Should I File Amended Tax Return An amended tax return is filed when a taxpayer realizes a mistake was made on the initial return and needs to correct it says Nell Curtis an accounting instructor at Milwaukee Area

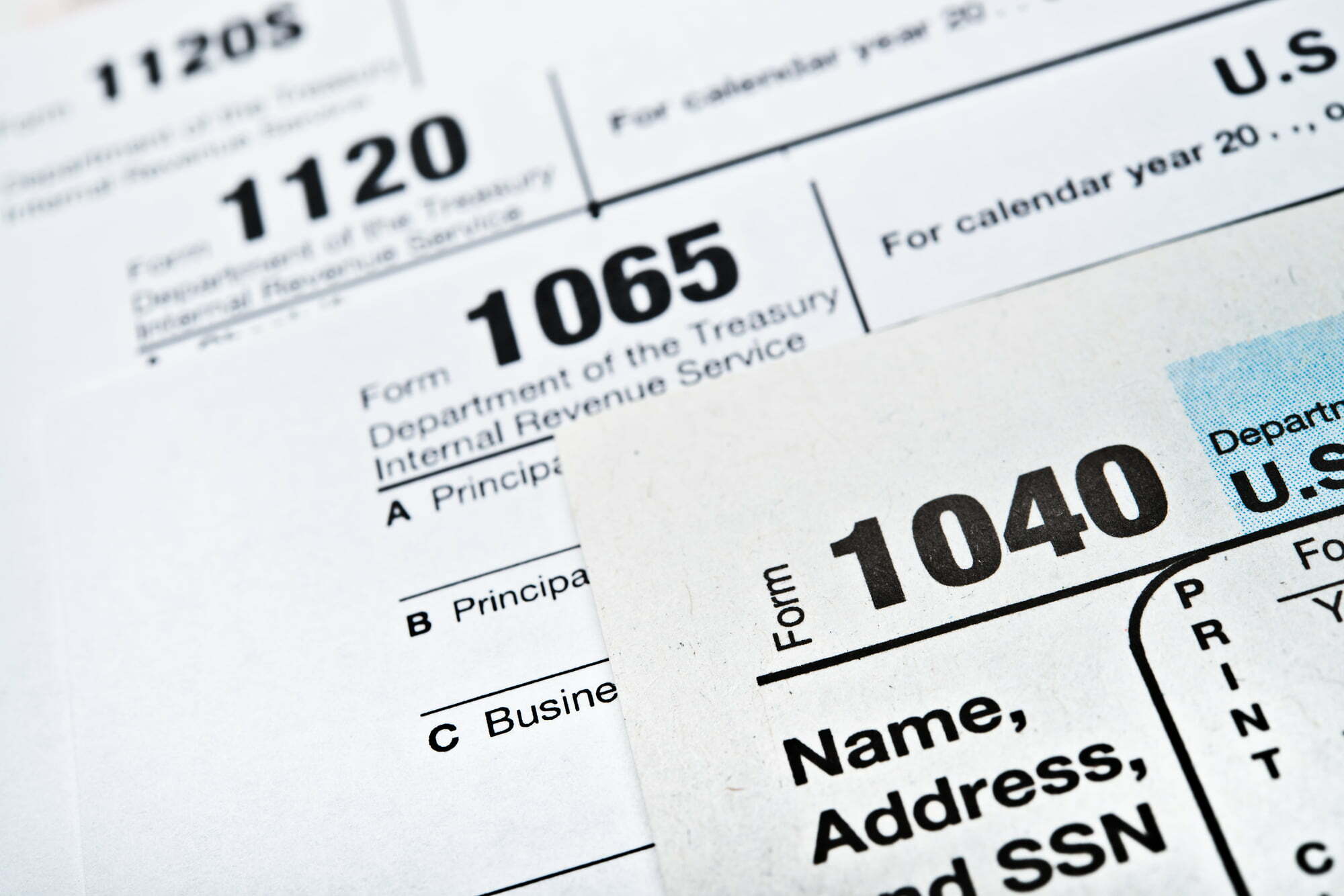

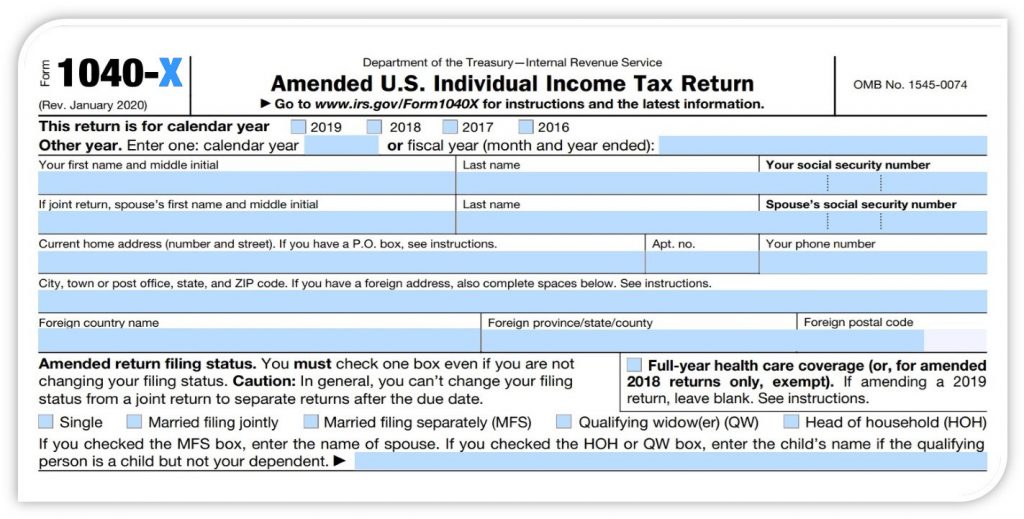

1 When to use Form 1040 X You can file Form 1040 X to amend a previously filed tax return that used one of these forms 1040 SR 1040A 1040EZ If you do need to file an amended return the IRS says you have either three years after the date you filed your original tax return the one with the mistake you re now trying to fix or

Should I File Amended Tax Return

Should I File Amended Tax Return

https://irstaxtrouble.com/wp-content/uploads/sites/5/2021/12/amended-tax-return-late.jpg

Filing An Amended Tax Return Wheeler Accountants

https://wheelercpa.com/wp-content/uploads/blog3.jpg

Filing An Amended Tax Return What You Need To Know Wessel Company

https://www.wesselcpa.com/wp-content/uploads/2019/06/62771803-1200x600.jpg

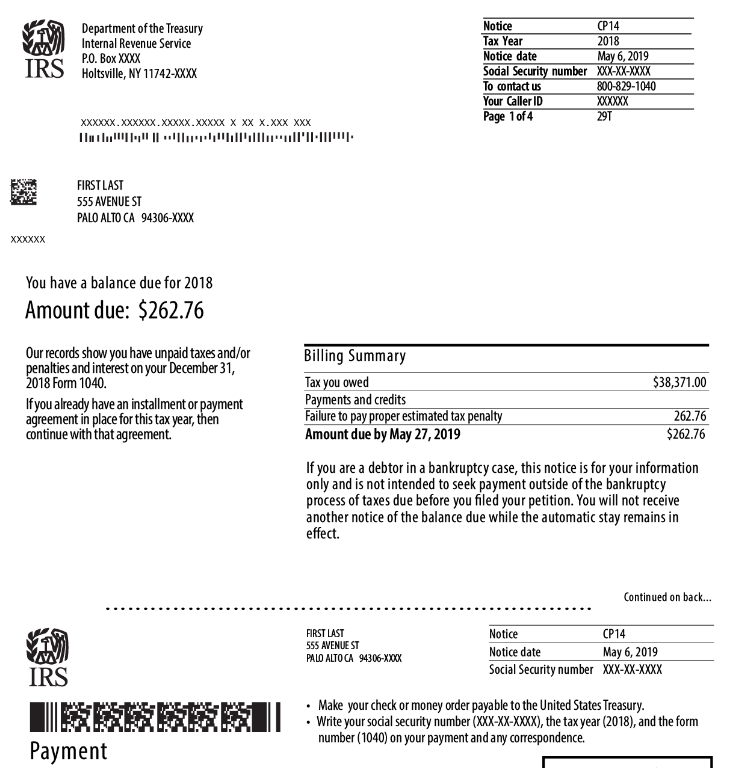

IRS Form 1040 X also known as an amended tax return is a form that taxpayers can file with the IRS to correct mistakes made on a federal tax return 1 Correct an error or omission to your income If you find out after you file that you left income off your return from Form W 2 or 1099 for example or you got a corrected

An amended return is a form filed in order to make corrections to a tax return from a previous year An amended return can correct errors and claim a more advantageous tax status such The IRS says you should file an amended return Form 1040X if you discover mistakes in any of the following filing status dependents total income deductions or credits Don t jump

Download Should I File Amended Tax Return

More picture related to Should I File Amended Tax Return

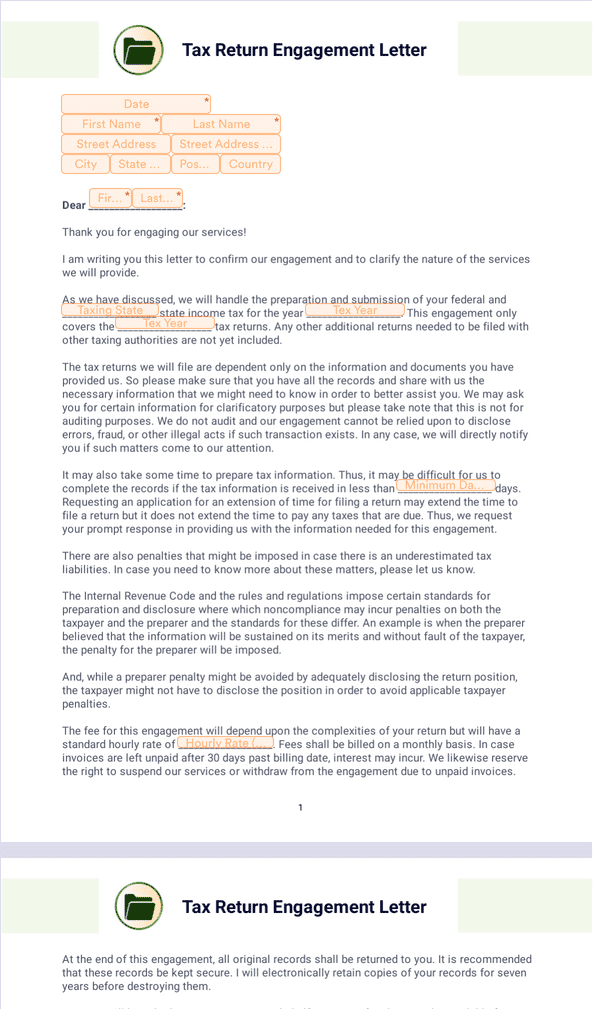

Tax Return Engagement Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-return-engagement-letter-b367df64e2cb9e588c62860163aa9e7e_og.png

Amended Tax Returns You Don t Always Need To File One Cambaliza McGee LLP

https://www.cpa-cm.com/assets/blog/amended-return-form.jpg

How To File An Amended Tax Return WTOP News

https://wtop.com/wp-content/uploads/2020/07/GettyImages-897291366.jpg

First off make sure you need to amend your tax return If you ve made minor math errors the IRS states that they will be able to handle adjustments for minor math Filing an amended tax return with the IRS is a straightforward process This article includes step by step instructions for when and how to amend your tax return

Change in filing status Inaccurate reporting of number of dependents Mistake in reporting your total income Error in figuring deductions and or credits You e Here are the steps to take to amend your tax return Continue reading Enter the tax year for which you are amending your return at the top of IRS Form 1040X

Amended Tax Returns Form 1040X How When And Why To File One How

https://www.deskera.com/blog/content/images/size/w1000/2021/12/Purple-White-Clean---Professional-List-Real-Estate-Professional-Instagram-Post-23-.png

How When To File An Amended Federal Tax Return

https://blog.cmp.cpa/hubfs/how-and-when-to-file-amended-tax-return.jpg#keepProtocol

https://www.forbes.com/advisor/taxes/how-t…

An amended tax return is filed when a taxpayer realizes a mistake was made on the initial return and needs to correct it says Nell Curtis an accounting instructor at Milwaukee Area

https://turbotax.intuit.com/tax-tips/amend-return/...

1 When to use Form 1040 X You can file Form 1040 X to amend a previously filed tax return that used one of these forms 1040 SR 1040A 1040EZ

How To Write A Non Filing Income Tax Return Letter In 2023

Amended Tax Returns Form 1040X How When And Why To File One How

Amended Tax Return Here s What You Should Do

How To File An Amended Tax Return The Motley Fool

How To Read My Tax Return Transcript Mueller Wilver

How To File An Amended Tax Return SDG Accountants

How To File An Amended Tax Return SDG Accountants

IRS Letter Notice CP11 CP12 CP13 And CP14 For Refund Adjustments Or

Is The Irs Processing Amended Returns Archives SDG Accountants

When You Can File An Amended Tax Return And It s Way

Should I File Amended Tax Return - IRS Form 1040 X also known as an amended tax return is a form that taxpayers can file with the IRS to correct mistakes made on a federal tax return