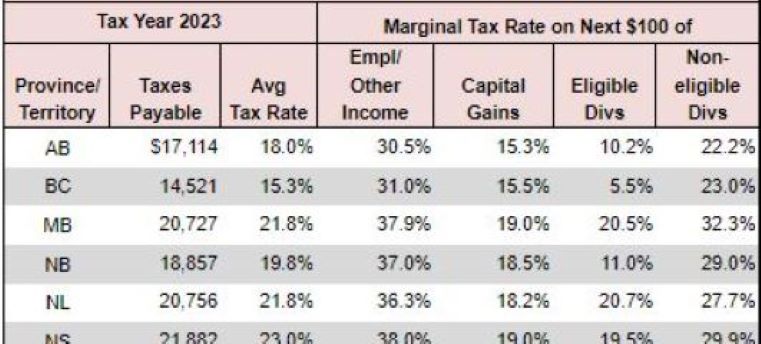

Senior Tax Offset 2023 Age Limit Offset Amounts The maximum SAPTO amounts for the 2023 24 income year are Single 2 230 Each partner of a couple 1 602 Each partner of an illness separated couple

Maximum Offset Amount The maximum SAPTO amount varies based on your circumstances ranging from 1 602 to 2 230 Shading Out Threshold If your income Tax Australia 2023 Income tax returns Individual return Tax offsets Individual return Item T1 Seniors and Pensioners includes self funded retirees Australians entitled to

Senior Tax Offset 2023 Age Limit

Senior Tax Offset 2023 Age Limit

https://www.nme.com/wp-content/uploads/2023/07/cardi-b-offset-getty.jpg

/cardi-b-offset-kids-a19f8c8893b84c1b8f482b9ecf622c6d.jpg)

All About Cardi B And Offset s Kids

https://people.com/thmb/x-cuQQsu9286_6QbCXTiwvW738U=/2000x1500/filters:fill(auto,1)/cardi-b-offset-kids-a19f8c8893b84c1b8f482b9ecf622c6d.jpg

Seniors And Pensioners Tax Offset YourLifeChoices

https://assets.yourlifechoices.com.au/2022/07/22095547/seniors-pensioners-tax-offset.png

Seniors Pension age To be eligible for the age pension you must be 65 years or older The qualifying age will gradually increase by 6 months every 2 years to 67 On 1 July 2019 the pension age will increase to 66 years and it will continue to increase by six months every two years until 1 July 2023 when will be set at 67 years for

Age Eligibility You must have reached the age pension age which is currently set between 66 and 67 depending on your birthdate Residency You must be an Australian resident Seniors and pensioners tax offset If you meet the age requirement for the Age Pension or you receive another Australian Government pension from Centrelink or

Download Senior Tax Offset 2023 Age Limit

More picture related to Senior Tax Offset 2023 Age Limit

CDS Eligibility 2023 Age Limit Qualification Physical Standards

https://blog.careerwill.com/wp-content/uploads/2023/05/2023-16.png

Who Is Entitled To The Low And Middle Income Tax Offset One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/08/LMITO.jpg

Cardi B On The Moment She And Offset Learned Of Takeoff s Death

https://www.nme.com/wp-content/uploads/2022/12/CardiB-Offset-Takeoff-message-.jpg

2023 24 Tax offset available for taxable component Age and income stream type Taxed element Untaxed element Beneficiary under preservation age All income streams This will cause many taxpayers 2023 income tax return refunds to be significantly less than the past couple of years The main tax offsets still available to

Standard Deduction for Seniors If you do not itemize your deductions you can get a higher standard deduction amount if you and or your spouse are 65 years old If you or your spouse or common law partner are self employed you have until June 15 2023 to file on time Filing your return before the respective deadline will

The Low Income Super Tax Offset SMSF Specialists

https://www.smsfconsulting.com.au/wp-content/uploads/2022/05/Tax-Offset-1024x683.png

Zone Tax Offset Guide Australia Who How One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/09/tax-offset.jpg

https://www.yourlifetime.com.au/news/1298/...

Offset Amounts The maximum SAPTO amounts for the 2023 24 income year are Single 2 230 Each partner of a couple 1 602 Each partner of an illness separated couple

/cardi-b-offset-kids-a19f8c8893b84c1b8f482b9ecf622c6d.jpg?w=186)

https://www.kpgtaxation.com.au/blog/how-does-sapto...

Maximum Offset Amount The maximum SAPTO amount varies based on your circumstances ranging from 1 602 to 2 230 Shading Out Threshold If your income

Two New Tax Changes Affecting Individuals SKP Advisors Accountants

The Low Income Super Tax Offset SMSF Specialists

HPSC SDAO Eligibility Criteria 2023 Age Limit Qualification

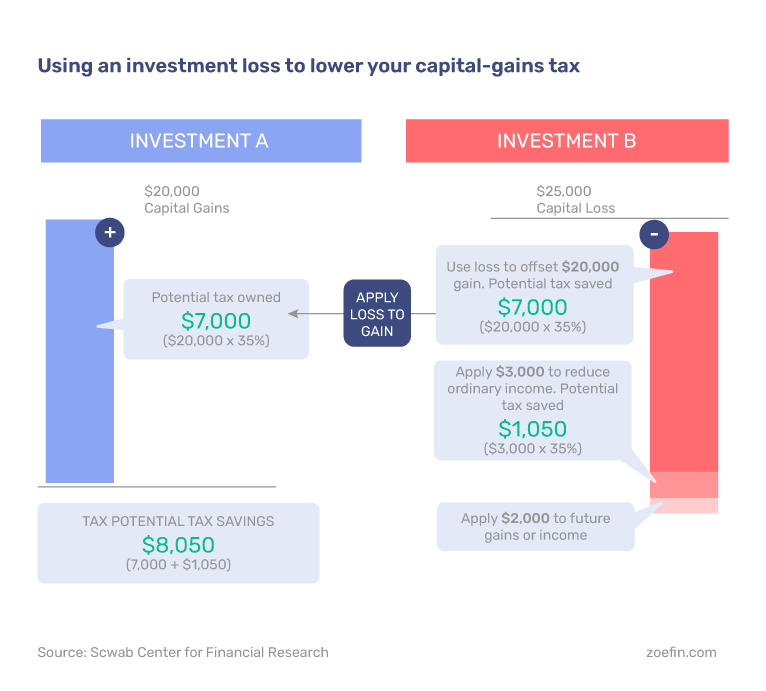

Capital Gains On Sale Of Vacant Land Canadian Money Forum

Guide To Low And Middle Income Tax Offset LMITO Of 1 080 Sydney

:max_bytes(150000):strip_icc()/IRSForm1040-SR-cabde4390e1b4590b59cf978edb7675e.png)

Tax Form For Seniors 2023 Printable Forms Free Online

:max_bytes(150000):strip_icc()/IRSForm1040-SR-cabde4390e1b4590b59cf978edb7675e.png)

Tax Form For Seniors 2023 Printable Forms Free Online

Do Pensioners Need To Lodge A Tax Return Expat US Tax

Do s And Don ts Of Tax Loss Harvesting Zoe

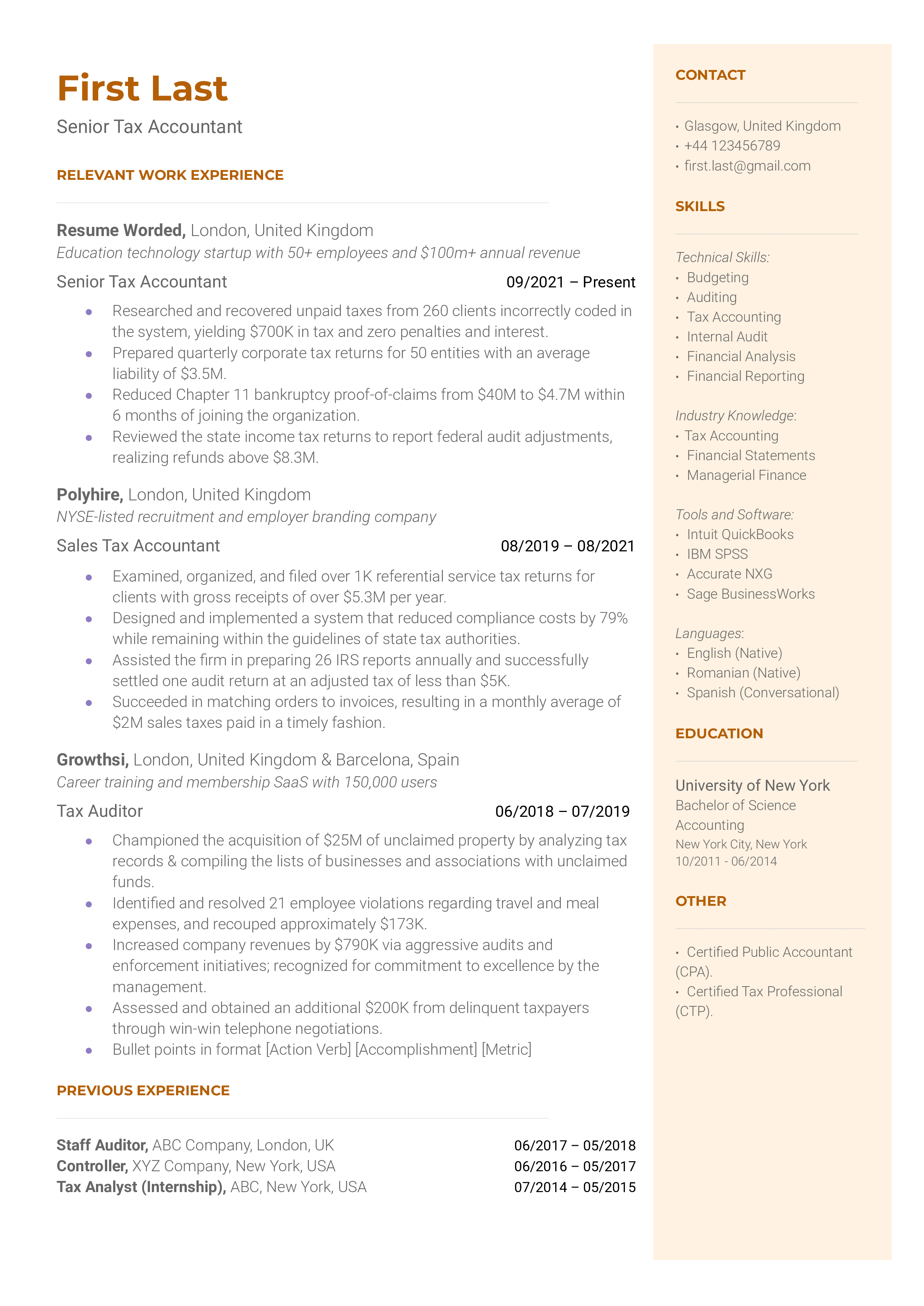

Senior Tax Accountant Resume Examples For 2024 Resume Worded

Senior Tax Offset 2023 Age Limit - A pensioner can earn up to 33 000 before paying tax in Australia if single or 30 500 if a member of a couple This is calculated using the tax free threshold of 18 200 plus