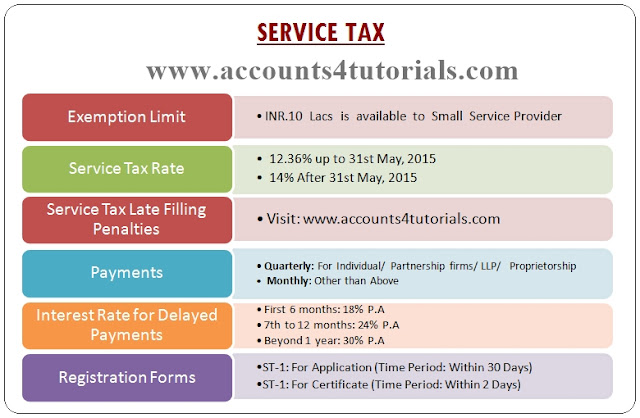

Service Tax Exemption Limit Service tax applies to prescribed taxable services provided by prescribed taxable persons With effect from 1 January 2019 service tax also applies to imported taxable services

1 Threshold Exemption A Small service provider whose value of taxable service from one or more premises did not exceeds Rs 10 lakhs in previous financial Initially in 2005 small scale service providers with an annual taxable service value of less than Rs 4 lakh were exempt from service tax In 2007 the limit was raised

Service Tax Exemption Limit

Service Tax Exemption Limit

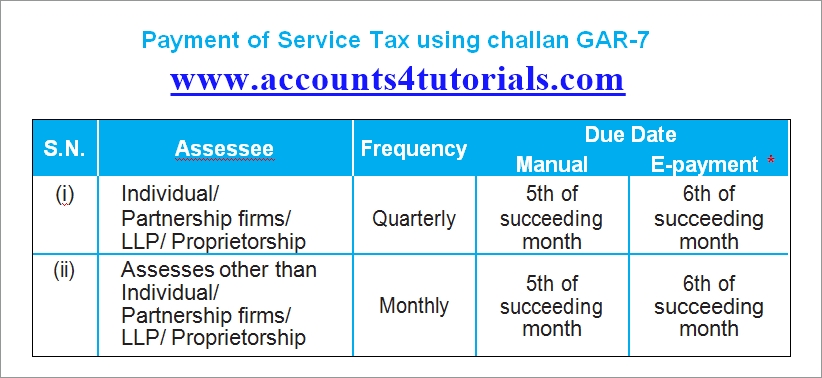

https://2.bp.blogspot.com/-df4xuBUzB8s/VbKcoMnuz4I/AAAAAAAAGQ4/oBUUXfl9E4Y/s1600/Payment+of+Service+Tax+using+challan+GAR-7.jpg

SERVICE TAX Exemption Limit Rates Forms Challans Interest Rates

https://3.bp.blogspot.com/-QJ2KJ4v4oDs/VbKbca6qDgI/AAAAAAAAGQo/W6fQRHAqD0w/s640/SERVICE%2BTAX_%2BExemption%2BLimit_%2BRates_%2BForms.jpg

SERVICE TAX Exemption Limit Rates Forms Challans Interest Rates

https://1.bp.blogspot.com/-CxD7Hbao37U/VbKdDajnstI/AAAAAAAAGRA/z2Z9-346Hbk/s640/Interest%2Brate%2Bfor%2Bdelayed%2Bpayment.jpg

Service tax exemption for business to business transactions B2B exemption and to advertising services under the Service Tax Persons Exempted From Payment of Tax The rate of service tax is 6 ad valorem for all taxable services and digital services except for the provision of charge or credit card services Service tax for the provision of charge

Last week Vice President Kamala Harris proposed two measures that would raise the incomes of lower wage workers raising the federal minimum wage and Assets previously held in an 18 to 25 trust Fill in form IHT100h to tell us about assets that have stopped being held in an 18 to 25 trust This is a trust where one parent

Download Service Tax Exemption Limit

More picture related to Service Tax Exemption Limit

SERVICE TAX Exemption Limit Rates Forms Challans Interest Rates

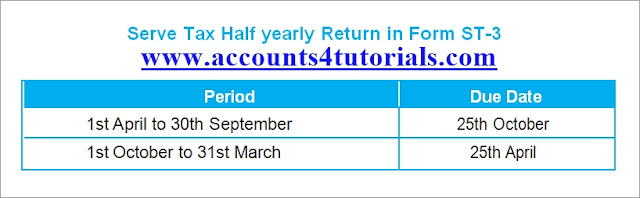

https://2.bp.blogspot.com/-81YL-drASzM/VbKdgNXe-6I/AAAAAAAAGRM/5_V2KmFJ9RU/s640/Serve%2BTax%2BHalf%2Byearly%2BReturn%2Bin%2BForm%2BST-3.jpg

SERVICE TAX Exemption Limit Rates Forms Challans Interest Rates

https://2.bp.blogspot.com/-KQOq4-qJn0I/VbKcULre3jI/AAAAAAAAGQw/AfxDoeBWZEo/s1600/Service%2BTax%2BRegistration%2BForms.jpg

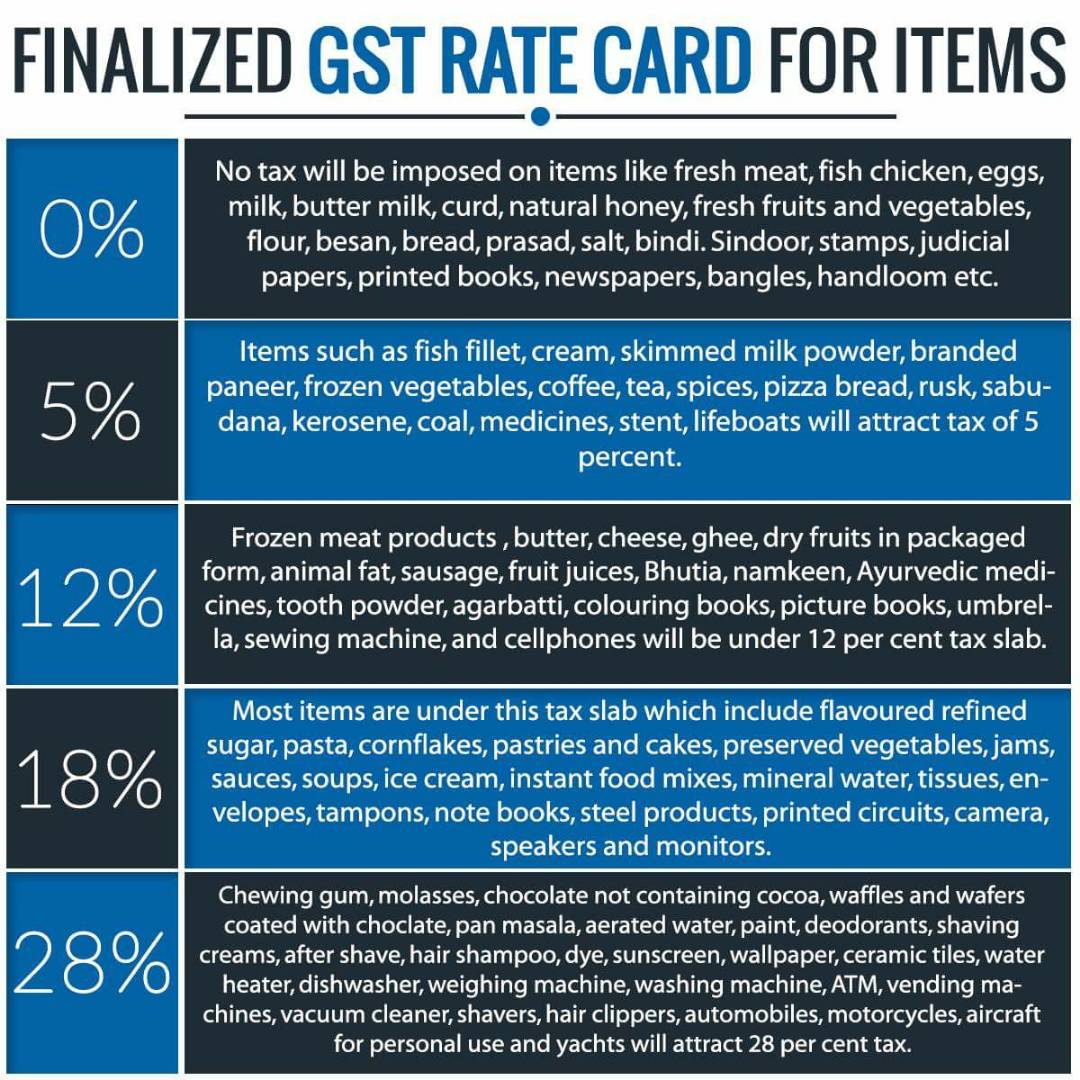

GST TAX RATE CHART FOR FY 2017 2018 AY 2018 2019 GOODS AND SERVICE

https://taxdose.b-cdn.net/wp-content/uploads/2016/09/GST-Easy-Chart.jpg

Thailand Tax News Flash Issue 148 On 17 July 2024 a new Ministerial Regulation No 394 M R No 394 on income exemption for severance pay was published in the Royal Photo by ANDREJ IVANOV AFP via Getty Images files The Parliamentary Budget Officer released a report last week that estimated the federal government will

Resident Investors The withholding tax rate on mutual fund income for resident individuals has been set at 10 However if the annual income from mutual Schedule to the STR is exempted from payment of Service Tax on provision of advertising services Conditions for Service Tax exemption

Maximum Income Tax Exemption Limit In India For FY 2016 17

http://apnaplan.com/wp-content/uploads/2017/01/Maximum-Income-Tax-Exemption-Limit-in-India-for-FY-2016-17.png

Income Tax Exemption Limit Likely To Be Enhanced In Budget

https://www.siasat.com/wp-content/uploads/2020/03/income-tax.jpg

https://www.pwc.com/my/en/services/tax/indirect-tax/service-tax.html

Service tax applies to prescribed taxable services provided by prescribed taxable persons With effect from 1 January 2019 service tax also applies to imported taxable services

https://taxguru.in/service-tax/service-tax...

1 Threshold Exemption A Small service provider whose value of taxable service from one or more premises did not exceeds Rs 10 lakhs in previous financial

What Is The Wealth Tax Exemption Limit All About Wealth Tax Sqrrl

Maximum Income Tax Exemption Limit In India For FY 2016 17

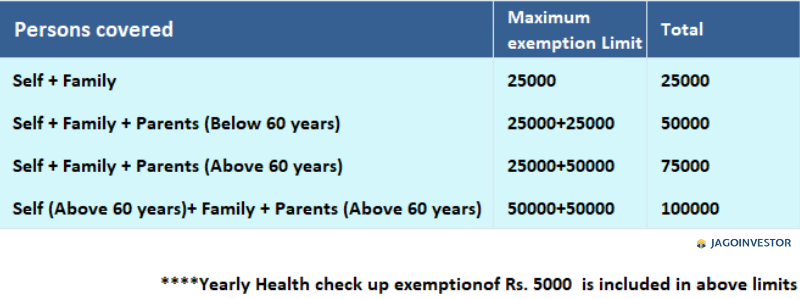

How Much Tax Benefit Can Be Claimed U s 80D Rules Limits

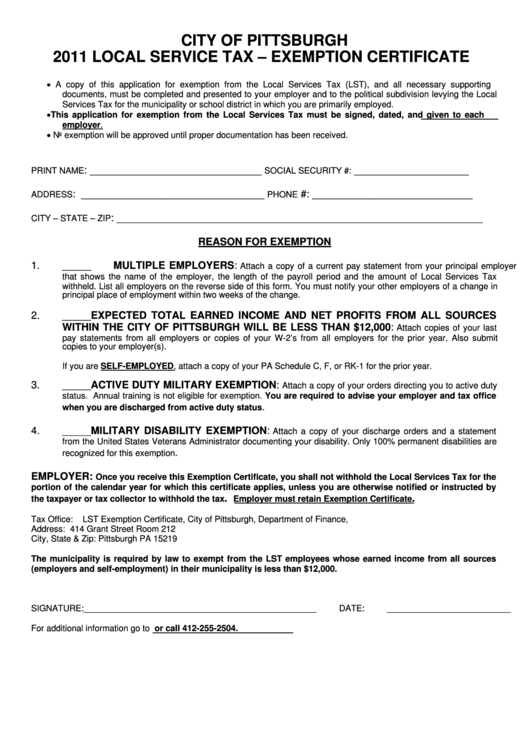

Local Service Tax Exemption Certificate City Of Pittsburgh 2011

Budget 2015 RBI Governor Raghuram Rajan Favours Higher Tax Exemption

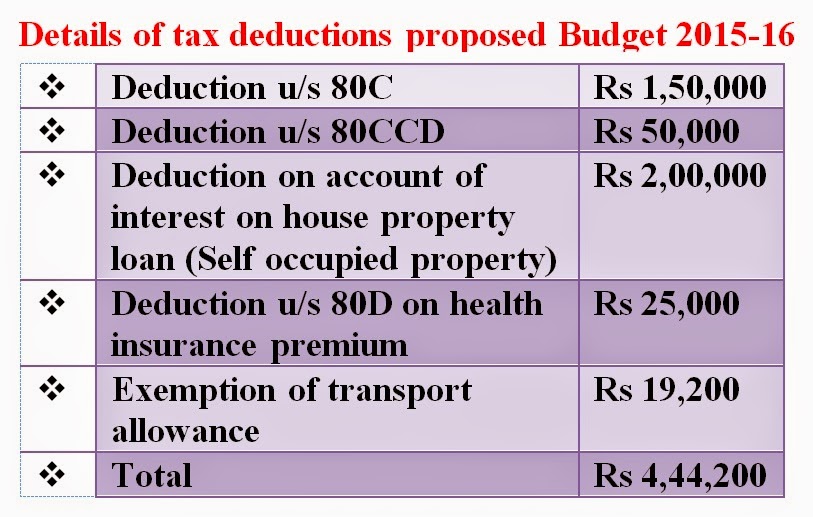

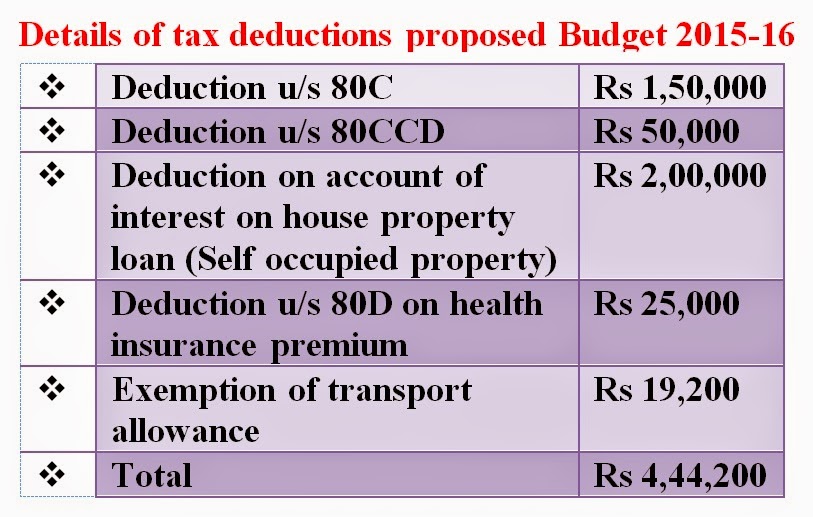

Income Tax Exemption Limit In The Budget 2015 16 Central Govt

Income Tax Exemption Limit In The Budget 2015 16 Central Govt

Gift Tax Limit 2022 Calculation Filing And How To Avoid Gift Tax

Difference Old Tax Regime Vs New Tax Regime Learn By Quicko

Service Tax Exemption Limit To Be Raised To Rs 25 Lakh In Budget

Service Tax Exemption Limit - The rate of service tax is 6 ad valorem for all taxable services and digital services except for the provision of charge or credit card services Service tax for the provision of charge