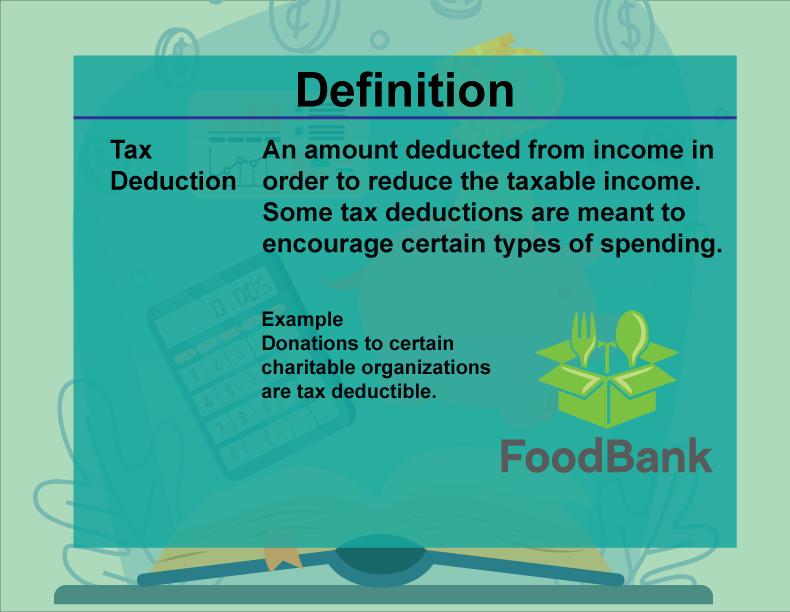

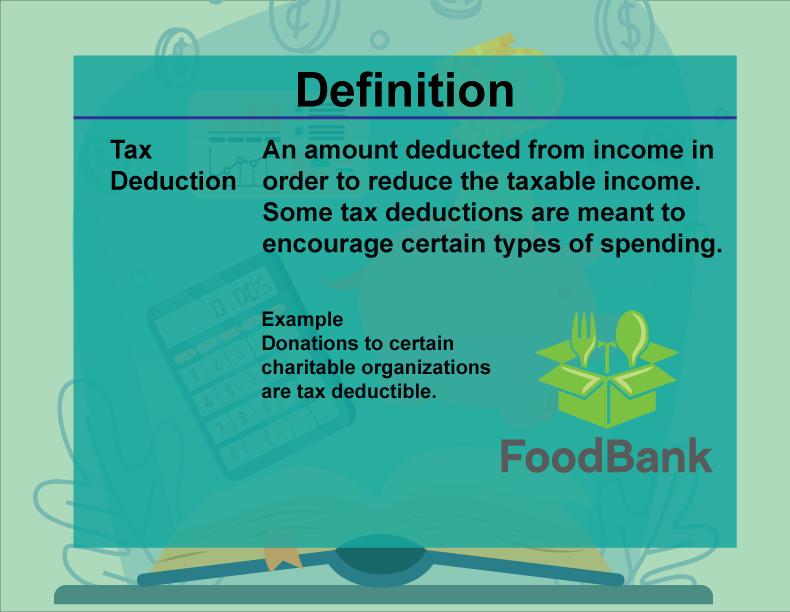

Standard Tax Deduction Definition A tax deduction reduces your taxable income and how much tax you owe You can itemize your deductions or take a fixed

Under United States tax law the standard deduction is a dollar amount that non itemizers may subtract from their income before income tax but not other kinds of tax such as payroll tax is applied Taxpayers may choose either itemized deductions or the standard deduction but usually choose whichever results in the lesser amount of tax payable The standard deduction is available to individuals who are US citizens or resident aliens The standard deduction is based on filing status The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic

Standard Tax Deduction Definition

Standard Tax Deduction Definition

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

What Is A Tax Deduction Definition Examples Calculation

https://i0.wp.com/biznessprofessionals.com/wp-content/uploads/2020/04/Copy-of-Copy-of-Copy-of-Copy-of-Untitled-Design-5.jpg?w=1000&ssl=1

What Is Tax Deduction Definition Types And Benefits

https://www.askbankifsccode.com/blog/wp-content/uploads/2023/04/What-is-Tax-Deduction-Definition-Types-and-Benefits-1024x576.jpg

Standard deduction The standard deduction amount increases slightly every year The standard deduction amount depends on the taxpayer s filing status The standard tax deduction is a fixed amount that the tax system lets you deduct from your income no questions asked

The standard deduction is a set amount based on tax filing status that reduces taxable income for the year The Internal Revenue Service IRS has revamped Form 1040 The standard deduction is a flat dollar amount set by the IRS based on your filing status It s the simplest way to reduce your taxable income on your tax return In fact

Download Standard Tax Deduction Definition

More picture related to Standard Tax Deduction Definition

:max_bytes(150000):strip_icc()/ItemizedDeduction-8e6b2aadaf8a4679b8371b744e3dfb85.jpg)

What Are Itemized Tax Deductions Definition And Impact On Taxes

https://www.investopedia.com/thmb/9IDo2XOws1VT7CE4ueWwb0IwS7Y=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ItemizedDeduction-8e6b2aadaf8a4679b8371b744e3dfb85.jpg

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1588xN.5462529921_cvyy.jpg

Tax Deduction Definition Types And Benefits

https://www.mudranidhi.com/wp-content/uploads/2023/05/Tax-Deduction-Definition-Types-and-Benefits-1024x576.jpg

The standard deduction reduces a taxpayer s taxable income by a set amount determined by the government It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for The standard deduction is a flat amount that you can deduct from your taxable income based on your filing status number of dependents and what year you re filing the taxes for Itemized

The standard deduction is a specific dollar amount that filers can subtract from their adjusted gross income This lowers how much of their income is subject to tax The IRS adjusts The 2023 Standard Deduction is 13 850 for taxpayers filing as Single or Married Filing Separately 20 800 if you re filing as Head of Household 27 700 for

Definition Financial Literacy Tax Deduction Media4Math

https://www.media4math.com/sites/default/files/library_asset/images/Definition--FinancialLiteracy--TaxDeduction.png

Itemized Deduction Definition TaxEDU Tax Foundation

https://files.taxfoundation.org/20190307135332/PaF-Chart-8.png

https://www.investopedia.com/terms/t/t…

A tax deduction reduces your taxable income and how much tax you owe You can itemize your deductions or take a fixed

https://en.wikipedia.org/wiki/Standard_deduction

Under United States tax law the standard deduction is a dollar amount that non itemizers may subtract from their income before income tax but not other kinds of tax such as payroll tax is applied Taxpayers may choose either itemized deductions or the standard deduction but usually choose whichever results in the lesser amount of tax payable The standard deduction is available to individuals who are US citizens or resident aliens The standard deduction is based on filing status

Premium Photo Tax Deduction

Definition Financial Literacy Tax Deduction Media4Math

Pre Tax Deduction Technology Glossary Definitions G2

Tax Rates Absolute Accounting Services

What Will My Tax Deduction Savings Look Like The Motley Fool

What Are Pre tax Deductions Before Tax Deduction Guide

What Are Pre tax Deductions Before Tax Deduction Guide

What Is TAX DEDUCTION In This Video We Simply Define tax Deduction

What Is A Tax Deduction

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Standard Tax Deduction Definition - The standard tax deduction is a fixed amount that the tax system lets you deduct from your income no questions asked