Seniors Home Tax Credit 2023 The Seniors Home Safety Tax Credit is a temporary refundable personal income tax credit for 2021 and 2022 This means that if you re eligible you can get a credit regardless of whether you owe income taxes for the tax year

For the 2023 and subsequent taxation years Budget 2022 introduced the Multigenerational Home Renovation Tax Credit MHRTC a refundable credit to assist with the cost of renovating an eligible dwelling to establish a secondary unit that enables a qualifying individual a senior or an adult who is eligible for the disability tax credit to To receive the 2024 OSHPTG you must file a 2023 income tax and benefit return and complete the application area on Form ON BEN Application for the 2024 Ontario Trillium Benefit and Ontario Senior Homeowners Property Tax Grant

Seniors Home Tax Credit 2023

Seniors Home Tax Credit 2023

https://cupe.ca/sites/default/files/gettyimages-1215380721_resize.jpg

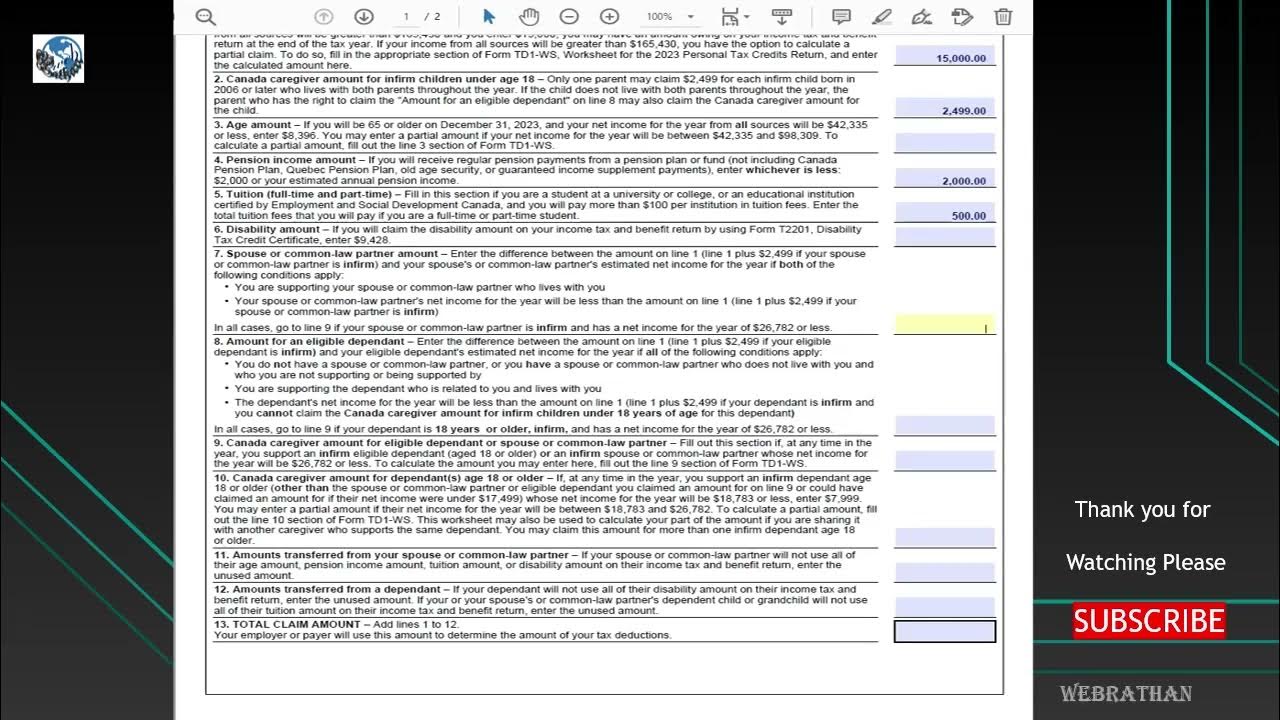

How To Fill TD1 2023 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/GhVvNvHpO9M/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLA1GWVUtAc4s-DKgsChFuSuhonPog

Introducing The 2023 Tax Return

https://www.etax.com.au/wp-content/uploads/2022/12/2023-tax-return-is-coming.jpg

Seniors 65 and family members living with them may get back 25 of up to 10 000 in eligible expenses per year for their principal residence in Ontario If you re a low to moderate income senior you may be eligible for up to 500 back on your property taxes The Ontario Seniors Care at Home Tax Credit is a refundable personal income tax credit to help low to moderate income seniors with eligible medical expenses including expenses that support aging at home or one s place of residence

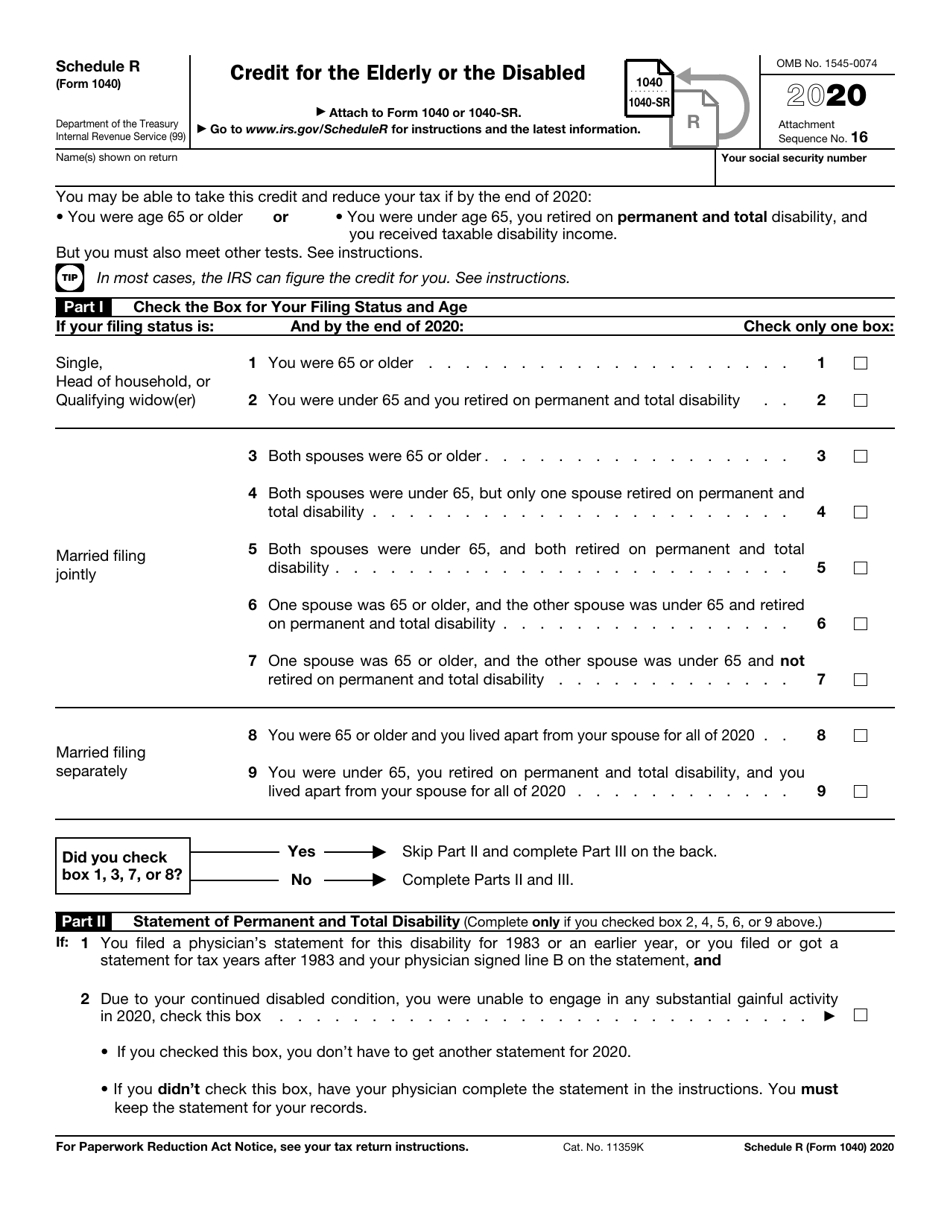

A credit for taxpayers aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year AND with an adjusted gross income OR the total of nontaxable Social Security pensions annuities or Multigenerational Home Renovation Tax Credit The MHRTC could provide a valuable refundable credit for eligible expenses related to certain qualifying renovations to create a self contained secondary unit for an individual to reside with a relation

Download Seniors Home Tax Credit 2023

More picture related to Seniors Home Tax Credit 2023

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

2023 Tax Tables Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/624/911/624911793/big.png

These Would Be Pension Changes From January 2023 See Seniors Can

https://d-art.ppstatic.pl/kadry/k/r/1/a0/9d/63a414f5c5edf_o_original.jpg

The bill increased both the allowable exclusion and the tax credit itself effective tax year 2022 The previous exclusion was 6 300 and the previous maximum credit was 1 000 The new law doubled the exclusion to 12 600 and increased the credit to as much as 1 150 You might be eligible for this tax credit if You were a resident of Ontario on December 31 2023 You re a senior over 65 years old or have senior relatives living with you

If you re 65 years or older at the end of the tax year you can claim a non refundable tax credit towards your federal taxes To qualify your net income must be less than 39 826 and the amount you may claim varies depending on your income The Ontario Seniors Home Safety Tax Credit assists seniors in making their homes safer and more accessible by providing a refundable tax credit for eligible expenses In order to calculate the credit amount eligible seniors should follow these steps

What You Don t Know About Property Taxes Abbotsford Today

http://www.abbotsfordtoday.ca/wp-content/uploads/2019/05/propertytaxes.jpg

Setc Tax Credit 2023 1099 Expert

http://1099.expert/wp-content/uploads/2023/12/image-title-Generate-high-resolution-50941.png

https://www.ontario.ca/page/seniors-home-safety-tax-credit

The Seniors Home Safety Tax Credit is a temporary refundable personal income tax credit for 2021 and 2022 This means that if you re eligible you can get a credit regardless of whether you owe income taxes for the tax year

https://www.canada.ca/en/revenue-agency/programs...

For the 2023 and subsequent taxation years Budget 2022 introduced the Multigenerational Home Renovation Tax Credit MHRTC a refundable credit to assist with the cost of renovating an eligible dwelling to establish a secondary unit that enables a qualifying individual a senior or an adult who is eligible for the disability tax credit to

2023 Irs Tax Brackets Chart Printable Forms Free Online

What You Don t Know About Property Taxes Abbotsford Today

2022 Form MO DoR MO PTS Fill Online Printable Fillable Blank PdfFiller

Irs Printable Forms

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Printable Tax Declaration Form Printable Form Templates And Letter

Your Personal Guide To The Homebuyer Tax Credit 2023 SavingAdvice

Your Personal Guide To The Homebuyer Tax Credit 2023 SavingAdvice

What Happens To Tax Credits Now That Our Home Is In A Trust Nj

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

What Is A Renovation Tax Credit For Seniors And Persons With Disabilities

Seniors Home Tax Credit 2023 - To claim home accessibility expenses complete the chart for line 31285 using your Federal Worksheet and enter the result on line 31285 of your return A qualifying individual can claim up to 20 000 per year in eligible expenses