Solar Property Tax Exemption New York Learn how to apply for a 15 year tax exemption for real property that contains solar wind or other eligible energy systems Find out the eligibility requirements e

New York State Real Property Tax Exemption New York City Real Property Tax Abatement Program In addition to our incentive programs and financing options you may qualify for The NYC solar property tax abatement is one of many incentives that make New York City one of the best places for solar savings The abatement reduces the amount of

Solar Property Tax Exemption New York

Solar Property Tax Exemption New York

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

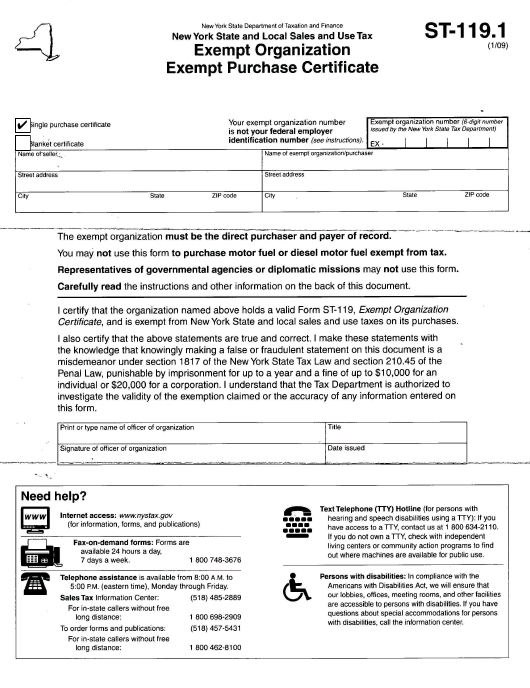

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/free-10-sample-tax-exemption-forms-in-pdf-15.jpg

New York State Tax Exempt Form Farm ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/farmers-tax-exempt-form-ny-farmer-foto-collections-11.png

New York State Real Property Tax Law 487 provides a 15 year real property tax exemption for renewable energy systems However some local governments and school districts have opted In most of New York State there is a 15 year property tax exemption that applies to the value of solar systems You still have to pay property taxes but the value of your solar system will not increase your

The 2021 2022 Enacted State Budget established a process for the New York State Department of Taxation and Finance to develop a standard appraisal methodology for solar and wind Real property which includes a solar or wind energy system farm waste energy system micro hydroelectric energy system fuel cell electric generating system micro

Download Solar Property Tax Exemption New York

More picture related to Solar Property Tax Exemption New York

Going Solar How Does It Affect Property Values And Property Taxes

https://www.solaflect.com/wp-content/uploads/2020/03/prop-tax-1024x473.jpeg

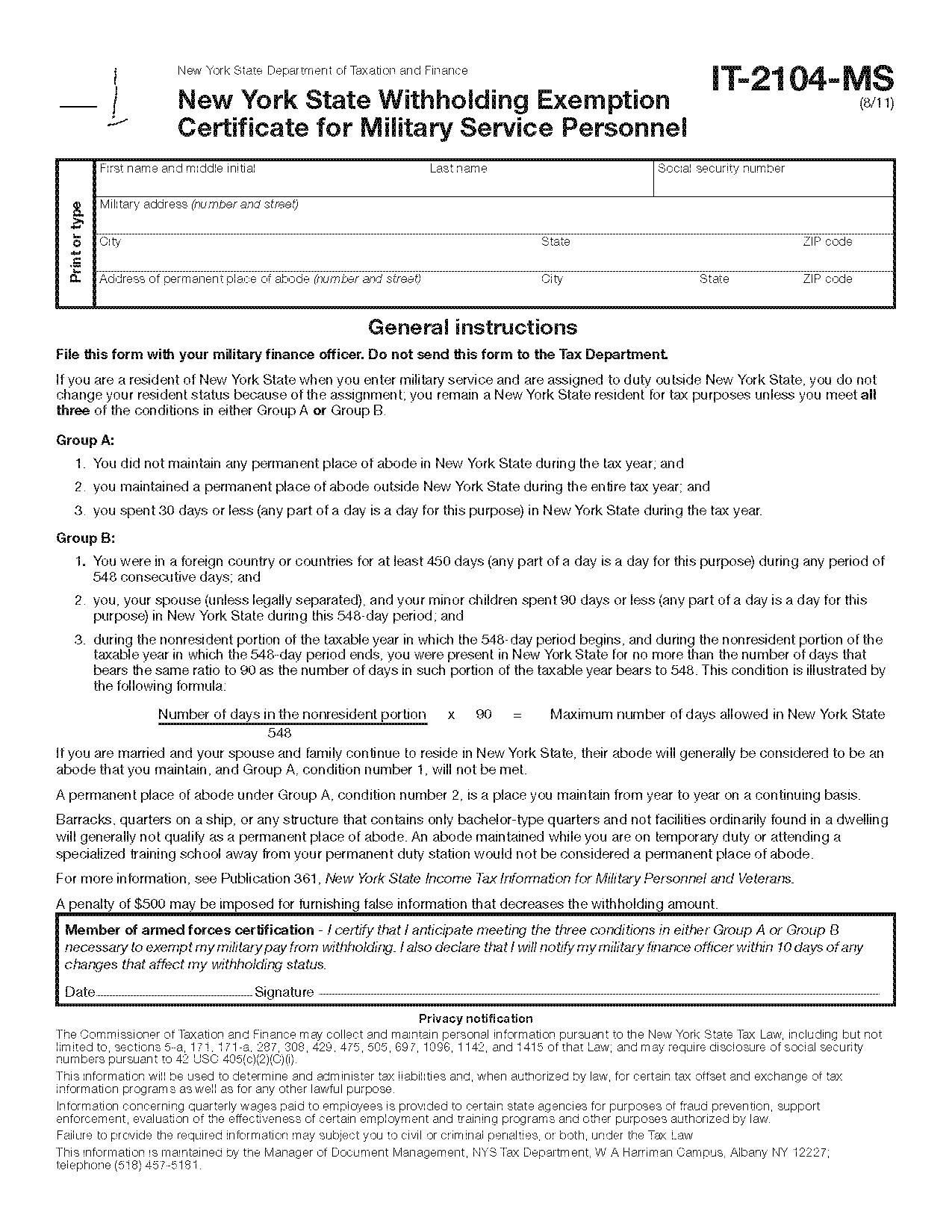

New York State Tax Withholding Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-it-2104-ms-fill-in-new-york-state-withholding-exemption-2.png

Senior Citizen Property Tax Exemption New York State ZDOLLZ

https://www.tax.ny.gov/images/thumb-co-305.jpg

Real Property Tax Law section 487 exempts from taxation but not special ad valorem levies or special assessments real property which includes the following when satisfying guidelines NY RPTL Section 487 offers a 15 year real property tax exemption for properties located in New York State with renewable energy systems such as solar PV projects It s

This law provides a 15 year real property tax exemption for properties located in New York State with renewable energy systems including solar electric systems The Solar and Electric Property Tax Abatement is a financial incentive for properties that install a solar PV system and or BESS in New York City The program is an expanded and extended

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

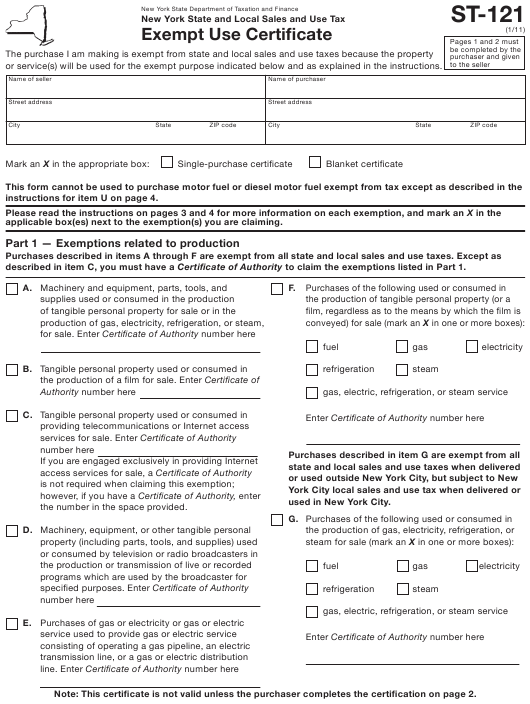

Nys Sales Tax Exempt Form St 121 ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-st-121-download-fillable-pdf-or-fill-online-exempt-use-certificate.png

https://www.tax.ny.gov/research/property/assess/...

Learn how to apply for a 15 year tax exemption for real property that contains solar wind or other eligible energy systems Find out the eligibility requirements e

https://www.nyserda.ny.gov/.../Tax-Credit

New York State Real Property Tax Exemption New York City Real Property Tax Abatement Program In addition to our incentive programs and financing options you may qualify for

Upstate NY Has Some Of The Highest Property Tax Rates In The Nation

York County Sc Residential Tax Forms Homestead Exemption CountyForms

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

Community Health Taxscan Simplifying Tax Laws

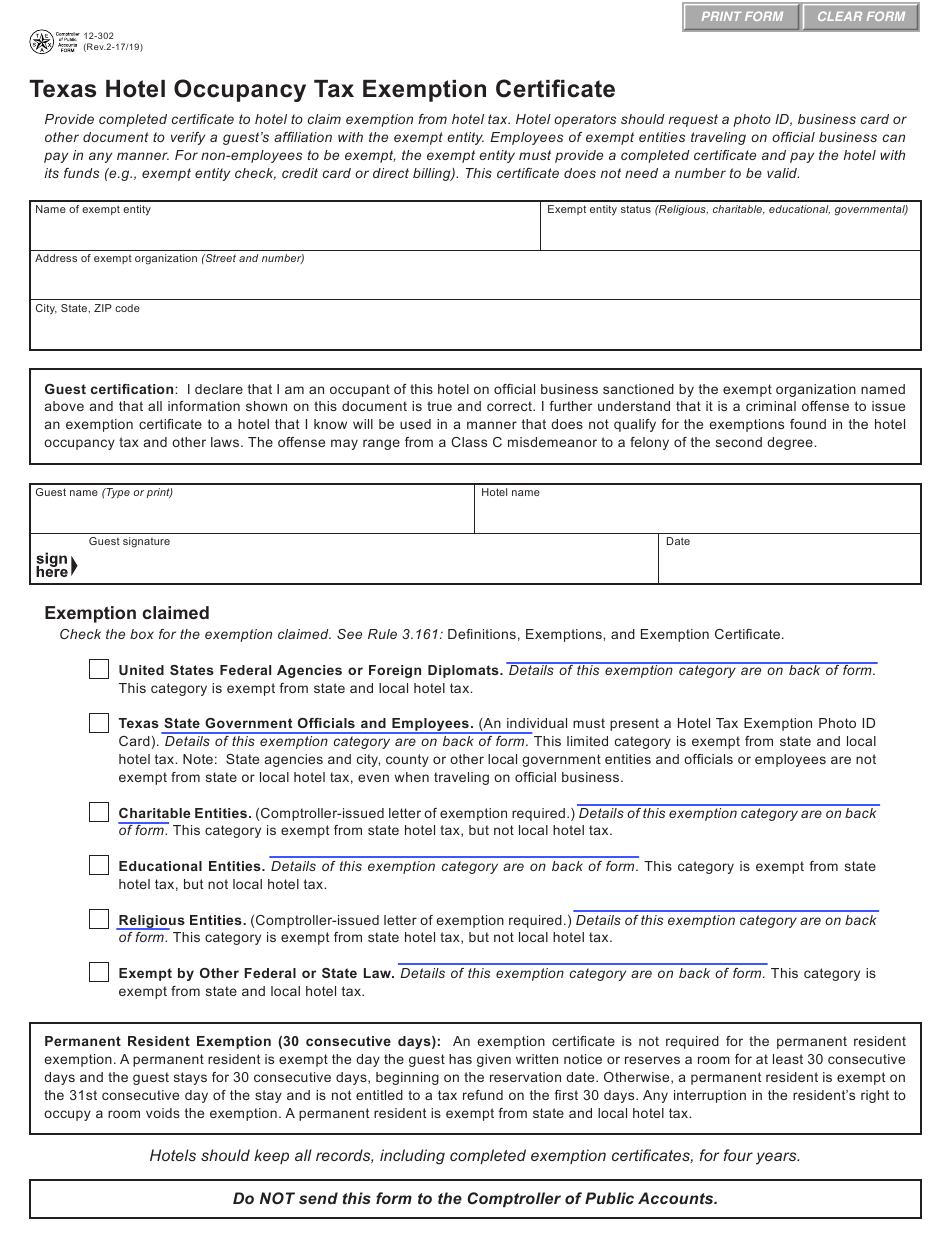

Texas State Tax Exempt Form Hotel ExemptForm

NY State And Federal Tax Exemption For Your New York Nonprofit

NY State And Federal Tax Exemption For Your New York Nonprofit

Which States Offer Disabled Veteran Property Tax Exemptions Military

Solar Property Tax Exemption Massachusetts PROFRTY

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

Solar Property Tax Exemption New York - Provides a property tax abatement to properties that use solar power Solar power is a reliable renewable source of electricity Solar panels generate electricity recover