State Of Illinois Real Estate Tax Rebate 2024 The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own your residence in order to take this credit

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid Starting with property taxes due in tax year year 2023 which are due in 2024 a change in state law has permanently lowered the interest rate for eligible seniors who defer some or all of the property taxes they owe by participating in the Senior Citizen Real Estate Tax Deferral Program a State of Illinois program adminstered by county

State Of Illinois Real Estate Tax Rebate 2024

State Of Illinois Real Estate Tax Rebate 2024

https://www.pdffiller.com/preview/453/611/453611818/large.png

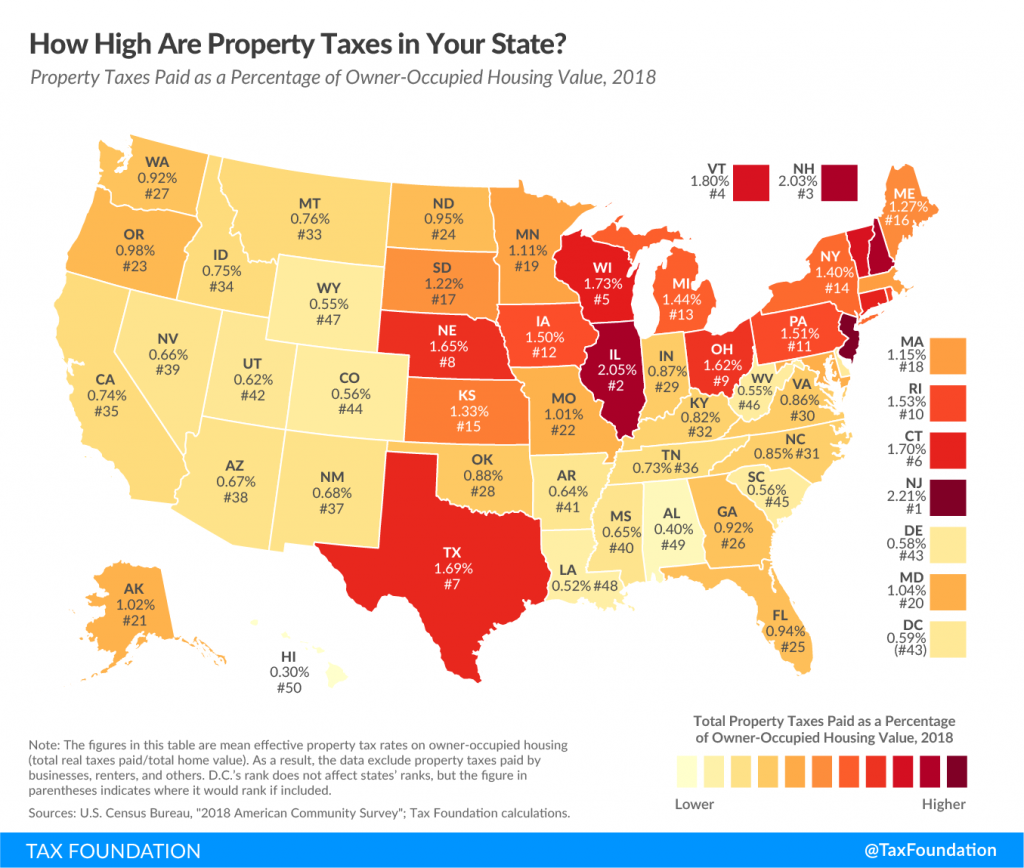

How High Are Property Taxes In Your State American Property Owners Alliance

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

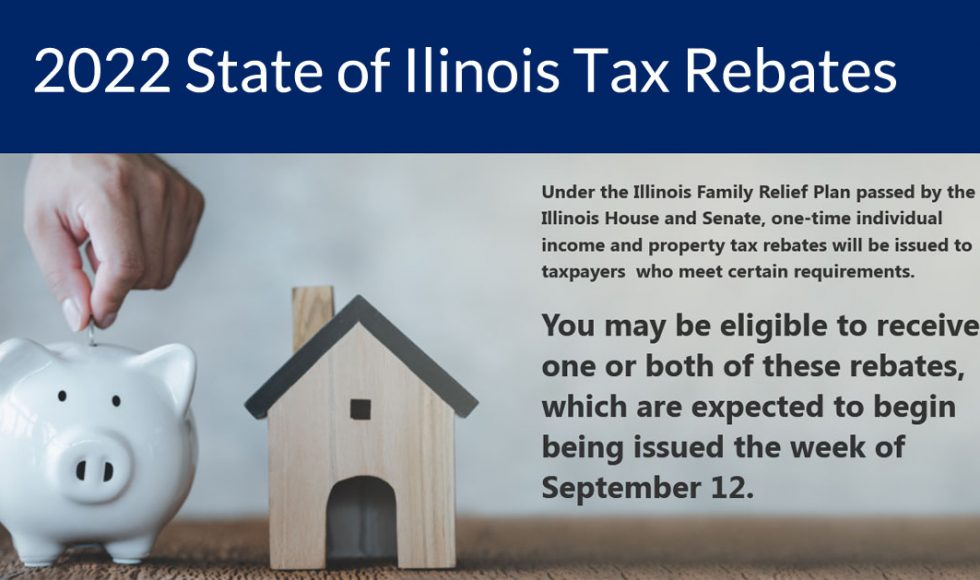

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/42b0372/2147483647/strip/true/crop/758x413+0+0/resize/1760x958!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

A tax credit used by millions of Illinois residents that lawmakers quietly pared back last year is getting more generous in the new state budget approved by the legislature and awaiting Gov J B Pritzker s signature It s called the standard exemption If your home was eligible for the Homeowner Exemption for past tax years including 2023 2022 2021 2020 or 2019 and the exemption was not applied to your property tax bill the Assessor s Office can help you obtain a refund through what is called a Certificate of Error

Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable residents including The Property Tax Rebate requires that recipients be Illinois residents who paid property taxes on their primary residence in 2021 and 2022

Download State Of Illinois Real Estate Tax Rebate 2024

More picture related to State Of Illinois Real Estate Tax Rebate 2024

Il 1040 Instructions Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/14/453014487/large.png

Property Taxes By State 2016 Eye On Housing Property Tax Estate Tax Tax

https://i.pinimg.com/originals/24/29/28/242928bdbdd8a19ed759e33061b9c191.png

The Real Estate Professional Rules What Counts As A Rental Activity

https://irstaxtrouble.com/wp-content/uploads/sites/5/2020/08/real-estate-tax-attorney-in-housto.jpg

A lien is filed on the property in order to ensure repayment of the deferral The state pays the property taxes and then recovers the money plus an amount of annual interest specified under the Senior Citizens Real Estate Tax Deferral Act when the property is sold or transferred Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020 and 2021 and your adjusted gross income on the 2021 Form IL 1040 must be under 250 000 for single filers and 500 000 for joint filers

Most Illinois taxpayers will be getting a tax rebate from the state all you need to know Distribution of the one time income and property tax rebates to qualifying Illinois residents starts Monday By Satchel Price Sept 9 2022 3 15am PDT Illinois state officials say it could take eight weeks to get the money to everyone who s eligible A newly proposed bill could help provide Illinoisans with up to 50 property tax relief by redirecting savings in the state budget to support local school districts

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And Strategies To Maximize Your

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-2023-Illinois.jpg?resize=978%2C781&ssl=1

U S Real Estate Property Tax Tax nYou

https://taxnyou.com/wp-content/uploads/2023/01/og.jpg

https://tax.illinois.gov/content/dam/soi/en/web/...

The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own your residence in order to take this credit

https://www.nbcchicago.com/news/local/you-may...

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have paid

IL Tax Rebates Set To Go Out Next Week See If You Qualify Across Illinois IL Patch

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And Strategies To Maximize Your

Illinois Tax Rebate 2022 Cray Kaiser

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Real Estate Tax 101 Zoom Luma

21 Differences Between Real Estate Tax And Property Tax

21 Differences Between Real Estate Tax And Property Tax

Tax Rebate FAQs Rep Thaddeus Jones

Tax Rebate Check 2023 Michigan Tax Rebate

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

State Of Illinois Real Estate Tax Rebate 2024 - If your home was eligible for the Homeowner Exemption for past tax years including 2023 2022 2021 2020 or 2019 and the exemption was not applied to your property tax bill the Assessor s Office can help you obtain a refund through what is called a Certificate of Error