State And Local Taxes In Montana The State of Montana collects 5 065 in state and local tax collections per capita Montana has 5 185 in state and local debt per capita and has a 73 percent funded ratio of public

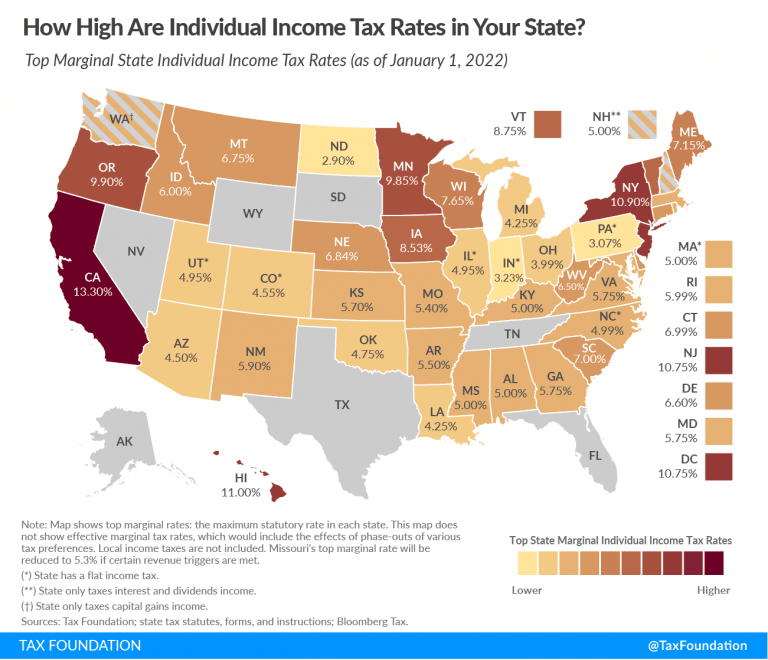

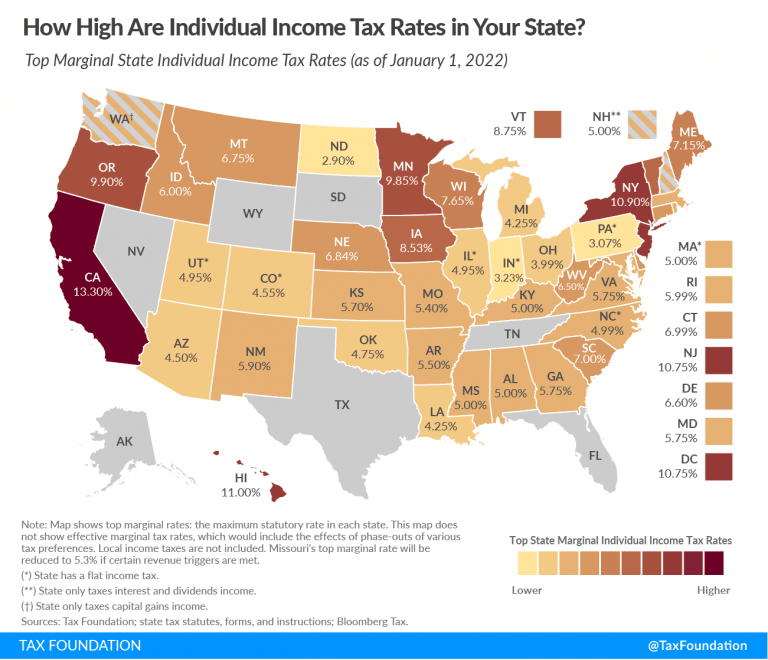

Montana has a progressive state income tax with a top rate of 6 75 Montana has only a few other types of taxes There is no sales tax in the state and property taxes are below the national average Enter your Montana state tax rates and rules for income sales property fuel cigarette and other taxes that impact residents

State And Local Taxes In Montana

State And Local Taxes In Montana

https://townsquare.media/site/1098/files/2020/02/Taxes-4.jpg?w=980&q=75

Montana Payroll Taxes A Complete Guide

https://www.deskera.com/blog/content/images/size/w1000/2022/04/MISSOURI-PAYROLL-TAXES--4-.png

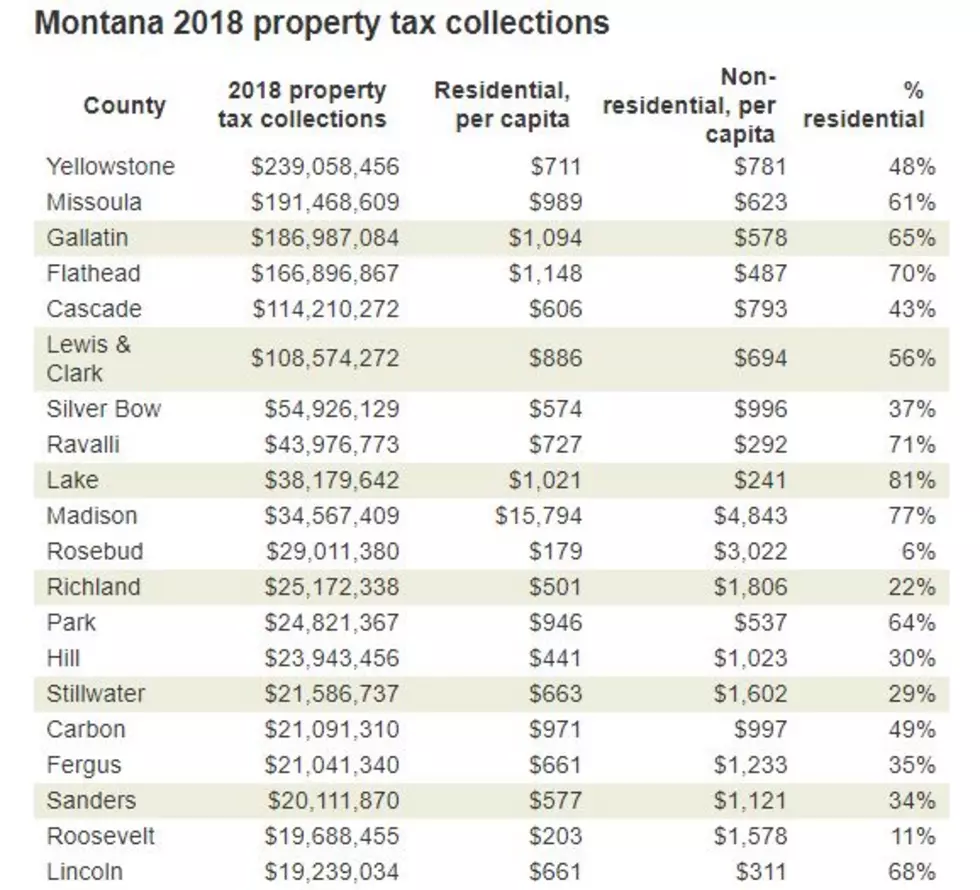

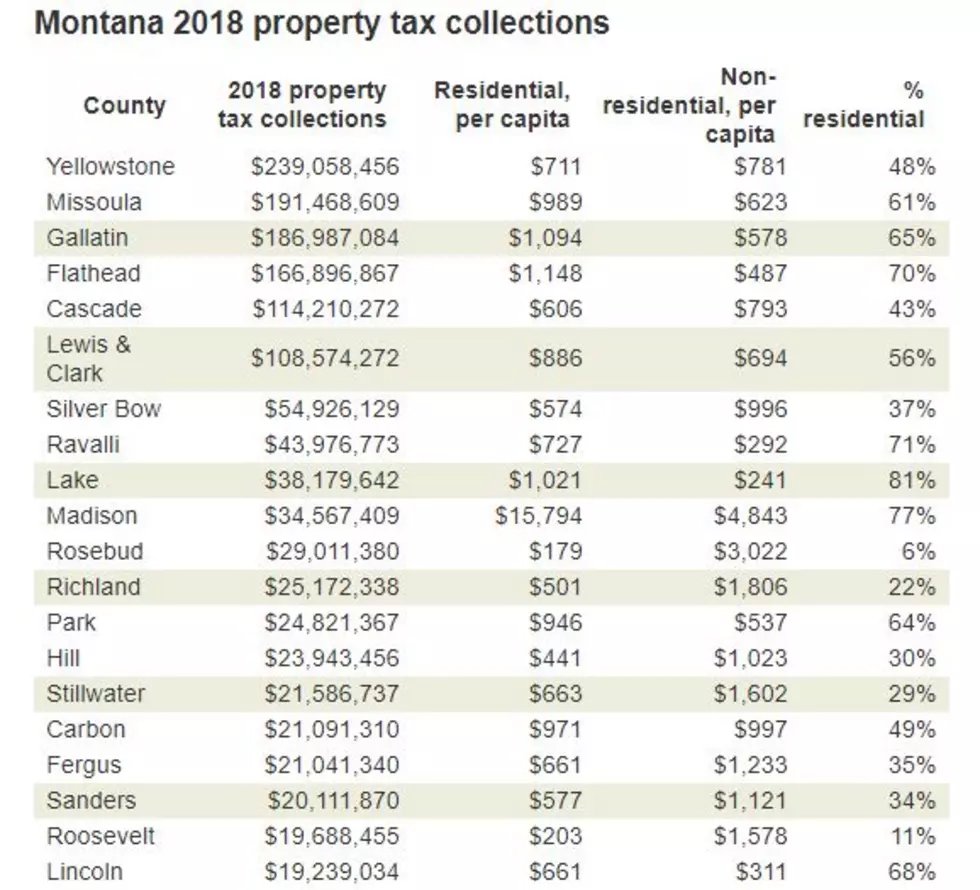

Property Taxes In Montana Where Do We Rank

https://townsquare.media/site/124/files/2021/02/Untitled-design-2021-02-25T083811.365.jpg?w=980&q=75

In Montana those with incomes below 18 000 pay 7 8 percent of their income in state and local taxes while those with income above 448 500 pay 6 5 percent The chart on the second page outlines the three main Tax Simplification Resource Hub Tax Year 2024 Resources for Individuals and Estates and Trusts Resources Filing and Payment Options Manage Tax Payments and Returns Online Need Help Citizen Service and

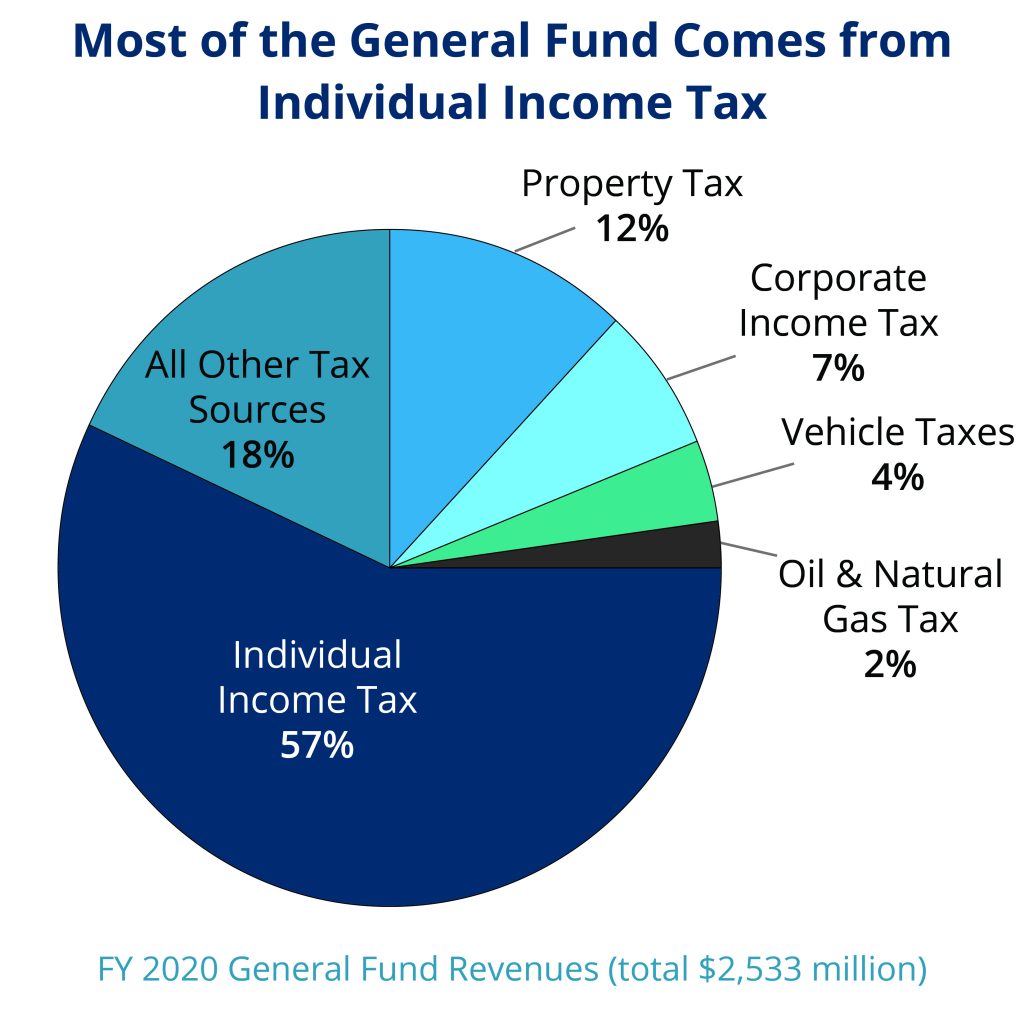

Compare total state and local tax burden by state Tax burdens rose across the country as pandemic era economic changes caused taxable income activities and property values Learn about individual income taxes in Montana that make up the single largest source of revenue comprising nearly 60 percent of the state s General Fund

Download State And Local Taxes In Montana

More picture related to State And Local Taxes In Montana

Montana Income Tax MT State Tax Calculator Community Tax

https://www.communitytax.com/wp-content/uploads/2020/01/image8.jpg

Hecht Group How To Pay Your Property Taxes Under Protest In Montana

https://img.hechtgroup.com/1665367487428.jpg

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

https://files.taxfoundation.org/20210707180628/2021-sales-taxes-by-state-2021-sales-tax-rates-by-state-2021-state-and-local-sales-tax-rates-July-2021-1200x1033.png

The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0 While Montana has no statewide sales tax some municipalities and cities In Montana families making less than 18 000 a year pay 7 9 percent of their income in state and local taxes while the top 1 percent of taxpayers those making more than

Montana State income tax rates are between 1 and 6 75 Most residents use the state s standard deductions and credits to minimize their taxes Factors like your age disability The Montana income tax has seven tax brackets with a maximum marginal income tax of 6 750 as of 2024 Detailed Montana state income tax rates and brackets are available

2022 State Income Tax Rate Map Arnold Mote Wealth Management

https://arnoldmotewealthmanagement.com/wp-content/uploads/2019/06/2022-state-income-tax-rate-map-768x660.png

Visualizing Taxes By State

https://cdn.howmuch.net/articles/133_Gas-Tax-per-Gallon-b125.jpg

https://taxfoundation.org/location/montana

The State of Montana collects 5 065 in state and local tax collections per capita Montana has 5 185 in state and local debt per capita and has a 73 percent funded ratio of public

https://smartasset.com/taxes/montana-t…

Montana has a progressive state income tax with a top rate of 6 75 Montana has only a few other types of taxes There is no sales tax in the state and property taxes are below the national average Enter your

Taxes Fees Montana Department Of Revenue

2022 State Income Tax Rate Map Arnold Mote Wealth Management

Report Shows That Households Making 25 000 Annually Pay 17 0 Of Their

Policy Basics Individual Income Taxes In Montana Montana Budget

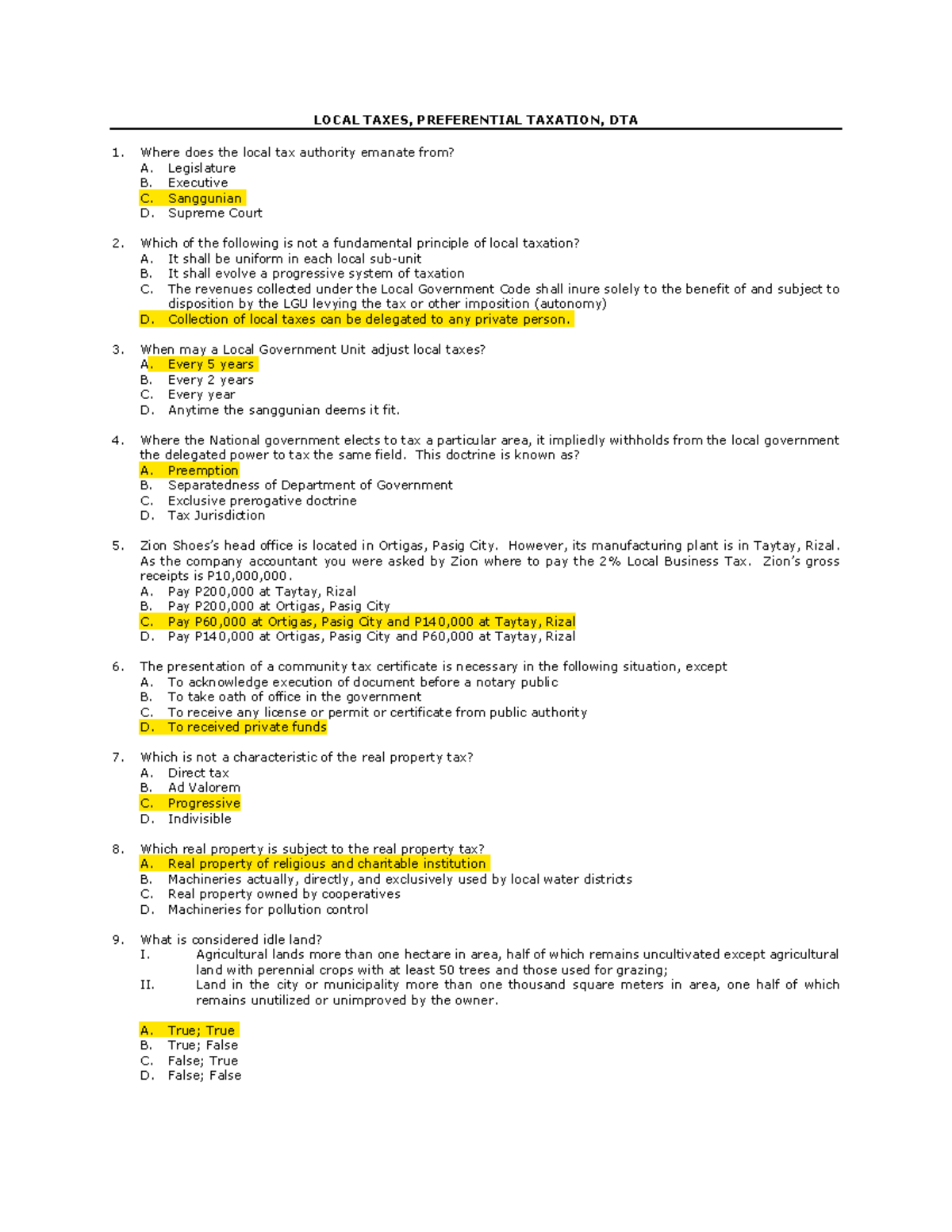

Local Taxes Lecture Notes LOCAL TAXES PREFERENTIAL TAXATION DTA

Is A Tax Surprise Waiting For You Dana McGuffin CPA Accounting

Is A Tax Surprise Waiting For You Dana McGuffin CPA Accounting

The Union Role In Our Growing Taxocracy California Policy Center

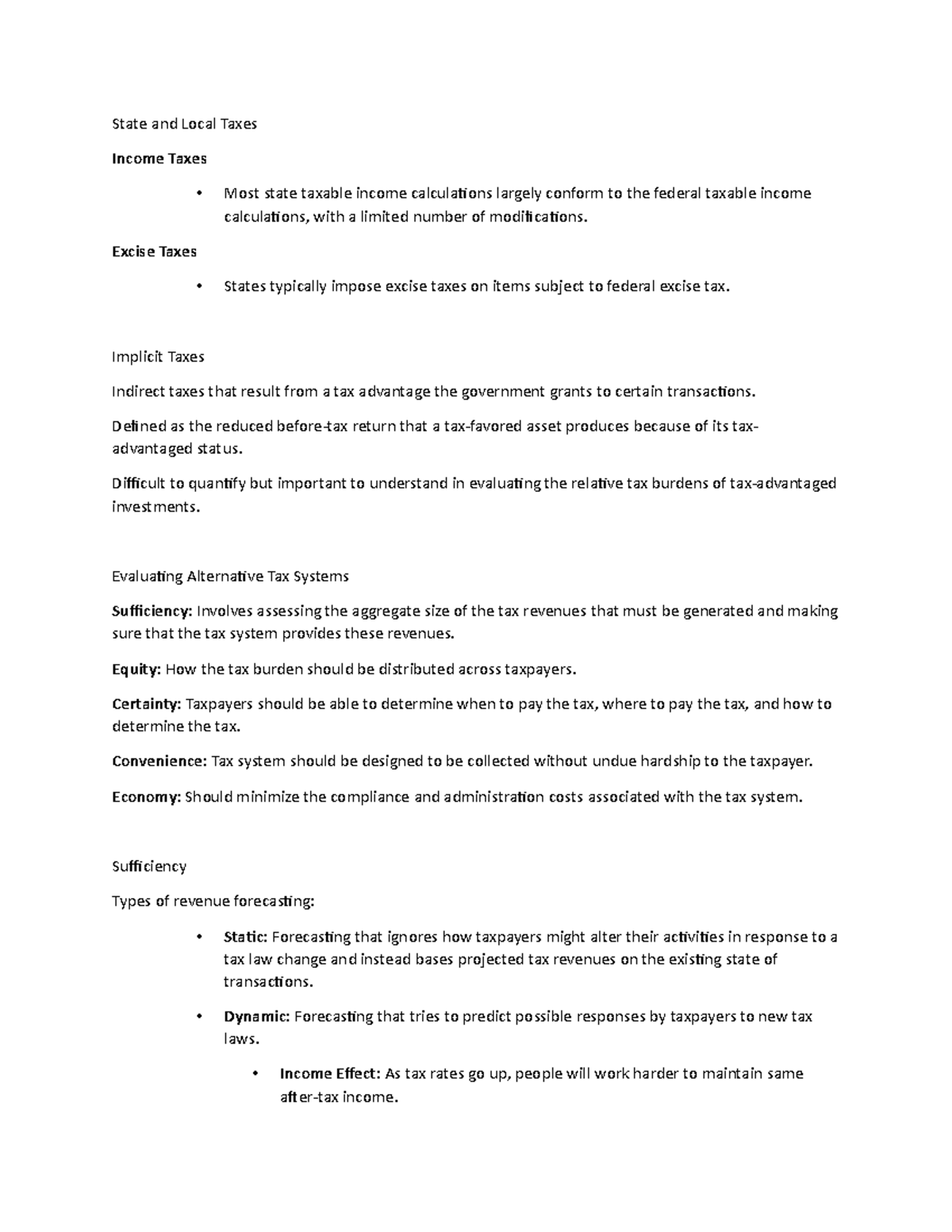

Lecture Notes 3 State And Local Taxes Income Taxes Most State

Montana State Taxes Tax Types In Montana Income Property Corporate

State And Local Taxes In Montana - Learn about individual income taxes in Montana that make up the single largest source of revenue comprising nearly 60 percent of the state s General Fund