State Tax Rebate 2024 State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to Spanish Online Application Now Available for Property Tax Rent Rebate Program January 25 2024 the Department of Revenue is encouraging Spanish speaking Property Tax Rent Rebate Program Expansion How It Will Impact First Time Filers January 17 2024 Keystone State Proudly founded in 1681 as a place of tolerance and freedom

State Tax Rebate 2024

State Tax Rebate 2024

https://www.pdffiller.com/preview/563/640/563640699/large.png

Missouri State Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Missouri-Tax-Rebate-2023-768x587.png

Income Tax Rates 2022 Vs 2021 Caroyln Boswell

http://thumbor-prod-us-east-1.photo.aws.arc.pub/r-5-lDAfA7hx2qRoVpXX6UhZ43k=/arc-anglerfish-arc2-prod-advancelocal/public/U5MVCZVZI5COTCDGVU3MWDQABQ.png

Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age Michigan s Working Families Tax Credit is worth up to 2 080 for the 2022 tax year Eligible taxpayers received up to 6 of the credit as part of last year s state tax refund The credit

Download State Tax Rebate 2024

More picture related to State Tax Rebate 2024

4923 H 2014 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/468/470/468470575/large.png

SC State Tax Rebate 2023 Eligibility And Claiming Process Explained PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-768x994.png

When Does Tax Season End And What Happens If I Don t Declare My Taxes Marca

https://phantom-marca.unidadeditorial.es/fa8dca0f613b5b2703e6297386515270/resize/1320/f/jpg/assets/multimedia/imagenes/2022/09/17/16634245499228.jpg

Applications are open for Pennsylvania s Property Tax Rent Rebate program after an announcement by Governor Josh Shapiro on Tuesday The rebate rate has been increased from 650 to 1 000 for The Property Tax Rebate is a rebate of up to 675 per year of property taxes paid on a principal residence There is a rebate available for property taxes paid for Tax Year 2022 and another rebate available for property taxes paid for Tax Year 2023 Check the status of your Property Tax Rebate Rebate Resources County Property Tax Lookup

On January 1 2024 The state will issue tax rebate checks to eligible taxpayers under provisions of the state s fiscal year budget HB4700 The rebate will be 50 for single filers whose Illinois adjusted gross income in 2021 was less than 200 000 or 100 for joint filers whose Illinois adjusted gross income was less than 400 000 in 2021 According to Minnesota Governor Tim Walz the IRS will tax rebates sent to eligible Minnesota residents in 2023 These rebates commonly known as Walz checks were worth up to 1 300 in some

Ga State Refund Cycle Chart 2023 Printable Forms Free Online

https://assets-global.website-files.com/600089199ba28edd49ed9587/639cea54c198630aeee5555f_bNV6iWgT5vJ_yDpbDq6FOQd8uecl8AoDbc3OST7eDyES5Wo66fZYQHyAMSrt88WS4XPf5vMuqIBIuQ3f6RK_OgjKpkcA7hVoX5TMGxlmsaunWtl3XuOnSpuyVykgb5sZMz8qxrJHHDTqiNZYrXEHzBEj5VcLo8jVmQioEXzzgugLty9QrLWN__neHMME4ouh3QV6mkb43w.png

California Tax Rebate 2023 How To Claim And Eligibility Criteria Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/California-State-Tax-Rebate-2023.jpg?ssl=1

https://taxfoundation.org/research/all/state/2024-state-tax-changes/

State Tax Changes Taking Effect January 1 2024 December 21 202317 min read By Manish Bhatt Benjamin Jaros Latest Updates See Full Timeline Thirty four states will ring in the new year with notable tax changes including 17 states cutting individual or corporate income taxes and some cutting both

https://www.kiplinger.com/taxes/state-stimulus-checks

January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Ga State Refund Cycle Chart 2023 Printable Forms Free Online

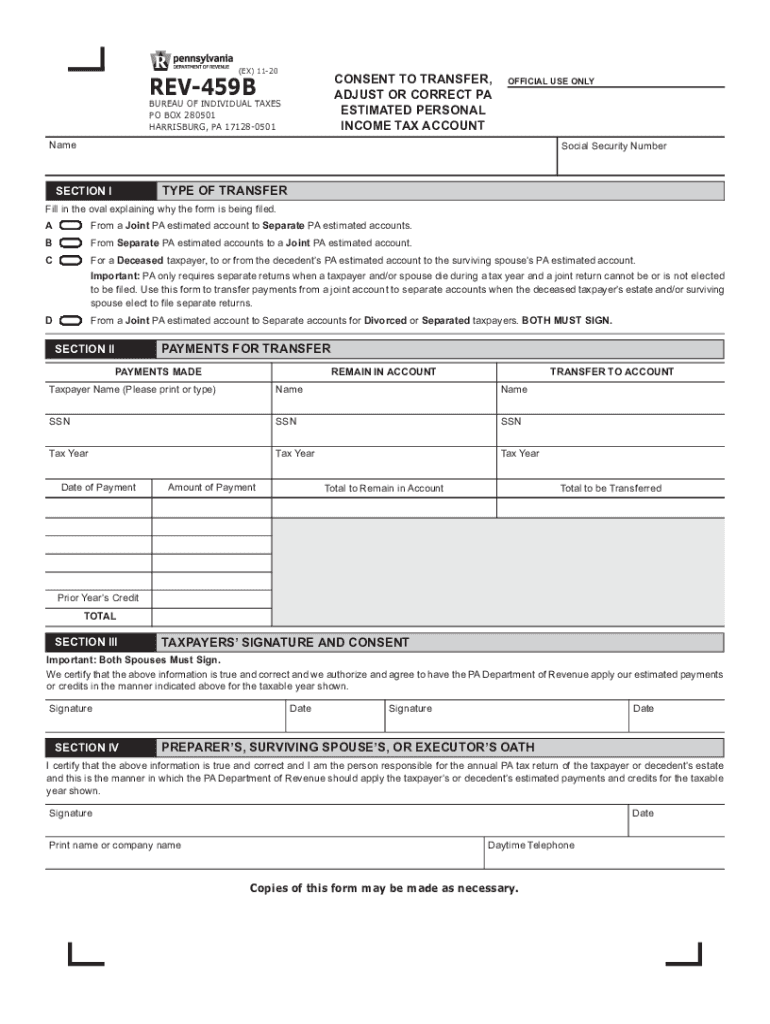

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

Wondering About Your Idaho Tax Rebate Track Its Status With A New Online Tool Idaho Capital Sun

Minnesota Property Tax Refund 2019 2023 Form Fill Out And Sign Printable PDF Template SignNow

Homeowner Renters District 16 Democrats

Homeowner Renters District 16 Democrats

Illinois 1040 2017 2024 Form Fill Out And Sign Printable PDF Template SignNow

Kansas Tax Rebate 2023 Eligibility Application Deadline PrintableRebateForm

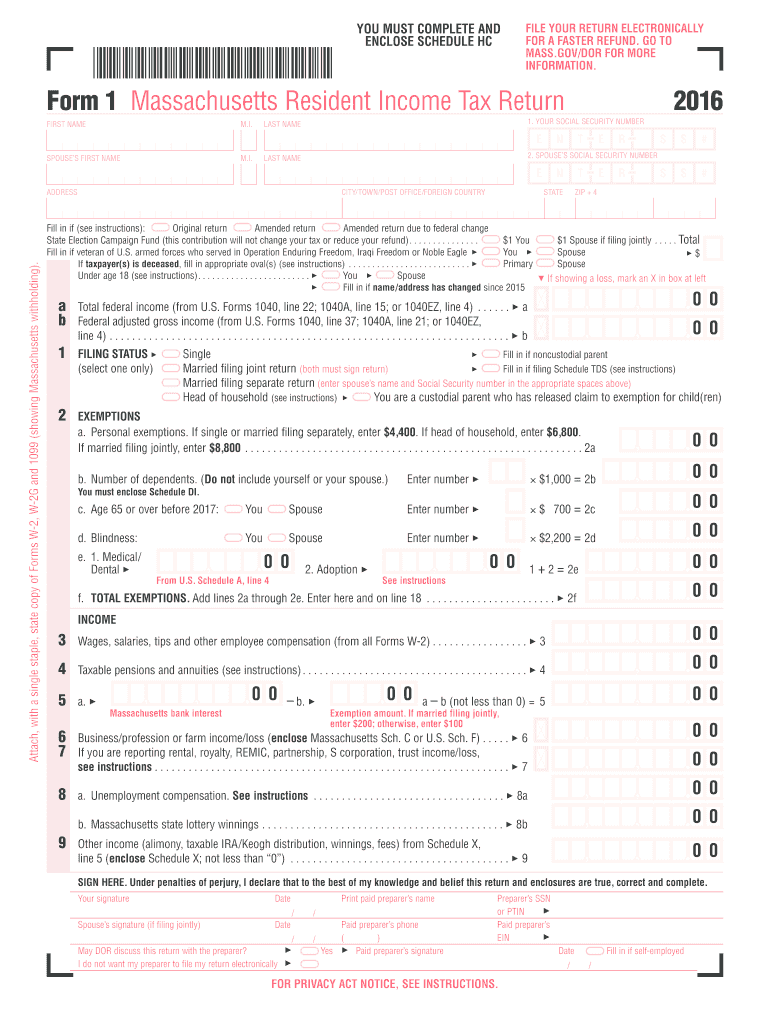

Printable Ma Tax Forms Printable Forms Free Online

State Tax Rebate 2024 - If you have not received your benefit by January 12 2024 contact us This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age