State Of Florida Sales And Use Tax Web Florida Department of Revenue Florida Sales and Use Tax Page 1 Sales Tax Each sale admission purchase storage or rental in Florida is taxable unless the transaction is exempt Florida imposes a general state sales tax rate of 6 on sales and purchases of items services and transient rentals However other rates may apply such as

Web State Sales Tax Rate Imposed on Rentals Leases or Licenses to Use Real Property Reduced to 4 5 Effective December 1 2023 the state sales tax rate imposed under section 212 031 Florida Statutes F S on the total rent charged for renting leasing letting or granting a license to use real property commercial rentals is reduced from Web York corporate trancllise tax reforms multistate Pl 86 272 KPMG This Week in State Tax produced weekly by the KPMG State and Local Tax practice focuses on recent state and local tax developments Florida The Department of Revenue issued guidance on who is responsible for remitting sales and use

State Of Florida Sales And Use Tax

State Of Florida Sales And Use Tax

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/17-lovely-florida-tax-exempt-certificate.png

Florida State Sales Tax Exemption Form Example ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/state-sales-tax-state-sales-tax-exemption-florida.jpg

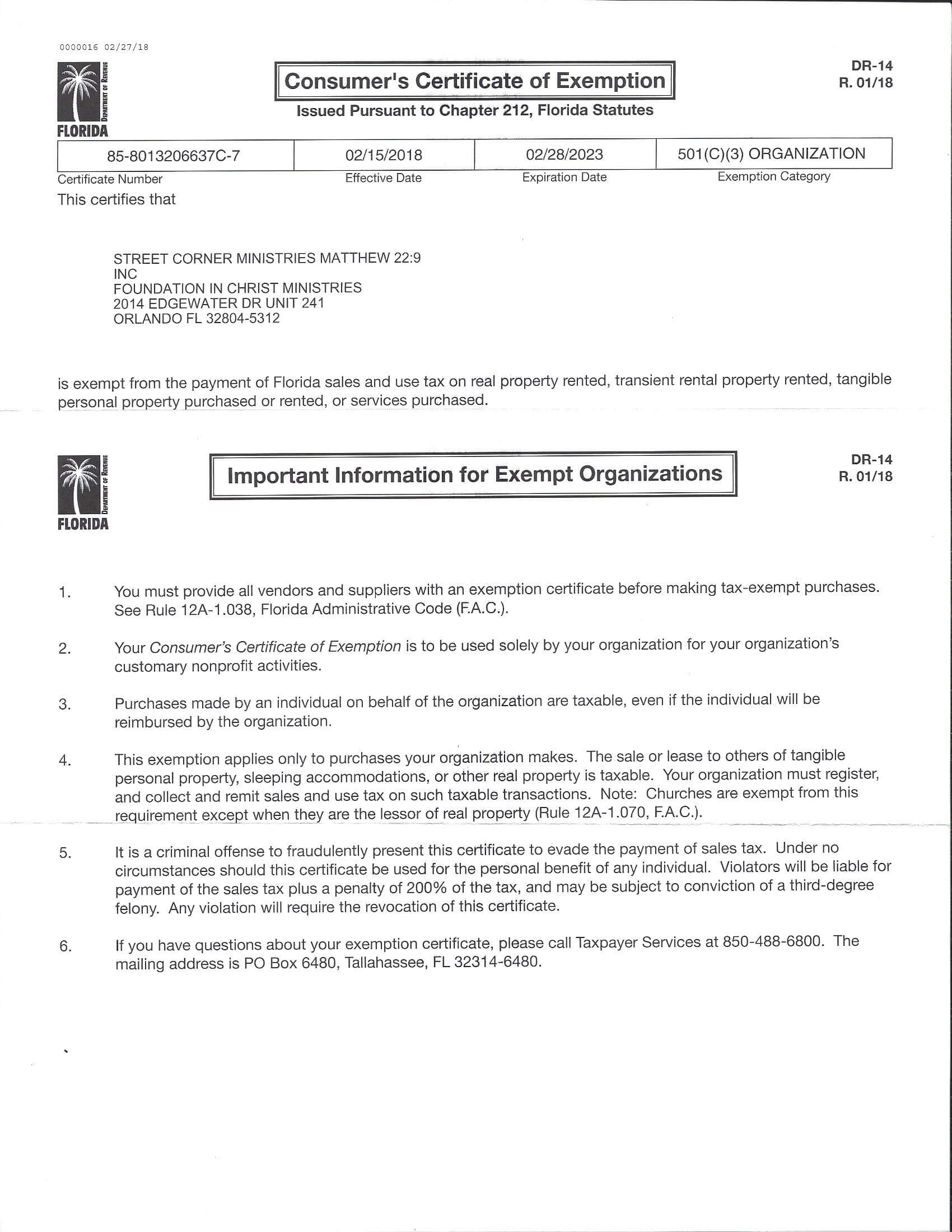

Florida Tax Information Publication 2024 Avis Kameko

https://eoqsmt5wite.exactdn.com/wp-content/uploads/FL-Sales-Tax-Exemption-Certificate.jpg?strip=all&lossy=1&w=2560&ssl=1

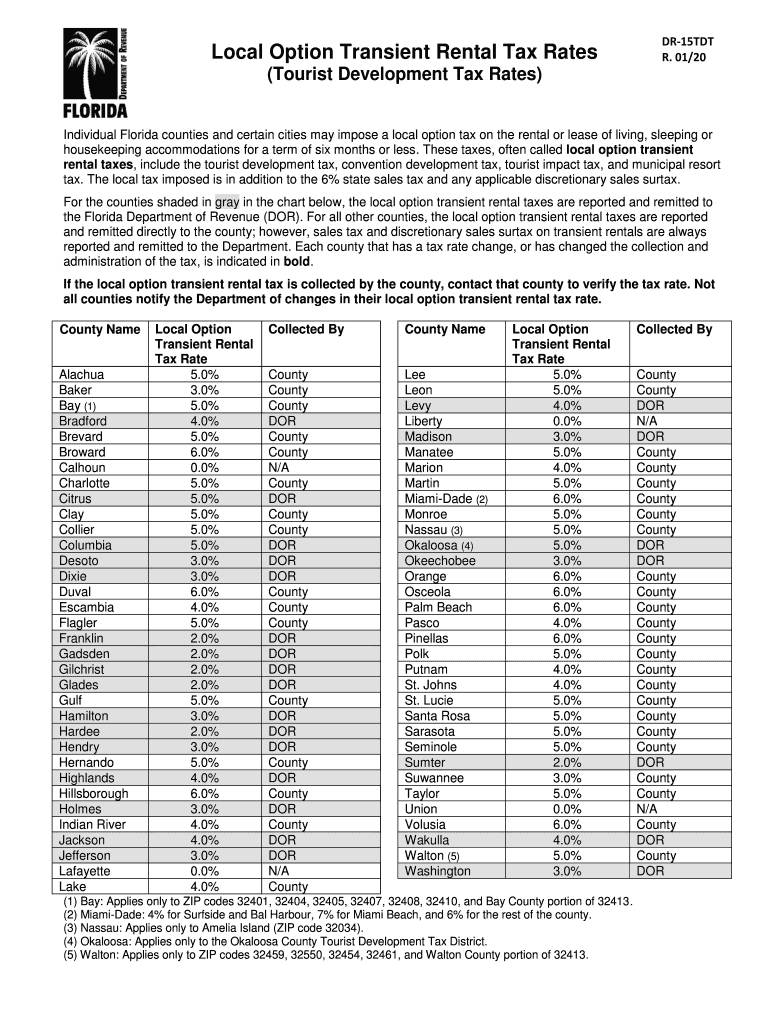

Web In addition to the Florida sales and use tax state rate n additional discretionary sales surtax Discretionary sales surtax rates vary by county Counties may charge a rate between 0 5 and 2 5 however there are some counties that do not impose a surtax New discretionary sales surtax rates become effective on January 1 and terminate on Web Municipal governments in Florida are also allowed to collect a local option sales tax that ranges from 0 to 1 5 across the state with an average local tax of 1 042 for a total of 7 058 when combined with the state sales tax The maximum local tax rate allowed by Florida law is 1 5 You can lookup Florida city and county sales tax rates

Web Florida sales tax details The Florida FL state sales tax rate is currently 6 Depending on city county and local tax jurisdictions the total rate can be as high as 8 In the state of Florida all sellers of tangible property or goods including leases licenses and rentals are required to register with the state and file and pay sales tax Web When tangible personal property is purchased in Florida sales tax is generally collected by the retailer at the point of sale Should it not be collected or if goods are purchased out of state and no tax is collected a use tax is likely due and it is up to the buyer to file it Use tax is one of the most overlooked and misunderstood taxes

Download State Of Florida Sales And Use Tax

More picture related to State Of Florida Sales And Use Tax

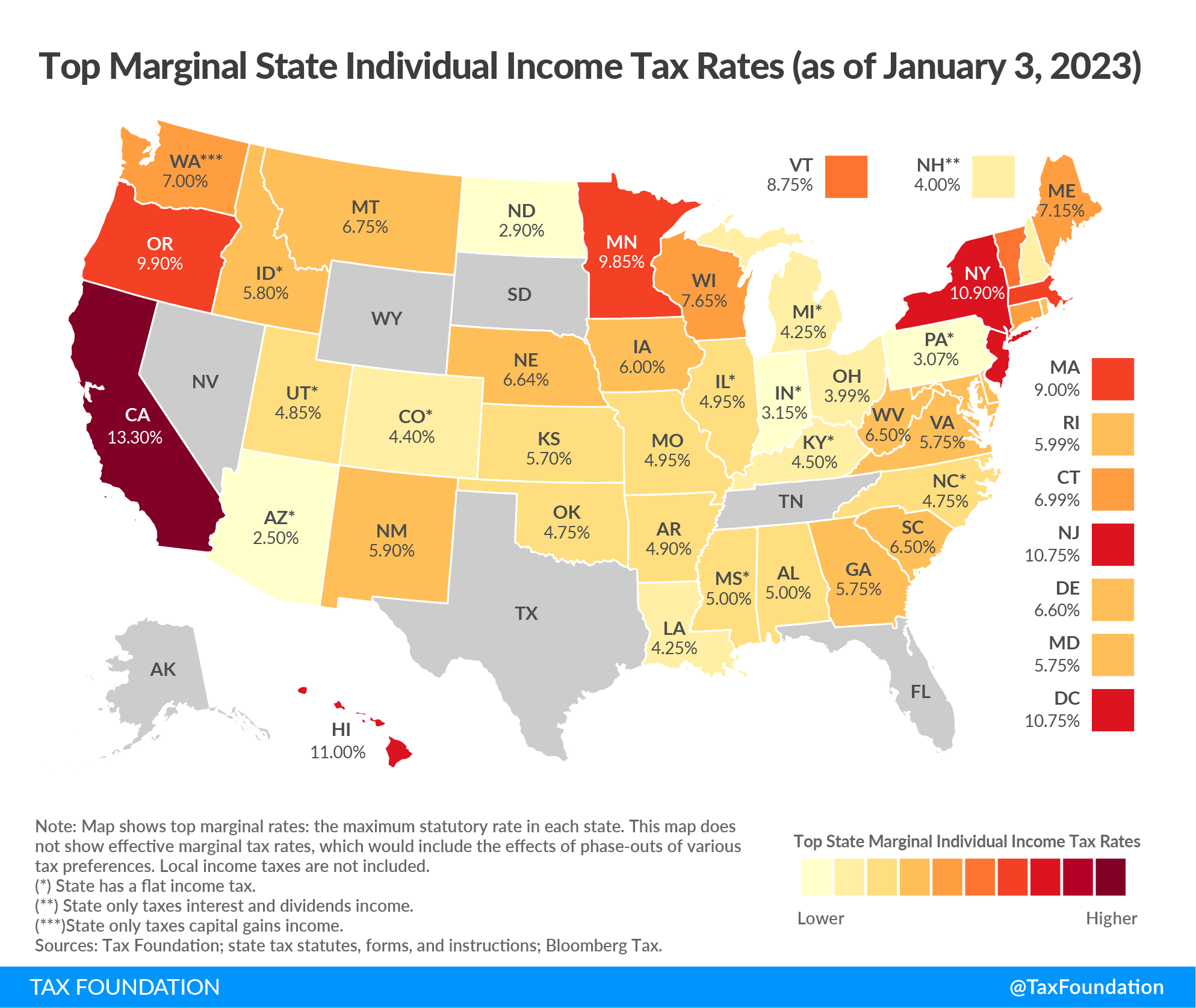

2023 State Income Tax Rates And Brackets Tax Foundation

https://taxfoundation.org/wp-content/uploads/2023/02/2023-state-individual-income-tax-rates-2023-state-income-taxes-by-state.png

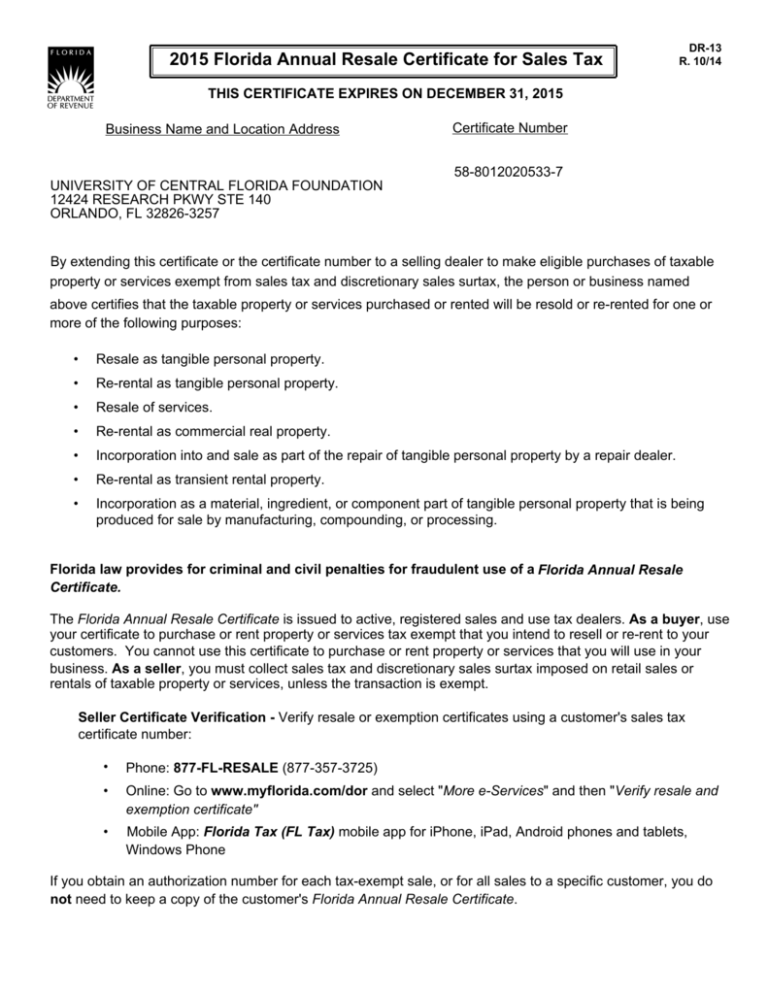

2015 Florida Annual Resale Certificate For Sales Tax

https://s3.studylib.net/store/data/008282993_1-8a7c8c08753fcdd6b90b038d7d7079ed-768x994.png

Florida Sales And Use Tax Florida Dept Of Revenue Fill Out And Sign

https://www.signnow.com/preview/493/895/493895268/large.png

Web 18 Juni 2017 nbsp 0183 32 On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 10 and 2 percent Currently combined sales tax rates in Florida range from 6 3 to 8 3 percent depending on the location of the sale As a business owner selling taxable goods or Web 13 Aug 2023 nbsp 0183 32 The current sales tax in Florida as of 2023 is 6 Sales tax collection is overseen by the state s Department of Revenue DOR The final amount of certain sales is taxed at 6 and this is paid to the DOR There are certain transactions that are exempt from this sales tax This includes There is a 3 tax on the retail sale of a new mobile

Web 28 Nov 2023 nbsp 0183 32 Florida state sales tax rate The general state sales tax rate in Florida is 6 with some exceptions The exceptions are the tax on the retail sale of mobile homes 3 the tax on amusement Web Florida Department of Revenue The Florida Department of Revenue has three primary lines of business 1 Administer tax law for 36 taxes and fees processing nearly 37 5 billion and more than 10 million tax filings annually 2 Enforce child support law on behalf of about 1 025 000 children with 1 26 billion collected in FY 06 07 3 Oversee property

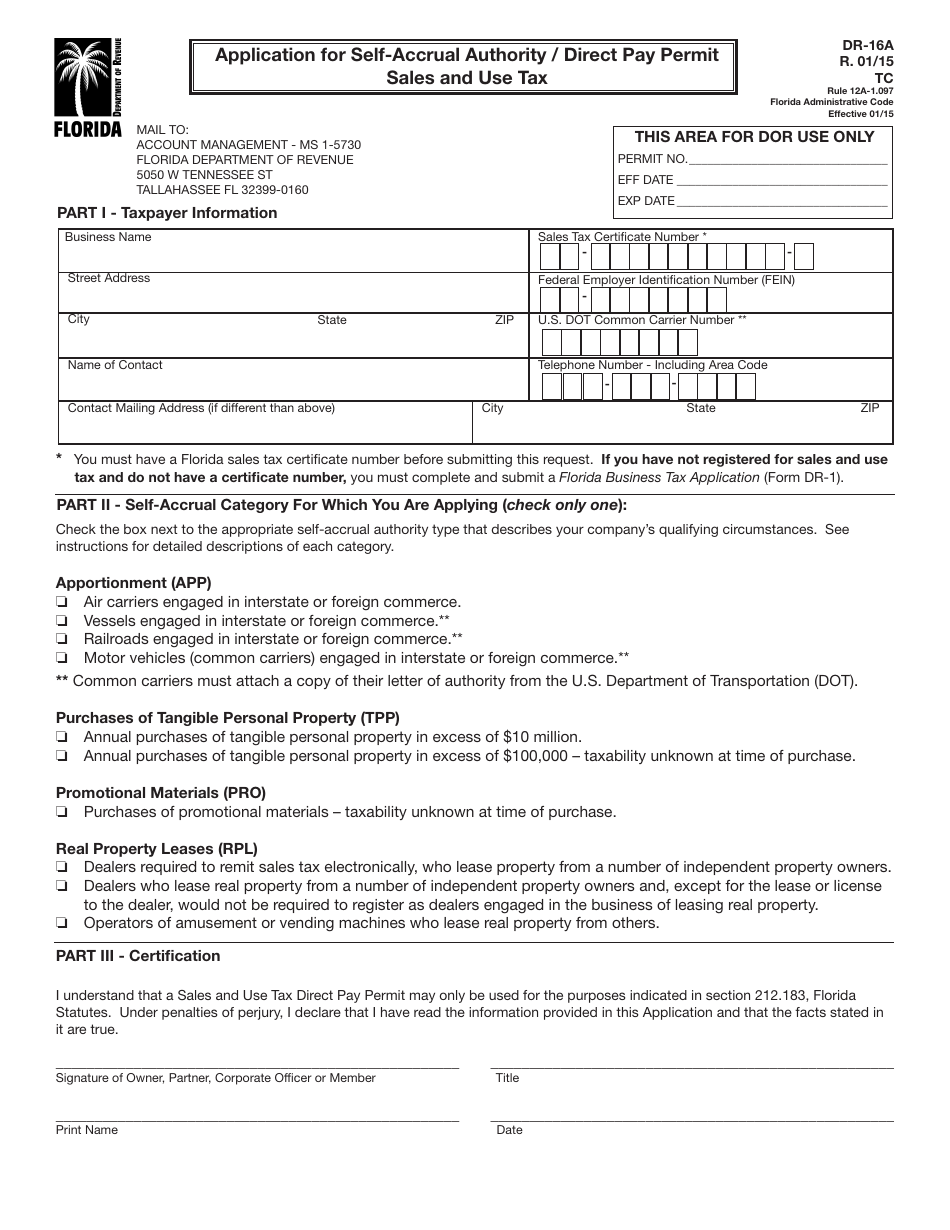

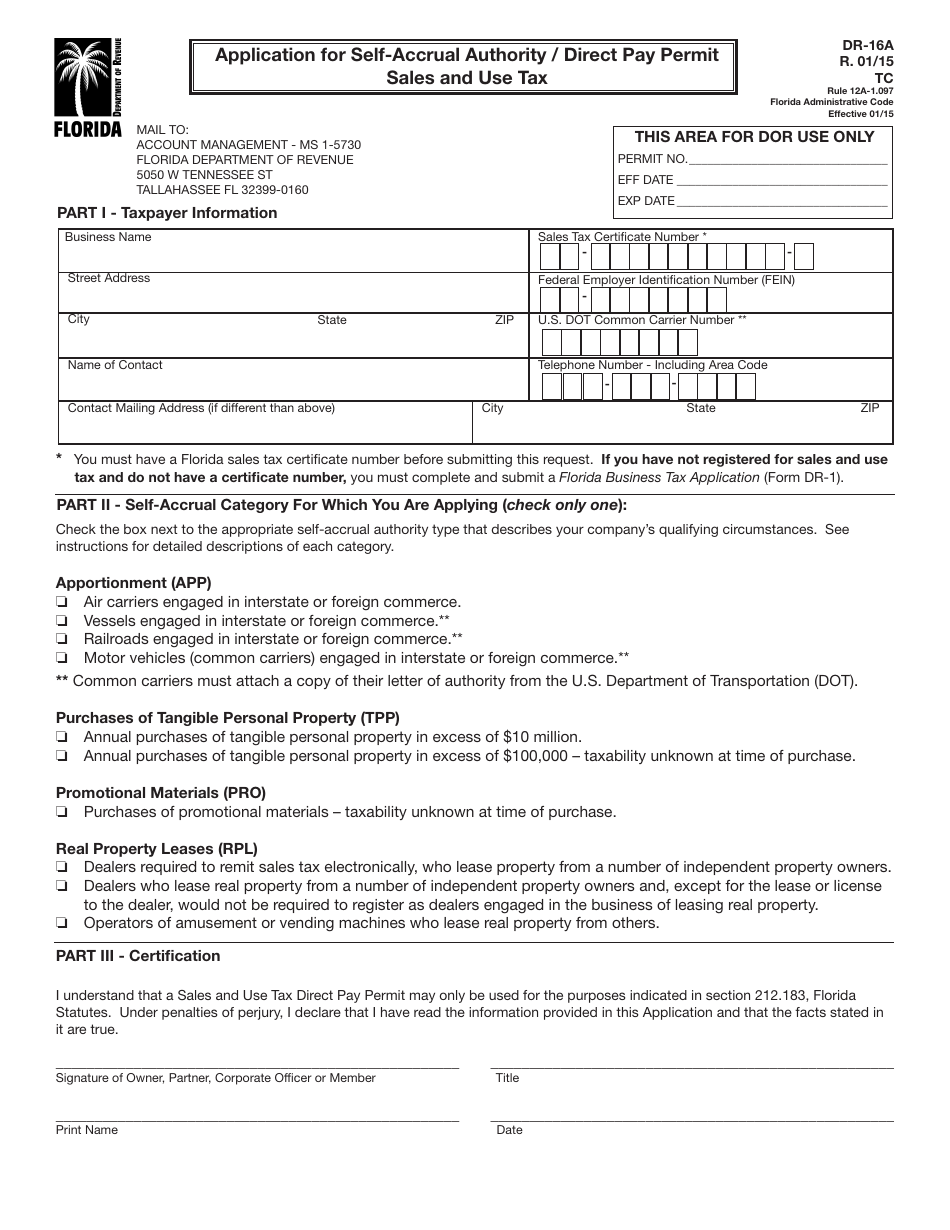

Form DR 16A Fill Out Sign Online And Download Printable PDF Florida

https://data.templateroller.com/pdf_docs_html/538/5384/538418/form-dr-16a-application-self-accrual-authority-direct-pay-permit-sales-and-use-tax-florida_print_big.png

Florida Sales Tax Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/6/954/6954626/large.png

https://floridarevenue.com/Forms_library/current/gt8000…

Web Florida Department of Revenue Florida Sales and Use Tax Page 1 Sales Tax Each sale admission purchase storage or rental in Florida is taxable unless the transaction is exempt Florida imposes a general state sales tax rate of 6 on sales and purchases of items services and transient rentals However other rates may apply such as

https://floridarevenue.com/taxes/tips/Documents/TIP_2…

Web State Sales Tax Rate Imposed on Rentals Leases or Licenses to Use Real Property Reduced to 4 5 Effective December 1 2023 the state sales tax rate imposed under section 212 031 Florida Statutes F S on the total rent charged for renting leasing letting or granting a license to use real property commercial rentals is reduced from

Florida Sales Tax Exemption Form Dr 13 ExemptForm

Form DR 16A Fill Out Sign Online And Download Printable PDF Florida

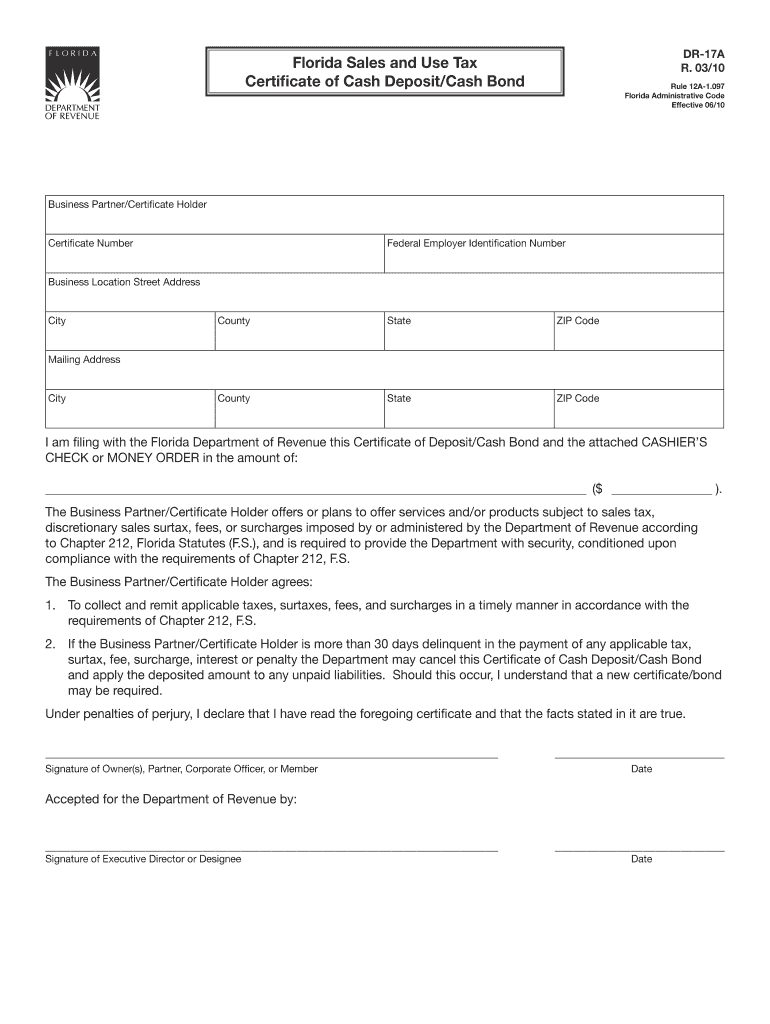

Florida Sales And Use Tax Certificate Of Cash Deposit Formula Fill

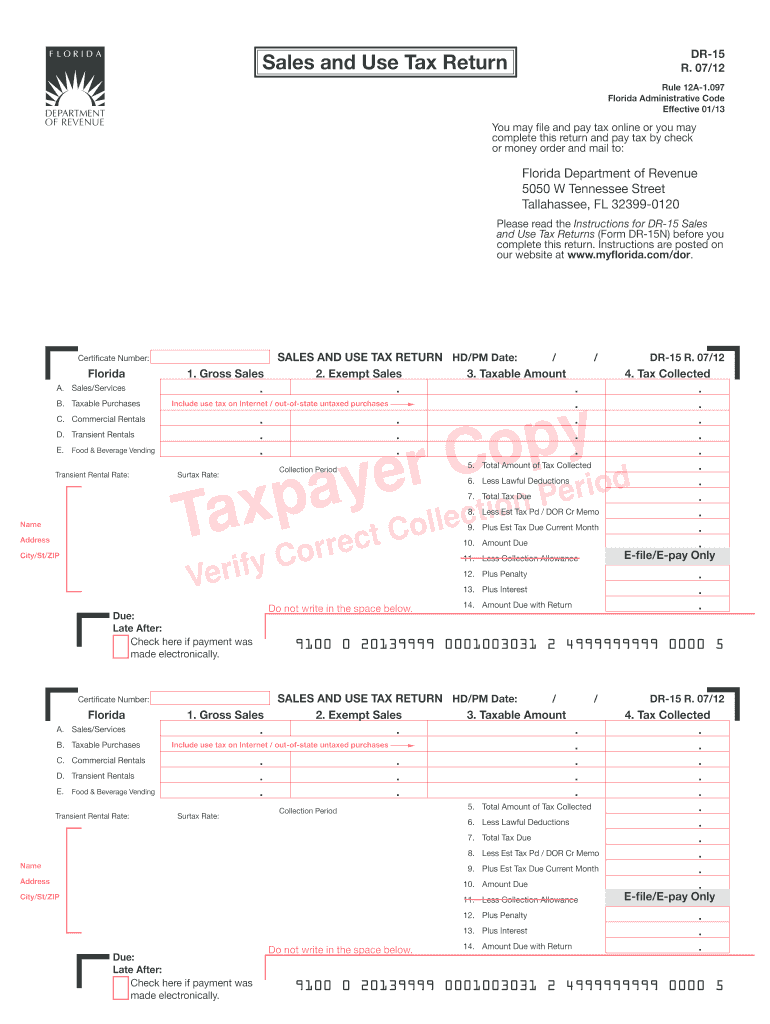

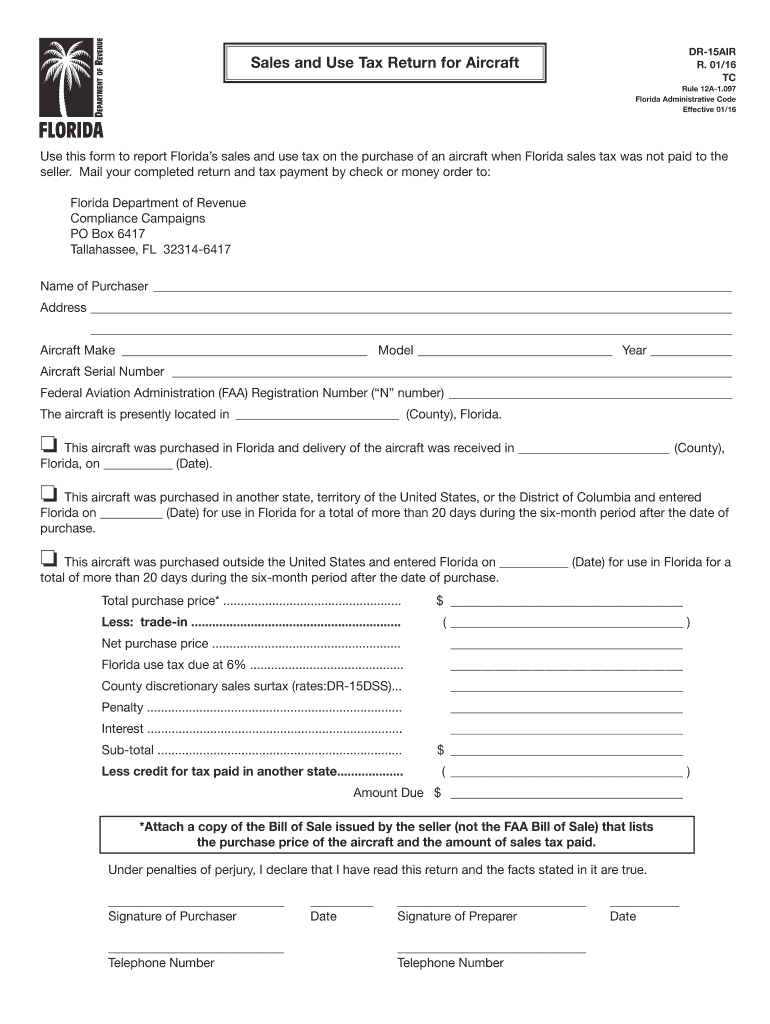

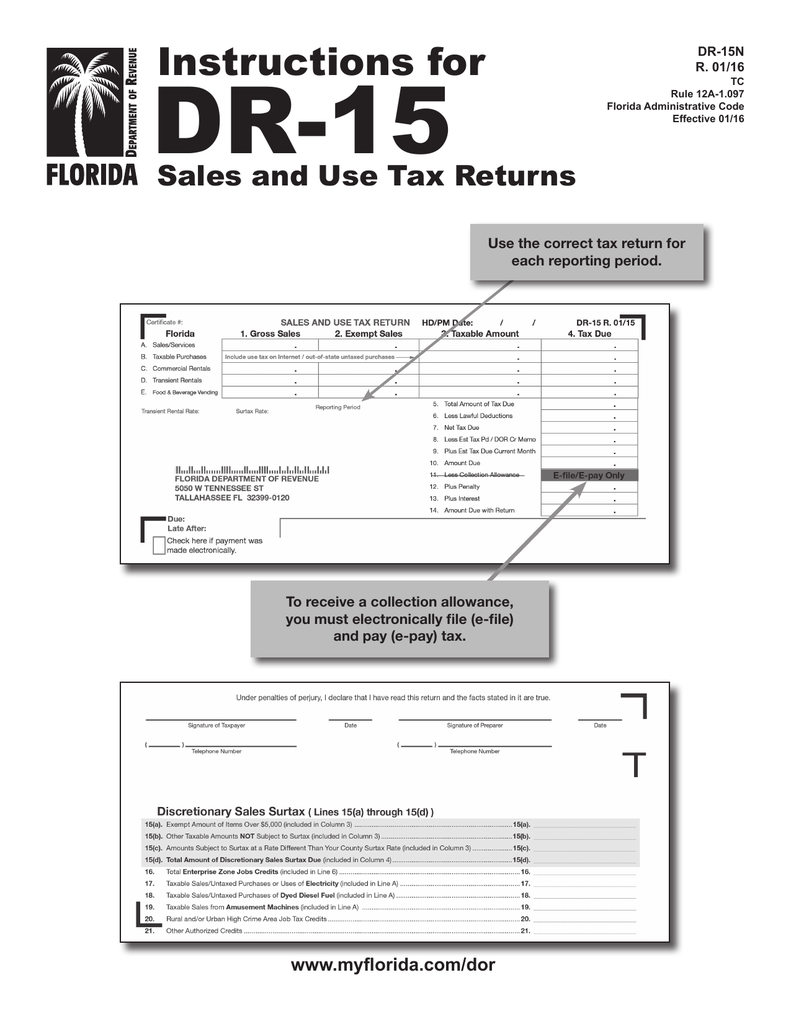

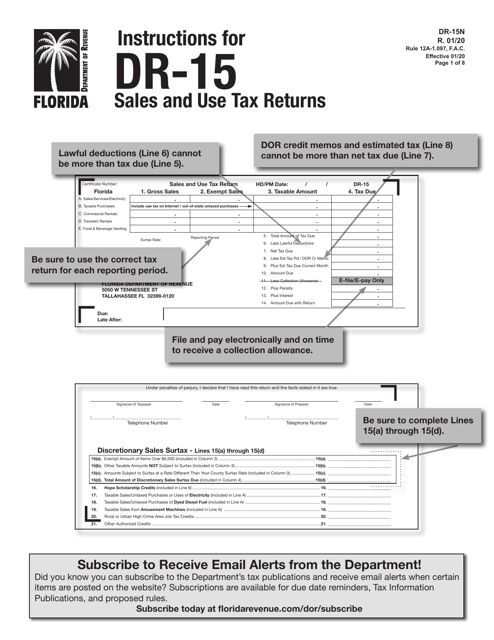

Sales And Use Tax Returns Florida Department Of Revenue

Download Instructions For Form DR 15 Sales And Use Tax Return PDF

Florida Department Of Revenue Sales And Use Tax Certificate 305 300 0364

Florida Department Of Revenue Sales And Use Tax Certificate 305 300 0364

State Sales Tax State Sales Tax Florida

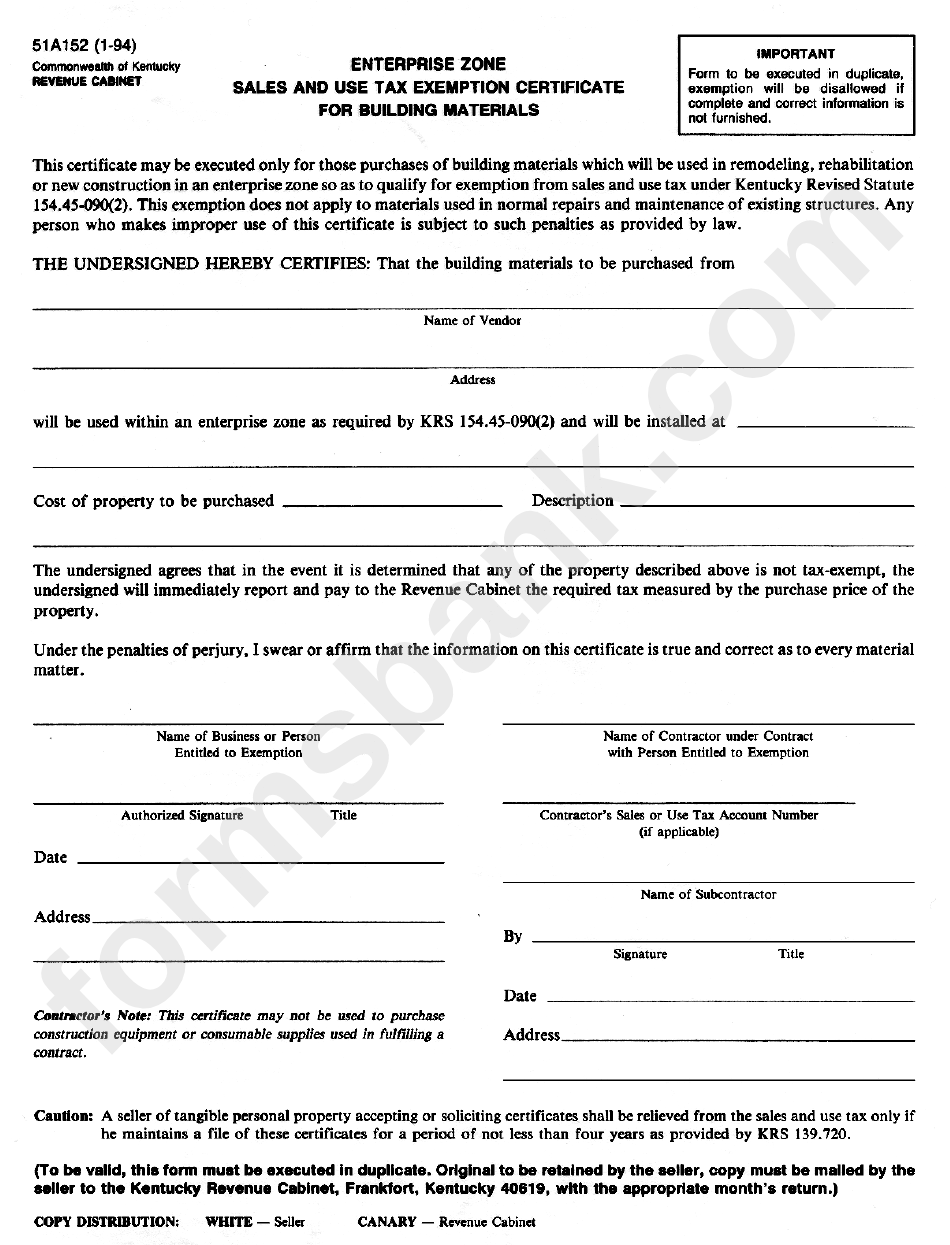

Form 51a152 Sales And Use Tax Exemption Certificate 1994 Printable

Dr 15ez Printable Form Printable Forms Free Online

State Of Florida Sales And Use Tax - Web In addition to the Florida sales and use tax state rate n additional discretionary sales surtax Discretionary sales surtax rates vary by county Counties may charge a rate between 0 5 and 2 5 however there are some counties that do not impose a surtax New discretionary sales surtax rates become effective on January 1 and terminate on