Solar Renewable Energy Credits Massachusetts Verkko 8 syysk 2023 nbsp 0183 32 The Residential Renewable Energy Income Tax Credit provides Massachusetts homeowners with a state tax credit worth up to 15 of the cost of their solar system The state tax credit

Verkko The federal solar tax credit is a top MA incentive Don t forget about federal solar incentives With the investment tax credit ITC now referred to as the Residential Clean Energy Credit for residential systems you can reduce the cost of your PV solar energy system by 30 percent Verkko Eligible facilities generate solar renewable energy certificates SRECs and will continue to do so until 2023 after which the facilities will generate Class I RECs RPS Solar Carve Out II The second phase of the Solar Carve Out Program began with the promulgation of changes to the RPS Class I Regulation on April 25 2014

Solar Renewable Energy Credits Massachusetts

Solar Renewable Energy Credits Massachusetts

https://financialtribune.com/sites/default/files/field/image/ordi/05_Renewable - 330..jpg

Reasons Why Solar Is Our Best Renewable Energy Bet

https://renewableenergysolar.net/wp-content/uploads/2020/11/shutterstock_722347258-scaled.jpg

Renewable Energy Infrastructure Can Power Through Hurricanes

https://www.gannett-cdn.com/presto/2018/10/09/USAT/61b60b95-be83-49ff-b536-d0354659677b-AFP_AFP_1983WN.JPG?crop=5183,2902,x0,y0&width=3200&height=1792&format=pjpg&auto=webp

Verkko Massachusetts also has some of the highest electricity costs in the U S which means the kilowatt hours produced by your home s solar panels save a higher dollar amount on your monthly Verkko Solar Massachusetts Renewable Target Program SMART a long term sustainable solar incentive program offered by DOER and sponsored by National Grid Eversource and Unitil electric utilities and open to those utility customers The Massachusetts Clean Energy Center Mass CEC offers several programs for businesses

Verkko 16 jouluk 2016 nbsp 0183 32 See G L c 62 167 6 d as amended by St 1987 c 677 The 1000 credit limitation applies to all renewable energy source expenditures made by an owner or tenant quot taxpayer quot with respect to his or her principal residence Verkko 15 elok 2023 nbsp 0183 32 Massachusetts renewable income tax credit allows homeowners to claim 15 of their solar installation costs on their Massachusetts income taxes with a 1 000 maximum credit Additional

Download Solar Renewable Energy Credits Massachusetts

More picture related to Solar Renewable Energy Credits Massachusetts

Solar Renewable Energy Credits Nova Solar Inc

https://novasolar.com/wp-content/uploads/2023/03/Array-2-2-scaled.jpg

LBE Priorities And Efforts Renewable Clean Energy Resources Mass gov

https://www.mass.gov/files/2022-03/renewables graphic2.0.jpg

Understanding Renewable Energy Credits

https://lirp.cdn-website.com/5a89c9f8/dms3rep/multi/opt/american-public-power-association-eIBTh5DXW9w-unsplash-1920w.jpg

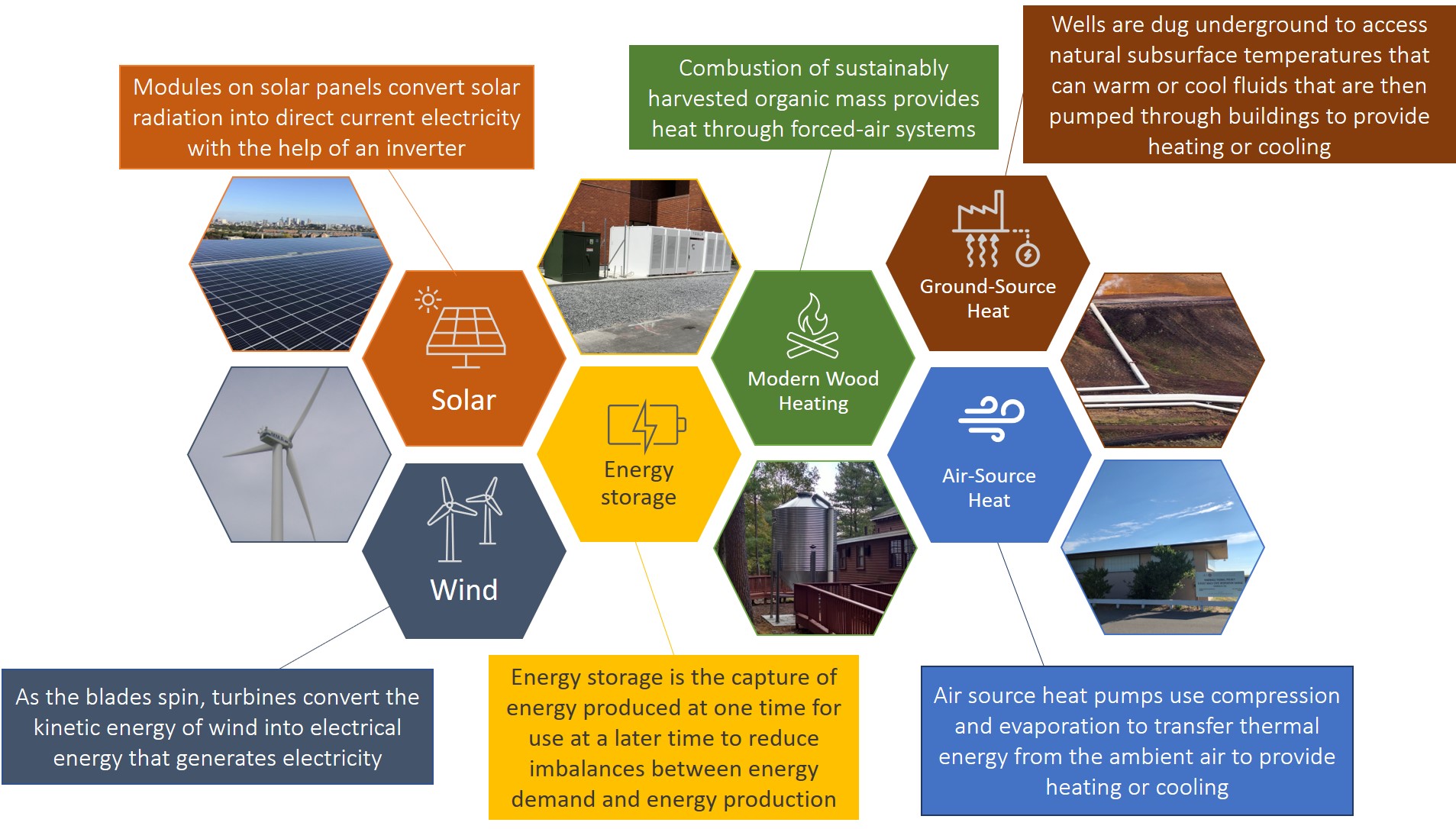

Verkko The Massachusetts Department of Energy Resources Renewable and Alternative Energy Division provides information regarding the different kinds of renewable energy funding programs and incentives installation assistance and more available in Massachusetts Types of renewable energy available in Massachusetts include Verkko 23 maalisk 2017 nbsp 0183 32 The Massachusetts Department of Energy Resources DOER has announced plans to extend the Commonwealth s successful Solar Renewable Energy Credit SREC 2 program until it completes a long term replacement Since its inception the SREC 2 program has led Massachusetts to more than 1 600 megawatts of solar

Verkko 10 hein 228 k 2023 nbsp 0183 32 Massachusetts state solar tax credits exemptions rebates and loan programs It replaced the state s former solar renewable energy credit SREC program in 2018 Verkko 7 jouluk 2023 nbsp 0183 32 The cost of solar panels in Massachusetts averages between 16 240 and 32 480 Many factors determine the total cost of solar for your home such as energy usage hardware and soft costs

What Are Renewable Energy Credits RECs Explained Inspire Clean

https://images.prismic.io/inspirecleanenergy/what-are-renewable-energy-credits.jpeg?auto=compress,format&rect=0,0,1920,1080&w=1920&h=1080

April 28 2021 3 Phases Renewables Inc

https://3phasesrenewables.com/wp-content/uploads/2021/04/All-About-Renewable-Energy-Incentives-1.jpg

https://www.forbes.com/home-improvement/solar/massachusetts-solar...

Verkko 8 syysk 2023 nbsp 0183 32 The Residential Renewable Energy Income Tax Credit provides Massachusetts homeowners with a state tax credit worth up to 15 of the cost of their solar system The state tax credit

https://www.energysage.com/local-data/solar-rebates-incentives/ma

Verkko The federal solar tax credit is a top MA incentive Don t forget about federal solar incentives With the investment tax credit ITC now referred to as the Residential Clean Energy Credit for residential systems you can reduce the cost of your PV solar energy system by 30 percent

Pin On Solar Renewable Energy News

What Are Renewable Energy Credits RECs Explained Inspire Clean

What Are Solar Renewable Energy Credits PA Solar Earnings

Solar Renewable Energy Credits Can Pay You

How Solar Renewable Energy Credits SRECs Work In Virginia YouTube

YouTube

YouTube

Advantages And Disadvantages Of Renewable Energy Waaree Energies

Guide To Solar Renewable Energy Credits RECs In MA Boston Solar

SRECTrade SREC Markets Renewable Energy State Abbreviations Marketing

Solar Renewable Energy Credits Massachusetts - Verkko Massachusetts also has some of the highest electricity costs in the U S which means the kilowatt hours produced by your home s solar panels save a higher dollar amount on your monthly