Standard 20 Tax Code Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension HM Revenue and Customs HMRC will tell them

22 rowsWhat tax codes are how they re worked out and what to do if you think your code is wrong Tax codes are a short string of numbers and letters that indicate how much tax free Personal Allowance you have on a particular source of income based on your individual

Standard 20 Tax Code

Standard 20 Tax Code

https://freespeech.org/wp-content/uploads/2022/03/20-tax-rate.png

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

A Guide To NZ Tax Codes Accountsdept

https://accountsdept.co.nz/wp-content/uploads/2023/10/Accounts-Dept-Blog-Thumb-size-900-x-1040.jpg

Your tax code is basically a note from HMRC to you and your employer or pension provider that explains how much tax you re due to pay on a monthly basis between April and March It will show you What your current tax code is 6th of April 2022 to 5th of April 2023 How they work out your tax code and the amount you are likely to pay Note The HMRC help

The BR code tells your employer to collect tax at the basic rate against your full earnings the basic rate of income tax has been 20 for a number of years This code should be The standard PAYE tax code for your main job in 2018 19 is 1185L 2017 18 1150L It represents 11 850 of tax free income For a second or subsequent job the standard

Download Standard 20 Tax Code

More picture related to Standard 20 Tax Code

What The OT Tax Code Means

https://goselfemployed.co/wp-content/uploads/2020/08/0t-tax-code.jpg

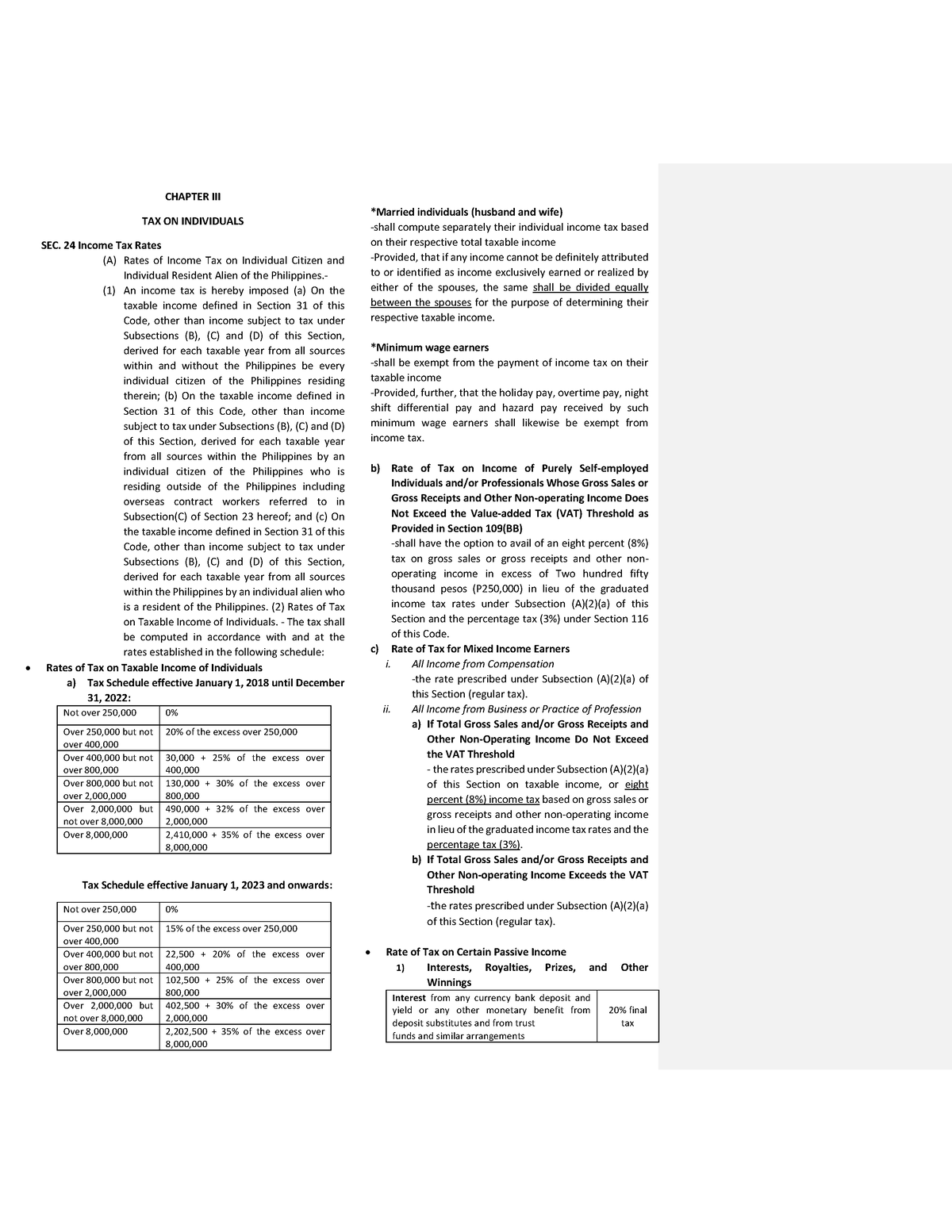

TAX CODE Summary CHAPTER III TAX ON INDIVIDUALS SEC 24 Income Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/931f688ab519b9279df08bda96cd3450/thumb_1200_1553.png

Look At How Many Pages Are In The Federal Tax Code 2014 R Accounting

https://preview.redd.it/look-at-how-many-pages-are-in-the-federal-tax-code-2014-v0-4quucdaenfz91.jpg?auto=webp&s=c0186d8fc7d345a4089ea059e46e611ffc7bb9bf

The standard tax code for the 2022 2023 year is 1257L which means you can earn 12 570 as a tax free personal allowance until midnight on the 5th April 2023 You can find your tax code on your payslip The personal Where no allowances exist code BR is used to tax at basic rate 20 code D0 is used to tax at higher rate 40 and code D1 is used to tax at the additional rate 45 If no

In 2024 25 the most common tax code is 1257L used for most people with one job and no untaxed income unpaid tax or taxable benefits This reflects that the personal allowance is 12 570 Use this free UK Tax Code Calculator from Martin Lewis and MoneySavingExpert to see if you re owed 1 000s in overpaid tax Plus full 1257L tax code help

Enhance Your Tax Calculation Process With The Tax Code Address Field

https://www.pronkoconsulting.com/media/wysiwyg/111_1_.png

Broken Tax Code Legalities

https://image.cnbcfm.com/api/v1/image/103537941-2ED1-PL-US-TAX-REFORM-041116.jpg?v=1529471211&w=1920&h=1080

https://www.gov.uk/tax-codes

Your tax code is used by your employer or pension provider to work out how much Income Tax to take from your pay or pension HM Revenue and Customs HMRC will tell them

https://www.gov.uk/tax-codes/what-your-tax-code-means

22 rowsWhat tax codes are how they re worked out and what to do if you think your code is wrong

Editorial Congress Reform The Tax Code

Enhance Your Tax Calculation Process With The Tax Code Address Field

Tax Rates Tax Code Sectio N Document Taxable Unit Tax Due Per Unit

Account Tax Tutor

Democratic Plan Would Close Tax Break On Exchange traded Funds

13 Of 20 Tax Prorations Copy On Vimeo

13 Of 20 Tax Prorations Copy On Vimeo

Committed To The Tax Code R ProgrammerHumor

Contact AAA Tax Service

Understanding Tax Codes Cooper Weston Payroll Services

Standard 20 Tax Code - If you haven t found what you re looking for try using our Which tax code should I use UK only or refer to HMRC s guide on VAT rates on different goods and services