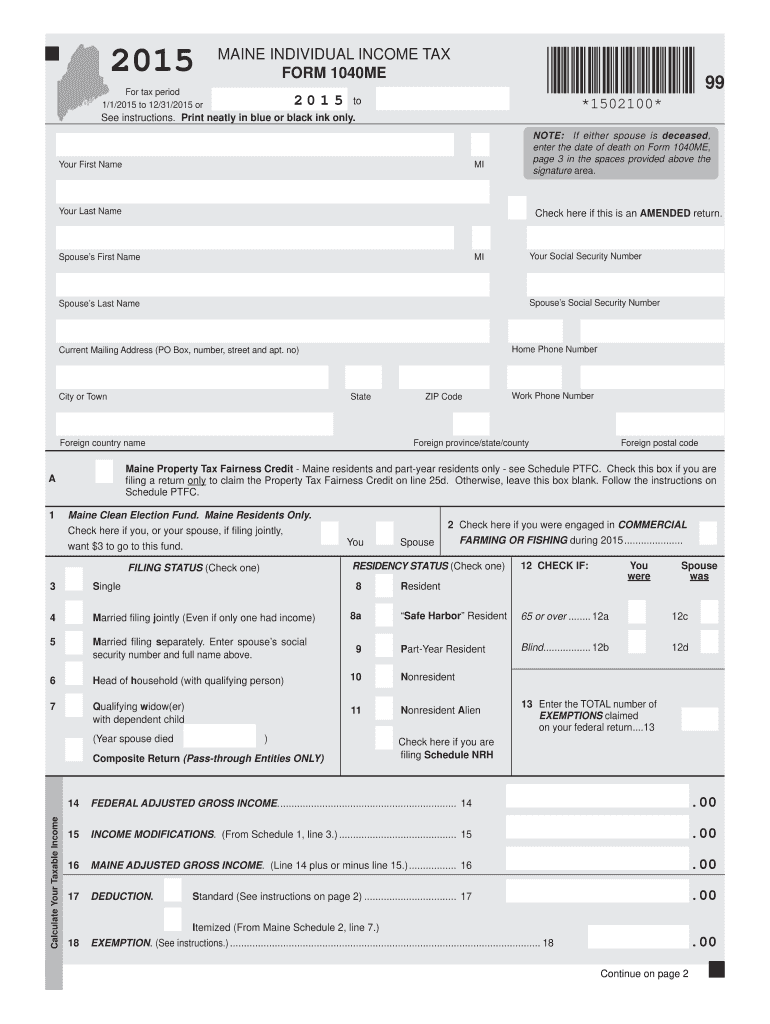

State Of Maine Property Tax Fairness Credit You may qualify for a refundable Property Tax Fairness Credit up to 1 000 1 500 if you are 65 years of age or older if you meet all of the following You were a Maine resident

Provided Direct Property Tax Relief to Maine Families Governor Mills expanded the Property Tax Fairness Credit to 83 000 Mainers by providing a one time boost in the Property tax fairness credit is the persons income including Social Security and railroad retirement benefits included in federal adjusted gross income This

State Of Maine Property Tax Fairness Credit

State Of Maine Property Tax Fairness Credit

https://www.spectrumgenerations.org/images/ibanners/0003.jpg

California Maine Become First States To Pass Cost of Living Refund

http://static1.squarespace.com/static/5acbc4bd0dbda3fb2fce2ab3/5b90592d758d46bfbe046f3c/5d0bcc6fc9bfcf00015b7f26/1561055816823/62017698_10156643014404751_1061460193218396160_n.jpg?format=1500w

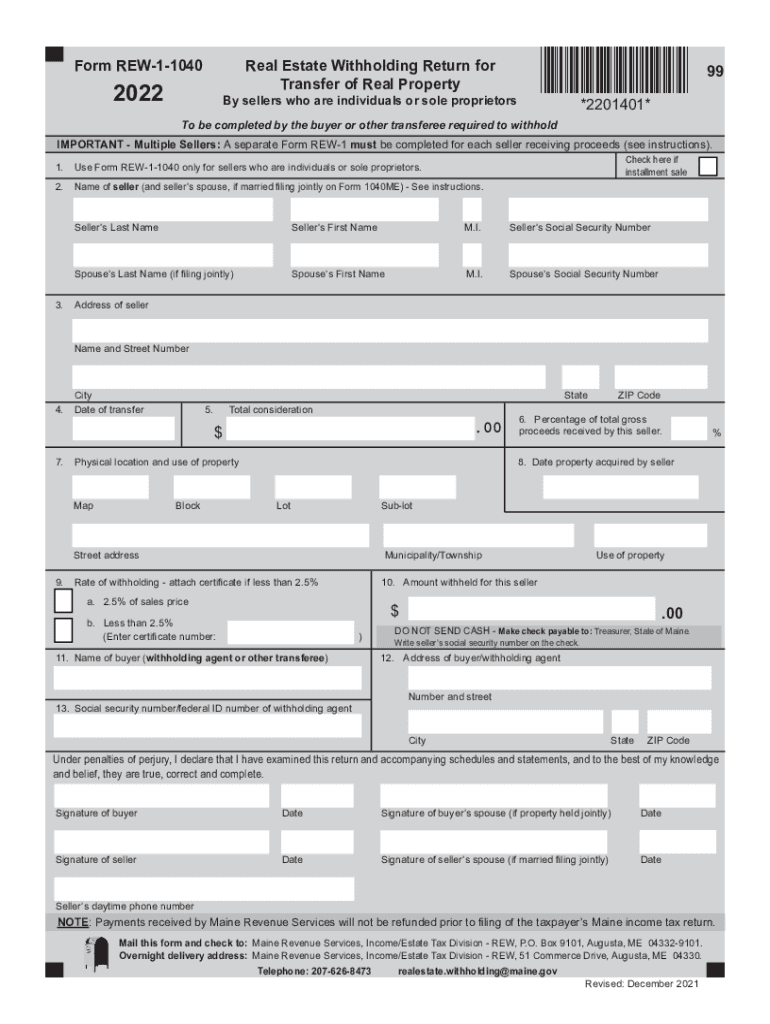

Maine Withholding Property 2022 2023 Form Fill Out And Sign Printable

https://www.signnow.com/preview/581/270/581270703/large.png

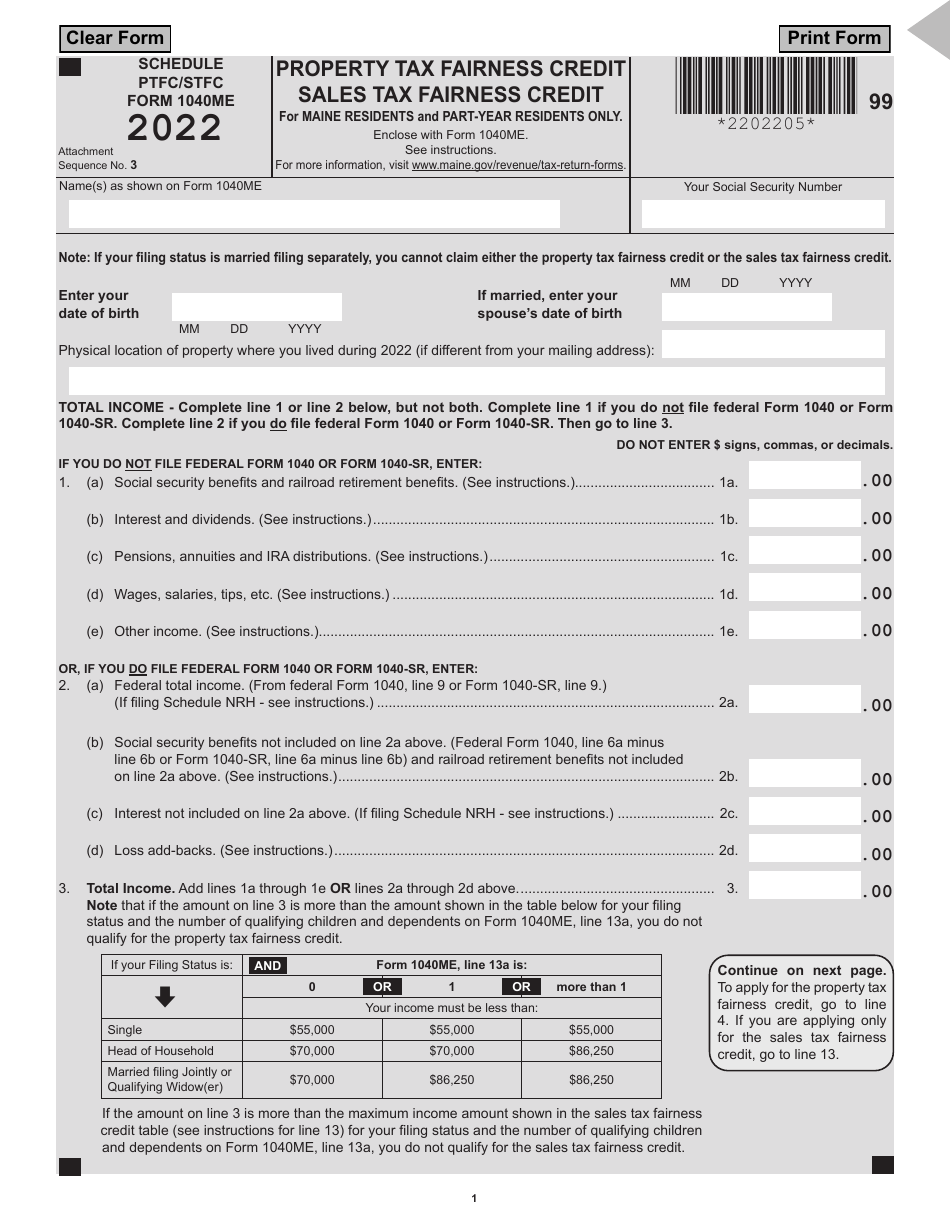

Property tax fairness credit For tax years beginning on or after January 1 2013 and before January 1 2014 a Maine resident individual is allowed a property tax fairness SCHEDULE PTFC PROPERTY TAX FAIRNESS CREDIT INSTRUCTIONS Who is eligible You may qualify for a refundable Property Tax Fairness Credit up to 300

For tax years beginning on or after January 1 2013 and before January 1 2014 a Maine resident individual is allowed a property tax fairness credit as computed under this This program uses the income tax process to provide a refund of a portion of property taxes paid on your property The Property Tax Fairness Credit is a reimbursable credit so

Download State Of Maine Property Tax Fairness Credit

More picture related to State Of Maine Property Tax Fairness Credit

State Corporate Income Tax Rates And Brackets For 2023 CashReview

https://files.taxfoundation.org/20230123172533/2023-state-corporate-income-tax-rates-and-brackets-see-state-corporate-tax-rates-by-state.png

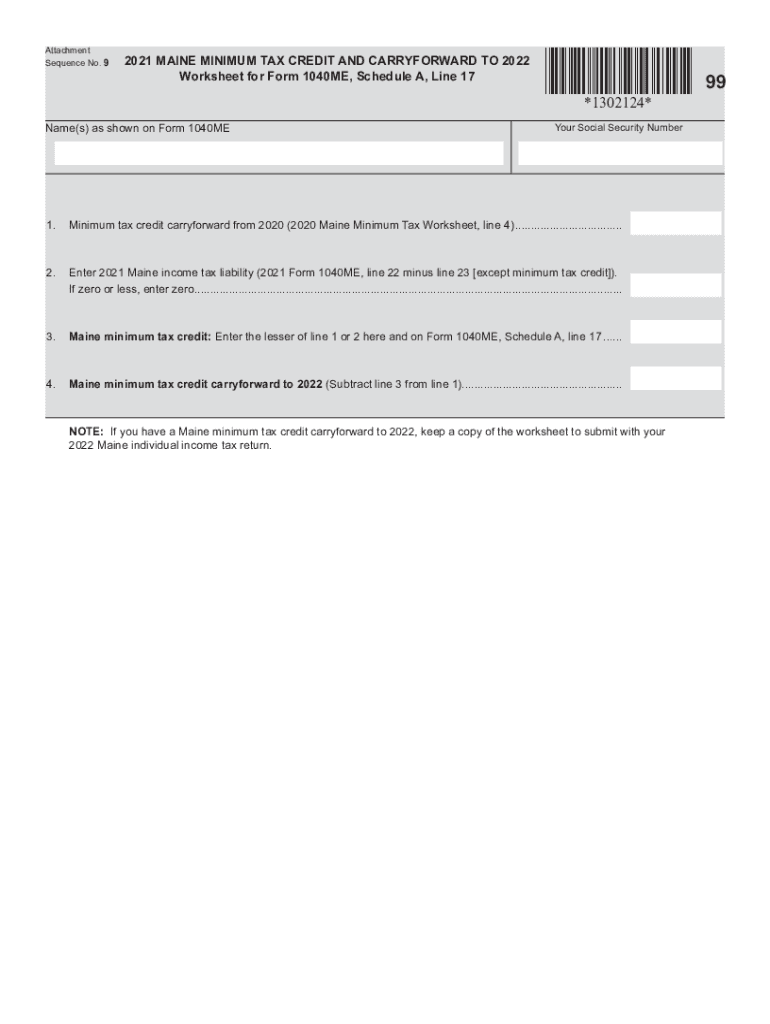

Maine Minimum Tax Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/596/93/596093627/large.png

Income Limit Maine State Property Fairness Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/maine-reaches-tax-fairness-milestone-itep.jpg?fit=768%2C433&ssl=1

The State of Maine provides a measure of property tax relief through different programs to qualified individuals While some are applied at a local level others may be applied for Property Tax Fairness Credit You could receive a property tax refund just by filing a Maine State income tax form even if you don t owe any state or federal income taxes

The maximum Property Tax Fairness credit for those aged 65 or older is 1 500 for 2023 and will be 2 000 next year Eligibility is based on your income and the amount of your In 2022 the Maine Legislature enacted an expanded benefit for veterans through the Property Tax Fairness credit While this benefit is based on the property tax paid by

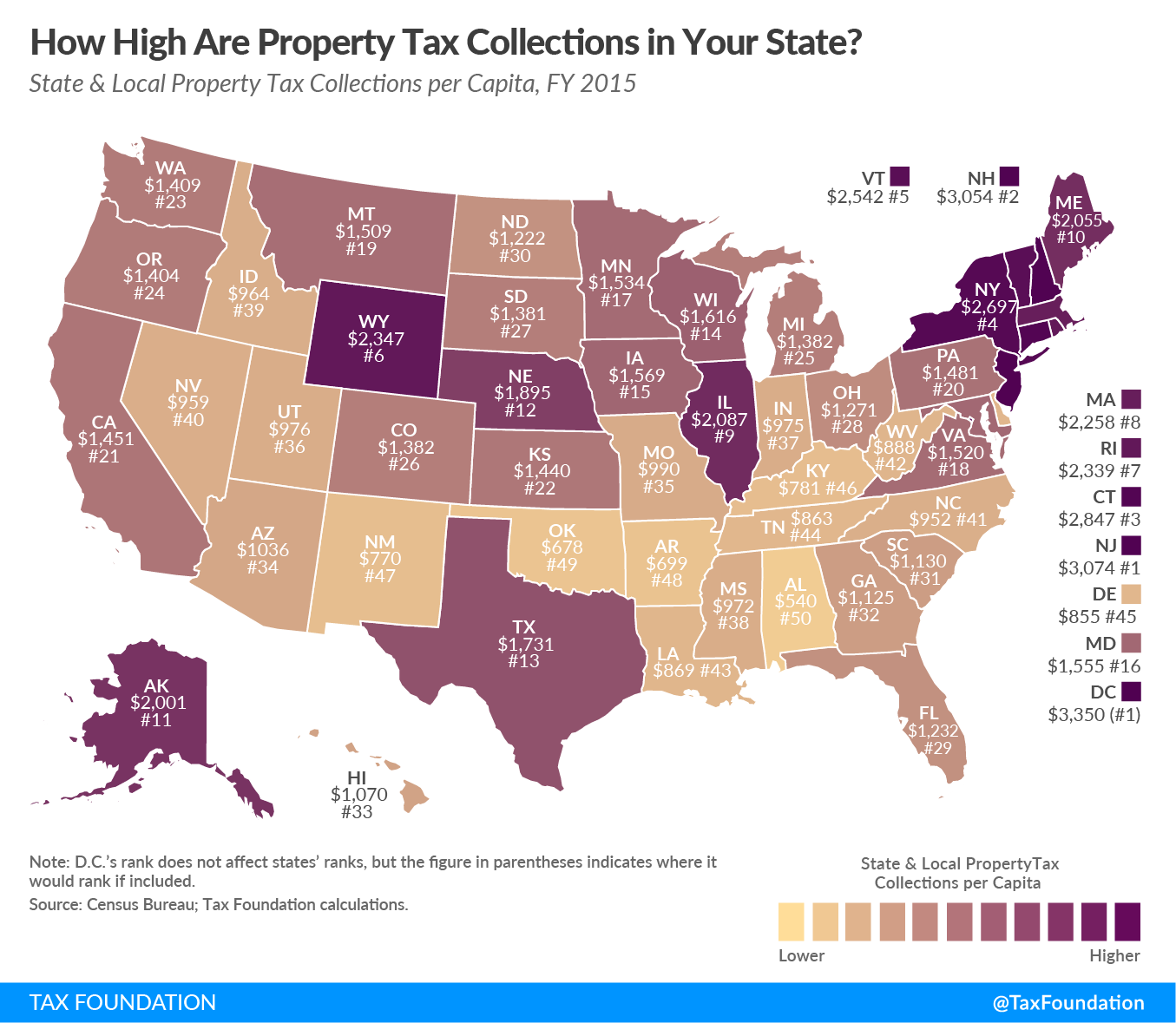

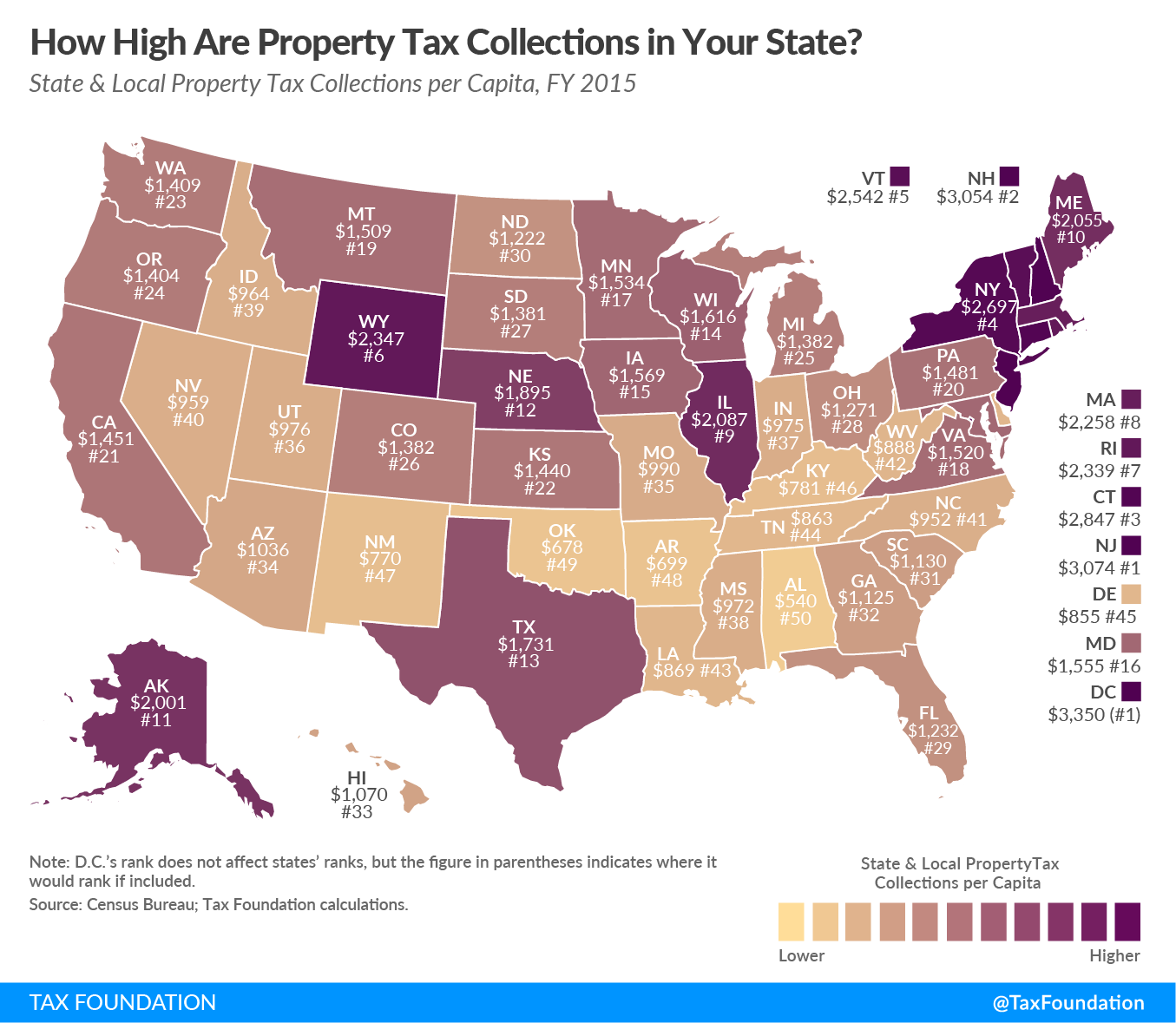

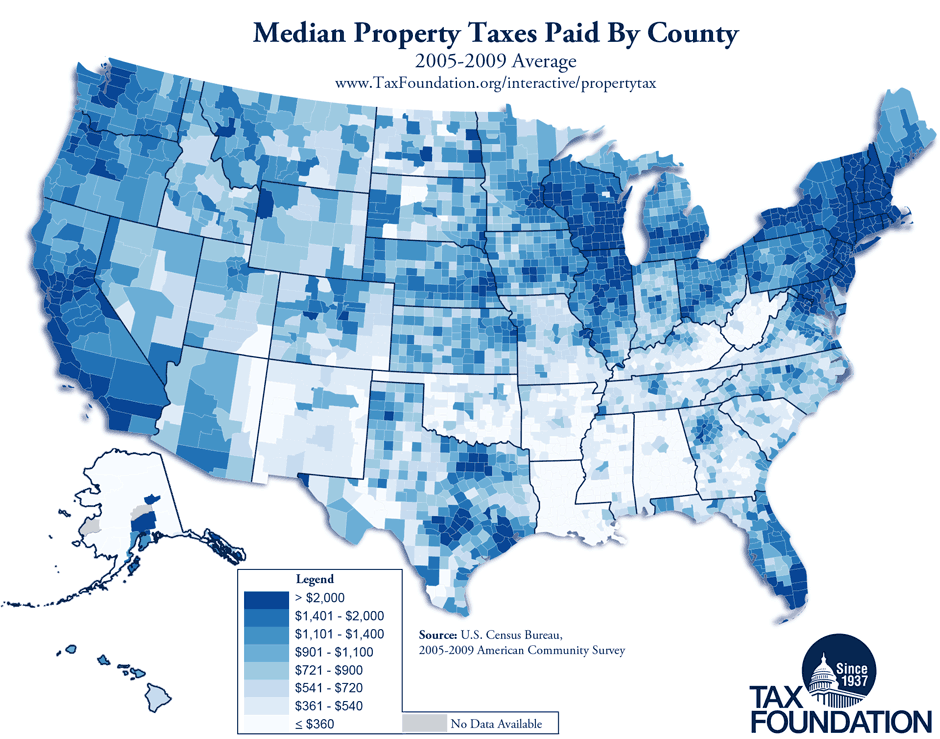

How High Are Property Tax Collections In Your State Tax Foundation

https://files.taxfoundation.org/20180511093121/PropTaxesPerCap-01.png

Map Of Maine Land Trusts Maine Land Trust Network

https://www.mltn.org/wp-content/uploads/2019/04/MLTN_Service_Area_34_44_20190423-b.png

https://www.maine.gov › revenue › sites › maine.gov...

You may qualify for a refundable Property Tax Fairness Credit up to 1 000 1 500 if you are 65 years of age or older if you meet all of the following You were a Maine resident

http://coronavirus.maine.gov › ... › housing-property-tax-relief

Provided Direct Property Tax Relief to Maine Families Governor Mills expanded the Property Tax Fairness Credit to 83 000 Mainers by providing a one time boost in the

The Words Maine Property Tax Fairness Credit Are In White On A Purple

How High Are Property Tax Collections In Your State Tax Foundation

Illustrated Map State Maine United States 1146067340

Property Tax Fairness Credit Sales Tax Fairness Credit

Form 1040ME Schedule PTFC STFC Download Fillable PDF Or Fill Online

Maine Retirement Income

Maine Retirement Income

Monday Map Property Taxes By County 2005 2009 Average Tax Foundation

Maine Form 1040me Fill Out And Sign Printable PDF Template SignNow

Property Tax Fairness Credit Sales Tax Fairness Credit

State Of Maine Property Tax Fairness Credit - Property Tax Fairness Credit Summary Eligible Maine taxpayers may receive a portion of the property tax or rent paid during the tax year on the Maine individual income tax