Sbi Mutual Fund Income Tax Rebate Web 37 on base tax where specified income exceeds Rs 5 crore 25 where specified income exceeds Rs 2 crore but does not exceed Rs 5 crore 15 where total income exceeds Rs 1 crore but does not exceed Rs 2 crore and 10 where total income exceeds Rs 50 lakhs but does not exceed Rs 1 crore

Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify for tax deduction under section 80C Investors can invest in ELSSs and claim tax deductions of up to Rs 1 5 lakh under Section 80C of the Income Tax Act Web Rebate of up to INR 25 000 is available for resident individuals whose total income does not exceed INR 700 000 under the default New Tax Regime u s 115BAC 1A In case such resident individual opts to pay tax under the old tax regime then rebate of up to Rs 12 500 is available if total income does not exceed Rs 5 00 000

Sbi Mutual Fund Income Tax Rebate

Sbi Mutual Fund Income Tax Rebate

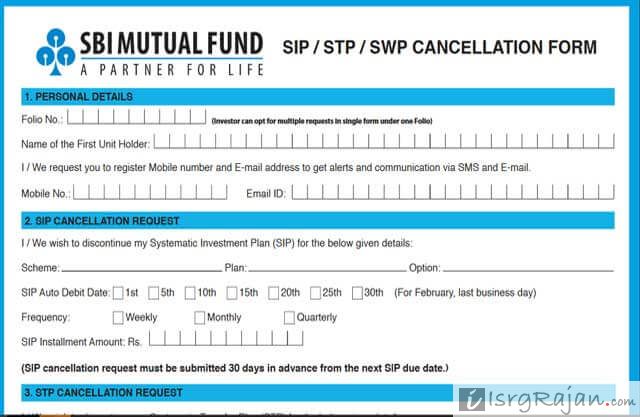

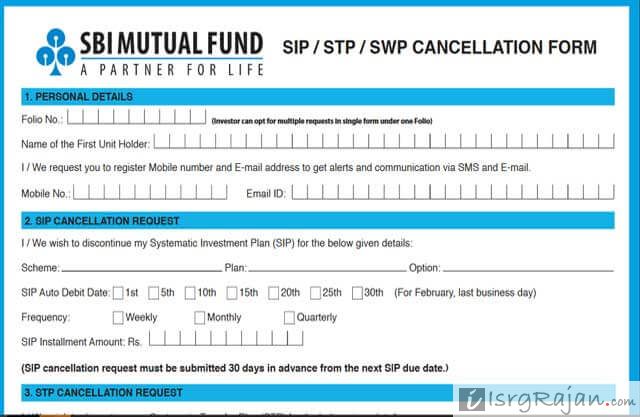

https://icdn.isrgrajan.com/2016/12/How-to-Fill-SBI-Mutual-Fund.jpg

Tax Saving Mutual Funds Top 5 ELSS Funds For 2020 INVESTIFY IN

https://www.investify.in/wp-content/uploads/2020/08/sbi-fund.png

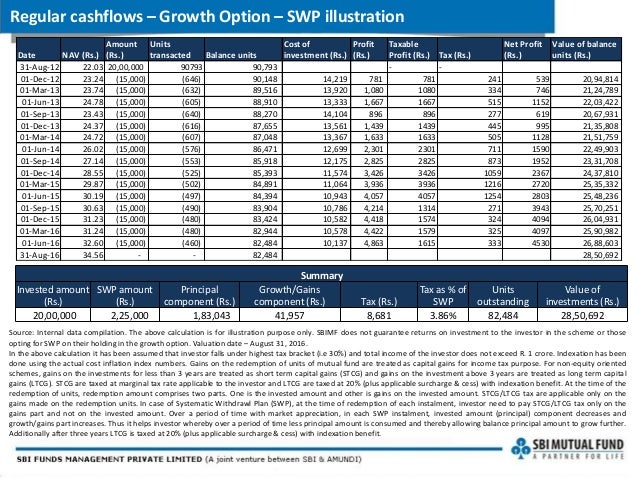

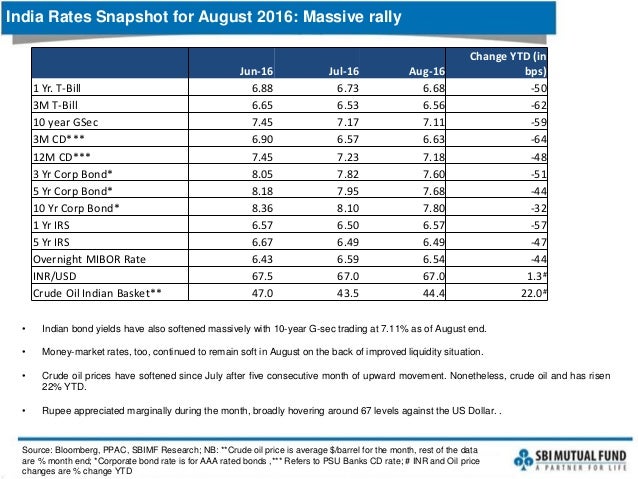

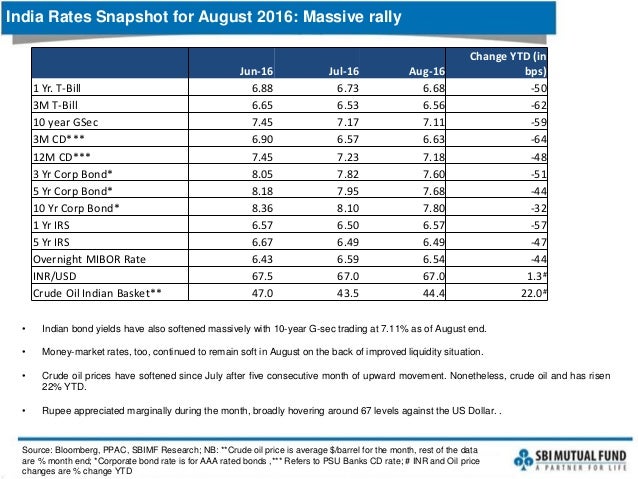

SBI Magnum Monthly Income Plan A Hybrid Mutual Fund Scheme Aug 2016

https://image.slidesharecdn.com/sbimmip-160916112549/95/sbi-magnum-monthly-income-plan-a-hybrid-mutual-fund-scheme-aug-2016-21-638.jpg?cb=1474025203

Web 21 juil 2023 nbsp 0183 32 Top performing Tax Saving Mutual Funds in 3 years till July 20 2023 Investments up to Rs 1 5 lakh per year in an Equity Linked Savings Scheme ELSS qualify for deduction under Section 80C of Web VDOM DHTML tml gt Are SBI mutual funds taxable Quora Something went wrong

Web 12 f 233 vr 2020 nbsp 0183 32 Updated on 27 Jul 2023 What is Tax on Mutual Funds Tax on mutual funds vastly depends on factors such as what kind of funds you have invested in equity debt or hybrid the duration of your investment long term or short term mutual fund income capital gains and dividend income and which income tax slab you belong to Web 20 f 233 vr 2020 nbsp 0183 32 Synopsis If you have any mutual fund queries message on ET Mutual Funds on Facebook We will get it answered by our panel of experts iStock I want to know if my SIP investment can be used for tax exemption How would I get to know whether my investments qualify for tax deduction Vigneshwaran

Download Sbi Mutual Fund Income Tax Rebate

More picture related to Sbi Mutual Fund Income Tax Rebate

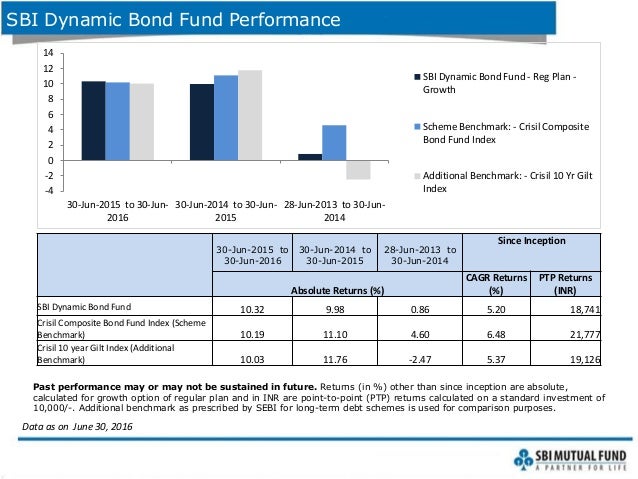

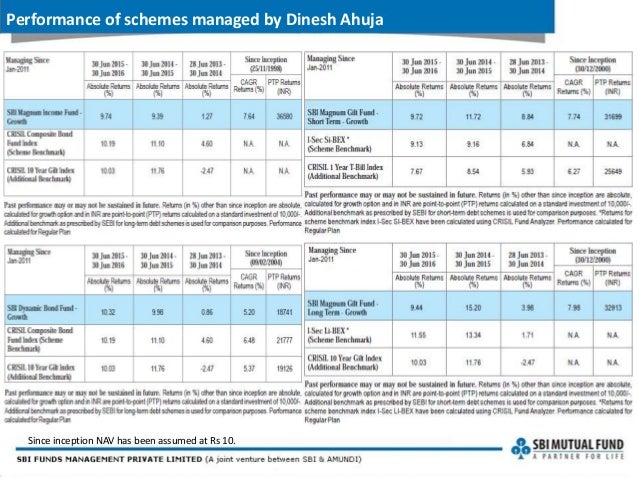

SBI Dynamic Bond Fund An Income Mutual Fund Scheme Aug 16

https://image.slidesharecdn.com/dynamicbondfund-160916111606/95/sbi-dynamic-bond-fund-an-income-mutual-fund-scheme-aug-16-4-638.jpg?cb=1474024622

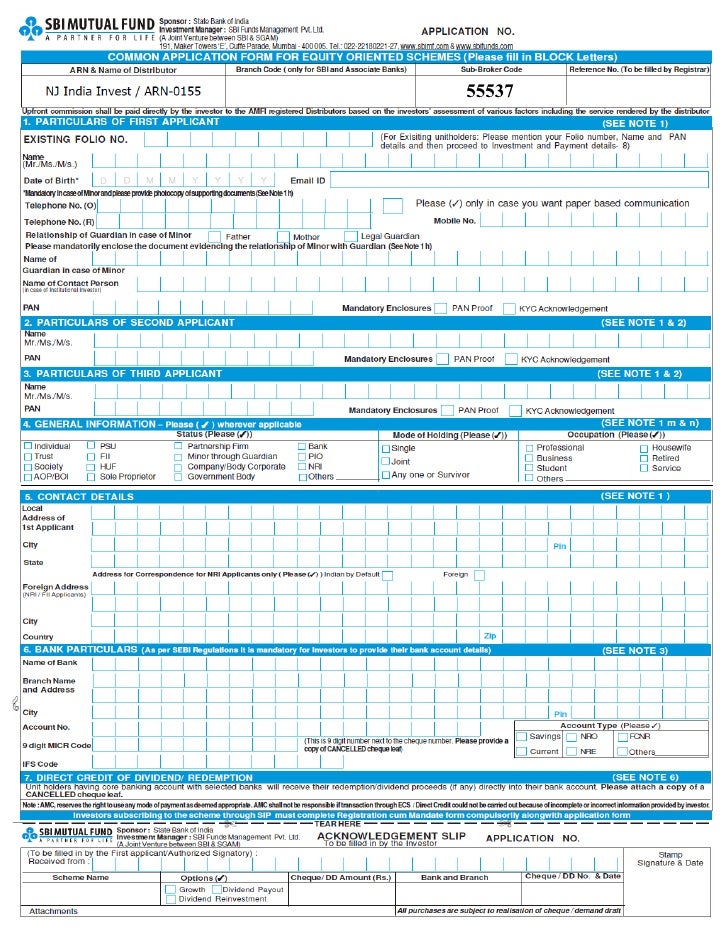

Sbi Mutual Fund Common Application Form Equity With Kim

https://image.slidesharecdn.com/sbimutualfundcommonapplicationformequitywithkim-111210052847-phpapp02/95/sbi-mutual-fund-common-application-form-equity-with-kim-2-728.jpg?cb=1323560206

Download SBI Mutual Fund Investments Statement PDF YouTube

https://i.ytimg.com/vi/9PjEniRvH2o/maxresdefault.jpg

Web 13 avr 2016 nbsp 0183 32 Are my SIPs eligible for tax deductions under under section 80C Rakesh Only investments in Equity Linked Savings Schemes ELSSs or tax saving mutual fund schemes qualify for a tax deduction under Section 80C of the Income Tax Act Unfortunately none of your Systematic Investment Plans SIPs are in ELSSs Web 1 avr 2016 nbsp 0183 32 Under section 80C up to 1 50 000 in premiums paid can be reduced from your total taxable income Apart from this you can claim deduction for premiums paid or amount deposited for annuity plans of any insurer under section 80CCC Only those plans are eligible that are meant for receiving a pension from a fund

Web Tax Saving Schemes Make Investment in ELSS mutual fund NPS Pension Plan Health amp Term Insurance to save tax up to 78 000 under section 80C 80CCD amp 80D One time Offer Get ET Money Genius at 80 OFF at 249 49 for the first 3 months Web 1 Life insurance amp Pension policies Even though it s not a pure tax saving investment option it does give dual benefits It gives you a life cover as well as you get tax benefits as per section 80C of the Income Tax Act 1961 hereinafter referred as

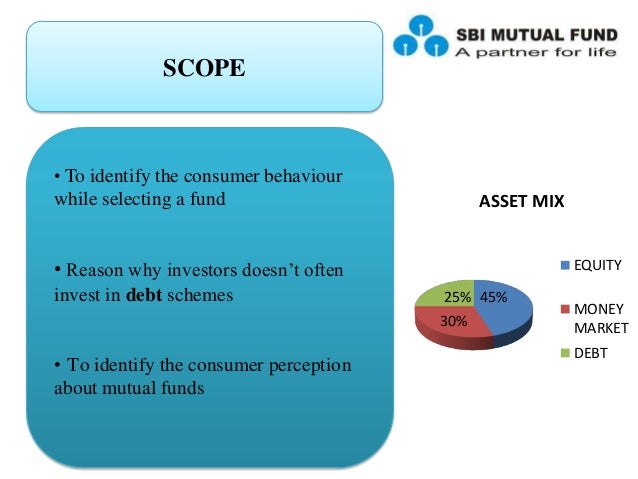

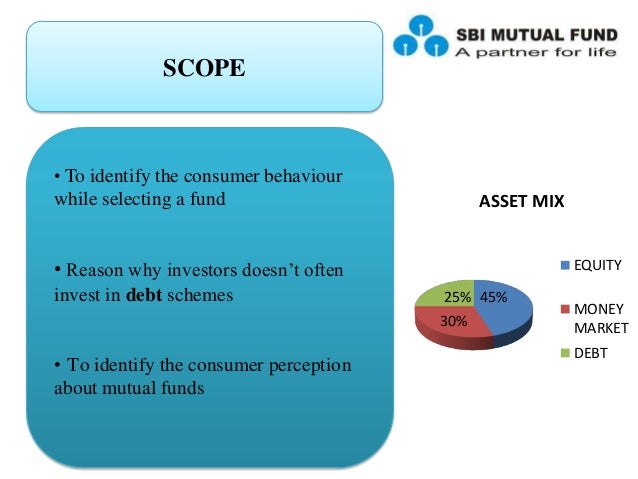

Sbi Mutual Fund

https://image.slidesharecdn.com/sbimutualfund-130909084631-/95/sbi-mutual-fund-3-638.jpg?cb=1378716430

SBI Magnum Monthly Income Plan A Hybrid Mutual Fund Scheme Aug 2016

https://image.slidesharecdn.com/sbimmip-160916112549/95/sbi-magnum-monthly-income-plan-a-hybrid-mutual-fund-scheme-aug-2016-29-638.jpg?cb=1474025203

https://www.sbimf.com/docs/default-source/pdf/sbi-mf-tax-r…

Web 37 on base tax where specified income exceeds Rs 5 crore 25 where specified income exceeds Rs 2 crore but does not exceed Rs 5 crore 15 where total income exceeds Rs 1 crore but does not exceed Rs 2 crore and 10 where total income exceeds Rs 50 lakhs but does not exceed Rs 1 crore

https://economictimes.indiatimes.com/mf/analysis/do-all-mutual-funds...

Web 11 oct 2019 nbsp 0183 32 No all mutual funds do not qualify for tax deductions under Section 80C of the income tax Act Only investments in equity linked saving schemes or ELSSs qualify for tax deduction under section 80C Investors can invest in ELSSs and claim tax deductions of up to Rs 1 5 lakh under Section 80C of the Income Tax Act

How SBI Mutual Fund Is Misleading Investors Through Its Advertisements

Sbi Mutual Fund

Basics Of Mutual Fund Investment Beginners Guide 2020

Sbi Deposit Interest Rates

Sbi Mutual Fund Common Application Form

SBI Dynamic Bond Fund An Income Mutual Fund Scheme Aug 16

SBI Dynamic Bond Fund An Income Mutual Fund Scheme Aug 16

SBI Magnum Monthly Income Plan A Good Hybrid Mutual Fund Scheme For

SBI Magnum Monthly Income Plan A Hybrid Mutual Fund Scheme Aug 2016

SBI Mutual Fund Sales Executive Recruitment 2021 MBA Graduate Can

Sbi Mutual Fund Income Tax Rebate - Web 12 f 233 vr 2020 nbsp 0183 32 Updated on 27 Jul 2023 What is Tax on Mutual Funds Tax on mutual funds vastly depends on factors such as what kind of funds you have invested in equity debt or hybrid the duration of your investment long term or short term mutual fund income capital gains and dividend income and which income tax slab you belong to