Standard Deduction 2022 Married Filing Jointly With One Dependent Dependents If you can be claimed as a dependent by another taxpayer your standard deduction for 2024 is limited to the greater of 1 1 300 or 2 your earned income plus 450

The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing If you can claim someone as a dependent deductions like the earned income tax credit EITC and child tax credit will lower your tax bill Learn which you can claim

Standard Deduction 2022 Married Filing Jointly With One Dependent

Standard Deduction 2022 Married Filing Jointly With One Dependent

https://i2.wp.com/www.westernstatesfinancial.com/uploads/1/8/7/0/18703714/2020-ca-tax-brackets-pic_orig.png

2022 Tax Brackets Irs Married Filing Jointly Unblocked 2022

https://i2.wp.com/static.wixstatic.com/media/9062d1_21e9afb4bd4f4806ab3cf18faa60cd95~mv2.jpg/v1/fit/w_730%2Ch_361%2Cal_c%2Cq_80/file.jpg

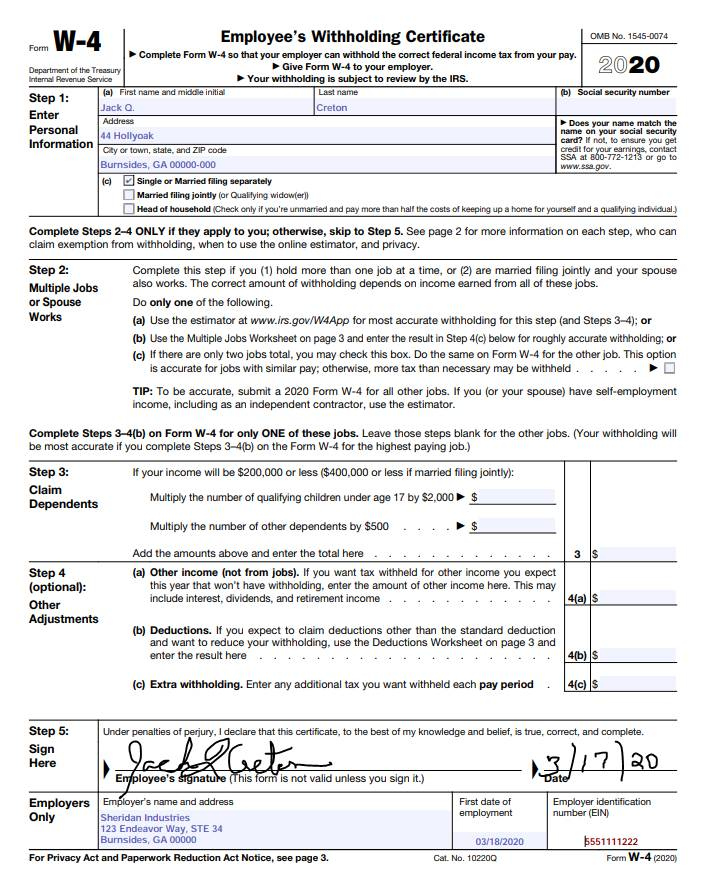

Sample W 4 Form Completed 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2021/07/what-is-a-w4-form-and-how-does-it-work-form-w-4-for-employers-2.jpg

If you are married filing jointly and ONE of you was born before Jan 2 1959 your standard deduction increases by 1 500 If BOTH you and your spouse were born before Jan 2 1959 your standard deduction increases by Tax year 2022 Standard Deduction amounts filed in 2023 A person is considered to reach age 65 on the day before his or her 65th birthday If the taxpayer or spouse is legally blind and or

Use this worksheet only if someone can claim you or your spouse if filing jointly as a dependent 1 Check if You were born before January 2 1958 You are blind Spouse was born before Married couples filing jointly can benefit by deducting interest paid during the tax year This deduction applies to loans taken for your own education or that of a dependent This

Download Standard Deduction 2022 Married Filing Jointly With One Dependent

More picture related to Standard Deduction 2022 Married Filing Jointly With One Dependent

2022 Us Tax Brackets Irs Rezfoods Resep Masakan Indonesia

https://imageio.forbes.com/specials-images/imageserve/618be39f8dd74be3a7c319d4/Married-Separately-tax-rates-2022/960x0.jpg?height=440&width=711&fit=bounds

2022 Tax Tables Married Filing Jointly Printable Form Templates And

https://images.axios.com/Ker5wAavgxDK0S7kOs1MY-vJkQM=/0x0:1280x720/1920x1080/2022/10/19/1666195709283.png

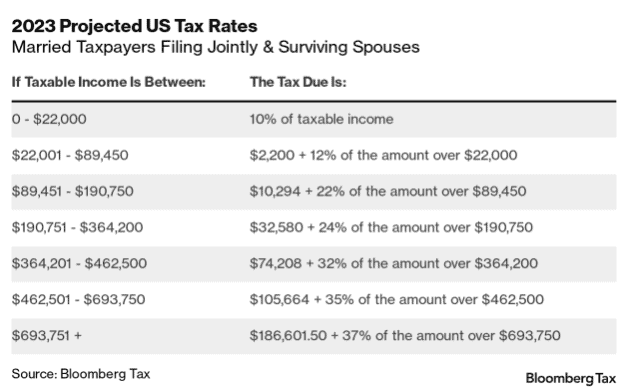

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

If you can be claimed as a dependent by another taxpayer your 2022 standard deduction is limited to the greater of 1 150 or your earned income plus 400 but the total can t be more Taxpayers who are filing as head of household it s for unmarried individuals with dependents can claim a standard deduction of 19 400 18 800 in 2021 This category

The annual standard deduction is a static amount determined by Congress In 2025 it is 15 000 for single taxpayers and 30 000 for married taxpayers filing jointly slightly increased from The standard deduction marginal rates for the tax year 2022 are listed below Standard Deduction Married couples filing jointly 25 900 800 increase from 2021 Single taxpayers

Incredible Us Tax Brackets 2021 References Finance News

https://i2.wp.com/federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-3-1536x1086.png

2022 Tax Brackets Married Filing Jointly Standard Deduction Horace

https://imageio.forbes.com/specials-images/imageserve/618be34d322f395ce83b72d2/Joint-tax-rates-2022/960x0.jpg?height=358&width=711&fit=bounds

https://www.irs.gov › taxtopics

Dependents If you can be claimed as a dependent by another taxpayer your standard deduction for 2024 is limited to the greater of 1 1 300 or 2 your earned income plus 450

https://www.forbes.com › sites › ashleaebe…

The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing

Tax Brackets 2022 Married Jointly Sustainablejulu

Incredible Us Tax Brackets 2021 References Finance News

New 2023 IRS Income Tax Brackets And Phaseouts

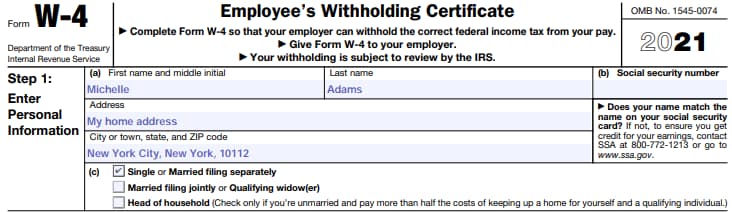

W4 Form Example For Single 2024 W 4 Forms Zrivo

New 2021 IRS Income Tax Brackets And Phaseouts The Estate Legacy And

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

2022 Tax Tables Married Filing Jointly Printable Form Templates And

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

2022 Tax Tables Married Filing Jointly Printable Form Templates And

State Of Maine 2023 W4 Form Printable Forms Free Online

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

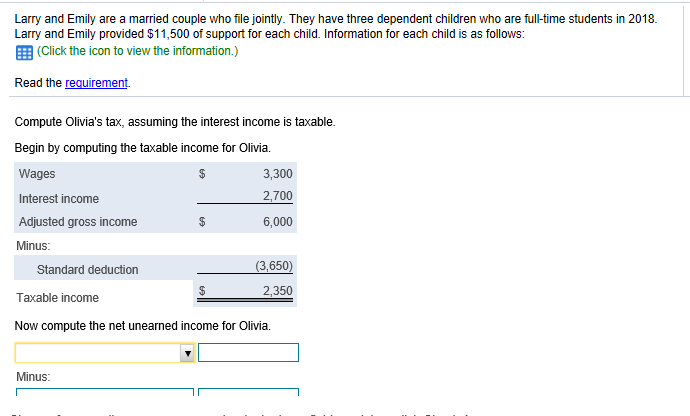

Solved Larry And Emily Are A Married Couple Who File Chegg

Standard Deduction 2022 Married Filing Jointly With One Dependent - Use this worksheet only if someone can claim you or your spouse if filing jointly as a dependent 1 Check if You were born before January 2 1958 You are blind Spouse was born before