Senior Citizen Income Tax Exemption In India Senior citizens are required to pay tax over the income of Rs 3 00 000 while this limit is Rs 5 00 000 for super senior citizens under the old tax regime This benefit is not available for the ordinary individuals as the limit is Rs 2 50 000 for them

The basic exemption limit for senior citizens individuals aged 60 years or above is currently Rs 3 lakh for the financial year 2023 24 old tax regime Deductions and Exemptions Consider eligible deductions and exemptions available to senior citizens There are not many income tax exemptions available for senior citizens These are listed below Q 1 What are the benefits available to a senior citizen and very senior citizen in respect of tax rates Ans Senior citizens and a very senior citizen are granted a higher exemption limit as compared to normal tax payers

Senior Citizen Income Tax Exemption In India

Senior Citizen Income Tax Exemption In India

https://i.ytimg.com/vi/XQDCOVLK05g/maxresdefault.jpg

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

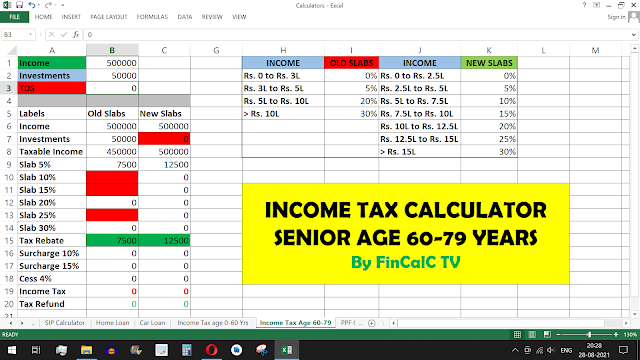

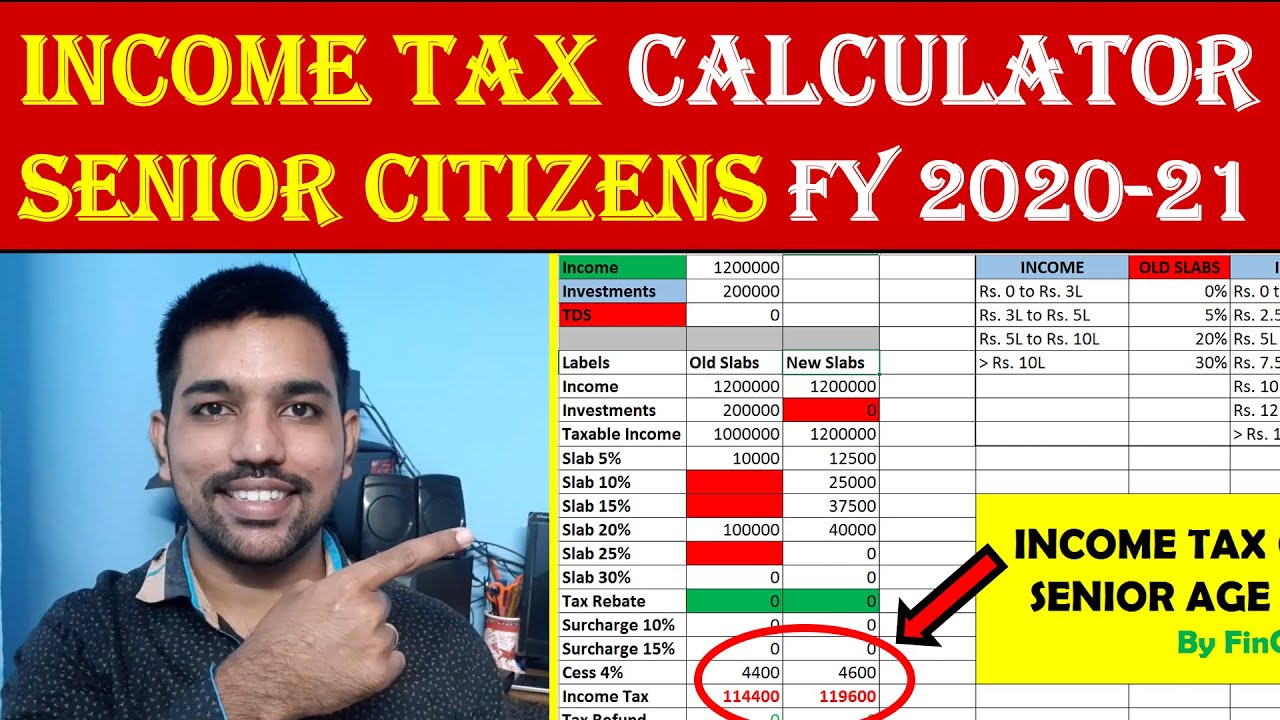

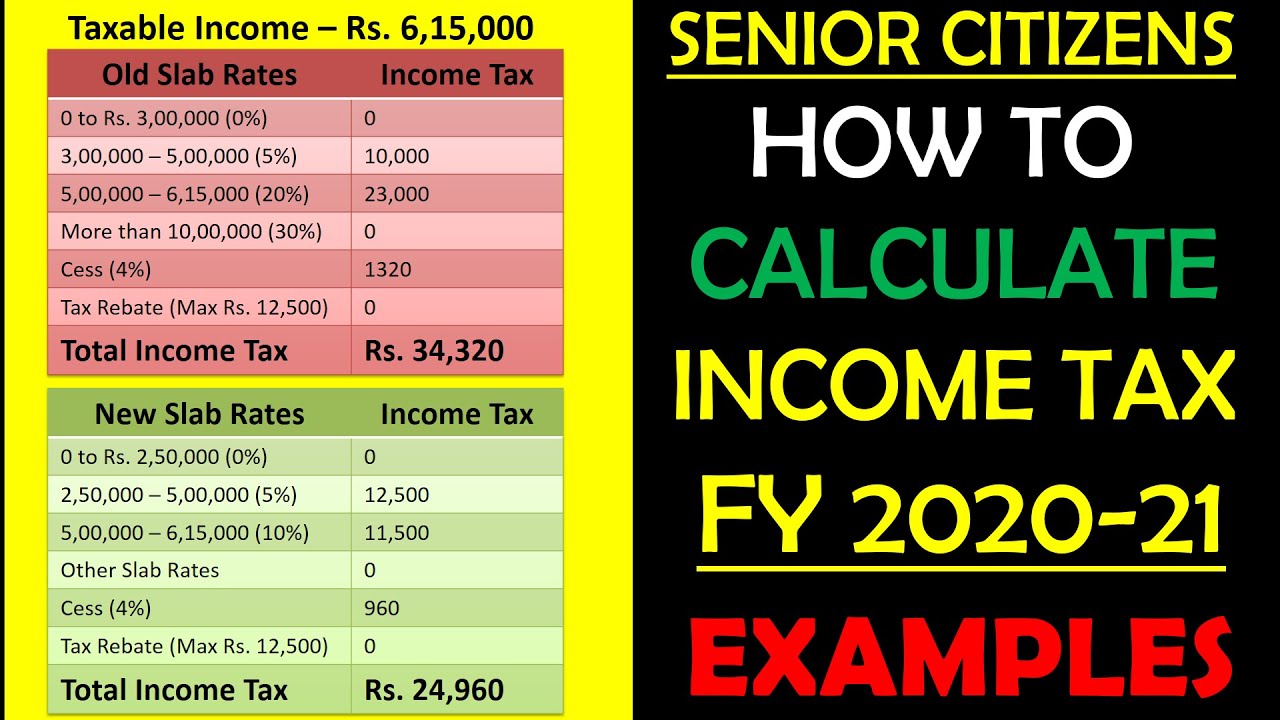

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Mobile

https://lh3.googleusercontent.com/-U1e5Z6_6JG0/YSpPbnEJD9I/AAAAAAAABg4/-wgXY_fRowUwDgpuDIQ8U8Iyo4DFkZRLgCLcBGAsYHQ/w640-h360/image.png

Updated on Mar 11th 2024 6 min read Finance Act 2021 inserted a new section 194P which provided conditions for exempting senior citizens from filing income tax returns aged 75 years and above New Section 194P will become applicable from 1st April 2021 What is Section 194P Exemption limit for senior citizens Under the old regime the exemption limit is 3 lakh for seniors and 5 lakh for super seniors 80 years and above In the new regime

As per this newly introduced section any senior citizen as a resident individual in India can claim a deduction of up to Rs 50 000 from the interest income earned on deposits saving or fixed during the concerned financial year However there are certain limitations and exceptions to this section The basic exemption limit under the new tax regime was increased from 2 5 lakhs to 3 lakhs The new tax regime will become the default tax regime from this F Y however the taxpayers can choose the old tax regime

Download Senior Citizen Income Tax Exemption In India

More picture related to Senior Citizen Income Tax Exemption In India

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

https://i.ytimg.com/vi/GHq5DhLzRhQ/maxresdefault.jpg

Senior Citizen Income Tax Return E Filing 2020 21 How To File ITR1

https://i.ytimg.com/vi/jWRJuKyUjgQ/maxresdefault.jpg

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

https://i.postimg.cc/bN09RcMs/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

The basic tax exemption for non senior citizens in India is Rs 2 50 000 On the other hand senior citizens enjoy a higher exemption limit of up to Rs 3 00 000 Therefore a senior citizen need not pay any tax file an ITR or face TDS deduction if his her annual income is up to the prescribed limit Deduction on interest income A senior citizen with an income of 7 5 lakhs will have no tax liability in either tax regime This is assuming that the person claims maximum deductions and exemptions including the standard deduction of 50 000 in the old regime The net income becomes 5 lakhs and thus eligible for the section 87A rebate hence no taxes

New tax regime for senior citizens Through the Finance Bill 2023 the Government has revised the income tax rates under the new tax regime for taxpayers including senior citizens Now there are 5 rates ranging from 5 to 30 and income up to 7 Lakh is tax free for those who opt for the New Tax Regime Income tax exemption limit is up to Rs 2 50 000 for Individuals HUF below 60 years aged and NRIs up to Rs 3 00 000 for senior citizens aged above 60 years but less than 80 years up to Rs 5 00 000 for super senior citizens aged above 80 years Surcharge and cess will be applicable over and above the tax rates

Income Tax Benefits For Senior Citizens Deductions To Save Tax

https://fincalc-blog.in/wp-content/uploads/2022/09/senior-citizen-income-tax-benefits-video-1024x576.webp

Get More Tax Exemptions For Income Tax In Malaysia IMoney

https://static.imoney.my/articles/wp-content/uploads/2021/03/05180919/Income-Tax-Exemption-2020-768x2384.png

https:// cleartax.in /s/income-tax-slab-for-senior-citizen

Senior citizens are required to pay tax over the income of Rs 3 00 000 while this limit is Rs 5 00 000 for super senior citizens under the old tax regime This benefit is not available for the ordinary individuals as the limit is Rs 2 50 000 for them

https:// tax2win.in /guide/income-tax-for-senior-citizens

The basic exemption limit for senior citizens individuals aged 60 years or above is currently Rs 3 lakh for the financial year 2023 24 old tax regime Deductions and Exemptions Consider eligible deductions and exemptions available to senior citizens

2017 PAFPI Certificate of TAX Exemption Certificate Of

Income Tax Benefits For Senior Citizens Deductions To Save Tax

How To Claim Tax Exemptions Here s Your 101 Guide

Sample Letter Exemption Doc Template PdfFiller

Income Tax Calculation SENIOR CITIZENS 2020 21 How To Calculate

Tax Exemption Certificate SACHET Pakistan

Tax Exemption Certificate SACHET Pakistan

Corporate Tax Exemption For Companies And Startup India In Budget 2020

What Are The Income Tax Exemption For NRI In English

Tax Exemptions For Startups In India Bizzopedia

Senior Citizen Income Tax Exemption In India - Exemption limit for senior citizens Under the old regime the exemption limit is 3 lakh for seniors and 5 lakh for super seniors 80 years and above In the new regime