Standard Tax Deduction 2024 Married Filing Jointly Verkko 27 jouluk 2023 nbsp 0183 32 For the tax year 2024 the standard deduction for married couples filing jointly will increase to 29 200 an increase of 1 500 over the tax year 2023

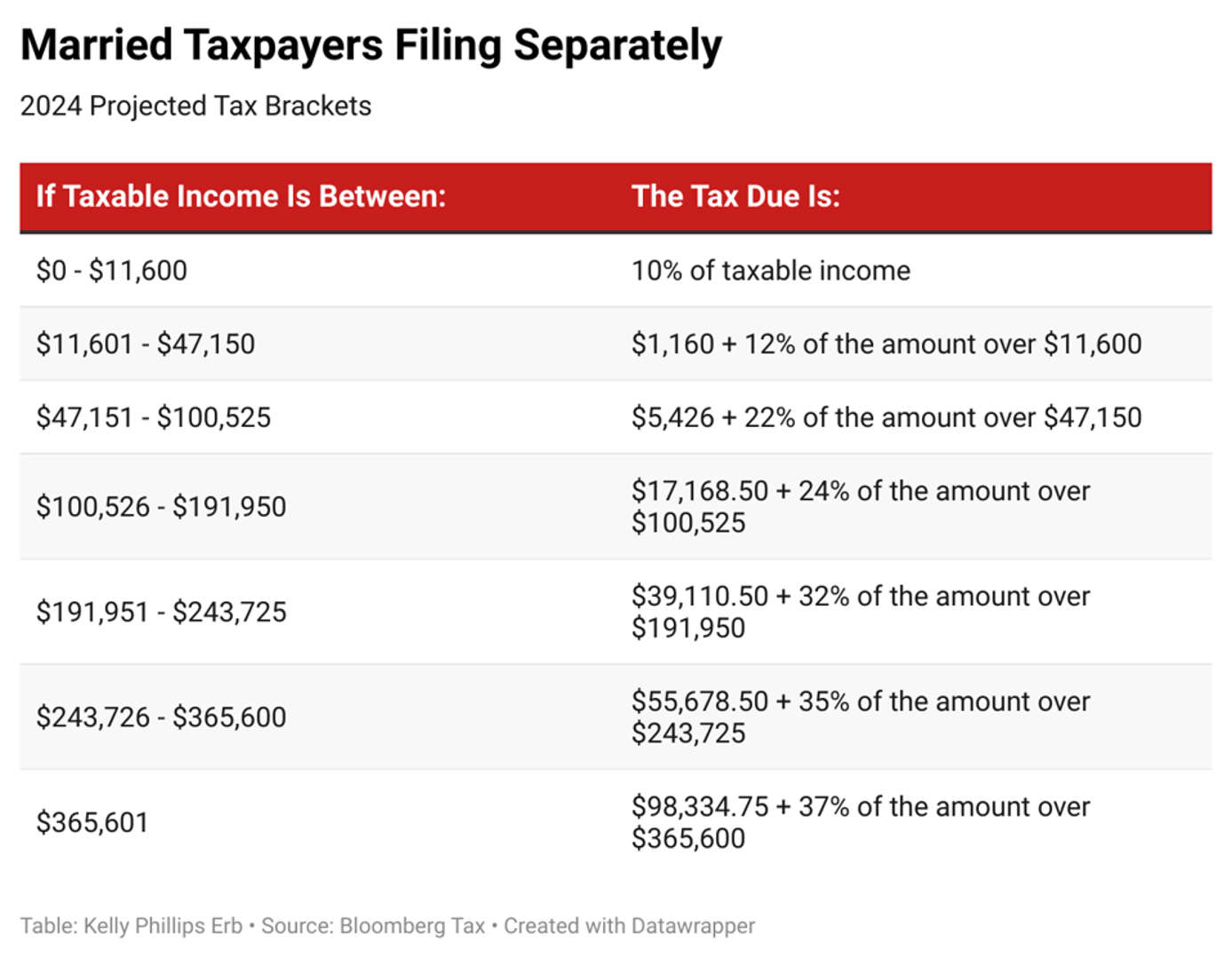

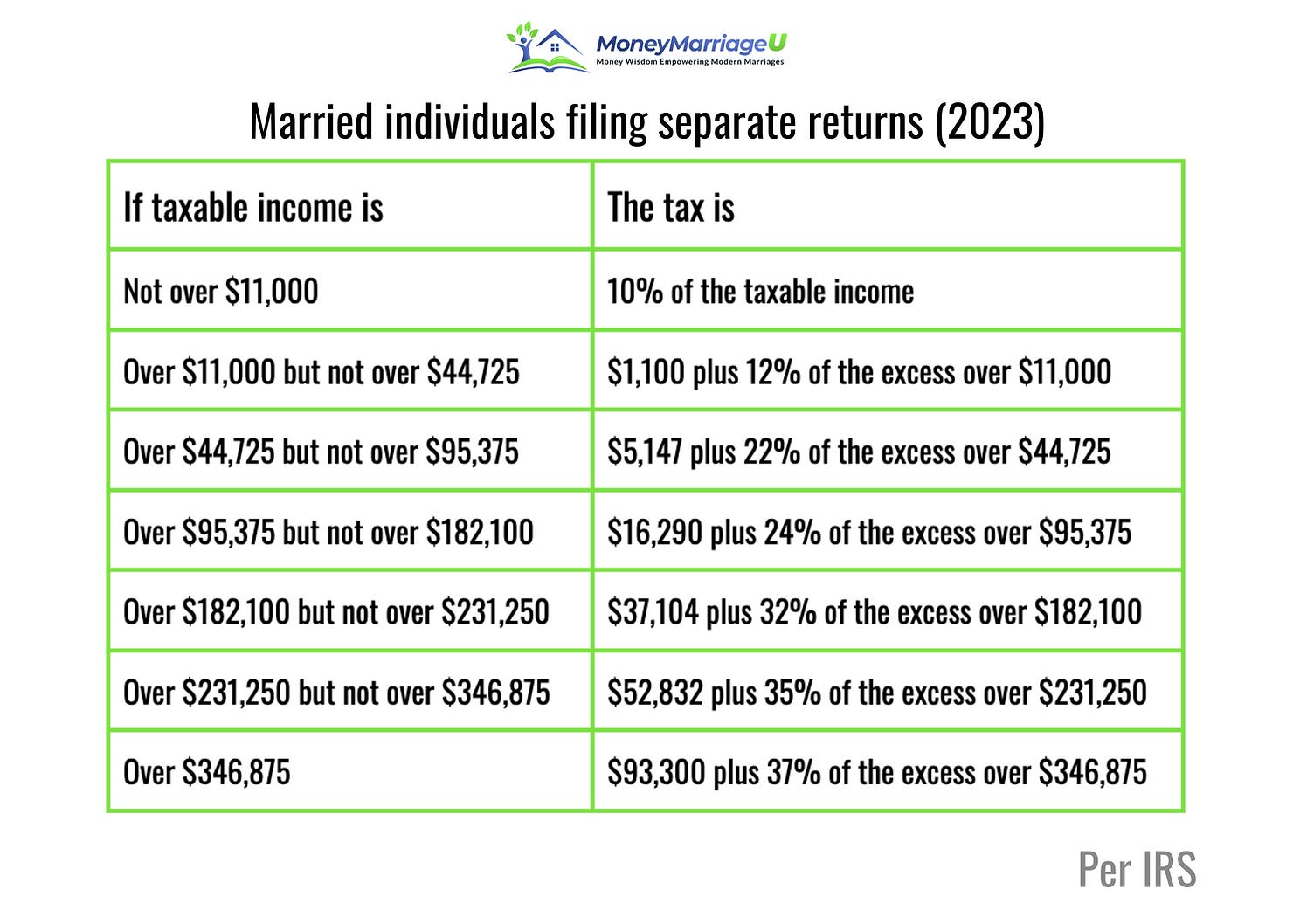

Verkko 9 marrask 2023 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 14 600 for 2024 an increase of 750 from 2023 and Verkko 9 marrask 2023 nbsp 0183 32 In 2024 the 28 percent AMT rate applies to excess AMTI of 232 600 for all taxpayers 116 300 for married couples filing separate returns AMT

Standard Tax Deduction 2024 Married Filing Jointly

Standard Tax Deduction 2024 Married Filing Jointly

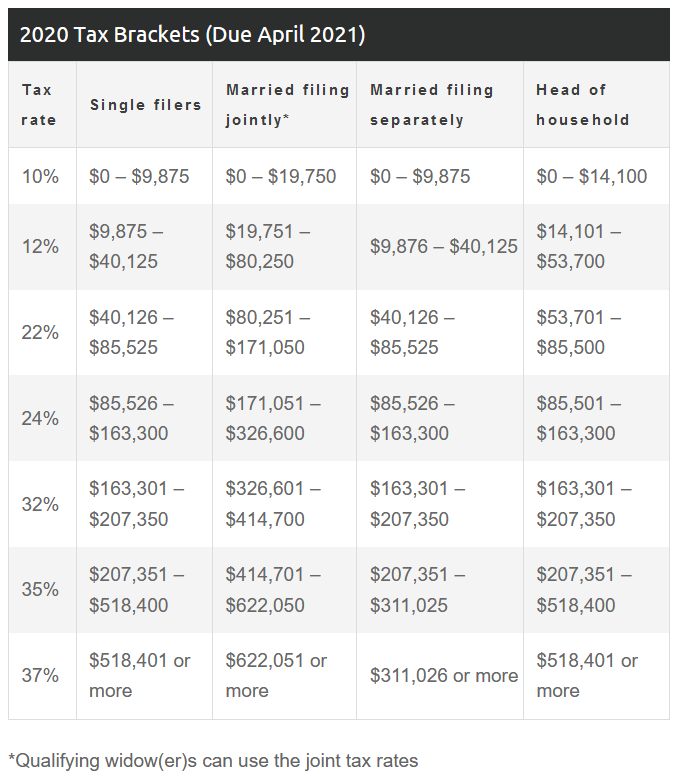

https://federal-withholding-tables.net/wp-content/uploads/2021/07/irs-tax-brackets-2020-2021-news-and-freedom-1.png

How Much Is The Eitc For 2024 The Conservative Nut

https://theconservativenut.com/wp-content/uploads/2023/12/tax-brackets-irs-2024481206605-768x400.jpg

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Verkko 10 marrask 2023 nbsp 0183 32 How much is the standard deduction for 2024 Returns normally filed in 2025 Standard deduction amounts increased between 750 and 1 500 Verkko 4 jouluk 2023 nbsp 0183 32 For 2023 they ll get the regular standard deduction of 27 700 for a married couple filing jointly They also both get an additional standard deduction amount of 1 500 per person

Verkko 10 marrask 2023 nbsp 0183 32 The standard deduction for 2024 will rise to 29 200 for married couples filing jointly and to 14 600 for single filers Verkko 15 marrask 2023 nbsp 0183 32 The deduction set by the IRS for the 2024 tax year is as follows 14 600 for single filers 14 600 for married couples filing separately 21 900 for heads of households 29 200 for

Download Standard Tax Deduction 2024 Married Filing Jointly

More picture related to Standard Tax Deduction 2024 Married Filing Jointly

What Is My Tax Bracket 2022 Blue Chip Partners

https://www.bluechippartners.com/wp-content/uploads/2022/11/Chart2-2022-Marginal-Tax-Rates-For-Married-Filing-Jointly.jpg

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

https://boxelderconsulting.com/wp-content/uploads/2022/11/Screen-Shot-2022-11-17-at-12.20.59-PM-1024x469.png

Verkko 9 marrask 2023 nbsp 0183 32 And the standard deduction for heads of households will be 21 900 up 1 100 from 2023 Taxpayers who qualify for the Earned Income Tax Credit EITC Verkko 12 tuntia sitten nbsp 0183 32 Details The 2024 tax year standard deduction for married couples filing jointly will be 29 200 a 1 500 increase from 27 700 for the 2023 tax year

Verkko 4 jouluk 2023 nbsp 0183 32 The 2023 standard deduction is 13 850 for single filers and those married filing separately 27 700 for those married filing jointly and 20 800 for heads of household Filing Verkko Federal tax brackets for 2024 The U S federal income tax system is progressive Married filing jointly MFJ 29 200 Head of household HOH 21 900 Married

What Is New For 2023 Tax Year Get New Year 2023 Update

https://image.cnbcfm.com/api/v1/image/107136829-1666125948655-lh8qe-marginal-tax-brackets-for-tax-year-2023-married-filing-jointly_1.png?v=1666125962

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

2022 Tax Tables Married Filing Jointly Printable Form Templates And

https://www.investopedia.com/thmb/XEFUK6tcW2xt3Ej2XPwmYcWwc4s=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png

https://www.irs.com/en/2024-tax-brackets-deductions

Verkko 27 jouluk 2023 nbsp 0183 32 For the tax year 2024 the standard deduction for married couples filing jointly will increase to 29 200 an increase of 1 500 over the tax year 2023

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments...

Verkko 9 marrask 2023 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 14 600 for 2024 an increase of 750 from 2023 and

Your First Look At 2024 Tax Rates Brackets Deductions More KM M CPAs

What Is New For 2023 Tax Year Get New Year 2023 Update

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Married Withholding Rates 2024 Aurlie Trenna

The 2023 Tax Brackets By Income Modern Husbands

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Tax Married Filing Separately Vs Jointly Video Bokep Ngentot

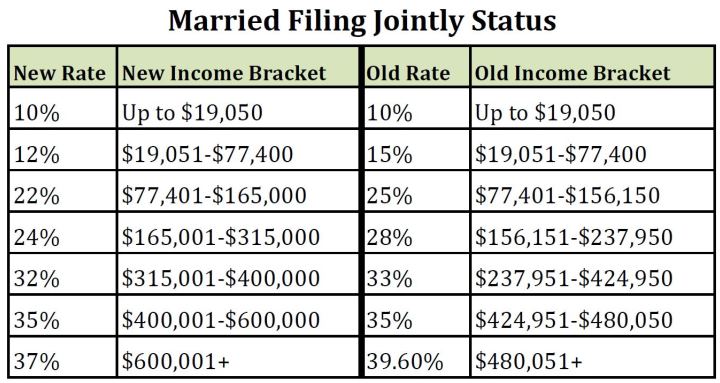

Married Taxpayers Filing Jointly

Married filing jointly tax brackets

Standard Tax Deduction 2024 Married Filing Jointly - Verkko 15 marrask 2023 nbsp 0183 32 The deduction set by the IRS for the 2024 tax year is as follows 14 600 for single filers 14 600 for married couples filing separately 21 900 for heads of households 29 200 for