State Of Illinois Tax Rebate 2024 CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue

The Property Tax Rebate requires that recipients be Illinois residents who paid property taxes on their primary residence in 2021 and 2022 Their adjusted gross income must be 500 000 or Taxpayers who did not file or are not required to file their 2021 IL 1040 individual income tax returns but want to claim both the property tax and individual income tax rebatesmust file Form IL

State Of Illinois Tax Rebate 2024

State Of Illinois Tax Rebate 2024

https://www.pdffiller.com/preview/453/611/453611818/large.png

Il 1040 Instructions Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/453/14/453014487/large.png

Illinois Electric Vehicle Rebate State Launches EV Program To Residents Offering Up To 4K For

https://cdn.abcotvs.com/dip/images/12010375_070122-wls-electric-vehicle-rebate-img.jpg?w=1600

The Illinois Department of Revenue IDOR announced on Thursday Jan 25 that it will begin accepting and processing 2023 tax returns on Monday Jan 29 the same date the Internal Revenue Service IRS begins accepting federal income tax returns We encourage taxpayers to file electronically as early as possible as this will speed processing The Tax tables below include the tax rates thresholds and allowances included in the Illinois Tax Calculator 2024 Illinois provides a standard Personal Exemption tax deduction of 2 625 00 in 2024 per qualifying filer and qualifying dependent s this is used to reduce the amount of income that is subject to tax in 2024

The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300 If filing jointly 500 000 is the maximum income permitted to receive the property tax rebate while 400 000 is the limit for income tax rebates Single filers can have adjusted gross incomes of

Download State Of Illinois Tax Rebate 2024

More picture related to State Of Illinois Tax Rebate 2024

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-768x994.png

Stadelman Encourages Older Adults To Claim Their Property Tax Rebate

https://www.senatorstadelman.com/images/PropertyTaxRebate_2022_FB.JPG

Retirees Need To Take Action For Latest Property Tax Rebate NPR Illinois

https://npr.brightspotcdn.com/dims4/default/42b0372/2147483647/strip/true/crop/758x413+0+0/resize/1760x958!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Fcf%2F92%2Fc1613a8b4b4ba9b8b28ebd901285%2Ftaxrebate.png

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to Illinois tax rebates are coming in time for the election FILE Illinois Gov J B Pritzker addresses reporters on April 7 2022 in Springfield Ill Democrats who run state government celebrated while announcing that tax rebate checks totaling more than 1 2 billion on Monday Sept 12 2022 began heading to 6 million taxpayers

Updated Jan 25 2024 03 51 PM CST ROCKFORD Ill WTVO The Illinois Department of Revenue IDOR announced Thursday that it will begin accepting and processing 2023 tax returns on January Illinois federal income tax season 2024 opens Monday Dave Dawson Assistant editor Jan 26 2024 The Illinois Department of Revenue is providing taxpayers with tips and alerting them to

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Homeowner Renters District 16 Democrats

https://ld16nj.com/wp-content/uploads/2022/10/Homeowners-2.jpg

https://news.yahoo.com/illinois-tax-season-2024-heres-210017466.html

CHICAGO The Illinois Department of Revenue has announced the start of the 2024 tax season accepting 2023 tax returns beginning on January 29 That aligns with when the Internal Revenue

https://www.nbcchicago.com/news/local/who-is-eligible-for-illinois-income-and-property-tax-rebates-heres-what-to-know/2928403/

The Property Tax Rebate requires that recipients be Illinois residents who paid property taxes on their primary residence in 2021 and 2022 Their adjusted gross income must be 500 000 or

2022 Illinois Tax Rebates Suzanne Ness State Rep Illinois 66

Missouri State Tax Rebate 2023 Printable Rebate Form

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

Illinois Income Tax Rebate 2023 Tax Rebate

2022 State Of Illinois Tax Rebates Scheffel Boyle

Illinois Tax Rebate 2022 Cray Kaiser

Illinois Tax Rebate 2022 Cray Kaiser

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

California Tax Rebate 2023 How To Claim And Eligibility Criteria Tax Rebate

Illinois Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

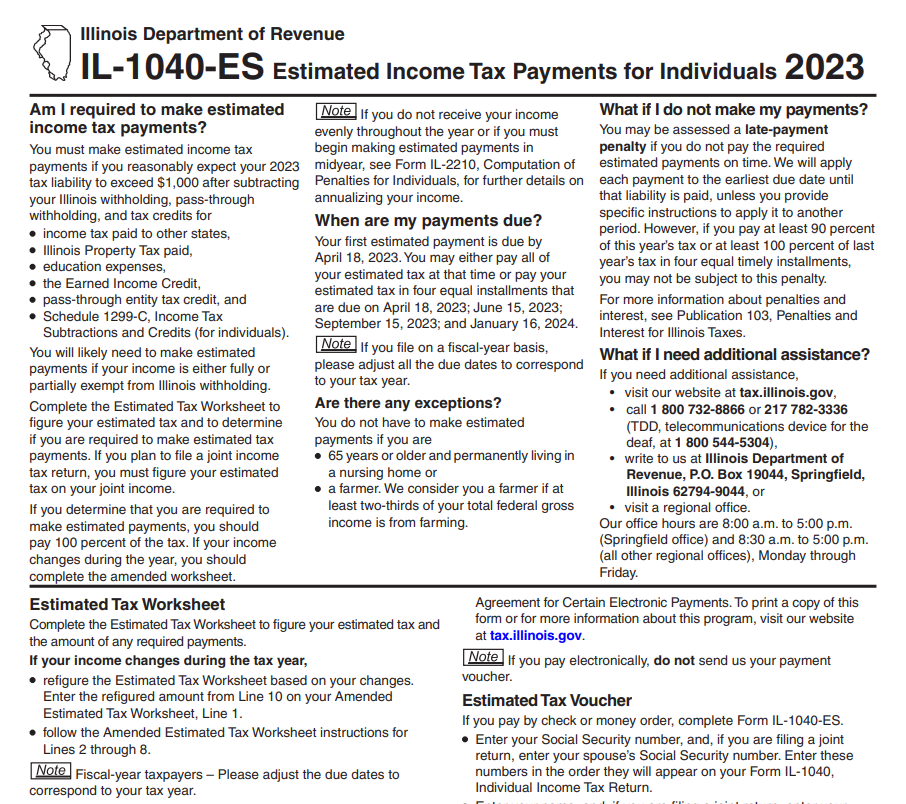

State Of Illinois Tax Rebate 2024 - The property tax rebate amount your clients can receive is equal to the property tax credit they were qualified to claim on the 2021 IL 1040 with a maximum credit of 300 State of Illinois The income tax rebate works in a similar manner allowing individuals to claim a credit of 50 each with an additional 100 per dependent up to 300