Solar Tax Rebate For Business South Africa Individuals who pay Personal Income Tax and install new and unused PV panels can claim the rebate of 25 of the cost of these panels up to a maximum of R15 000 against

To this effect two short term incentives have been introduced namely a solar energy tax credit under section 6C for natural persons and an enhanced deduction on certain assets used in Businesses can claim the deduction when completing their tax returns ITR12 for individuals sole props or ITR14 for companies Trusts investing in renewable energy can

Solar Tax Rebate For Business South Africa

Solar Tax Rebate For Business South Africa

https://energytheory.com/wp-content/uploads/2023/08/solar-rebate-South-Africa.png

What Is 87 A Rebate Free Tax Filer Blog

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

Tax Rebate For Individuals Swaper Investing Blog

https://swaper.com/blog/wp-content/uploads/SWAPER_blogpost_tax_1920x1080.png

Treasury said businesses are able to deduct 50 of the costs in the first year 30 in the second and 20 in the third for qualifying investments in wind concentrated solar For businesses a 125 tax incentive applies in terms of section 12B of the Income Tax Act for new and unused energy assets such as wind solar PV concentrated

The Provisional Tax Return IRP6 has been updated with a Solar energy tax credit field to enable provisional taxpayers to take the tax credit into account in determining provisional tax Individuals who install rooftop solar panels will be able to claim a rebate of 25 of the cost of the panels up to a maximum of R15 000 per individual The rebate can be used to reduce tax

Download Solar Tax Rebate For Business South Africa

More picture related to Solar Tax Rebate For Business South Africa

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-scaled.jpg

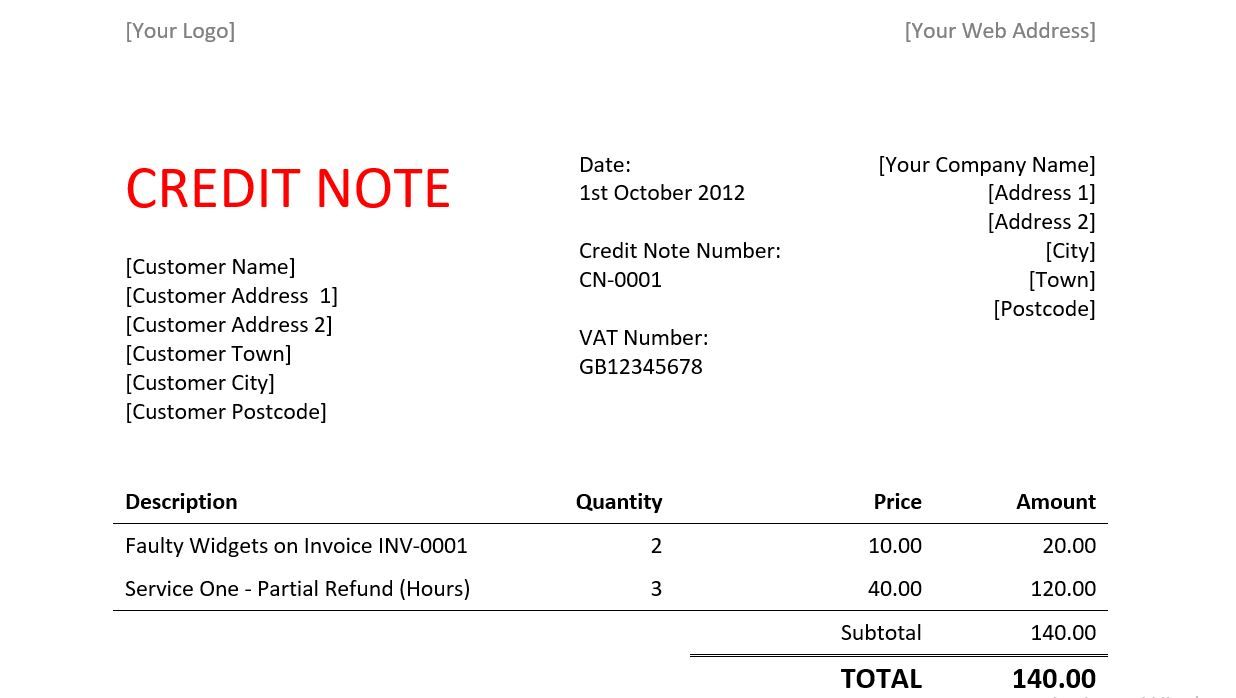

Tax Credit Note Under VAT In UAE Tax Credit Note Requirements

https://www.xactauditing.ae/wp-content/uploads/2021/11/Tax-credit-note-VAT-in-UAE.jpg

For private households individuals who install rooftop solar panels from 1 March 2023 will be able to claim a rebate of 25 of the cost of the panels up to a maximum of R15 000 Learn how to claim the solar tax rebate for your small business in South Africa Discover eligibility filing tips and other solar tax incentives

If you re considering installing solar panels in South Africa you may be eligible for certain tax breaks for your company or yourself This guide provides an overview of the Roger Hislop energy management systems executive at CBI energy says the solar panel tax incentive means businesses can claim a 125 deduction in the first year for all renewable energy

How To Calculate Income Tax South Africa 2018 YouTube

https://i.ytimg.com/vi/Lcg0W9lWpYM/maxresdefault.jpg

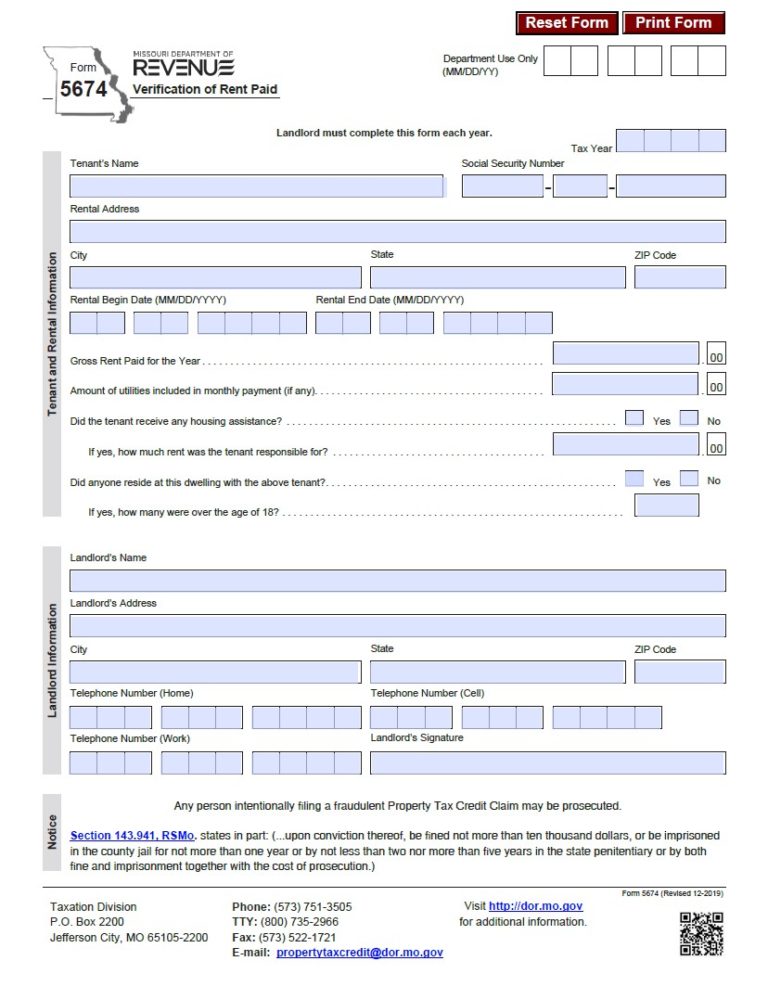

Rent Rebate Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021-768x999.jpg

https://www.sars.gov.za › ... › solar-tax-rebate

Individuals who pay Personal Income Tax and install new and unused PV panels can claim the rebate of 25 of the cost of these panels up to a maximum of R15 000 against

https://www.sars.gov.za › wp-content › uploads › Ops › ...

To this effect two short term incentives have been introduced namely a solar energy tax credit under section 6C for natural persons and an enhanced deduction on certain assets used in

2022 Income Tax Brackets Chart Printable Forms Free Online

How To Calculate Income Tax South Africa 2018 YouTube

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&fit=crop&w=1200&h=630&dpr=2)

Mechanics Tax Rebate Don t Let Your Tool Tax Throw A Spanner In The

Tax Credits For Energy Efficient Home Improvements Kiplinger

Tax Credits For Energy Efficient Home Improvements Kiplinger

Primary Rebate South Africa Printable Rebate Form

Is Section 87A Rebate For Everyone SR Academy India

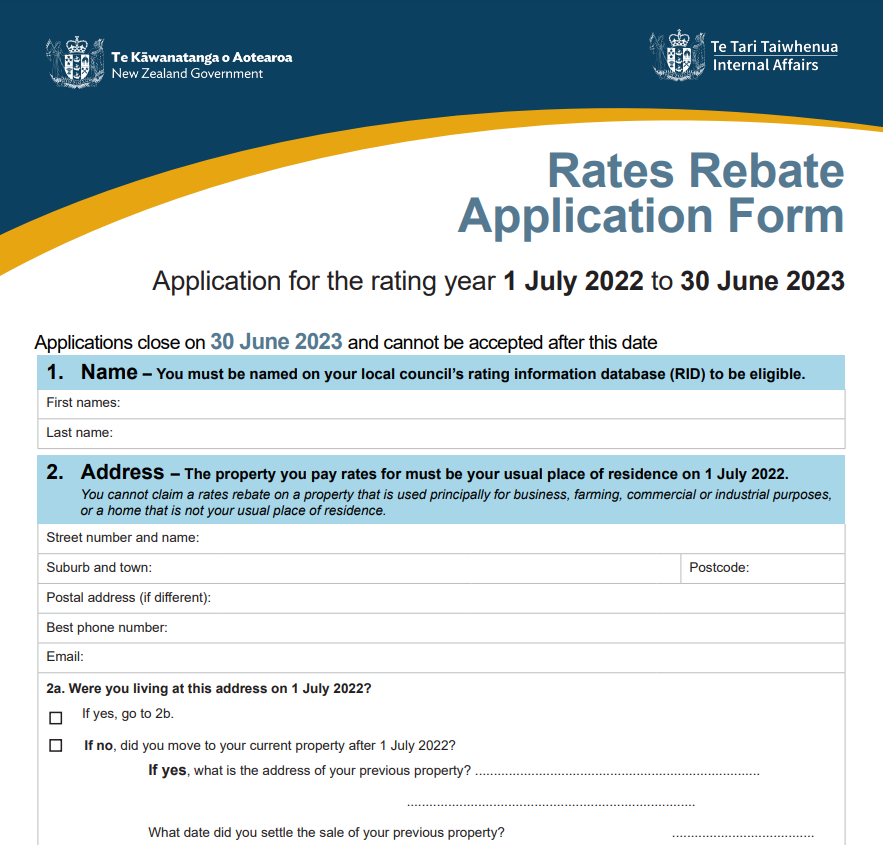

Rates Rebate Form For Pensioners Durban 2022 Calendar Printable

Solar Tax Rebate For Business South Africa - Individuals who install rooftop solar panels will be able to claim a rebate of 25 of the cost of the panels up to a maximum of R15 000 per individual The rebate can be used to reduce tax