Spouse Joint Tax Return The best way to find out if you should file jointly or separately with your spouse is to prepare the tax return both ways Double check your calculations and then look at the net refund or balance due

You may also file a joint tax return if your spouse died during the tax year and you haven t remarried or if you live apart but are not legally separated Married filing jointly is an income tax filing status that allows a couple to file a single return that reports their combined income You file your tax return separately from your spouse

Spouse Joint Tax Return

Spouse Joint Tax Return

https://crossborderplanner.com/wp-content/uploads/2020/09/how-marriage-impacts-irs-tax-return.jpg

How Do I Get Innocent Spouse Relief From My Joint Tax Returns SH

https://www.mdtaxattorney.com/wp-content/uploads/2015/10/injured-spouse-tax-relief.jpg

Can Married Couples File Taxes As Single VERIFY Wcnc

https://media.wcnc.com/assets/WCNC/images/0655f001-4ebb-46a4-9bd2-8c4a696cd59d/0655f001-4ebb-46a4-9bd2-8c4a696cd59d_1920x1080.jpg

If a taxpayer is married they can file a joint tax return with their spouse If one spouse died in 2021 the surviving spouse can use married filing jointly as their Taxpayers may use the married filing jointly status if they are married and both agree to file a joint return This includes taxpayers who live apart but are not legally separated

Joint assessment allows you to allocate transfer between you most of your tax credits reliefs and rate band with your spouse or civil partner The Tax Rates Bands Married filing jointly On a joint return you report your combined income and deduct your combined allowable expenses For many couples filing jointly lowers their taxes In

Download Spouse Joint Tax Return

More picture related to Spouse Joint Tax Return

Who Goes First On Your Joint Tax Return Probably Not The Woman WSJ

https://images.wsj.net/im-709909/square

I Love Filing A Joint Tax Return With My Wife Because It Saves Us A Ton

https://i.insider.com/5e62d482fee23d2aaa692d12

What Is A Schedule C Tax Form H R Block

https://resource-center.hrblock.com/wp-content/uploads/2019/11/tax-forms-1080x675.jpg

A joint return is a tax return filed with the Internal Revenue Service IRS on the new simplified Form 1040 as of 2018 by two married taxpayers whose filing status On a joint tax return both you and your spouse include all of your income exemptions and deductions This information is found in Publication 501 Dependents Standard

Married couples can decide to file taxes jointly or separately Learn the benefits of each filing status to determine the best option for your return Married filing jointly or MFJ for short means you and your spouse fill out one tax return together Now don t get me wrong You don t have to file jointly You could file

What You Need To Know About Spouse Benefits For Railroad Retirement

https://static.twentyoverten.com/5b74784bd10c860c99acdebb/KQqLyZERwKR/Know-Spouse-Benefits-for-RRR.png

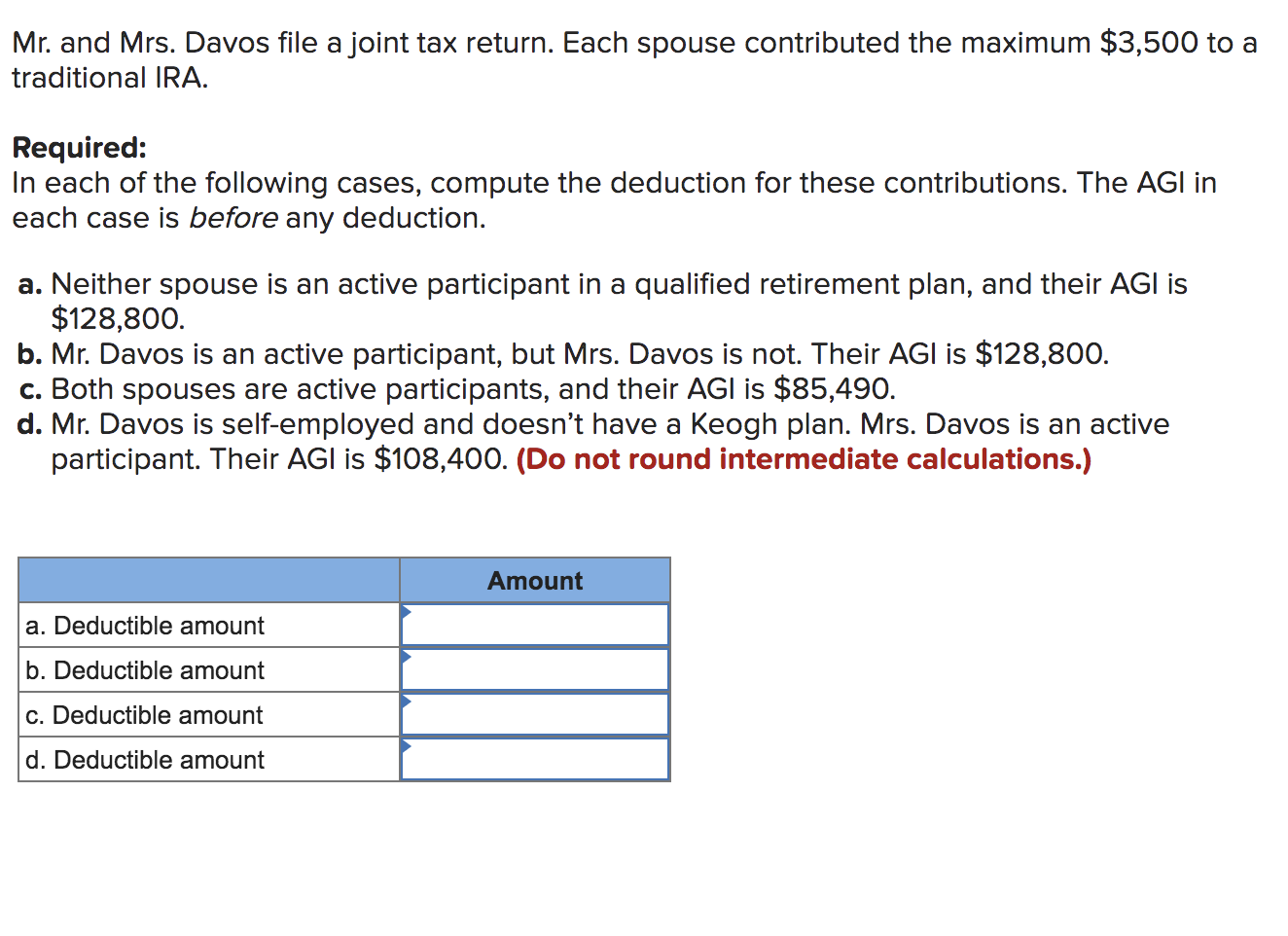

Solved Mr And Mrs Davos File A Joint Tax Return Each Chegg

https://media.cheggcdn.com/media/458/458cdc4e-f806-40e6-b0c8-8b148a94d7f9/phpGmNISP

https://turbotax.intuit.com/tax-tips/marr…

The best way to find out if you should file jointly or separately with your spouse is to prepare the tax return both ways Double check your calculations and then look at the net refund or balance due

https://www.forbes.com/advisor/taxes/…

You may also file a joint tax return if your spouse died during the tax year and you haven t remarried or if you live apart but are not legally separated

Do Both Spouses Have To Sign A Joint Tax Return Tax Walls

What You Need To Know About Spouse Benefits For Railroad Retirement

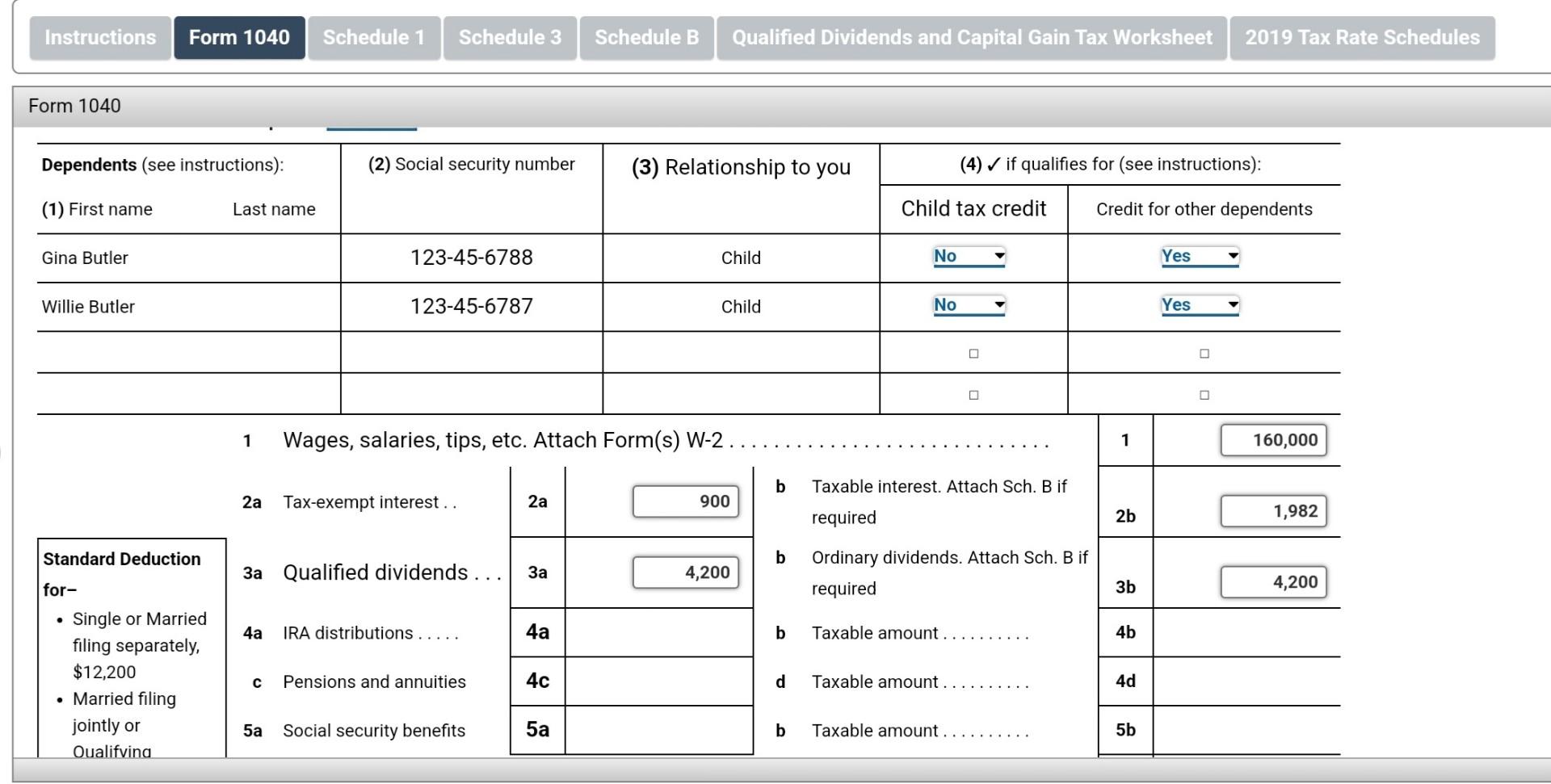

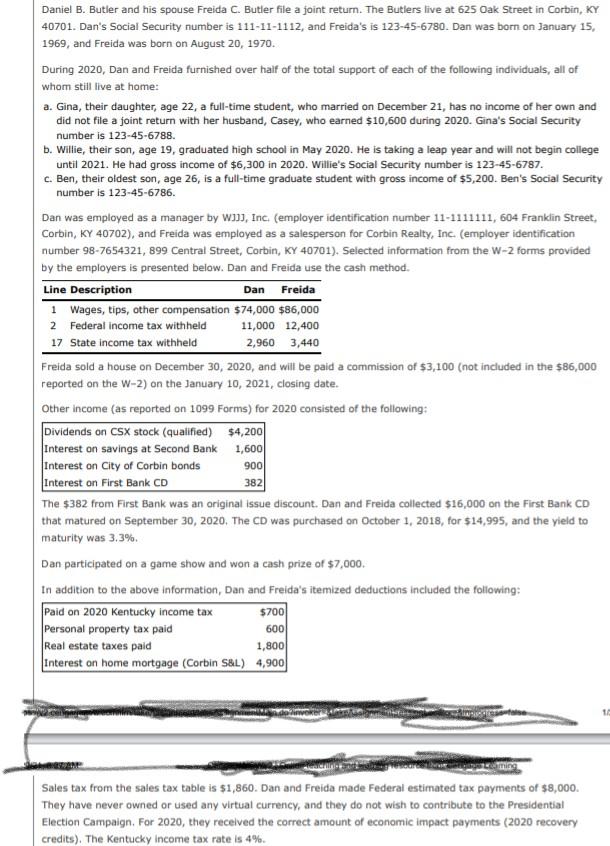

Solved Note This Problem Is For The 2019 Tax Year Daniel Chegg

Solved Daniel B Butler And His Spouse Freida C Butler File Chegg

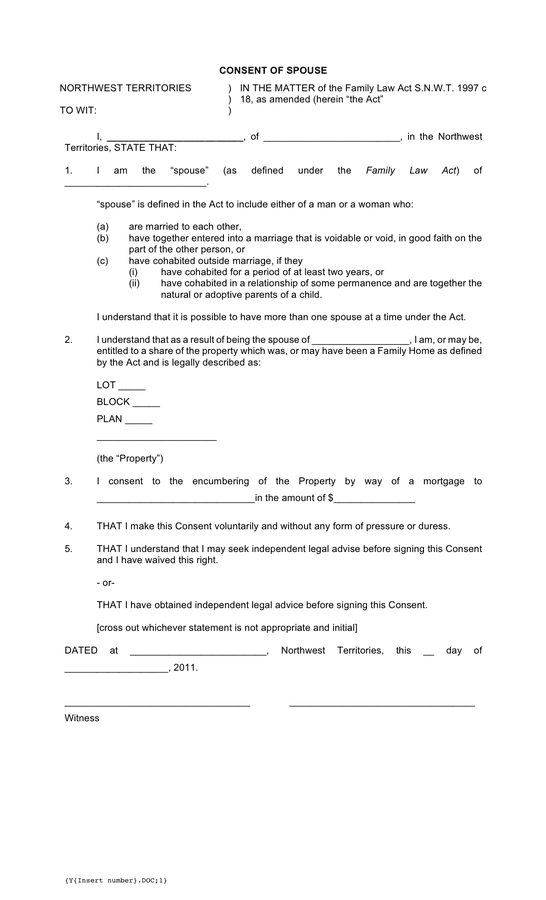

Tt Services Consent Form Canada Printable Consent Form

How To Fill Out IRS Form W 4 Married Filing Jointly One Income YouTube

How To Fill Out IRS Form W 4 Married Filing Jointly One Income YouTube

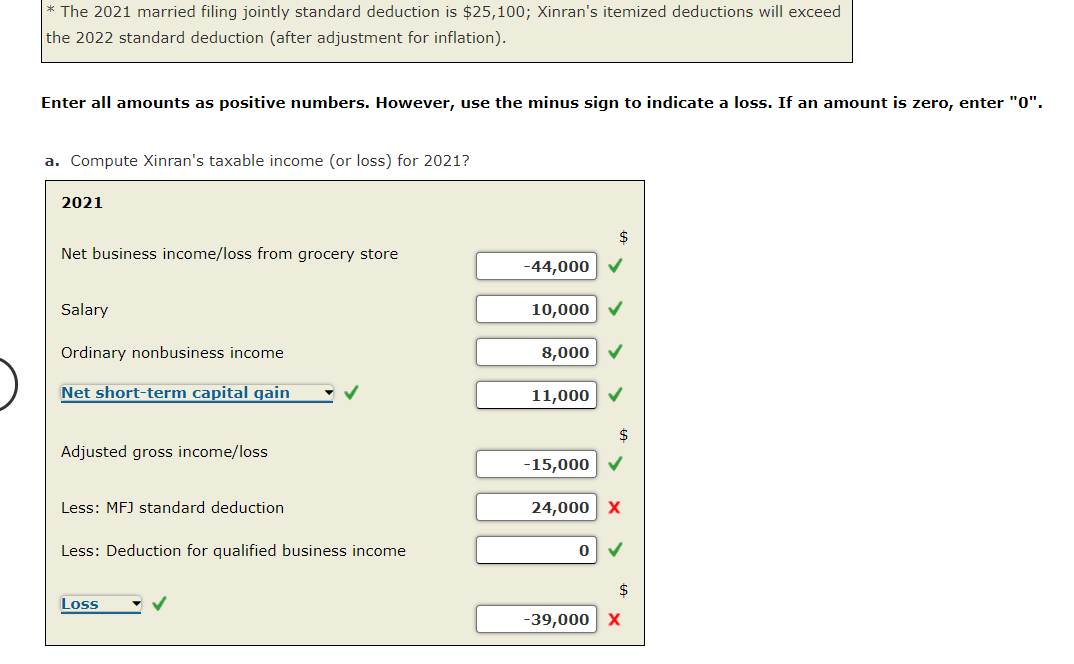

Solved Problem 7 44 LO 7 Xinran Who Is Married And Files Chegg

1040 Tax Table Married Filing Jointly Elcho Table

Should You File A Joint Tax Return For The Year Of Your Spouse s Death

Spouse Joint Tax Return - Married filing jointly On a joint return you report your combined income and deduct your combined allowable expenses For many couples filing jointly lowers their taxes In