Seniors And Pensioners Tax Offset 2022 23 Seniors and retirees including self funded retirees may be eligible to claim a tax offset if you meet the conditions set out below However you can t claim this tax offset if you

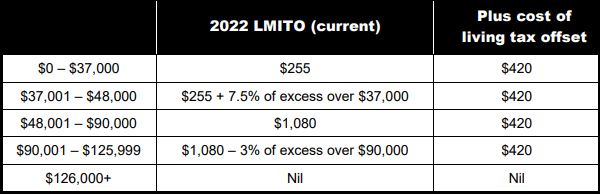

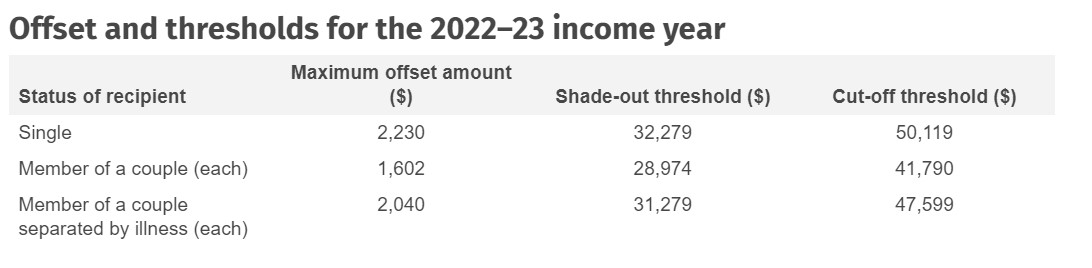

You are eligible if you were receiving an Australian Government age pension or allowance from Centrelink or a pension allowance or benefit from the Department of The table below sets out the maximum Seniors and Pensioners Tax Offset SAPTO and the thresholds at which the offsets shade out and cut out for the 2022 23

Seniors And Pensioners Tax Offset 2022 23

Seniors And Pensioners Tax Offset 2022 23

https://www.yellowpages.com.au/wp-content/uploads/2022/06/what-is-tax-offset-2048x1365.jpg

How Does The Seniors And Pensioners Tax Offset Work National Seniors

https://nationalseniors.com.au/generated/1440w-3-2/istock-609917508-jpg.jpg?1655260171

Stop The Attacks On Retired Workers Green Left

https://www.greenleft.org.au/sites/default/files/p5_melb_rally_for_pensioners_may_20_2015_photo_annaki_rowlands.jpg

The Senior Australians and Pensioners Tax Offset SAPTO won t shower you in riches But depending on your age relationship status and income it could provide a handy tax offset of up to 2 230 for SAPTO stands for Seniors and Pensioners Tax Offset It s available to eligible pensioners and seniors who reside here in Australia The offset is made up of the Senior Australian Tax Offset SATO and

The Seniors and Age Pension Tax Offset SAPTO provides valuable financial assistance to eligible Australian seniors and pensioners Understanding the eligibility criteria rebate income Thresholds The SAPTO income thresholds determine the amount of offset you can claim As of the 2022 23 financial year the thresholds are 32 279 for singles and 28 974 per person for couples However the Senior

Download Seniors And Pensioners Tax Offset 2022 23

More picture related to Seniors And Pensioners Tax Offset 2022 23

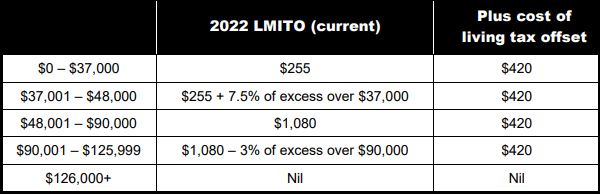

Top 18 Low Income Tax Offset Calculator 2022

https://atotaxrates.info/wp-content/uploads/2021/05/foreign-income-tax-offset-claim-2021-1024x549.jpg

Australia 2019 2020 Income Tax Year Les Imp ts Sur Les Salaires

https://www.oecd-ilibrary.org/sites/8d148778-fr/images/images/AustraliaFR20_final/media/image3.png

Seniors And Pensioners Tax Offset YourLifeChoices

https://assets.yourlifechoices.com.au/2022/07/22095547/seniors-pensioners-tax-offset.png

A pensioner can earn up to 33 000 before paying tax in Australia if single or 30 500 if a member of a couple This is calculated using the tax free threshold of 18 200 plus being eligible for the Low Income Tax Offset SAPTO is a valuable tax offset designed to ease the financial burden on eligible seniors and pensioners by reducing the amount of income tax they pay Let s understand how SAPTO works and whether you might be

myTax 2022 Seniors and pensioners includes self funded retirees How to determine your eligibility for the seniors and pensioners tax offset when you lodge In 2022 23 you do not have to pay the Medicare levy if your taxable income is equal to or less than the lower threshold of 24 276 for taxpayers not entitled to the

2022 23 Federal Budget What It Means For You

https://www.knoxtax.com.au/wp-content/uploads/2022/03/2022-LMITO.jpg

Age Of Entitlement Age based Tax Breaks Grattan Institute

https://grattan.edu.au/wp-content/uploads/2020/11/Household-Finance-Retirement-scaled-e1613090690244.jpeg

https://www.ato.gov.au/.../t1-seniors-and-pensioners-tax-offset-2023

Seniors and retirees including self funded retirees may be eligible to claim a tax offset if you meet the conditions set out below However you can t claim this tax offset if you

https://www.ato.gov.au/forms-and-instructions/...

You are eligible if you were receiving an Australian Government age pension or allowance from Centrelink or a pension allowance or benefit from the Department of

Top 10 Tax Planning Tips Enter The New Financial Year With The Basics

2022 23 Federal Budget What It Means For You

Federal Budget 2023 24 Personal Income Tax Pitcher Partners

Seniors And Pensioners Tax Offset SAPTO For 2022 23 Lexology

Government Don t Have Regards For Us Pensioniers Speak

Who Isn t Eligible For The Foreign Pensioners Tax Break IIA

Who Isn t Eligible For The Foreign Pensioners Tax Break IIA

Breaking Down The 2023 Federal Budget Insights For Individuals KMT

How To Save On Tax When Retirement Planning Claiming SAPTO TNR Wealth

Why Special Tax Breaks For Seniors Should Go ABC News

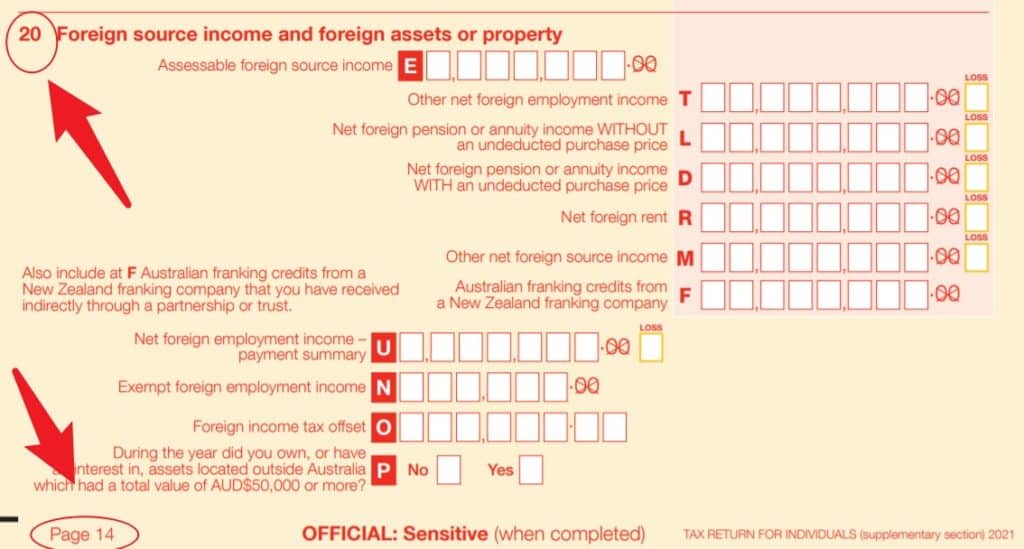

Seniors And Pensioners Tax Offset 2022 23 - Please help to tell me where I can enter the tax offset code You are claiming tax offsets or adjustments We will show tax offsets if they are relevant to you