Star Health Insurance Income Tax Deduction To claim tax deductions on health insurance premiums you must follow these steps Check your eligibility You can claim a deduction on the health insurance premium paid for yourself your spouse

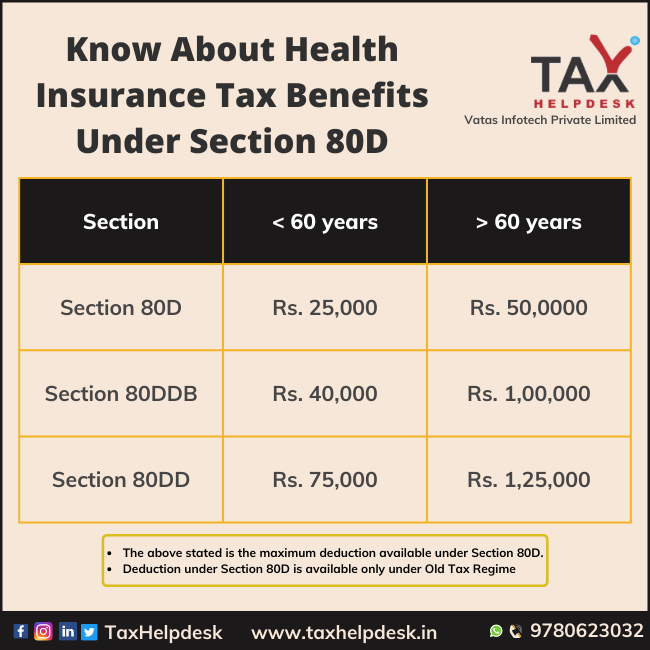

Section 80D of the Income Tax Act is a provision that allows taxpayers to claim deductions on their taxable income for amounts paid as medical insurance premiums Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn

Star Health Insurance Income Tax Deduction

Star Health Insurance Income Tax Deduction

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

Deduction Of Tax From Salaries During The Financial Year 2021 22

https://govtempdiary.com/wp-content/uploads/2022/04/IT.jpg

Section 80D Deduction In Respect Of Health Or Medical Insurance

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

Read this article to know about the deduction under section 80D or Income tax deduction in respect of medical insurance premia Let s understand how your medical and health insurance can be used for tax deduction under this clause 1 Eligibility for deductions The deduction under Section

Tax Benefits Payment of premium by any mode other than cash for this insurance is eligible relief under Section 80D of the Income Tax Act 1961 The Company Star Star health insurance premium is eligible for tax saving benefits as per the Income Tax Act As per Section 80D the premium paid towards buying or renewing medical insurance

Download Star Health Insurance Income Tax Deduction

More picture related to Star Health Insurance Income Tax Deduction

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

Tax Deduction Thailand 2022 Pay Less With Health Insurance

https://blog.lumahealth.com/hubfs/Blogs/Tax reduction/Tax deduction - banner.png

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Section 80D of the Income Tax Act allows you to get a tax deduction of up to Rs 25 000 per year for any individual and family health insurance policy covering self spouse The section offers tax deductions on the premium paid towards a health insurance plan for self dependent parents spouse and dependent children in a financial year The section

Under Section 80D a resident individual can claim a tax deduction of up to 25 000 in a year for medical insurance premiums paid for self spouse and children and Section 80D allows a tax deduction of up to 25 000 per financial year on medical insurance premiums for non senior citizens and 50 000 for senior citizens This limit also includes

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

https://i0.wp.com/komplytek.com/blogs/wp-content/uploads/2022/07/Income-Tax-Deduction-on-Crytocurrency.png?fit=5001%2C2626&ssl=1

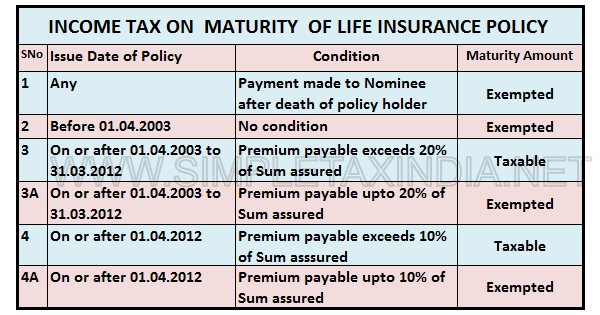

INCOME TAX ON MATURITY OF LIFE INSURANCE POLICY SIMPLE TAX INDIA

https://4.bp.blogspot.com/-34F_fiM0kIs/WynNwKRxE3I/AAAAAAAAElM/lwJ_1YFIX9gaCAKURaYu5ohFJR9T5eRwACLcBGAs/w1200-h630-p-k-no-nu/INCOME%2BTAX%2BON%2B%2BMATURITY%2B%2BOF%2BLIFE%2BINSURANCE%2BPOLICY.png

https://www.starhealth.in/blog/tax-dedu…

To claim tax deductions on health insurance premiums you must follow these steps Check your eligibility You can claim a deduction on the health insurance premium paid for yourself your spouse

https://www.starhealth.in/blog/what-is-section-80d...

Section 80D of the Income Tax Act is a provision that allows taxpayers to claim deductions on their taxable income for amounts paid as medical insurance premiums

INCOME TAX DEDUCTION 2023 24 Financesjungle

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

Income Tax Deductions For The FY 2019 20 ComparePolicy

Benefits Of Filing Income Tax Return

Life Insurance Go For Participating Policies Now Insurance News

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Tax Deduction For Union Dues Included In The Budget Plan Ballotpedia News

2017 Publication 517 P517

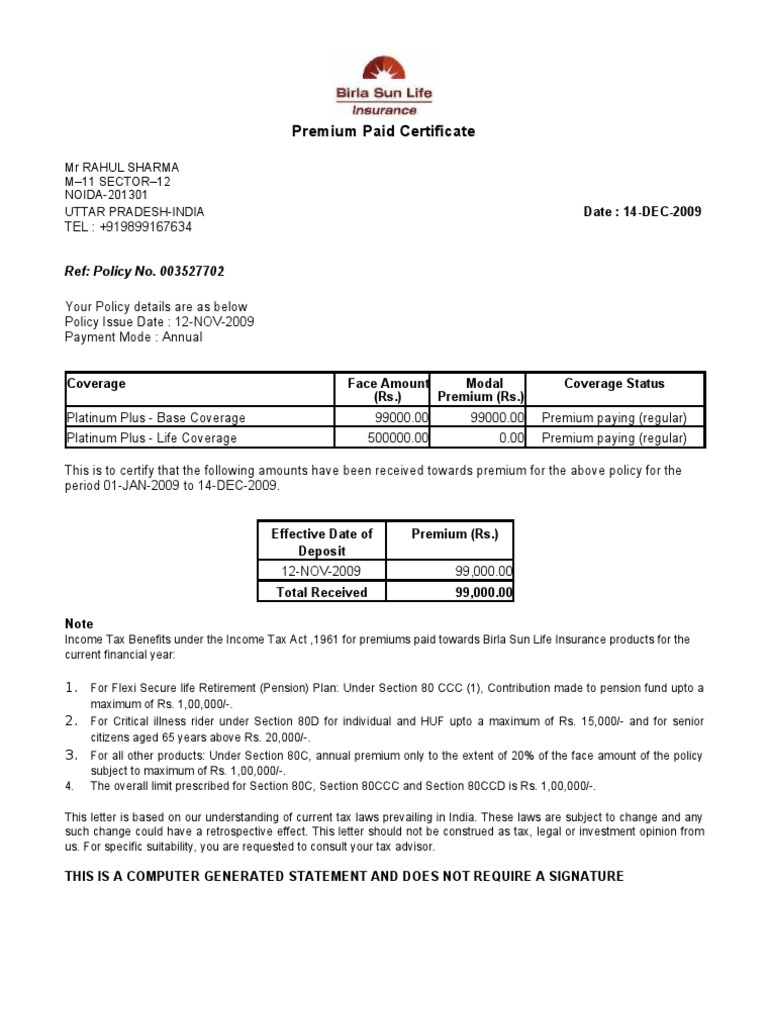

Premium Paid Certificate PDF

Star Health Insurance Income Tax Deduction - Star health insurance premium is eligible for tax saving benefits as per the Income Tax Act As per Section 80D the premium paid towards buying or renewing medical insurance