Senior Citizen Rebate In Income Tax 2021 22 For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime In the case of senior citizens if taxable income is up to Rs 5 00 000 then they can claim rebate from tax under the old tax regime i e they are not required to pay any tax Whereas under the

Senior Citizen Rebate In Income Tax 2021 22

Senior Citizen Rebate In Income Tax 2021 22

https://i.ytimg.com/vi/XQDCOVLK05g/maxresdefault.jpg

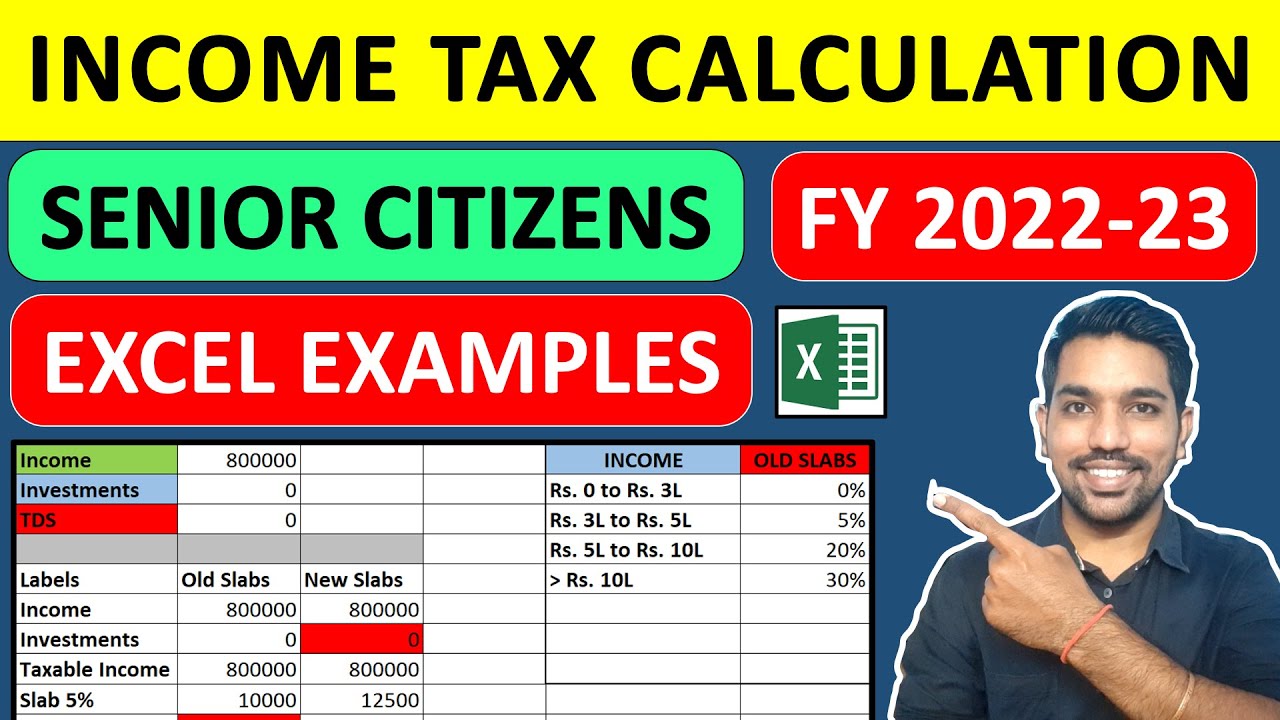

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator

https://i.ytimg.com/vi/GHq5DhLzRhQ/maxresdefault.jpg

Income Tax 2021 22 Income From House Property Q 7 Hc Mehrotra

https://i.ytimg.com/vi/ATOefiZQ2sg/maxresdefault.jpg

1 Rebate u s 87A is applicable under income tax for senior citizens if total income does not exceed Rs 5 lakh 2 Exemption of income tax for senior citizens includes payment of advanced tax no deductions of TDS on earned interest In order to provide relief to senior citizens who are of the age of 75 year or above and to reduce compliance for them it is proposed to insert a new section to provide a

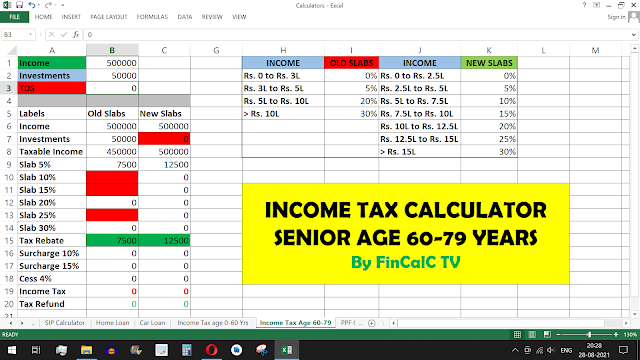

Basic Exemption Limit is Rs 2 50 000 in each and every case I e no different exemption limit is there in case of Senior citizen or Super Senior citizen There is exemption Starting from AY 2021 22 FY 2019 20 tax season Senior Citizens aged 60 years or above can avail the tax benefits in India Know Tax Benefits for Senior Citizens EZTax in This document covers Standard

Download Senior Citizen Rebate In Income Tax 2021 22

More picture related to Senior Citizen Rebate In Income Tax 2021 22

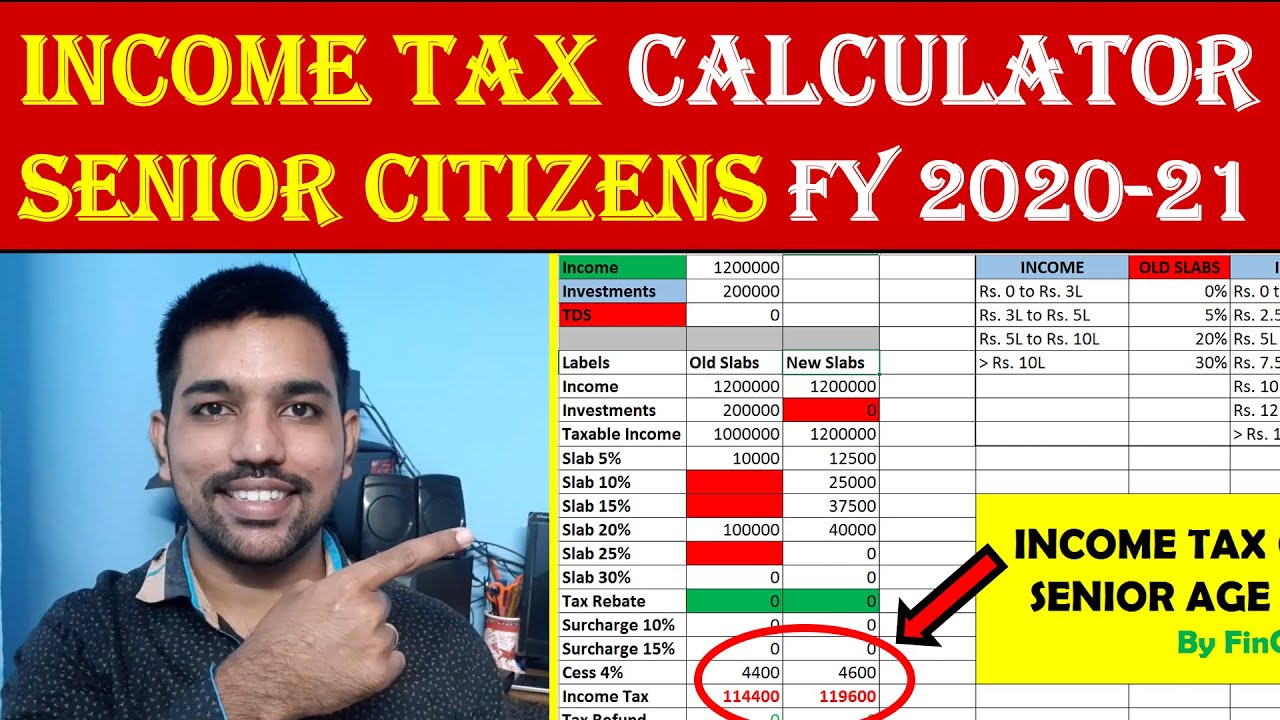

Senior Citizen Income Tax Calculation 2021 22 Excel Calculator

https://i.ytimg.com/vi/Ww-ESeJgiP8/maxresdefault.jpg

8 Exclusive Benefits Available To Senior Citizens In Income Tax

https://i.ytimg.com/vi/oBNpgX_lvp4/maxresdefault.jpg

Parliamentary Panel Recommends Senior Citizen Rebate Restoration In

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2016/05/PTI5_16_2016_000278B.jpg

For other taxpayer assessees i e senior citizens and super senior citizens the Income tax limit for availing the exemption would be Rs 3 00 000 Rs 5 00 000 respectively Individuals with net taxable income less than or Note in this regime the exemption limit for all categories of individuals such as Individual Senior Citizen Super Senior Citizen are the same i e Rs 2 50 000 REBATE

Section 87A Tax rebate is available under both new and old tax regimes for FY 2020 21 AY 2021 22 Individuals having taxable income of up to Rs 5 lakh will be eligible for Senior Citizen Income Tax Excel Calculator will help you calculate Income Tax But before calculating income tax you should know Income tax slab rates for FY 2021 22 Tax rebate

Senior Citizen Home Improvement Program Popular Before Approval News

https://ogden_images.s3.amazonaws.com/www.post-journal.com/images/2022/06/14163821/Senior-Citizen-Housing-scaled.jpg

Senior Citizen Discount Requirement POSTER Lazada PH

https://filebroker-cdn.lazada.com.ph/kf/Sb05870109ae446a792a5645f491229972.jpg

https://greatsenioryears.com

For the fiscal years 2021 22 and 2022 23 AY 2022 23 and AY 2023 24 senior citizens with taxable income up to Rs 5 00 000 can claim a tax rebate u s 87A The rebate amount is either

https://www.incometax.gov.in › iec › foportal › help › individual

Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old Tax Regime

Income Tax Rebate Under Section 87A

Senior Citizen Home Improvement Program Popular Before Approval News

Senior Citizen Income Tax Rebate And Tax Benefits Senior Citizen Tax

Minnesota Property Tax Refund 2019 2024 Form Fill Out And Sign

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Mobile

Download Your Income Tax Form 2021 22 2021 22

Download Your Income Tax Form 2021 22 2021 22

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Budget 2024 Income Tax Slabs Rates LIVE No Changes In Income Tax Rates

Senior Citizen Rebate In Income Tax 2021 22 - Finance Act 2021 inserted a new section 194P which provided conditions for exempting senior citizens from filing income tax returns aged 75 years and above New Section 194P will