Senior Tax Credit 2022 Quebec 463 Senior assistance tax credit You may be entitled to the refundable senior assistance tax credit if you qualify as an eligible individual and you meet at least one of the following conditions You were 70 or over on December 31 2023

an eligible senior living alone will be able to benefit from a refundable tax credit of up to 2 000 as long as his or her family income for the 2022 taxation year does not reach 64 195 with the 5 reduction rate applying from a family income of 24 195 Tax credits and deductions for seniors Refundable tax credit Senior assistance tax credit This credit is for modest income seniors Learn more Refundable tax credit Tax credit for home support services for

Senior Tax Credit 2022 Quebec

Senior Tax Credit 2022 Quebec

https://i.ytimg.com/vi/X1SvVe3_JzA/maxresdefault.jpg

Tax Credit Calculator My Free Taxes

https://www.myfreetaxes.org/wp-content/uploads/2022/01/iStock-Tax-Credit-word-scaled.jpg

Child Tax Credit 2022 PriorTax Blog

https://www.blog.priortax.com/wp-content/uploads/2017/10/shutterstock_253719982.jpg

458 Tax credit for home support services for seniors Eligibility You may be entitled to a refundable tax credit for expenses related to home support services if you meet both of the following conditions You were resident in Qu bec on December 31 2023 You were at least 70 years of age on December 31 2023 This measure will allow more than six million Quebecers to benefit as of December 2022 from financial assistance granted in a single payment Determination of the refundable tax credit granting a new one time cost of living amount

1 400 if you were between 60 and 64 on December 31 2023 1 450 if you were 65 or over on December 31 2023 The credit is reduced on the basis of your eligible work income If your eligible work income for 2023 was over 38 945 the credit is reduced by 5 of the excess income Senior Assistance Tax Credit Administered by Revenu Qu bec The Senior Assistance Tax Credit is a refundable tax credit paid automatically to eligible people 70 years of age or over who filed an income tax return Tax Credit for Home Support Services for Seniors Administered by Revenu Qu bec

Download Senior Tax Credit 2022 Quebec

More picture related to Senior Tax Credit 2022 Quebec

R sultats Des lections Qu bec 2022 En Direct

https://m1.quebecormedia.com/emp/jdx-prod-images/photo/ab8c9919-7b5c-44fb-b904-25b7f4827a53_partage.jpg

With The Participation Of Canada The Canadian Film Of Video Production

https://i.pinimg.com/originals/aa/60/32/aa60329d06ee2c2b47c1f795c44d3048.png

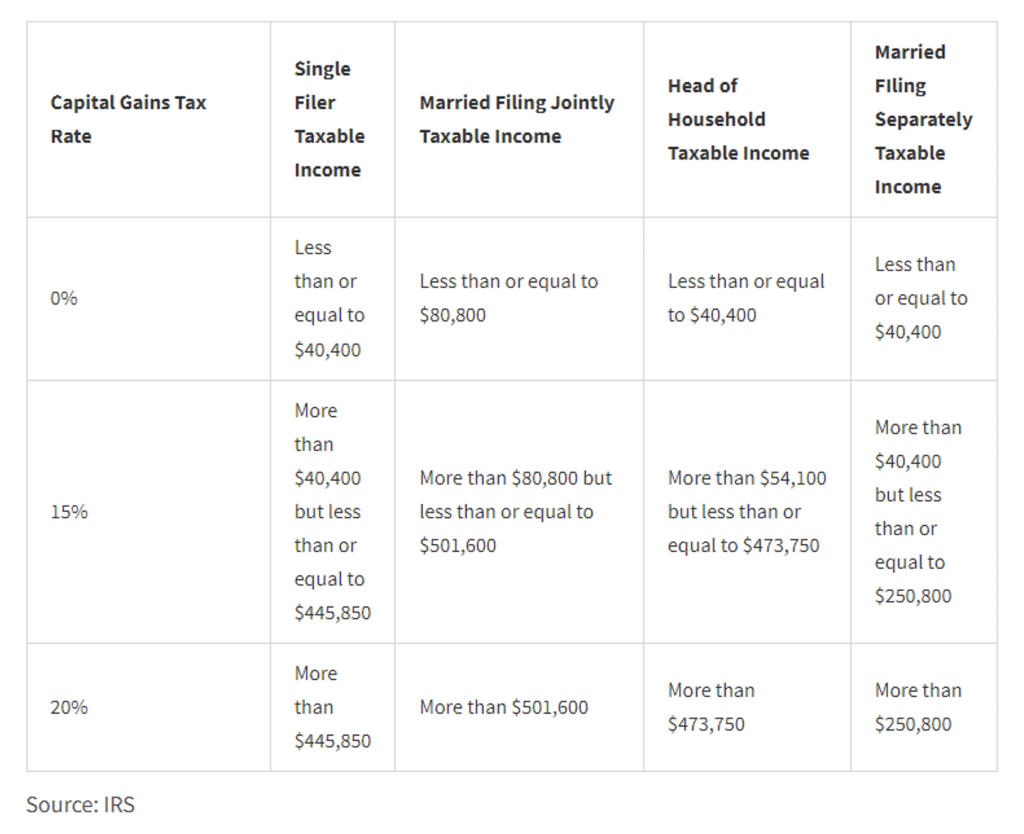

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.23.12-PM-1024x834.png

For seniors who have been hit hard by inflation the maximum refundable senior assistance tax credit will rise from 411 to 2 000 This will increase the aid provided to seniors who Payment of the Senior Assistance Tax Credit You do not have to claim the credit in your income tax return We will calculate the credit for you but if you prefer you can calculate it yourself by completing form TP 1029 SA V Senior Assistance Tax Credit

Tax credit for home support services for seniors If you are 70 or older you may be eligible for financial assistance in the form of a refundable tax credit for expenses incurred for home support services Tax credit for caregivers This tax credit helps support caregivers providing care to a loved one Tax credit for children s activities Revenu Quebec offers several special tax credits for seniors one of which being the Tax Credit for Seniors Activities Designed to encourage seniors to stay active this credit helps offset registration or membership fees for qualifying activities As a refundable credit it can also help you qualify for a tax refund Eligible Claimants

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

2022 Tax Brackets Canada Cra

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

https://www. revenuquebec.ca /en/citizens/income-tax...

463 Senior assistance tax credit You may be entitled to the refundable senior assistance tax credit if you qualify as an eligible individual and you meet at least one of the following conditions You were 70 or over on December 31 2023

https://www. finances.gouv.qc.ca /Budget_and_update/...

an eligible senior living alone will be able to benefit from a refundable tax credit of up to 2 000 as long as his or her family income for the 2022 taxation year does not reach 64 195 with the 5 reduction rate applying from a family income of 24 195

2022 Quebec Tax Rate Card Richter

2022 Income Tax Brackets Chart Printable Forms Free Online

TaxTips ca Business 2022 Corporate Income Tax Rates

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Resultat Election Quebec 2022 Tammi Frasier

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

Quebec Sodec Logo On July 20 2017 Tax Credits Film Incoming Call

Tax Credits Broadcast Development Lightbulb Nick Bahia Light

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

Senior Tax Credit 2022 Quebec - This measure will allow more than six million Quebecers to benefit as of December 2022 from financial assistance granted in a single payment Determination of the refundable tax credit granting a new one time cost of living amount