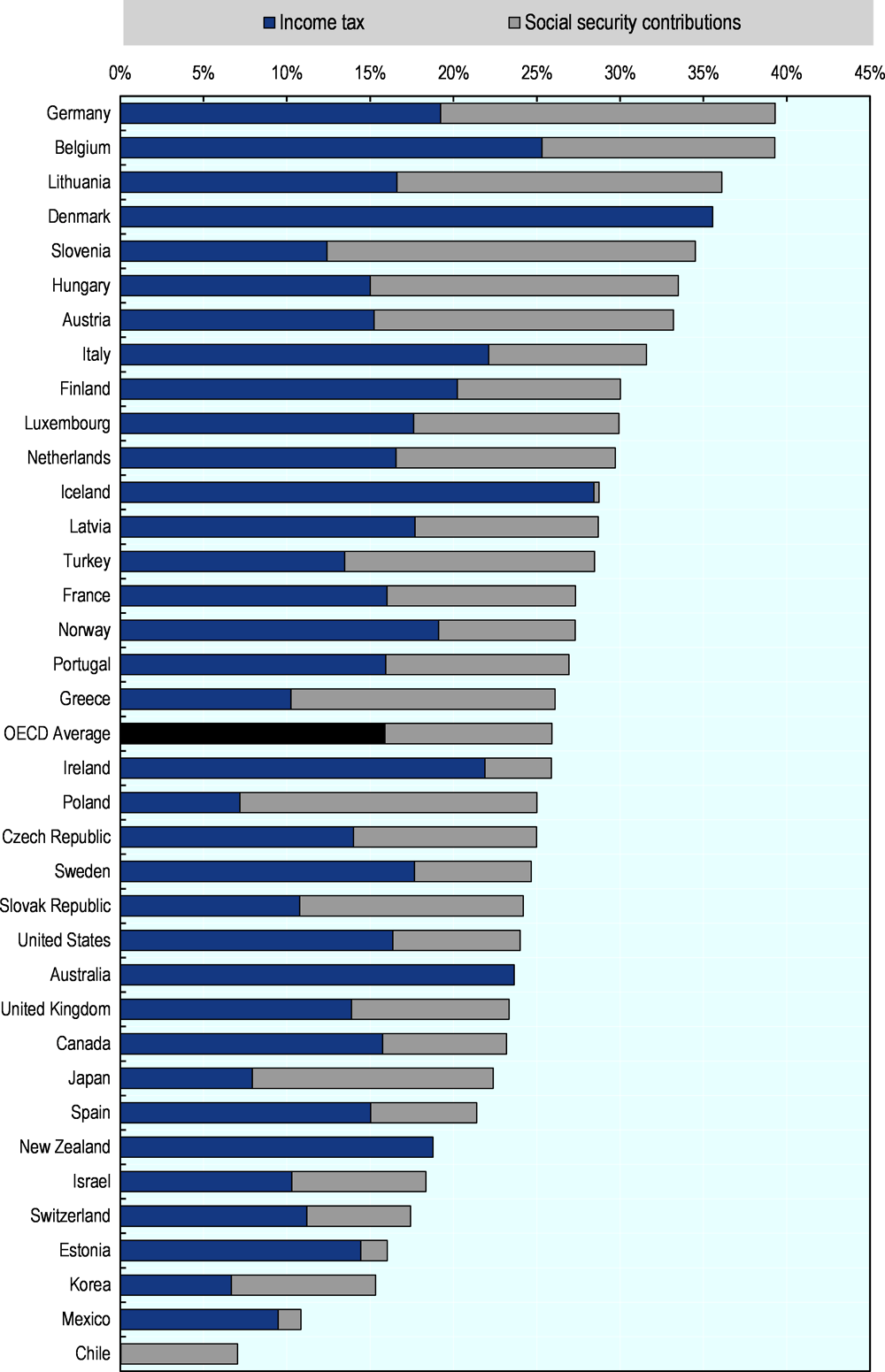

https://www.oecd-ilibrary.org/sites/bdfe626d-en/images/images/011_Part_I_Chapter-1/media/image3.png

What Concession Cards Are Available For Seniors And Pensioners

https://shakes.com.au/wp-content/uploads/2022/07/Untitled-design-2.png

Many Facilities And Concession Are Available For Senior Citizens In

https://i.pinimg.com/originals/67/08/fb/6708fb9d845ace2a6b605ee55139a656.jpg

Calculate Tax Rebates and Surcharge Senior citizens with lower incomes are eligible for certain rebates or concessions File Income Tax Return After For senior citizens the following criteria have been mandated for their eligibility for exemption from advance taxes In case an individual meets the following

The maximum amount of income up to which the income tax department does not charge income tax is Rs 3 lakh for senior citizens and Rs 5 lakh for super Eligible seniors have many free tax filing options Internal Revenue Service IRS Tax Tip 2024 05 Feb 12 2024 Whether they prepare and file their own tax returns

Download Senior Citizen Concession In Income Tax

More picture related to Senior Citizen Concession In Income Tax

Indian Railways Generated Rs 1500 Crore Revenue From Suspension Of

https://english.cdn.zeenews.com/sites/default/files/2022/05/17/1043422-senior.jpg

Senior Citizen Concessions Facilities In India Your Guide To Insurance

https://healthnewsreporting.com/wp-content/uploads/2019/09/senior-citizen-concession.jpg

Senior Citizen Concession In Train

https://images.hindustantimes.com/bangla/img/2022/06/15/600x338/9b6cc922-7945-11ec-8d96-73532ee3fb0e_1647008480229_1655308975831.jpg

By tax filing 1 Higher Tax Exemption Limit Senior citizens aged 60 80 enjoy a higher exemption limit of Rs 3 lakh compared to Rs 2 5 lakh for those below 60 Benefits of Standard Deduction Senior Citizen and Super Senior Citizen who are in receipt of pension income from his former employer can claim a deduction up

Earned income credit The maximum amount of income you can earn and still get the credit has changed You may be able to take the credit if you earn less than 17 640 24 210 Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above It is applicable from

Senior Citizen Concession IRCTC Guide Hub

https://i0.wp.com/guidehub.in/wp-content/uploads/2022/09/Featured-Image-Senior-Citizen-Concession-in-IRCTC.png

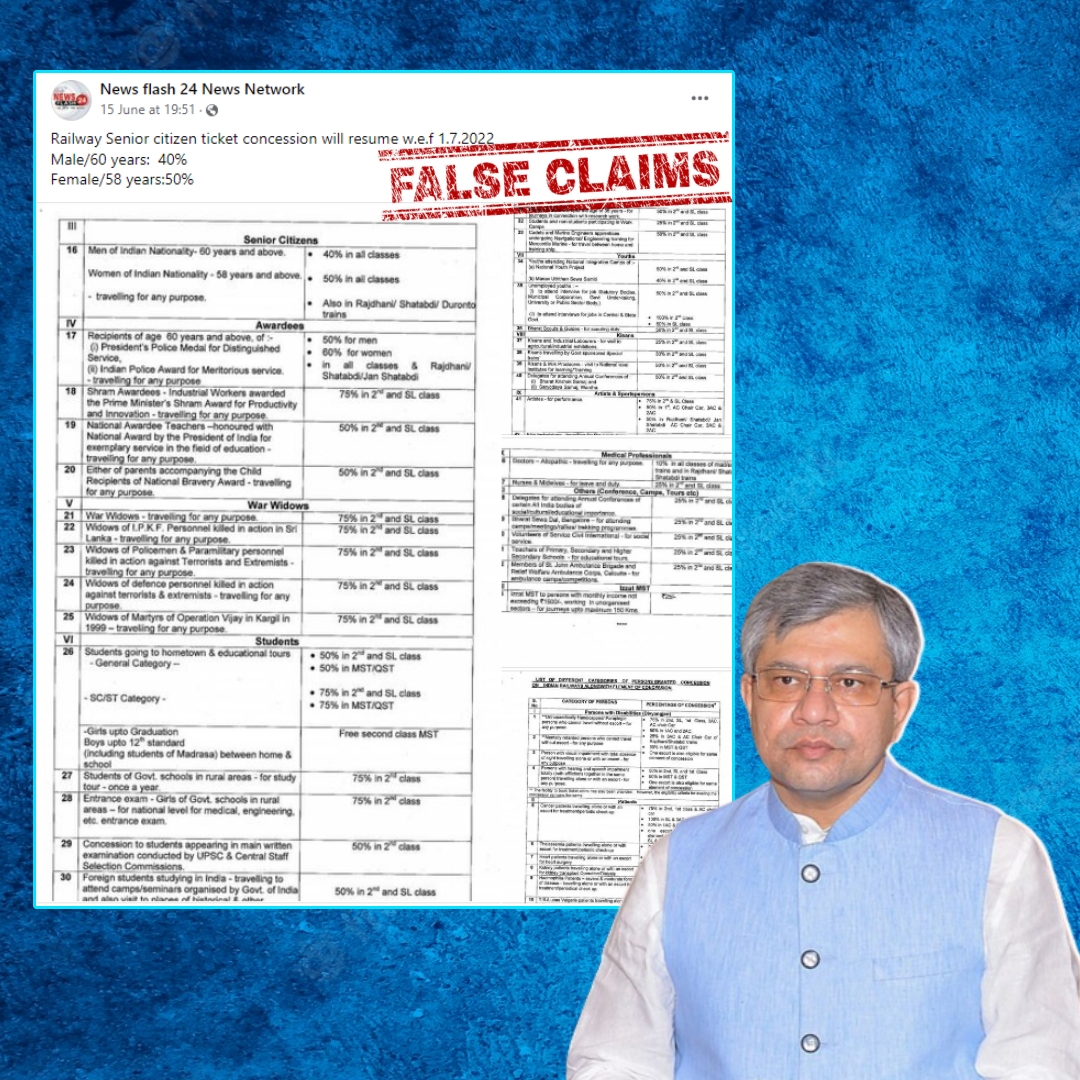

Claim About Indian Railways Resuming Senior Citizen Concessions Is False

https://thelogicalindian.com/h-upload/2022/06/22/218929-new-project-2022-06-22t121800104.jpg

https:// taxguru.in /income-tax/what-are-the-tax...

A senior citizen is granted a higher exemption limit compared to non senior citizens The exemption limit for the financial year 2022 23 available to a resident senior citizen is Rs 3 00 000 The exemption limit

https:// tax2win.in /guide/section-80ttb

Section 80TTB is a provision under the Indian Income Tax Act that offers tax benefits to senior citizens on their interest income

How Can I Book Ticket In Senior Citizen Quota In IRCTC App YouTube

Senior Citizen Concession IRCTC Guide Hub

Senior Citizen Concession To Railway Passengers Lok Sabha QA

How To Choose Between New Old Income Tax Regime For FY 2020 21

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Income Tax Appellate Tribunal Recruitment Https www itat gov in

Indian Railways Senior Citizen Concession Rules To Be Amended By

Senior Citizen Benefits In India

TIS

Senior Citizen Concession In Income Tax - Eligible seniors have many free tax filing options Internal Revenue Service IRS Tax Tip 2024 05 Feb 12 2024 Whether they prepare and file their own tax returns