Seniors And Pensioners Tax Offset Code Learn how to claim the seniors and pensioners tax offset if you meet the eligibility conditions based on your age income and marital status Find out the code

Learn how to claim the seniors and pensioners tax offset if you meet the eligibility conditions based on your age income and residence Find out the code letters The Senior Australians and Pensioners Tax Offset SAPTO won t shower you in riches But depending on your age relationship status and income it could provide a handy tax offset of up to 2 230 for

Seniors And Pensioners Tax Offset Code

Seniors And Pensioners Tax Offset Code

https://www.yellowpages.com.au/wp-content/uploads/2022/06/what-is-tax-offset-2048x1365.jpg

Top 18 Low Income Tax Offset Calculator 2022

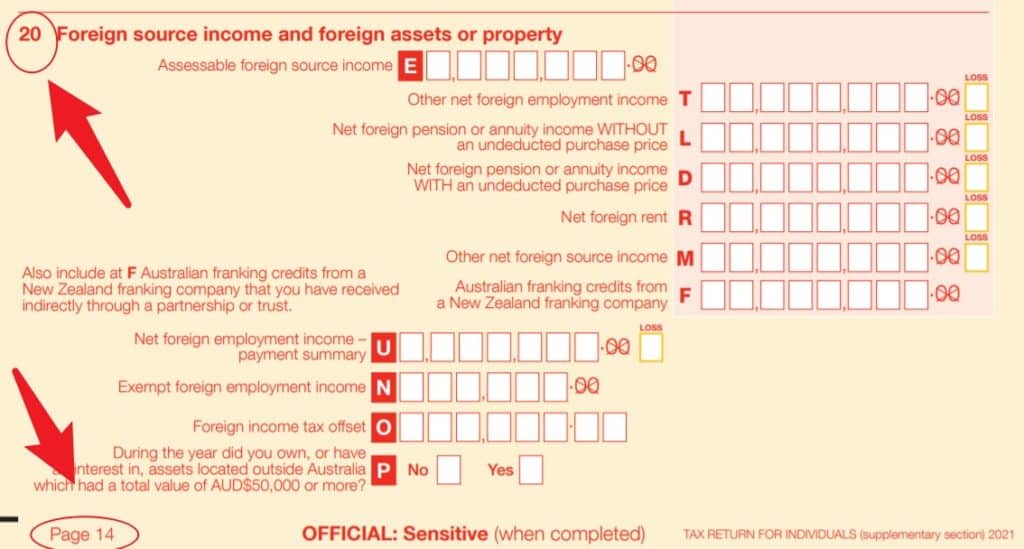

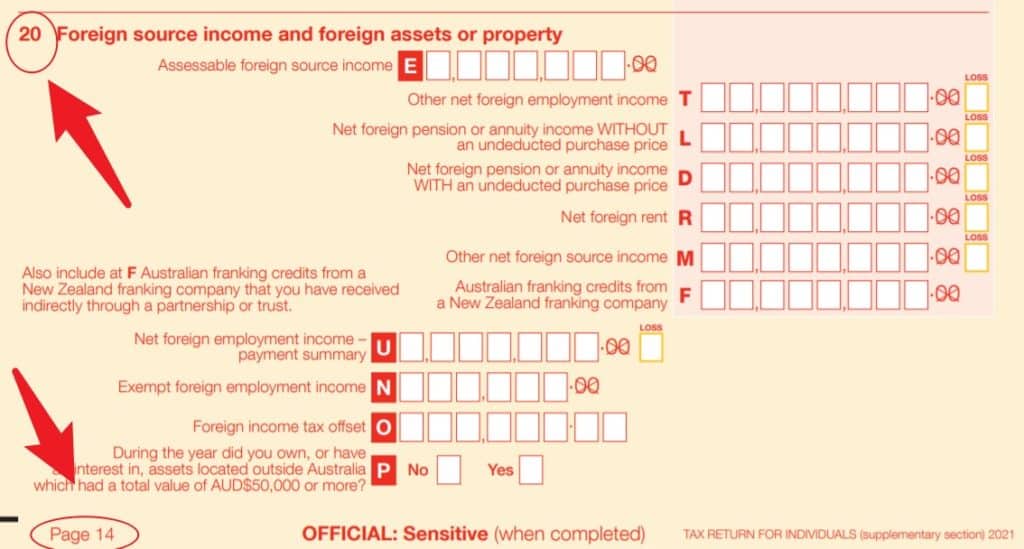

https://atotaxrates.info/wp-content/uploads/2021/05/foreign-income-tax-offset-claim-2021-1024x549.jpg

Unenacted Tax Measures At 30 June 2018 Bills Wrap Up TaxBanter Blog

https://taxbanter.com.au/wp-content/uploads/2022/11/table-for-blog.png

SAPTO is a tax offset for eligible pensioners and seniors in Australia It reduces the amount of tax you pay on your taxable income but it does not affect your Medicare levy Learn how to qualify how much SAPTO is a tax offset for senior Australians who are eligible for the Government Age or Service pension Learn about the age residency pension and

MyTax 2024 Seniors and pensioners includes self funded retirees ato gov au The tax offset code should be prefilled into your return If not follow the 15 310 Senior Australians and pensioners tax offset See Item T1 on the ATO website for further information The Senior Australians and pensioners includes self funded retirees

Download Seniors And Pensioners Tax Offset Code

More picture related to Seniors And Pensioners Tax Offset Code

Top 10 Tax Planning Tips Enter The New Financial Year With The Basics

https://www.mytaxrefundtoday.com.au/wp-content/uploads/2019/12/Depositphotos_43265651_s-2019.jpg

Seniors And Pensioners Tax Offset YourLifeChoices

https://assets.yourlifechoices.com.au/2022/07/22095547/seniors-pensioners-tax-offset.png

Solved Problem 7 1 Child Tax Credit LO 7 1 Calculate The Total

https://www.coursehero.com/qa/attachment/14536840/

SAPTO is a valuable tax offset for eligible senior Australians and pensioners providing financial relief by reducing their income tax liability By understanding the eligibility criteria income limits and transfer The seniors and pensioners tax offset SAPTO is incorporated into this schedule If your payee chooses to claim their entitlement to other tax offsets through reduced

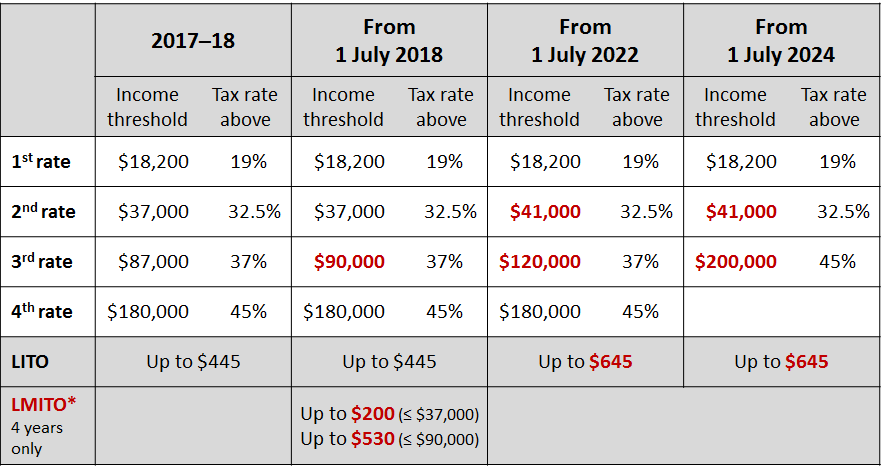

SAPTO stands for seniors and pensioners tax offset a tax benefit for eligible Australians Learn how to determine your eligibility and choose the right tax The table below sets out the maximum Seniors and Pensioners Tax Offset SAPTO and the thresholds at which the offsets shade out and cut out for the 2022 23 income year

Age Of Entitlement Age based Tax Breaks Grattan Institute

https://grattan.edu.au/wp-content/uploads/2020/11/Household-Finance-Retirement-scaled-e1613090690244.jpeg

Australia 2019 2020 Income Tax Year Les Imp ts Sur Les Salaires

https://www.oecd-ilibrary.org/sites/8d148778-fr/images/images/AustraliaFR20_final/media/image3.png

https://www.ato.gov.au › ...

Learn how to claim the seniors and pensioners tax offset if you meet the eligibility conditions based on your age income and marital status Find out the code

https://www.ato.gov.au › ...

Learn how to claim the seniors and pensioners tax offset if you meet the eligibility conditions based on your age income and residence Find out the code letters

How To Save On Tax When Retirement Planning Claiming SAPTO TNR Wealth

Age Of Entitlement Age based Tax Breaks Grattan Institute

3 4 Million Pensioners Missing Out On Help Up To 4 500 P yr Aged

What Is A Tax Offset

Transferring The Seniors And Pensioners Tax Offset CKG Partners Media

Why Special Tax Breaks For Seniors Should Go ABC News

Why Special Tax Breaks For Seniors Should Go ABC News

Breaking Down The 2023 Federal Budget Insights For Individuals KMT

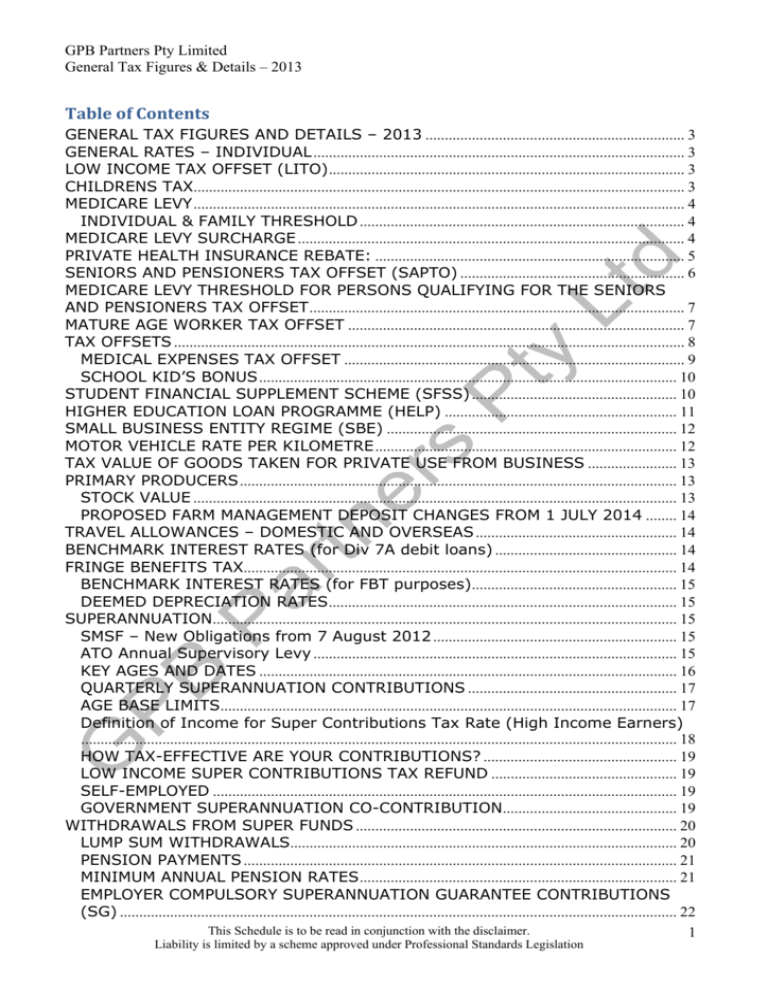

Table Of Contents GPB Partners Pty Ltd

Tax Changes For Seniors Now On The Table Trusted Aged Care Services

Seniors And Pensioners Tax Offset Code - 15 310 Senior Australians and pensioners tax offset See Item T1 on the ATO website for further information The Senior Australians and pensioners includes self funded retirees