Solar Panel Tax Credit Limit The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 annually Biomass stoves and boilers have a separate annual credit limit of 2 000 annually with no lifetime limit Residential Clean Energy Credit Now that you have your very own solar system the 30 Residential Solar Tax Credit is yours for the claiming How exactly do

Solar Panel Tax Credit Limit

Solar Panel Tax Credit Limit

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

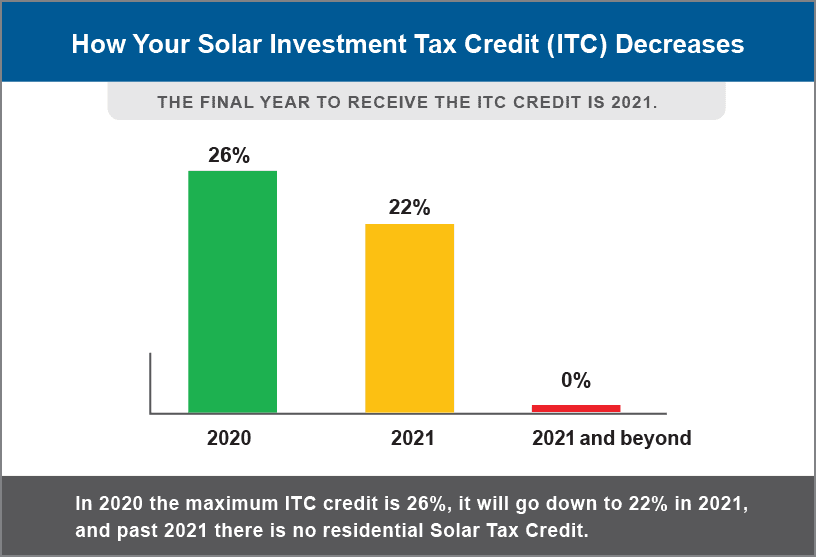

Nearing Expiration Idaho Solar Panel Tax Credit Update 2022

https://www.sitereportcard.com/wp-content/uploads/2022/06/solar-tax-credits-2022-1536x1024.jpeg

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Key takeaways In 2024 the ITC currently allows both homeowners and businesses to claim 30 of their solar system costs as a tax credit The tax credit will stay at 30 for the next nine years until 2033 at which point it will drop to 26 Federal solar tax credit You might be eligible for this tax credit inspection costs and developer fees if you meet all of the following criteria Your solar PV system was installed between January 1 2006 and December 31 2023 The solar PV system is located at your primary or secondary residence in the United States or for an off site

There s no dollar limit on those expenses you re entitled to that 30 percent tax break whether you spend 20 000 or more than 100 000 on costs associated with a residential solar The federal solar tax credit or solar investment tax credit ITC currently allows you to claim 30 of the total cost of your solar system on your annual income tax return to reduce the

Download Solar Panel Tax Credit Limit

More picture related to Solar Panel Tax Credit Limit

How To Get Residential Solar Panel Tax Credits In New Jersey

https://thenewutility.com/wp-content/uploads/2022/01/solar-panels-tax-credit-nj.png

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

Updated Feb 7 2024 8 min read If you re considering solar or you already have a solar system on your property you ve probably heard about the federal solar tax credit also known as the Investment Tax Credit ITC The ITC is one of the best ways to save money when you go solar because it reduces your overall costs by thousands of dollars You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Residential Clean Energy Credit In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems Fidelity Viewpoints Key takeaways The federal Residential Clean Energy Credit is commonly known as the solar tax credit because it can help defray the considerable costs of adding solar panels to your home The credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022

Government Financial Aid For Solar Panel Installation Bullide

https://bullide.com/wp-content/uploads/2022/04/Soalr-Energy-Tax-Credit-Edit.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

https://www.nerdwallet.com/.../taxes/solar-t…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

https://www.irs.gov/newsroom/installing-solar...

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 annually Biomass stoves and boilers have a separate annual credit limit of 2 000 annually with no lifetime limit Residential Clean Energy Credit

Understanding Tax Credits For Solar Energy Systems

Government Financial Aid For Solar Panel Installation Bullide

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

Solar Tax Credit Calculator NikiZsombor

Solar Energy Tax Credits By State MD NJ PA VA DC FL

Solar Panel Tax Credit Limit - Key takeaways The federal solar tax credit is a dollar for dollar income tax credit equal to 30 of solar installation costs Homeowners earn an average solar tax credit of 6 000 The 30 solar tax credit is available until 2032 before reducing to 26 in 2033 22 in 2034 and expiring completely in 2035