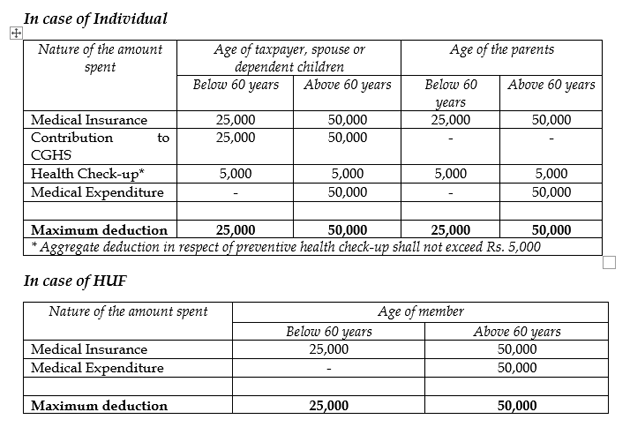

Standard Deduction For Senior Citizens Ay 2023 24 Here are the maximum deduction limits For Individual and Family Coverage Self Spouse and Dependent Children Individuals below 60 years Up to Rs 25 000 Individuals aged 60 years and above senior citizens Up to Rs

In Budget 2024 the tax slabs under the new regime have been revised Limit of Standard Deduction against salaried income has been increased from Rs 50 000 to Rs 75 000 Limit of Additionally the standard deduction for senior citizens is 50 000 under the old tax regime and 75 000 for the new tax regimes FY2024 25

Standard Deduction For Senior Citizens Ay 2023 24

Standard Deduction For Senior Citizens Ay 2023 24

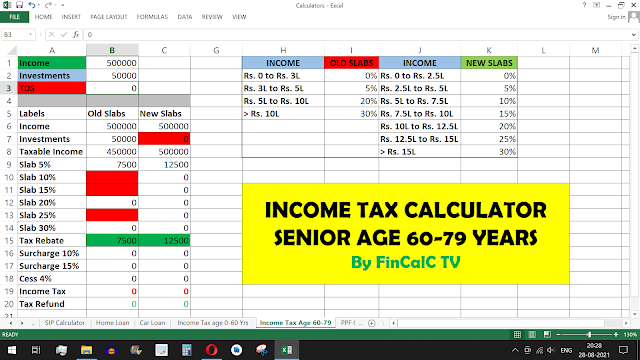

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-for-senior-citizens-FY-2022-23-1024x576.webp

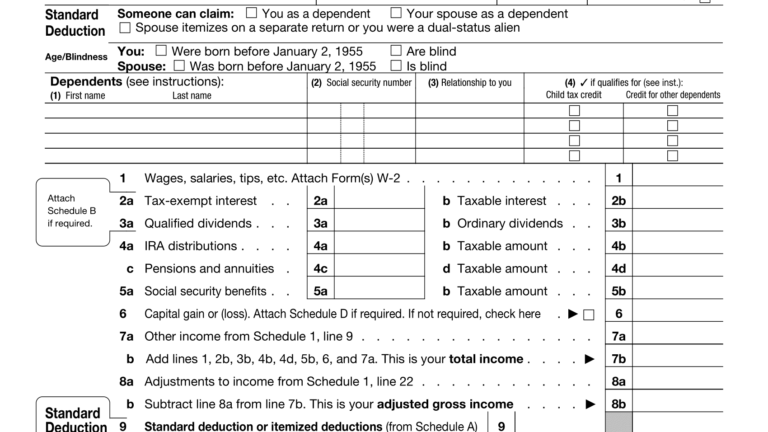

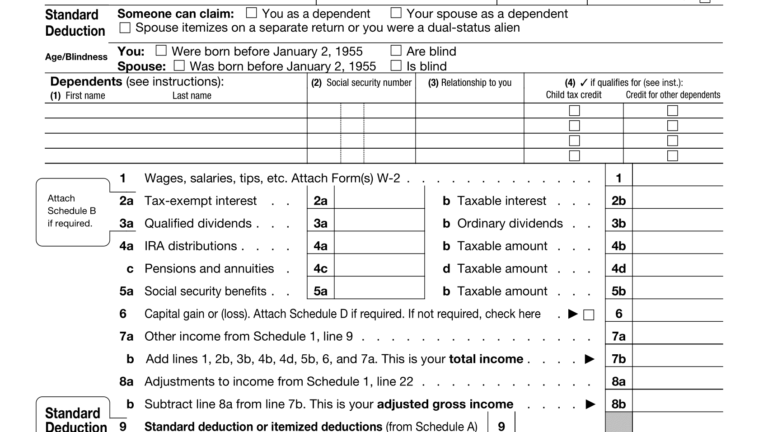

Irs Standard Deduction For Seniors 2020 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/form-1040-sr-seniors-get-a-new-simplified-tax-form-for-2019-3-768x432.png

KTP Company PLT Audit Tax Accountancy In Johor Bahru

https://images.squarespace-cdn.com/content/v1/59bb3b0146c3c48c4746b775/1608199551718-019TQ2H51Q3W5UY2FPO2/Slide1.JPG

Budget 2023 proposes to extend the benefit of standard deduction to the new tax regime for the salaried class and the pensioners including family pensioners Standard deduction of 50 000 to salaried individual and deduction from family Explore Standard Deduction under Section 16 ia and in the new tax regime Know standard deduction in new old tax regimes its applicability benefits for senior citizens Learn how it would impact your income tax

A standard deduction of 50 000 was increased to 75 000 from the financial year 2024 25 under the new tax regime and the rebate under section 87A increased for taxable Limit of Standard Deduction against salaried income has been increased from Rs 50 000 to Rs 75 000 Limit of maximum Deduction under Family Pension has been increased

Download Standard Deduction For Senior Citizens Ay 2023 24

More picture related to Standard Deduction For Senior Citizens Ay 2023 24

Standard Deduction On Salary For AY 2022 23 New Tax Route

https://newtaxroute.com/wp-content/uploads/2021/07/standard-deduction-on-salary-for-ay-2022-23.png

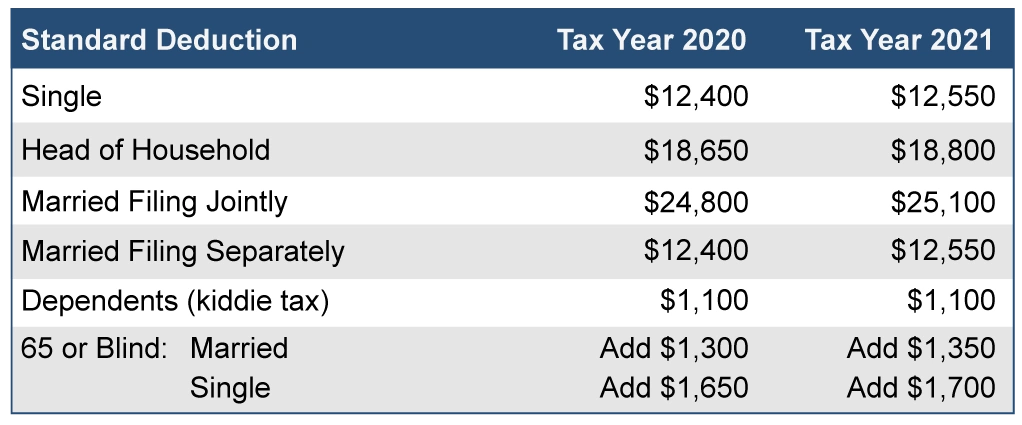

Standard Deduction 2020 Age 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/how-the-new-tax-law-is-different-from-previous-policies-2.jpg

What Is The Standard Deduction For 2021

https://img1.wsimg.com/isteam/ip/ddcf39a3-c914-4501-ba10-27324e31c122/2021 Standard Deductions.png/:/cr=t:0%25,l:0%25,w:100%25,h:100%25

What are the deductions for senior citizens in AY 2024 25 The deduction amount for senior citizen is Rs 1 lakh and Rs 40 000 for Non Senior Citizen taxpayers How much is the The deadline for filing taxes for FY 2023 24 AY 2024 25 is July 31 2024 unless there is an extension If an employee does not opt for the old tax regime initially their

If you are not a senior citizen then deduction will be 10000 as per section 80TTA otherwise you can claim entire amount as deduction as per section 80TTB The pensioners can claim a standard deduction of Rs 50 000 from their salary pension income under the new income tax regime according to Budget 2023

Income Tax 2022 23 Slab Bed Frames Ideas

https://i2.wp.com/www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1024x719.png

What Is The Standard Deduction For Senior Citizens In 2022 2024

https://i.ytimg.com/vi/G5o6PQr6e7w/hq720.jpg?sqp=-oaymwEcCNAFEJQDSFXyq4qpAw4IARUAAIhCGAFwAcABBg==&rs=AOn4CLCVR_8k7-4nguPyCIafilDJAJeofQ

https://www.caclubindia.com › articles

Here are the maximum deduction limits For Individual and Family Coverage Self Spouse and Dependent Children Individuals below 60 years Up to Rs 25 000 Individuals aged 60 years and above senior citizens Up to Rs

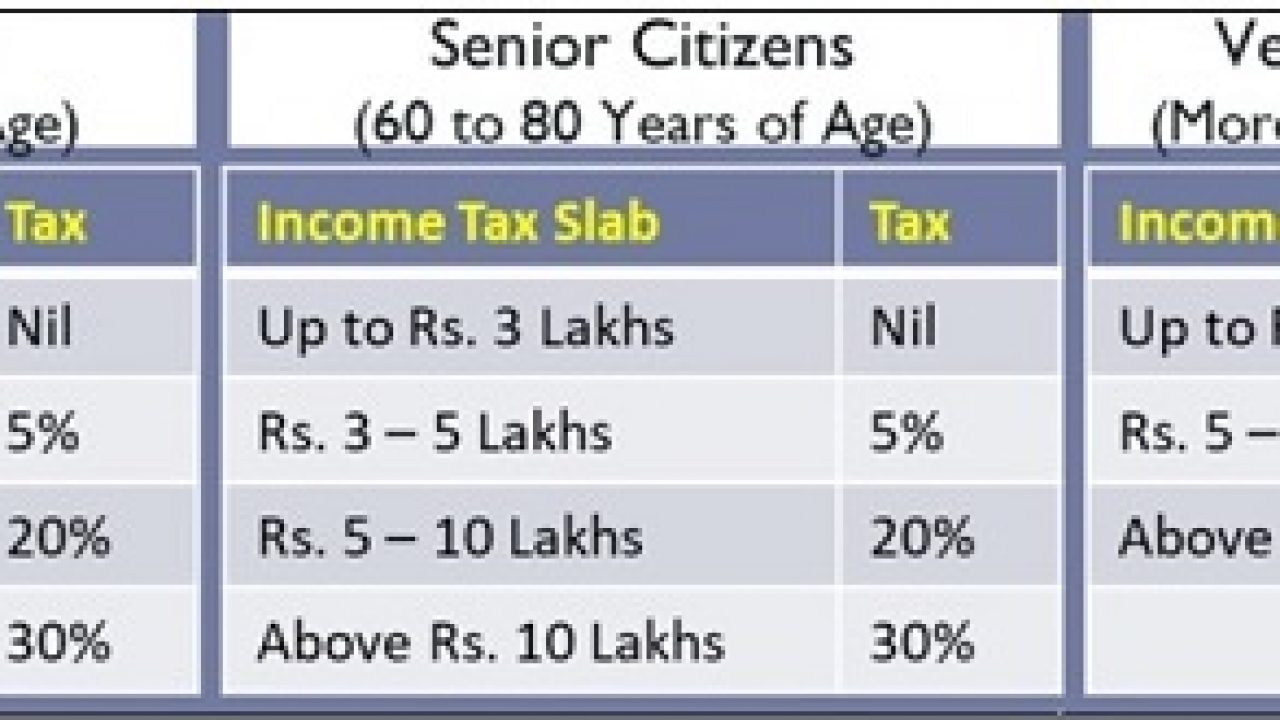

https://cleartax.in › income-tax-slab-for-senior-citizen

In Budget 2024 the tax slabs under the new regime have been revised Limit of Standard Deduction against salaried income has been increased from Rs 50 000 to Rs 75 000 Limit of

Income Tax Slab Rate Fy 2021 22 Ay 2022 23 And Fy 2020 21 Ay Mobile

Income Tax 2022 23 Slab Bed Frames Ideas

Senior Citizens How To Calculate Income Tax FY 2021 22 VIDEO

What Do Budget 2023 Highlights Have In Store For Women Union Budget

Union Budget 2022 Why Budget 2022 Should Allow Tax Deduction For

Section 80TTB Tax Deduction For Senior Citizens PulseHRM

Section 80TTB Tax Deduction For Senior Citizens PulseHRM

Income Tax Rates For Senior Citizens For Assessment Year Page My XXX

Standard Deduction For Ay 2020 21 For Senior Citizens Standard

Increased DEDUCTION For Medical Purposes For Senior Citizens YouTube

Standard Deduction For Senior Citizens Ay 2023 24 - However the standard deduction for salaried individuals has been raised from 50 000 to 75 000 annually New Income Tax Slabs FY 2025 26 Are senior citizens