Solar Rebate Federal 2024 Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of

Solar Rebate Federal 2024

Solar Rebate Federal 2024

https://sunstainable.com.au/wp-content/uploads/2022/08/solar-rebate-Melbourne.jpg

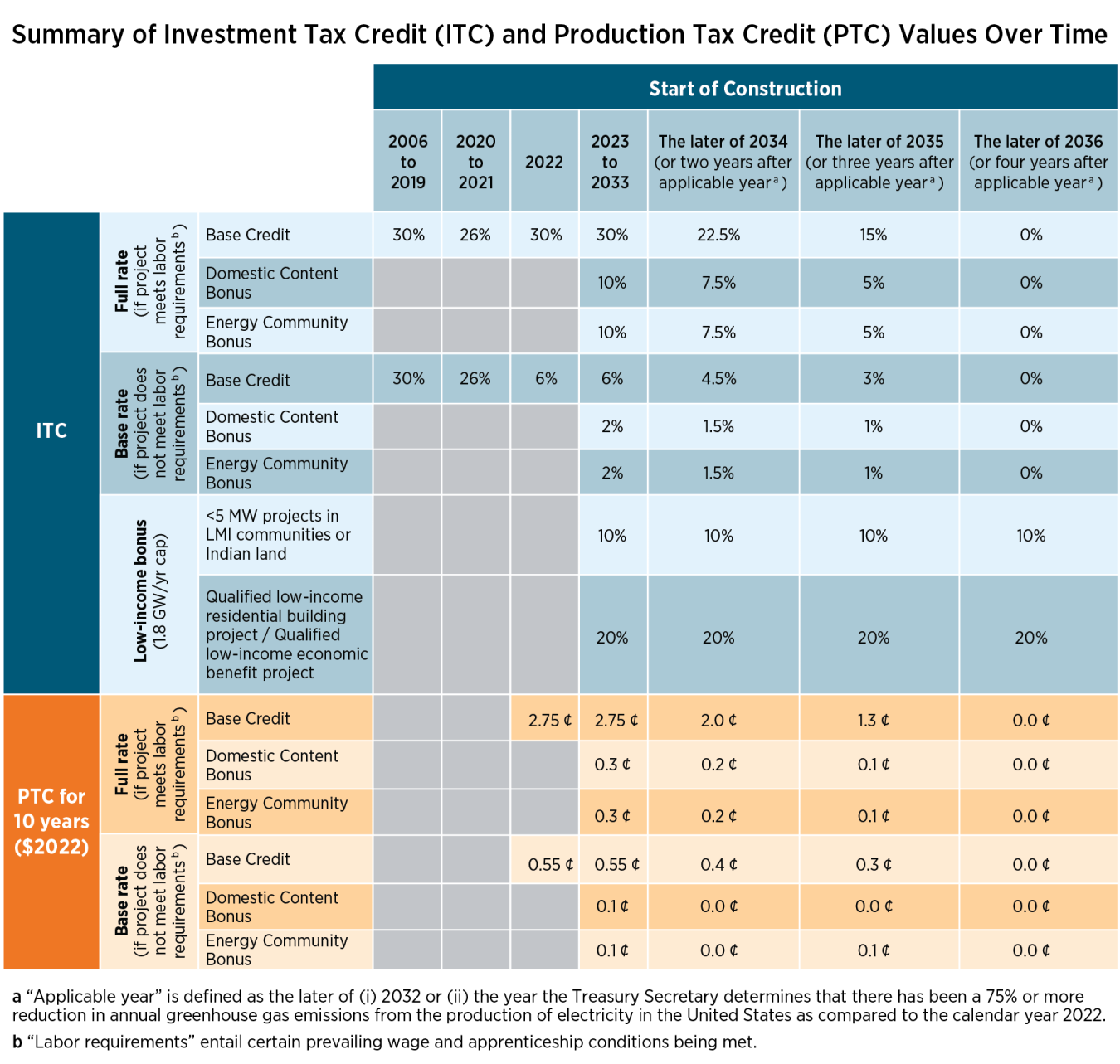

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

SolFarm Solar Co Solar News Blog Local National International

https://solfarm.com/wp-content/uploads/2018/01/solar-rebate-photo-e1524680778161.jpg

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the cost of a solar system that is installed during the tax year 1 The production tax credit PTC is a per kilowatt hour kWh tax credit for electricity generated by solar and other qualifying technologies for the first 10 The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar

Download Solar Rebate Federal 2024

More picture related to Solar Rebate Federal 2024

Solar Panel Rebate How It Works And How To Get It

https://www.solarquotes.com.au/wp-content/uploads/2020/07/solar-rebate-1.jpg

Solar Rebate Qld 2021 Your Guide Captain Green Solar

https://captaingreen.com.au/wp-content/uploads/2021/10/Solar-Rebate-Qld-1-1024x576.png

Solar Rebate Victoria 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Solar-Rebate-Victoria-2022.png

The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which According to our 2023 survey of homeowners with solar respondents paid an average of 15 000 to 20 000 for their solar panel systems When you factor in the 30 federal solar tax credit the

Home Energy Rebates are not yet available but DOE expects many states and territories to launch their programs in 2024 Our tracker shows which states and territories have applied for and received funding Installing renewable energy equipment on your home can qualify you for Residential Clean Energy credit of up to 30 of your total qualifying cost depending on the year the equipment is installed and placed in service 30 for equipment placed in service in tax years 2017 through 2019 26 for equipment placed in service in tax years 2020

How To Claim Solar Rebate In WA Energy Theory

https://energytheory.com/wp-content/uploads/2023/04/JAN23-How-to-Claim-Solar-Rebate-WA.jpg

The Federal Rebate For Solar Will Keep Your Installation Affordable New York Power Solutions

https://newyorkpowersolutions.com/wp-content/uploads/2022/12/Federal-Rebate-for-Solar.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

What s Next For The Missouri Solar Rebate Renewable Energy Law Insider

How To Claim Solar Rebate In WA Energy Theory

Solar Rebate New Solar Merchants Australia s Best Solar Company

More Calls For Victorian Solar Rebate Fix Solar Quotes Blog

You Cannot Afford To Overlook Solar Rebate Victoria For Solar Panel Installation

Solar Rebate Plus Tax Credit Solarponics

Solar Rebate Plus Tax Credit Solarponics

Solar Rebate Update YouTube

Solar Rebate Victoria 2021 Captain Green Solar

Space Solar Rebate Guide 2023 Edition Space Solar

Solar Rebate Federal 2024 - All solar panel incentives tax credits in 2024 by state Solar tax credits incentives calculator Solar incentive Federal ITC 30 tax credit State tax credit s if relevant Net metering by utility Calculate for your home s location Calculate Cost There can be solar tax credits and incentives available at the federal state and local levels