Solar Credit Extended As written in the Inflation Reduction Act of 2022 the tax credit will begin at 30 and step down to 26 in 2033 and 22 in 2034 In a surprise victory for the solar and clean technology industries Senator Joe Manchin

In 2022 President Joe Biden signed the Inflation Reduction Act which extended solar tax credits through 2034 The solar panel tax credit allows filers to take a tax credit equal to up to 30 of The investment tax credit ITC also known as the federal solar tax credit allows a solar developer to deduct 1 3rd of the cost of installing a solar energy system from federal taxes

Solar Credit Extended

Solar Credit Extended

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

Solar Tax Credit Extended For Two Years Henssler Financial

https://www.henssler.com/wp-content/uploads/2021/03/030321-TaxTip.jpg

Solar Stocks And Solar Flows

https://media.innovationorigins.com/2022/02/VXGJ4SjA-LV5iGzdc-WKvYMhQ4-DSC03549.jpg

The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

With the passage of the historic Inflation Reduction Act of 2022 the Investment Tax Credit ITC gets a reboot as the Residential Clean Energy Credit and increases the tax credit to 30 of The federal solar energy credit is a tax credit that can be claimed on federal income taxes for both individuals and corporations The credit was recently extended and increased

Download Solar Credit Extended

More picture related to Solar Credit Extended

SolO Archives Universe Today

https://www.universetoday.com/wp-content/uploads/2021/02/Solar_Orbiter_pillars-1920x1200.jpg

Solar Credit Webinar EagleView US

https://www.eagleview.com/wp-content/uploads/2022/08/Solar-Credit-Card.png

The Full Guide Solar Investment Tax Credit In 2022 Karla Dennis

https://www.karladennis.com/wp-content/uploads/2022/10/solar-credit-blog-pic-scaled.jpg

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30 credit for qualifying investments in wind solar energy storage You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery

File Solar system png Wikipedia

http://upload.wikimedia.org/wikipedia/commons/8/82/Solar-system.png

Contact Solar Gold Path Reach Out Today

https://www.goldpathsolar.com/GPS_Horizontal_RGB_Color.png

https://pv-magazine-usa.com

As written in the Inflation Reduction Act of 2022 the tax credit will begin at 30 and step down to 26 in 2033 and 22 in 2034 In a surprise victory for the solar and clean technology industries Senator Joe Manchin

https://www.nerdwallet.com › ... › taxe…

In 2022 President Joe Biden signed the Inflation Reduction Act which extended solar tax credits through 2034 The solar panel tax credit allows filers to take a tax credit equal to up to 30 of

Solar Federation Natural Science Solar Federation

File Solar system png Wikipedia

Sunconnect Solar Oudkarspel

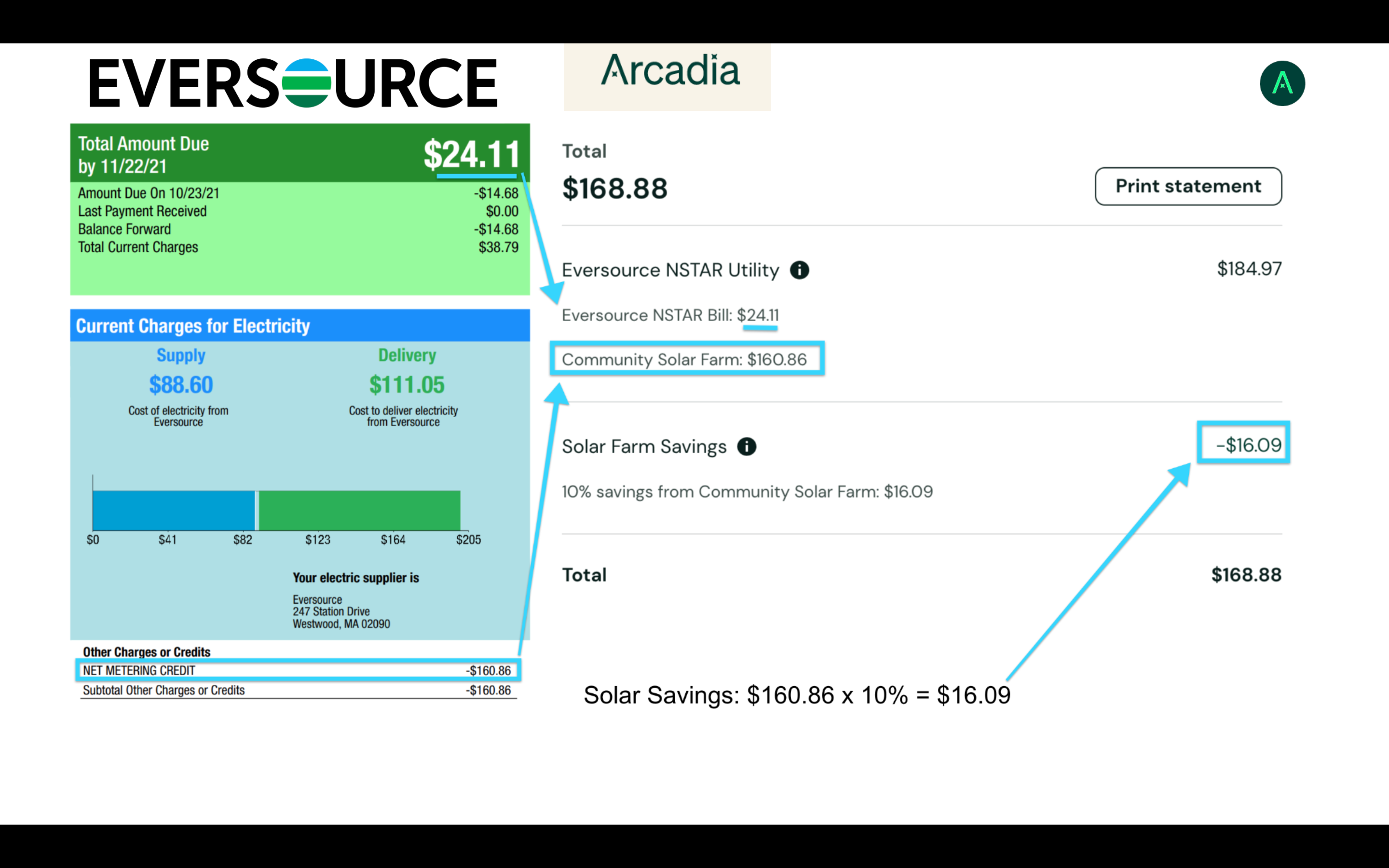

How Is My Bill Calculated With Community Solar In Massachusetts

Solar Panel Distribution Credit Card Processing Solar Panel

Federal Solar Tax Credit Extended And ENHANCED Solar Sam

Federal Solar Tax Credit Extended And ENHANCED Solar Sam

File Credit cards jpg Wikimedia Commons

Rewardsrus Login Official Login Page

File Solar System jpg Wikimedia Commons

Solar Credit Extended - The federal solar tax credit is worth 30 of the installed cost of a residential solar system with no maximum amount So whether you spend ten thousand or fifty thousand on a