Senior Discount For Property Taxes In Illinois The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

The Senior Citizens Real Estate Tax Deferral Program allows qualified seniors to defer all or part of their property taxes and special assessment payments on their principal residences Seniors needing assistance paying their property taxes have until March 1 2023 to apply for the program SPRINGFIELD Ill The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their property tax rebate of up to 300 by submitting Form IL 1040 PTR to the Illinois Department of Revenue

Senior Discount For Property Taxes In Illinois

Senior Discount For Property Taxes In Illinois

https://www.hegwoodgroup.com/wp-content/uploads/2022/11/pay-commercial-property-taxes-in-the-fall.jpg

High Property Taxes In Illinois Real Estate Lawyer

https://stelklaw.com/wp-content/uploads/2021/04/property-taxes-e1621345175143.jpg

CA Parent Child Transfer California Property Tax NewsCalifornia

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg?resize=2048%2C1192&ssl=1

A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property Automatic Renewal Yes this exemption automatically renews each year Due Date The deadline to file for tax year 2023 is Monday April 29 2024 Did you file online for your senior exemption Log in to view your application status The Senior Citizens Real Estate Tax Deferral Program provides tax relief for qualified senior citizens by allowing them to defer all or part of their property tax and special assessment payments on their principal residences The deferral is similar to a loan against the property s market value

Senior Citizens Homestead Exemption Statutory Citation 35 ILCS 200 15 170 Who is eligible To qualify you must be age 65 by December 31st of the assessment year for which the application is made own and occupy the property be liable for the payment of real estate taxes on the property How do I apply Senior citizens If you are 65 or older you can have your assessed value lowered by up to 5 000 or 8 000 in Cook County You can also apply for an assessment freeze that limits the amount of future assessment increases See 35

Download Senior Discount For Property Taxes In Illinois

More picture related to Senior Discount For Property Taxes In Illinois

HOW TO PAY YOUR LATE PROPERTY TAXES IN ILLINOIS YouTube

https://i.ytimg.com/vi/3soNdLC_blw/maxresdefault.jpg

How Our Local Taxes Really Work The JOLT

https://cdn2.creativecirclemedia.com/jolt/original/20210323-203543-IMG_0713.jpg

Circuit Breaker Tax Exemption Archives California Property Tax

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/11/The-History-of-Property-Taxes-in-California-scaled.jpg?resize=1200%2C1006&ssl=1

Senate Bill 1975 signed by Gov J B Pritzker on Friday increases the general homestead exemption and senior citizens homestead exemption reduces interest rates on tax deferrals for seniors and allows for automatic renewal of the homestead exemption for qualifying people with disabilities in Cook County according to the Published May 20 2022 Updated on May 20 2022 at 3 17 pm Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax

The Illinois Department on Aging IDoA is encouraging older adults and retirees who were not required to file an Illinois income tax return for 2021 to claim their property tax rebate of up to 300 by submitting Form IL 1040 PTR to the Illinois Department of Revenue Scherer s House Bill 3054 would amend the property tax code by allowing the maximum income limitation for the Low Income Senior Citizens Assessment Freeze Homestead Exemption to be 85 000 Currently access to the freeze exemption is limited to seniors who earn 65 000 or less annually

The Union Role In Our Growing Taxocracy California Policy Center

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

Property Taxes By State County Median Property Tax Bills Tax

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

https://www.illinoislegalaid.org/legal-information/...

The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

https://tax.illinois.gov/research/news/illinois...

The Senior Citizens Real Estate Tax Deferral Program allows qualified seniors to defer all or part of their property taxes and special assessment payments on their principal residences Seniors needing assistance paying their property taxes have until March 1 2023 to apply for the program

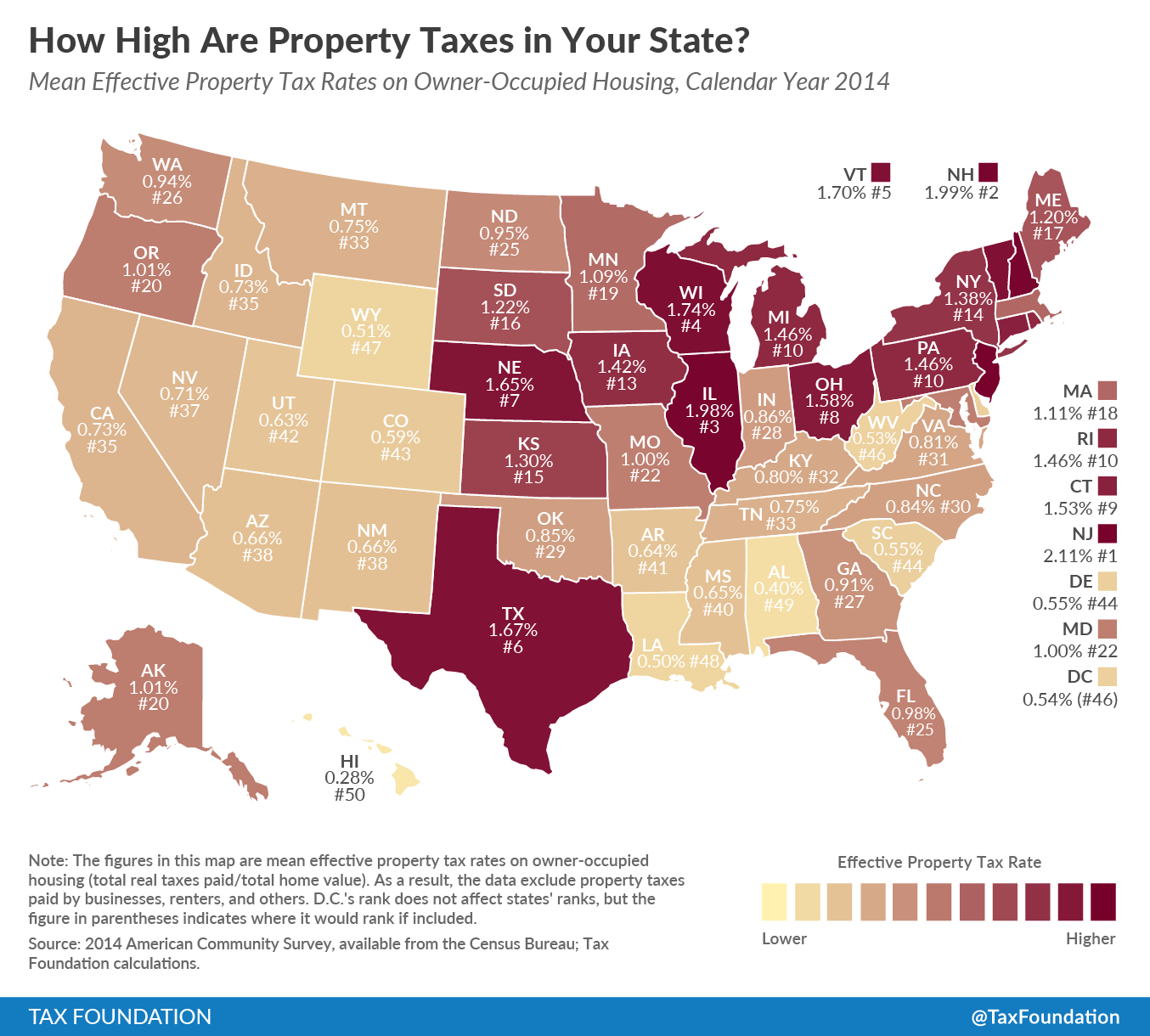

How High Are Property Taxes In Your State Tax Foundation

The Union Role In Our Growing Taxocracy California Policy Center

How High Are Property Taxes In Your State 2016 Tax Foundation

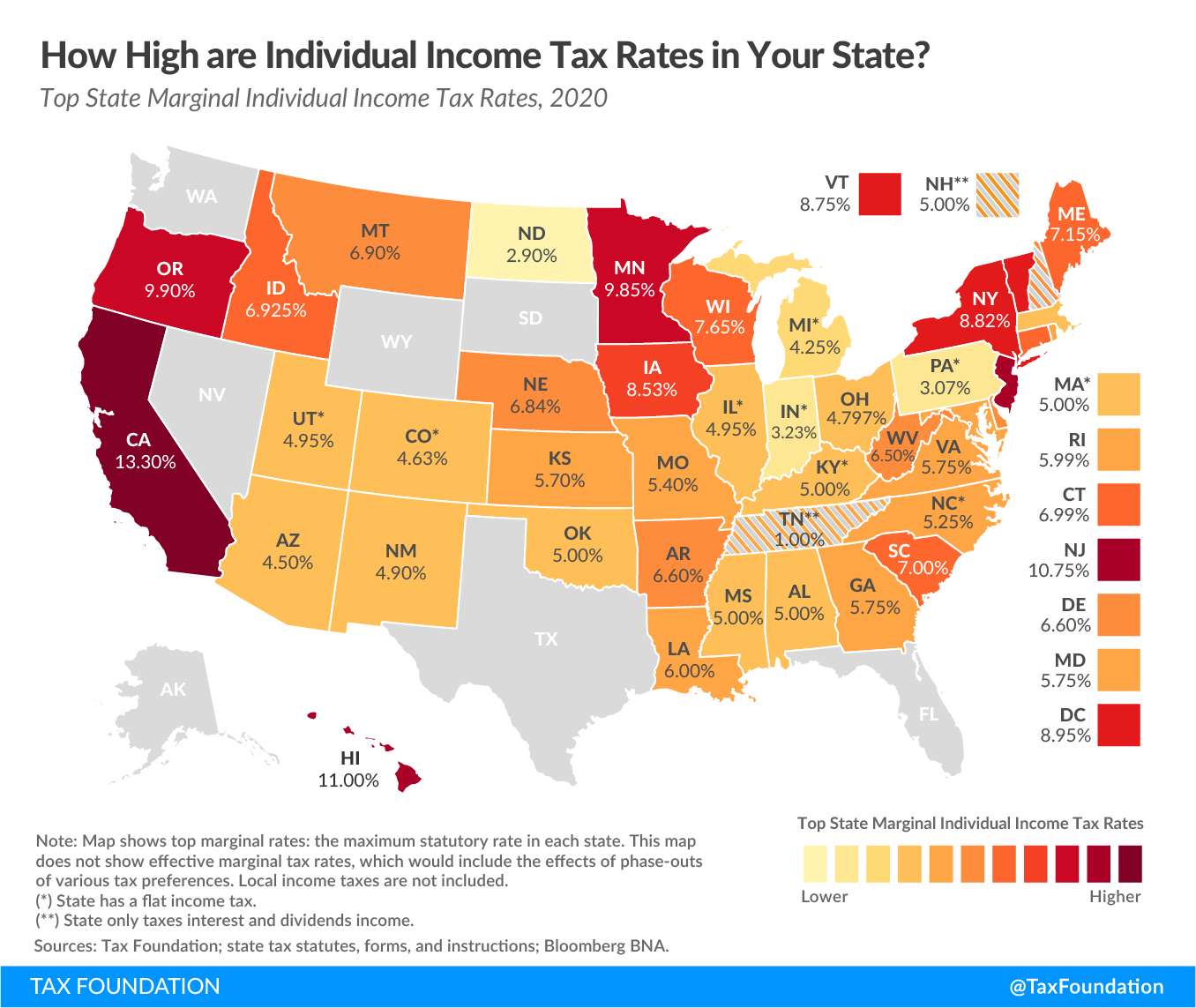

State Individual Income Tax Rates And Brackets For 2020 Upstate Tax

How Property Taxes In Illinois Work Real Estate Omni

Hecht Group How To Pay Your Property Taxes In Tarrant County

Hecht Group How To Pay Your Property Taxes In Tarrant County

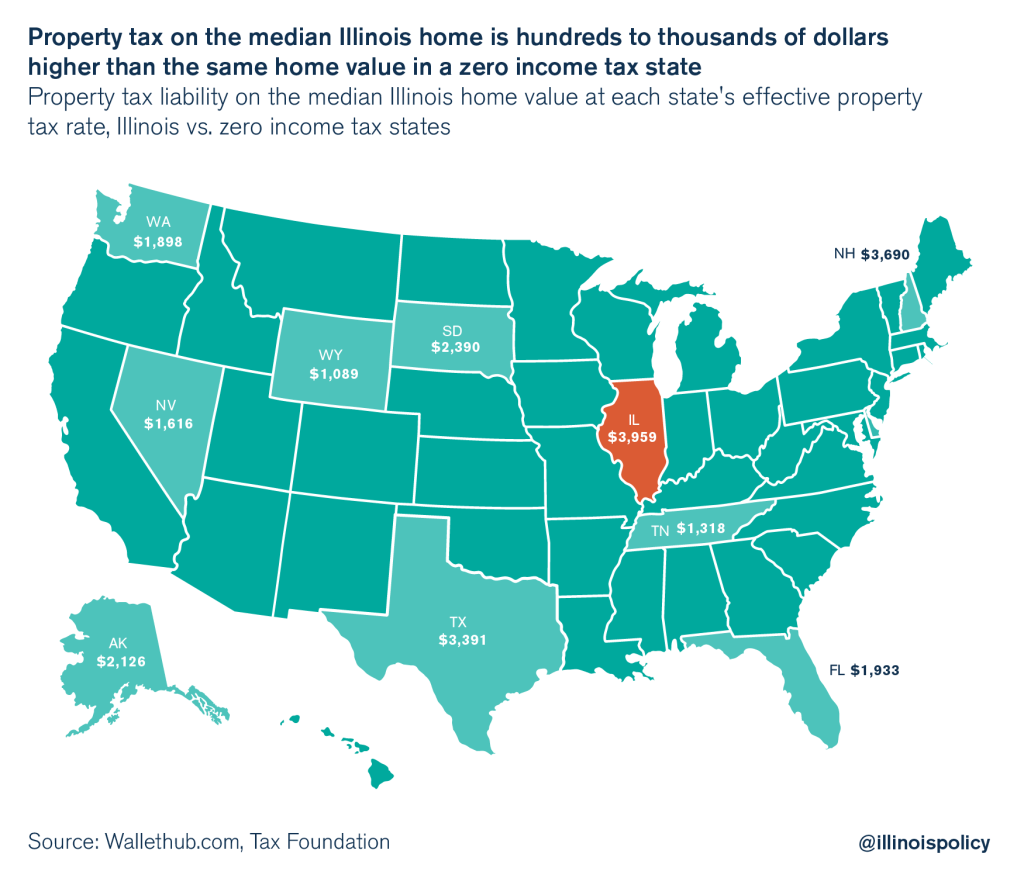

Illinois Has Higher Property Taxes Than Every State With No Income Tax

/dotdash-TheBalance-best-and-worst-states-for-property-taxes-3193328-final3-4972494b00d447d58e8943ad5b82913e.jpg)

K hl Schulische Ausbildung Billig States Of Jersey Tax R ckstand Tappen

Understanding The Senior Discount For Property Taxes

Senior Discount For Property Taxes In Illinois - Senior Citizens Homestead Exemption Statutory Citation 35 ILCS 200 15 170 Who is eligible To qualify you must be age 65 by December 31st of the assessment year for which the application is made own and occupy the property be liable for the payment of real estate taxes on the property How do I apply